CEOs routinely cite “ attracting and retaining talent” as their top concern. When hiring is competitive, companies tend to go overboard on benefits that are easy to put on a website, but don’t add much value—free lunch, phone stipends, unlimited vacation. Companies over-engineer these benefits. Instead, we believe the most important thing companies need to get right for employees is equity and liquidity.

Equity can generate life-changing returns. Not having a well thought out equity system, fair practices, and clear education is archaic—and a recipe for a toxic culture. The VC-backed community needs to do better.

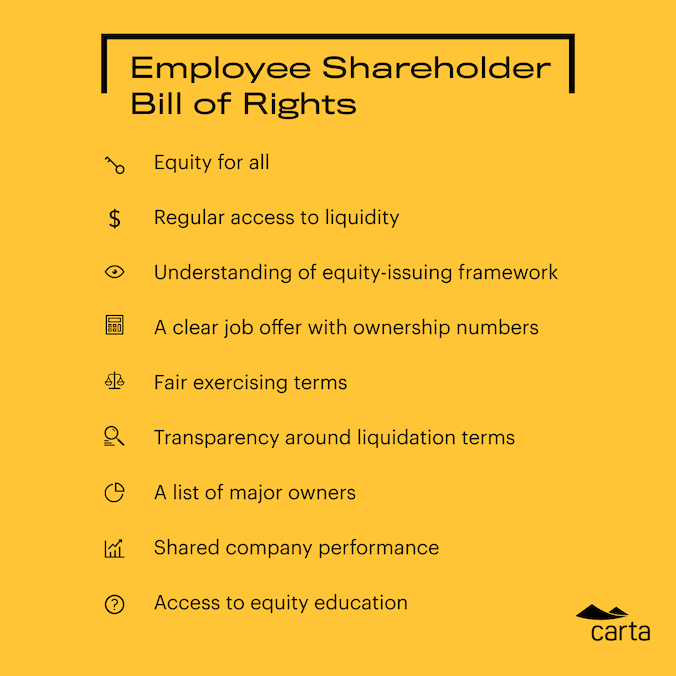

We believe that all full-time employee shareholders at venture-backed companies deserve:

Equity for all

If you are a full-time employee at a venture-backed company, you deserve to be an owner. Joining a startup can be riskier than other employment, so it’s important that companies reward employees who contribute to its success. Equity gives you (literal) ownership over your work.

Regular access to liquidity

If you’re an employee with exercised stock, you deserve the opportunity to sell your shares. Too often, companies only offer this benefit to founders and executives, but liquidity should be offered to all. Companies are staying private longer, and it’s unfair to restrict employee liquidity until an exit that may never come. Companies should be clear about the circumstances under which they will conduct a tender offer, which will help with recruiting and retaining talented employees. As an employee, you can ask about your company’s plans for liquidity.

Understanding of equity-issuing framework

Every company needs a system to explain who gets how much equity at the company and why. As an employee, it is within your rights to ask for this framework to be explained and applied consistently. This system should take into account refresh grants when employees are promoted or rewarded and equity leveling to ensure that new hires and existing employees are issued equity fairly if they have the same role or level.

A clear job offer with ownership numbers

Potential employees deserve a clear offer letter that comes with all the numbers necessary to understand the grant, including: strike price, cost to exercise, vesting schedule, preferred price, notional value, and fully-diluted shares outstanding.1

Fair exercising terms

Most exercising terms favor the wealthy—those who can afford to purchase their options. Employees deserve more flexibility around exercising, including the option to early exercise and an extended window to exercise post-termination. This way, employees are less likely to stay put because of “ golden handcuffs.”

Transparency around liquidation preferences

Liquidation terms state what happens in a material event (like an IPO or acquisition)—specifically who gets paid out when. These preferences typically benefit investors and ensure they get liquidity first. These terms should be shared with employees. As an employee, you deserve to know how liquidation preferences may affect you.

A list of major owners

Much like public companies, employees at private companies deserve to understand who their work is enriching. You should be given high-level cap table access that includes, at a minimum, who owns more than 5% of the company and who is on the board.

Shared company performance

As an employee and an owner, you are committing to and invested in the success of a venture-backed company. You should be kept informed about the performance of the company, including financial performance and KPIs. If this isn’t currently happening, ask your CEO or CFO to share quarterly reports.

Access to equity education

Much of the inequities that exist are due to information asymmetry and a lack of information for employees to evaluate their offers and existing equity. Employees need to learn about equity. We suggest that companies:

-

Present equity fundamentals in every offer letter and at employee onboarding

-

Update company metrics and answer employee questions whenever there is a material event (like a new funding round)

-

Offer guides on questions to ask lawyers, accountants, wealth advisors, and tax professionals

We invite startups of all sizes to adopt these rights and share them with their employees. You can include them in your offer letter, which we do at Carta.

1This depends on the stage of the company. For later stage companies, notional dollar amount might be a better way to communicate value to a candidate. For smaller companies (< Series B) the percent of ownership / fully-diluted shares is an important metric and should be given out since dollar amounts usually aren’t meaningful at that stage.