As a private company, you may need to get an independent valuations audit to satisfy investor requirements, answer a lender’s questions, or prepare for an IPO.

Going through the valuation process can help you better understand your financials and make more informed decisions when planning for a material event. Here’s what you need to know about 409A valuations and how to prepare for a successful valuations audit.

How to manage the valuations audit process

Valuations audits can be tedious, but there are steps you can take to eliminate potential hurdles and set your team up for success.

1. Host a kickoff call between your audit firm and appraisers

Communicating with your audit firm and appraisers before starting an audit can help prevent confusion and frustration down the road.

“You can get completely different valuations on the same asset depending on who’s doing the valuation,” says Tami Tande, a senior manager on Carta’s 409A valuations team. “Auditors have their own internal standards and opinions on how things should be done,” she adds, so it’s a good idea to make sure everyone is on the same page regarding methodology and assumptions.

“You basically want to get the auditor’s approval upfront so there are no surprises when the 409A report is delivered,” Tande says.

2. Prepare a financial forecast

One of the items a valuation firm looks at when reviewing a 409A report is the company’s financial forecast. Documenting any critical financial changes in your company and explaining these to your appraiser and auditor can result in a smoother, more accurate valuation.

When creating a forecast, make sure you address the effects of recent material events—for example, COVID-19—and use reasonable assumptions to support your predictions, says Candice Bassell, a managing director for Carta’s enterprise valuation team.

She recommends considering the following:

-

Was there a change in your forecast due to COVID-19? How do you estimate that change?

-

Did you lose customers?

-

Are there other things that occurred in the business that would support a change in value, such as a reduction in force or a change in the ability to raise a round?

You may also want to include any recent significant transactions in your valuation analysis, says Brian Allen, Carta’s VP, Corporate Controller. Think: primary rounds of funding or secondary transactions involving company stock.

“At Carta, we’ve done three tender offers in the last couple of years, and that’s had a big impact on how we think about our 409A process,” he says. “We’ve had a lot of conversations with our team explaining how the tender offer was constructed and how to think about that in a valuation.”

3. Review the valuation report and ask questions

Once your appraiser finishes your 409A report, review the valuation and ask questions. Understanding your valuation is crucial to effectively addressing any questions your auditor has later on.

“Don’t just look at the final value of common stock and say the value looks too high,” Tande says. “You need to really read through the report, consider all the major assumptions, and make sure everything seems reasonable.”

If you have questions about the data tables or inputs used, for example, take this time to ask your appraiser. Once you’re comfortable with the report, you can deliver it to the audit firm.

4. Prepare written responses to auditor questions

After reviewing a valuation, your audit firm will likely send questions for you and your appraiser to answer. “If you get questions, it doesn’t mean it’s a bad valuation—it’s just part of the audit process,” says Allen.

Work with your appraiser and management team to provide written responses to your auditor’s questions. “Sometimes, the auditors will want to get on the call right away,” Tande says. “However, I find that written responses are more effective and a better use of everybody’s time.”

After you share your written responses, you can schedule a call to address any follow-up questions your auditor might have.

5. Create a valuation memo

Before you close the books, create a valuation memo that can transport you to the mindset you were in when you went through a specific valuation, Allen says. This could come in handy for future valuations.

He recommends including the following:

-

Key information you sent to the valuation team

-

Copies of the forecasts or supporting materials you provided

-

The list of questions the auditor sent, plus your responses

“I also put together a summary talking about the 409A from a qualitative perspective,” Allen says. For example: “Here’s how our business is going. Here’s how we think COVID-19 is affecting the business. Here’s how we think our new forecast is going to impact us in the future.”

How often should you get a new valuation?

