When you’re ready to raise funding for your startup, ”What’s the size of the market?” is one of the first questions potential investors will ask. Investors like to see a clear path to profitability and knowing your product or service’s market size helps them gauge the potential return they could make by investing in your company.

What is market size?

Market size is the total revenue potential in a given market based on the total number of customers and historical sales or spending trends in that market or industry. It is a proxy for the upper limit of your own company’s total revenue potential and an important metric to assess whether there is enough potential demand for your product or service to warrant venture capital investment (that is, whether your company is “venture scale”).

Investors use the size of the market to assess the potential return on investment (ROI) based on the relative ownership they would purchase in your company and the potential value of your company at exit.

Looking to calculate your own market size? Carta’s Market Sizing Guide walks you through different scenarios and provides helpful tips.

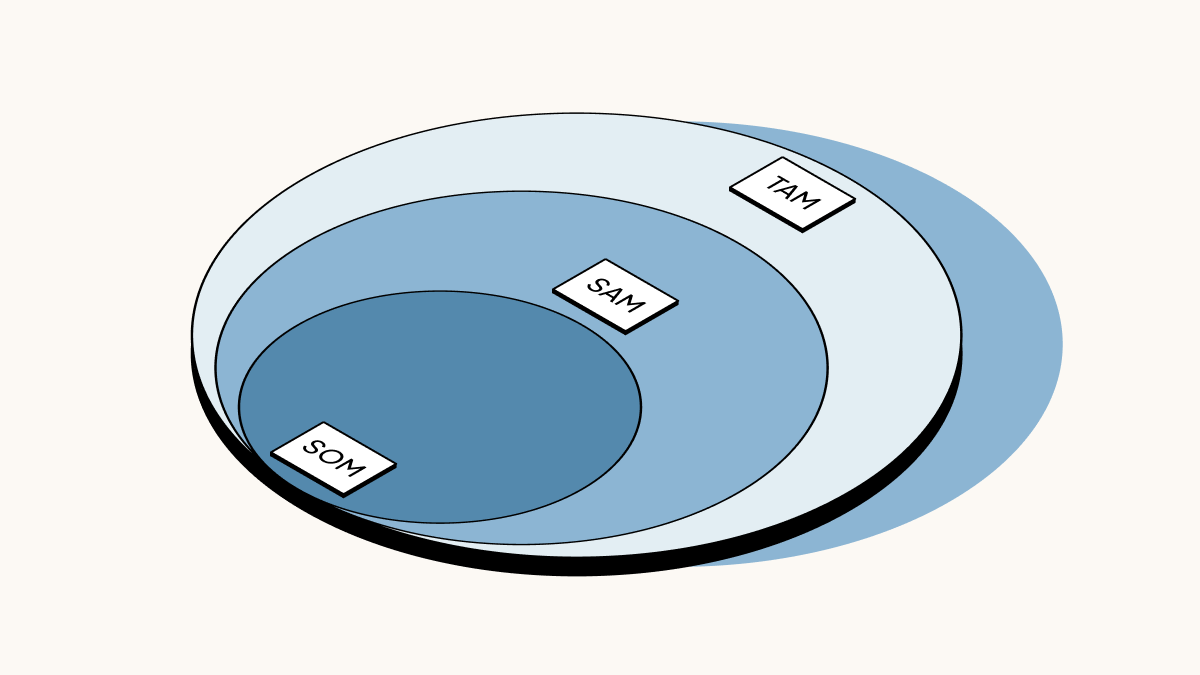

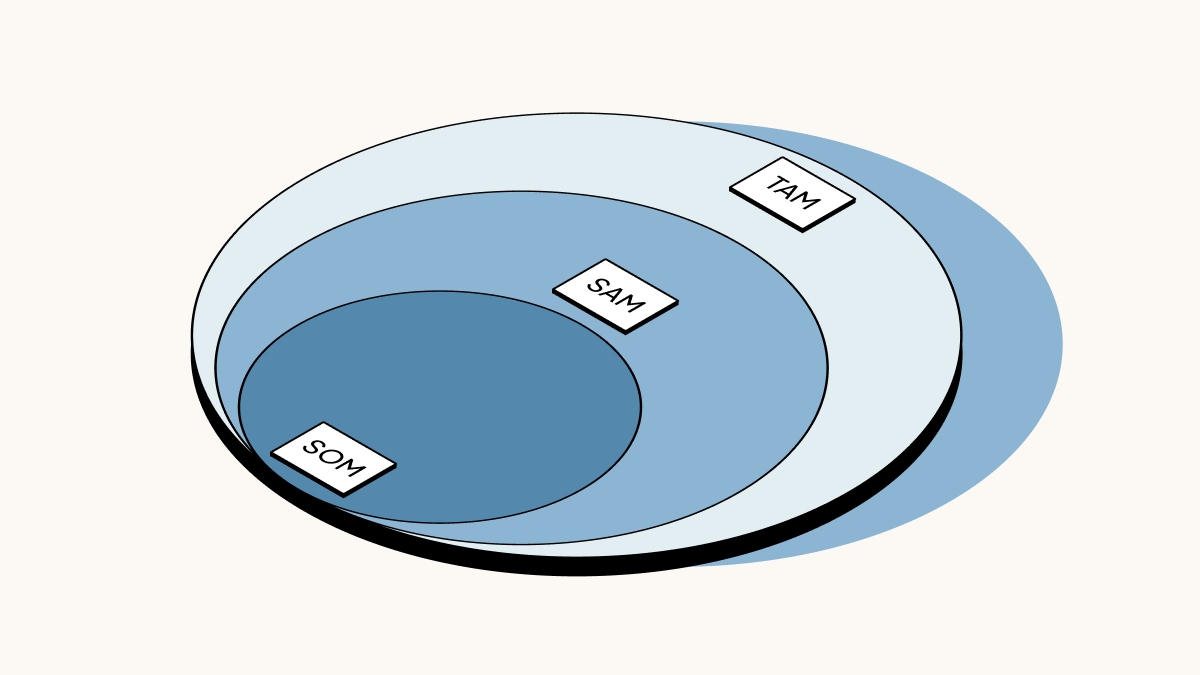

How to calculate market size: TAM, SAM, & SOM

To calculate market size, consider the number of potential customers, the average revenue per customer, the percentage of the market you can realistically capture, and the growth rate of the market.

There are three types of markets you need to know before you can get started: total addressable market, serviceable addressable market, and serviceable obtainable market.

Total addressable market (TAM)

TAM is the total demand for your product across all potential customers. To calculate TAM, follow these steps:

-

Define the target market. This can be anything from the total population in a city to the total number of businesses in a country.

-

Estimate the total potential customer base using data about prospective and existing customers in your industry.

-

Estimate potential spend per customer. For example, at Carta we use the average annual contract value (AACV).

TAM = [total potential customers] x AACV

For example, if you have a product that is for public schools in the United States, you’d use the total number of schools in the country ( approximately 100,000) as your base number. If you then determined that 10% of schools would be interested in your product, your TAM would be 10% of the base or 10,000.

Serviceable addressable market (SAM)

To calculate your SAM, determine what percentage of your TAM you can reasonably expect to reach with marketing and sales efforts. The percentage of the market you can realistically capture depends on many factors, including your competitive advantage, brand recognition, and pricing.

Continuing with the example above, if there are 1,000 schools in your TAM and you’ve determined only 10% would be interested in your product, that leaves you with 100 schools. But given the county-by-county tax rates, you may assume only 1% of those schools would have the budget to purchase your product, so your SOM would be 0.1% or 10 schools.

