No investor starts a firm to copy and paste financials and cap table information into a PDF so they can share it with their LP and other partners. And no one should.

But the best investors have that information at their fingertips. They know which company’s revenue is growing the fastest, who has the shortest runway, the sentiment about their portfolio companies, how stable their portfolio companies are, and who needs follow-on investment. They’re able to show their financial data, KPIs, and the status of their investment to their limited partners with clarity and confidence.

Now, you don’t need to pull the cap table to figure out your ownership. You don’t need to check your inbox to figure out your most recent quarterly notes, and you don’t need to comb through a PDF and a hundred different spreadsheets to figure out how revenue grew.

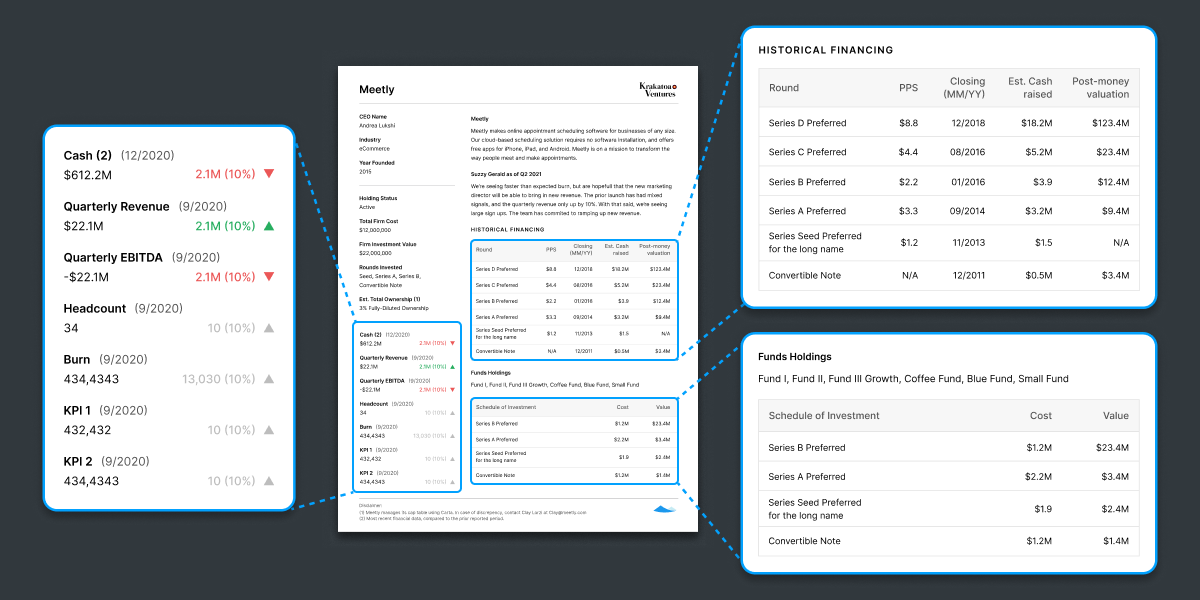

Announcing portfolio company one-pagers

Today, we launched portfolio company one-pagers. Now, you can bring together disparate data points with a single click, including:

-

Cap table information

-

Ownership percentage

-

Investment amounts

-

Economic rights

-

Qualitative partner reviews

-

P&L

-

Balance sheet

-

Headcount

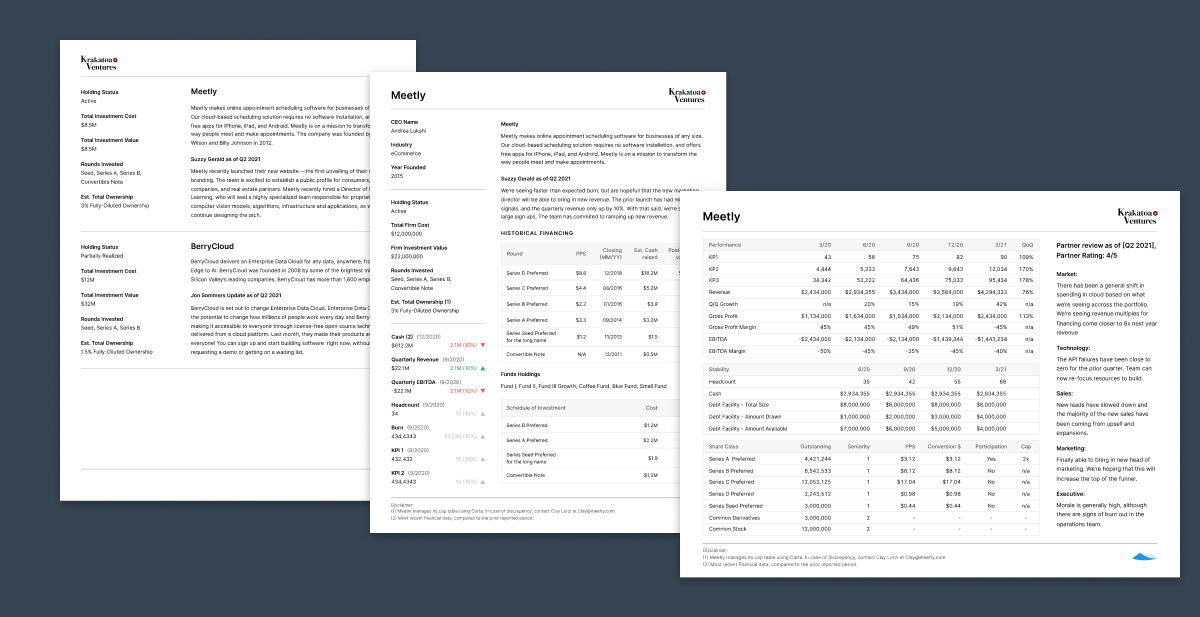

You can download the portfolio company one-pager sample pack now to see the reports in detail. Snapshots and tear sheet reports are available to current Fund Administration and ASC 820 customers in addition to current Portfolio Insights customers. The detailed report view is only available to Portfolio Insights customers.

If you’d like to learn more about Portfolio Insights and portfolio company one-pagers, reach out to us to set up time to talk.