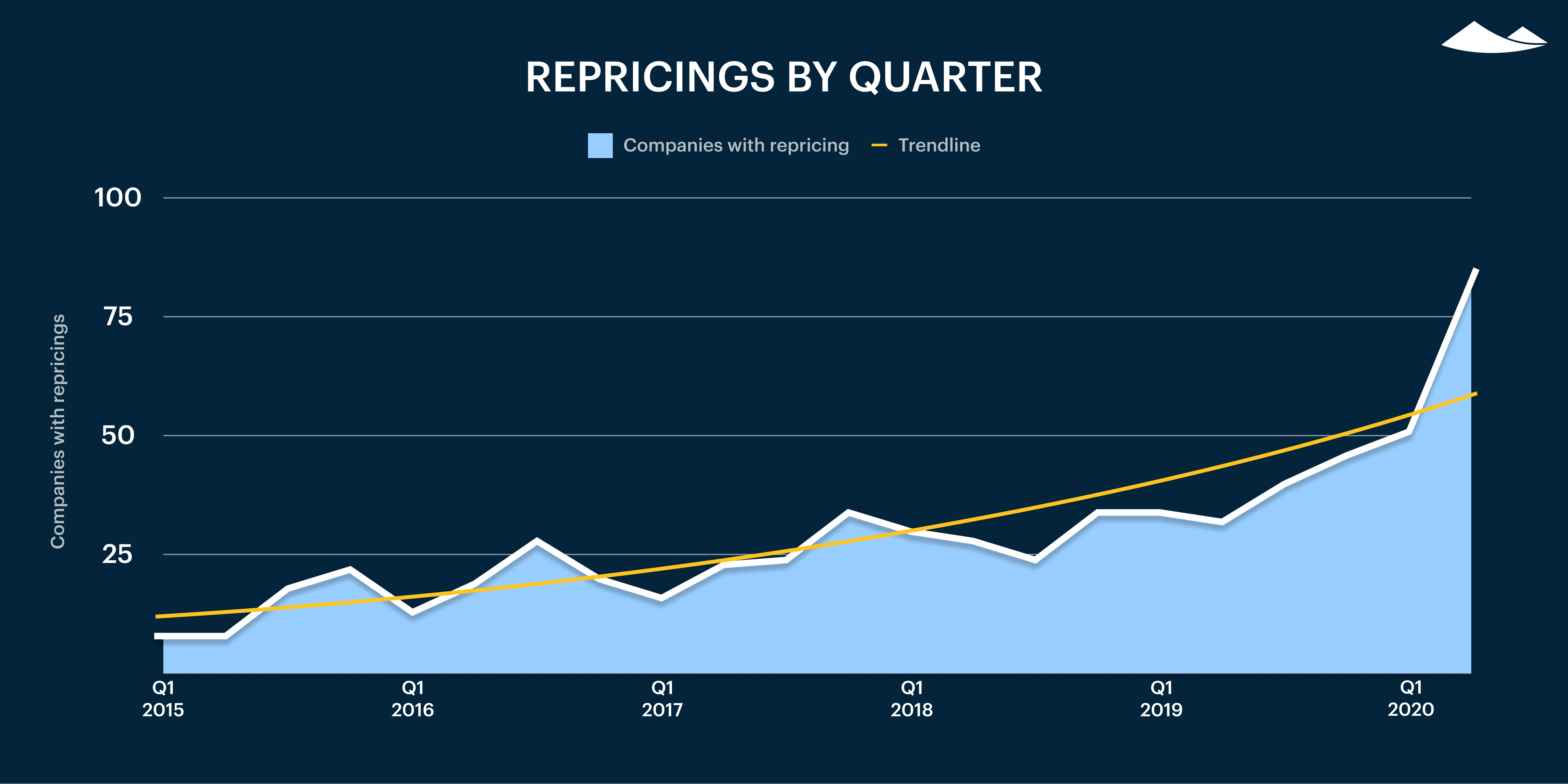

Most private companies get new 409A valuations annually or, sooner, if they experience a material event, like a merger or new financing round. However, with COVID-19 shifting business models and affecting financing, it can be helpful to get valuations more frequently.

“This year, only about 25% of the valuations Carta performed were driven by financing,” Bassell says, compared to nearly 60% of the valuations in April 2019. “This indicates to us that a lot of people are updating their valuations due to changes in business fundamentals, rather than changes based on financing.”

If your company hasn’t been notably affected by COVID-19 or the economy, you may not need an updated valuation, Bassell says. However, “If your forecast has changed significantly or if you’ve gone through a reduction in force, a new valuation could be helpful,” she says.

Reach out to your valuation provider to talk about what makes the most sense for your company.

409A valuations with Carta

A good valuation firm can facilitate the valuations audit process and make your job that much easier. Whether you’re getting a valuation for the first time or need a new valuation, Carta can help. We deliver over 6,500 409A valuations each year, so our team is well-equipped to guide you through the process and answer your questions.

After your first 409A, we’ll deliver an updated report every year or every time you have a material event to help keep you take advantage of the 409A IRS safe harbor. Plus, we’re always thinking of ways to make valuations audits even easier.

Here are a few changes we’re in the process of making:

-

Creating an online portal for you and your auditors to upload questions and receive written responses automatically

-

Hosting valuation reports online so auditors can log in to review calculations

-

Using more aggregated, anonymized data to show auditors how a valuation is performed and its assumptions compare to other valuations their firm has reviewed

“Those are all in the early stages,” Bassell says, “but we’re excited to find ways to disrupt the status quo and make the valuations audit process better for everyone involved.”

Getting through a valuations audit may seem intimidating, but with the right team and strategy, you can come out the other side more informed about where your company stands and what you need to achieve. If you need help along the way, Carta is here for you.