While valuations at most phases of the startup lifecycle were highly volatile in 2022, the earliest stage was an apparent exception. The median valuation for seed fundings on Carta stayed steady at $15 million in each of the first three quarters. In Q4, it inched down to $14 million.

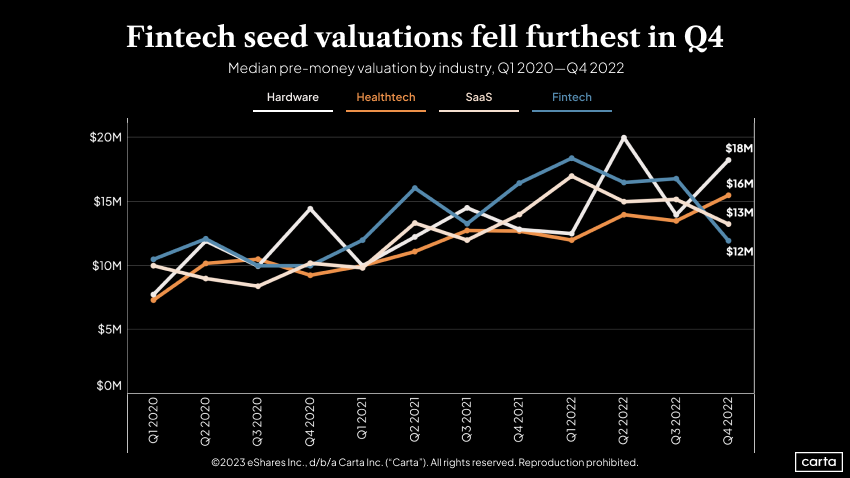

On a sector-by-sector basis, however, things were a bit more interesting. The downturn is affecting different sectors in different ways. In each of the four sectors seen below, median seed valuations moved by at least 20% over the course of the year.

Seed valuations by sector

The SaaS sector is by far the largest in Carta’s database, with more than 7,800 companies on the platform. SaaS companies on Carta logged more than 2,000 transactions last year.

The median seed valuation resulting from these transactions fell from $17 million to $13 million—a 24% dip. The plunge was steeper in fintech, where the median seed valuation fell by 39%.

Among this sample of four sectors, SaaS and fintech had the two highest median seed valuations in Q1. But by Q4, two other sectors were on top.

Chief among them is the umbrella category of hardware, electronics, and IT. The median seed valuation for startups providing these three types of tech infrastructure rose 39% over the course of the year—but it was a bumpy ascent, including a valuation spike in Q2 and a notable dip in Q3.

Seed valuations are also trending up in the healthtech sector, which saw a 33% increase over the course of the year. That includes a 23% jump in Q4 alone.

Learn more:

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: