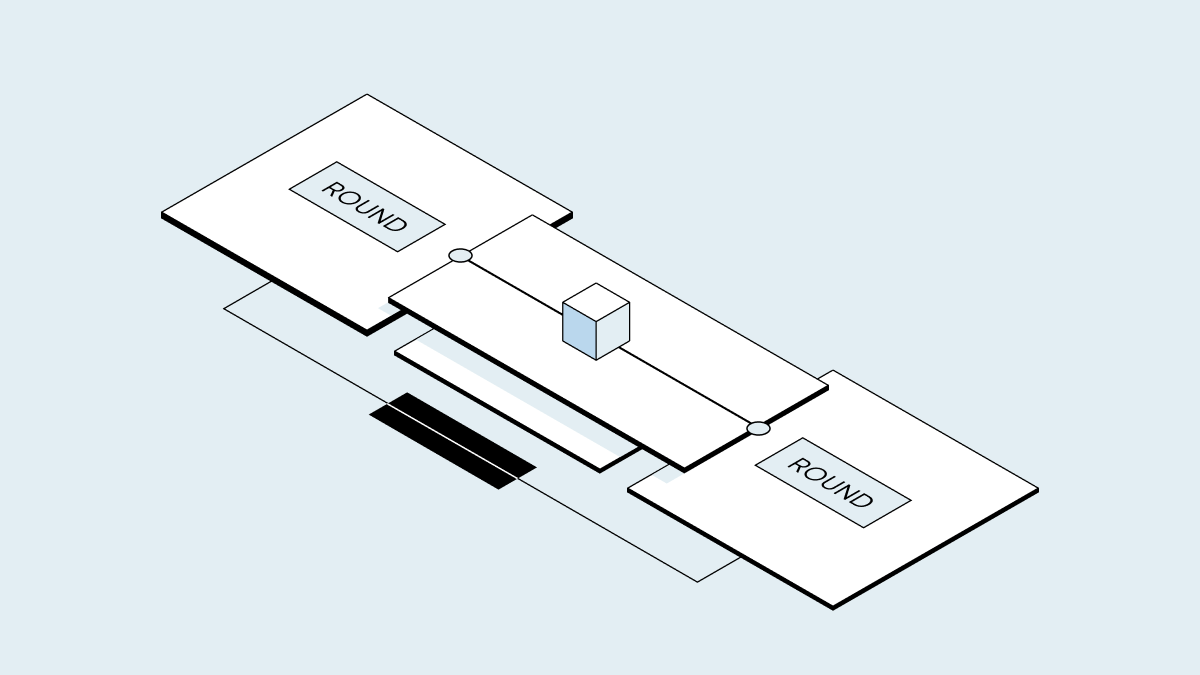

What is a bridge round?

A bridge round is extra money a company raises between priced rounds. One of the company’s current investors will often lead the bridge round, which is an unpriced round of financing.

How companies use bridge round financing

Venture capital firms typically use bridge rounds as a way to give a startup enough cash runway to make it to the next funding round.

In addition to avoiding bankruptcy or dissolution, companies use bridge round financing to:

-

Increase the rate of revenue growth

-

Invest in product improvements

-

Buy product inventory

-

Strengthen their balance sheet in the lead-up to an IPO or acquisition

In rare cases, VCs use bridge rounds to show a new CEO they have faith in a startup’s future.

Historically, bridge rounds have had a negative connotation: VCs and founders considered them a bailout for troubled portfolio companies that couldn’t manage their burn rates or made costly mistakes.

How bridge rounds work

In most bridge rounds, the company issues preferred equity or convertible notes. Investors prefer convertible notes because they let them set a valuation cap or discount price for shares sold in the next priced round. Startup founders are sometimes wary of this investment structure because they have to pay interest on the convertible note until their next capital raise.

Bridge rounds financed with preferred equity are more favorable to companies, but they’re also less common because companies that seek bridge financing are usually in a weaker negotiating position.

Carta data shows that the prevalence of bridge rounds is likely correlated to directional trends in the venture economy: When fundraising slows and valuations dip, the ratio of bridge rounds to total rounds raised increases.