When a venture-backed startup has consistently high growth and has already taken tens of millions of funding, it used to be a given that they’d go public. But the tides are turning.

At Carta, we’ve been thinking deeply about liquidity and the future of private and public markets since our founding. We believe that in the near future, the most successful companies will opt to stay private, and going public will be a less common path.

Given this, we were excited when Elon Musk, CEO of Tesla, tweeted yesterday about taking Tesla private. Due to Musk’s success in areas from building tunnels and going to space to making autonomous cars, his rhetoric quickly turns into a trend. Because of his now infamous tweet, the case for corporations to either go private, or stay private, is top of mind. The benefits of being a private company and the process for going private are now being widely shared.

How can companies stay private?

While it is currently possible to stay private and get liquidity, we still need new technology to make this a more realistic option for more companies. We imagine a not-so-distant reality where private company liquidity is readily available at scale, and companies have more options than going public or getting acquired. CEOs and CFOs will have the opportunity to choose their shareholders and allow employees to realize the upside of their stock options beyond paper gains. An open and controlled marketplace will exist in real-time. Companies like Tesla could see thousands of equity transactions a day as a private company.

Go public, go private, or stay private?

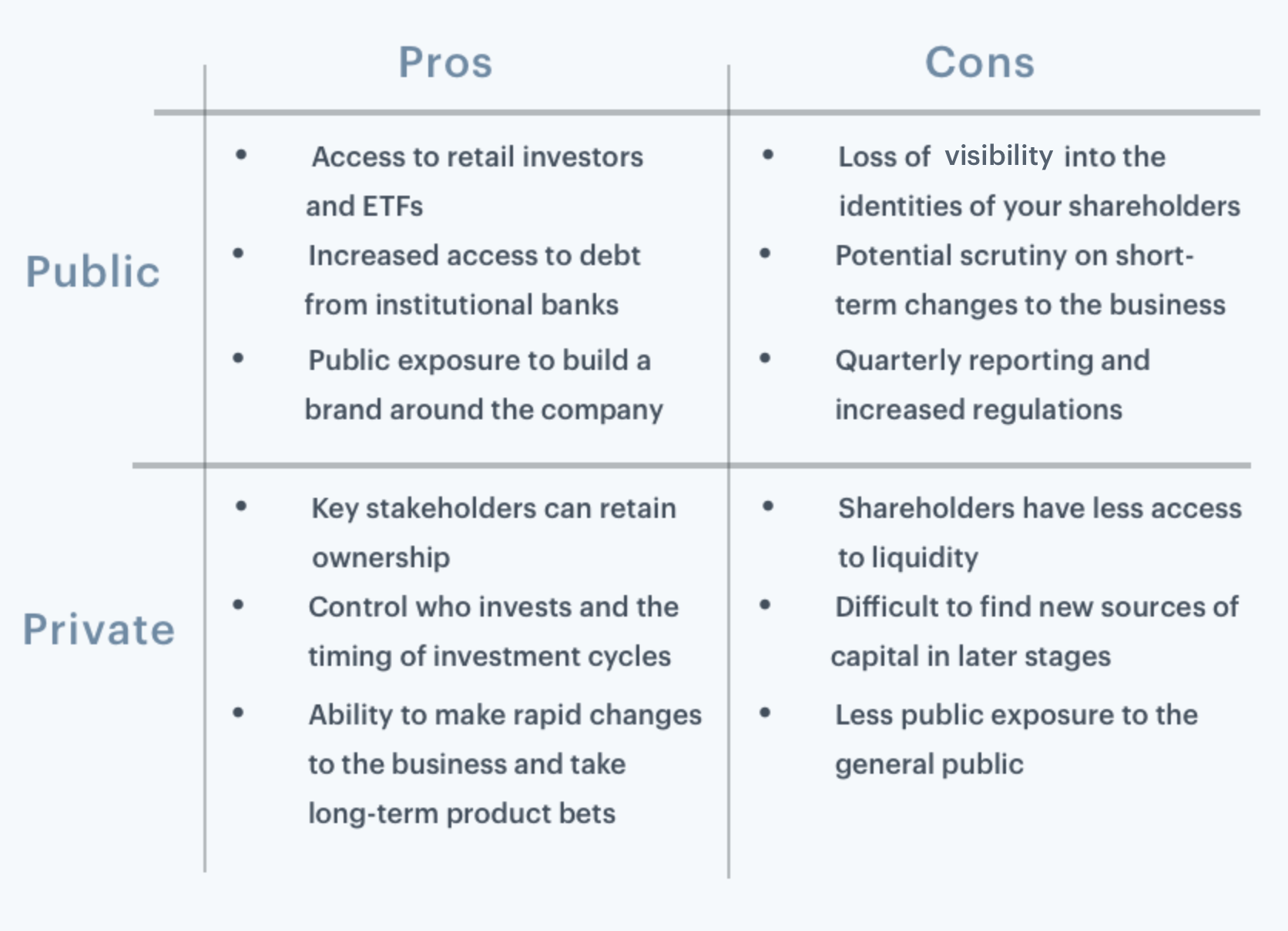

Going public, while a great way to raise money, isn’t always the happy ending it appears to be when executives crowd around the podium on a stock exchange floor on IPO debut day. Compliance and regulation costs to go public are high, as is the scrutiny on public companies. Being public puts pressure and focus on quarterly earnings and short-term strategies, which can distract from long-term strategy and high-risk/high-reward opportunities. Outside research backs up that these challenges have already caused a decrease in publicly traded companies: “About 3,600 firms were listed on U.S. stock exchanges at the end of 2017, down more than half from 1997.” ( Bloomberg, 2018)

At Carta, we’re invested in creating a future that enables entrepreneurs, investors, and employees to manage equity in the way that works best for the company—whether they stay private, go public, or go private again.

Here’s how we think about the options:

Going public is often thought to be the ultimate mark of entrepreneurial success, but in the future staying private will be just as well regarded, if not more.

Additional reading: Going public is already on the decline

-

In the mid-1990s, there were more than 8,000 publicly traded companies on exchanges. By 2016, there were only 3,627. ( Center for Research in Security Prices, 2016)

-

There were 23 publicly listed companies for every million people in 1975, but only 11 in 2016. ( National Bureau of Economic Research, 2018)

-

The average number of IPOs was 282 per year from 1976 through 2000. Since then, the average has been 114. ( Credit Suisse, 2017)

-

The disappearance of small and micro-firm IPOs was the main reason the total number of stocks declined between 1996 and 2016. ( Vanguard, 2016)

-

The number [of public companies] is shrinking in part because of the increasing benefits—from a company’s perspective—of remaining private. ( Vanguard, 2016)