Serviceable obtainable market (SOM)

SOM is the portion of your SAM you can currently capture with available resources. So if you’ve determined that 10% of public schools in the U.S. would be interested in your product but can only reasonably expect to capture 0.1% with available resources, then the SOM would be 0.1%

Looking at industry trends and projections can help you estimate the growth rate of your market and future market size.

Top-down vs. bottom-up market sizing

There are two common ways to size a market: top-down and bottom-up. The best approach for you depends on your business needs and the data available.

Top-down

Top-down market sizing starts with the industry and drills down to specific niches you can service and capture.

-

Identify the industry you’re serving or want to serve (TAM).

-

Identify the niche or geographic area you are serving in that industry (SAM).

-

Identify the percentage of your SAM you can realistically capture (SOM).

A top-down approach is often quicker, but it can be less accurate because it relies on estimates. It’s best when there’s little data available and you need to make quick assumptions.

Bottom-up

Bottom-up market sizing begins with your current customer base and estimates how much revenue can be generated from each customer. To calculate the average revenue per customer, you need to estimate how much each customer will spend. This can be determined by historical sales data, surveys, or competitor pricing.

-

Identify the number of customers you can currently serve or are currently serving (SOM).

-

Determine the percentage of total customers in the SOM segment (SAM).

-

Calculate the potential revenue you’ll earn if every possible customer in the target market segment uses your product (TAM).

The bottom-up method can be more time-consuming, but it often provides more accurate results.

Why do VCs care about TAM, SAM, SOM calculations?

Venture capitalists want the largest possible upside given the risk involved in their investment, especially at the pre-seed and seed stages. While VCs do not have a specific number, a good thumb-rule is a TAM over $1B.

Targeting a large market alone is not enough, though—investors also want to see that you have a realistic plan for capturing a significant portion of that market. Your SAM shows VCs how well you understand the dynamics of your market.

Your SOM is the market you are going to capture, which is typically your three to five-year revenue projections. VCs use revenue calculations to make an informed investment.

Market size calculations can be as helpful for you as they are for VCs. Knowing the size of your total addressable market can help you set goals and budget realistically. Being aware of how much of the market you can realistically capture can help you focus your efforts in the most effective way possible.