Financial infrastructure for enduring companies

Do more with Carta

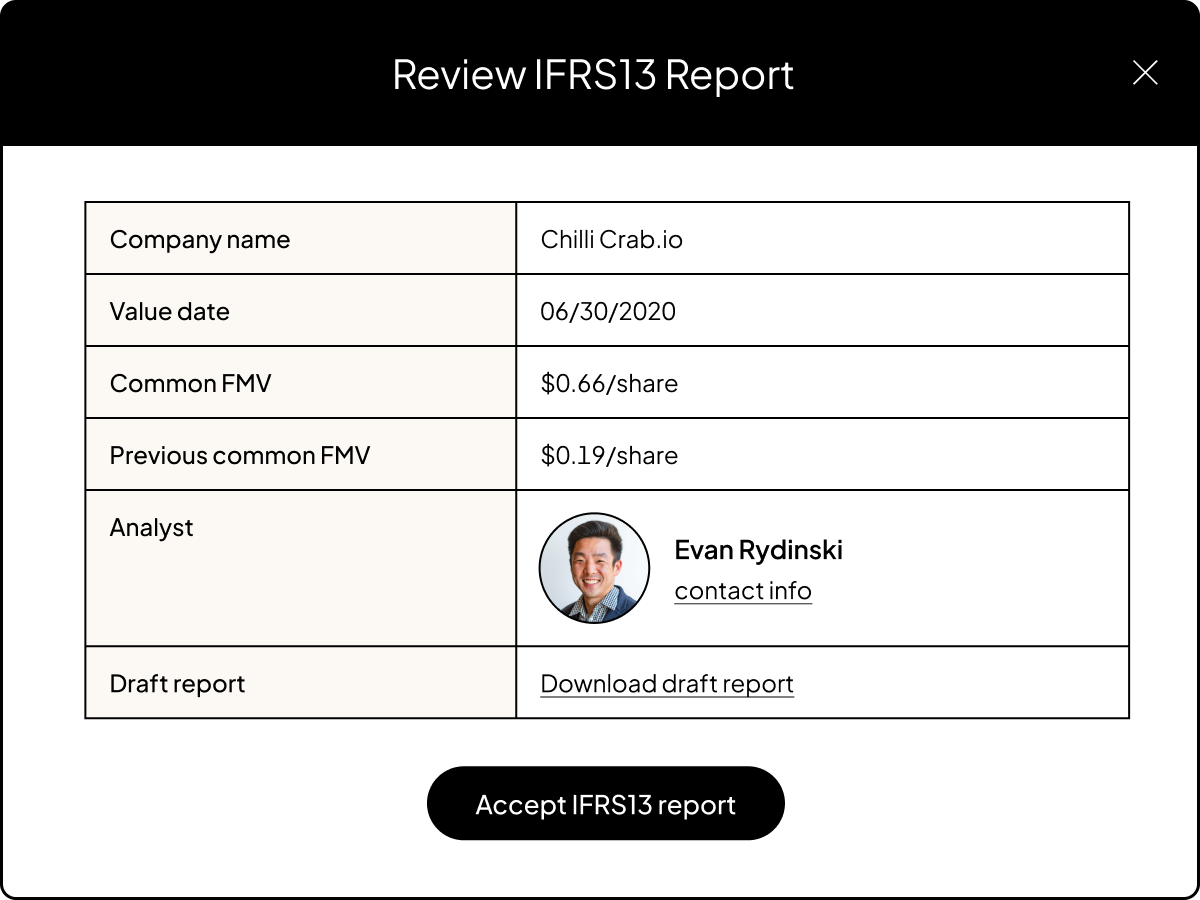

Leading VC-backed companies rely on Carta for audit-ready valuations (IFRS13/409A) and class-leading audit support. Our experts ensure the nuances of your business are accounted for and leverage Carta’s proprietary software to deliver fast, cost-effective, accurate valuations.

Carta’s scenario modeling tool offers sensitivity and breakpoint analysis, payout and dilution modeling, and pro-forma cap tables so you can understand the impacts of terms, fundraising, and exits.

Leverage Carta Total Compensation’s latest labor market data, benchmarking resources, and forecasting tools to avoid overspending on salary and equity compensation.

Carta helps you run liquidity events while controlling exactly who is moved on and off your cap table. All post-transaction administration is handled through Carta, allowing you to design and execute the liquidity program best suited to your company and stakeholders.

Carta’s cap table software automatically accrues equity expense in real time and generates expense (IFRS2/ASC718) reports in minutes.