Back in 2021, Los Angeles was the fastest-growing metro area in the U.S. for first-time venture capital funds. In fact, the number of first-time funds formed in the LA metro more than doubled from 2020 to 2021. This surge of new emerging managers appeared poised to fuel an up-and-coming startup ecosystem.

Since then, the venture sector entered a downturn. At the national level, funding for VC-backed companies has fallen dramatically. Is the same true for LA venture capital?

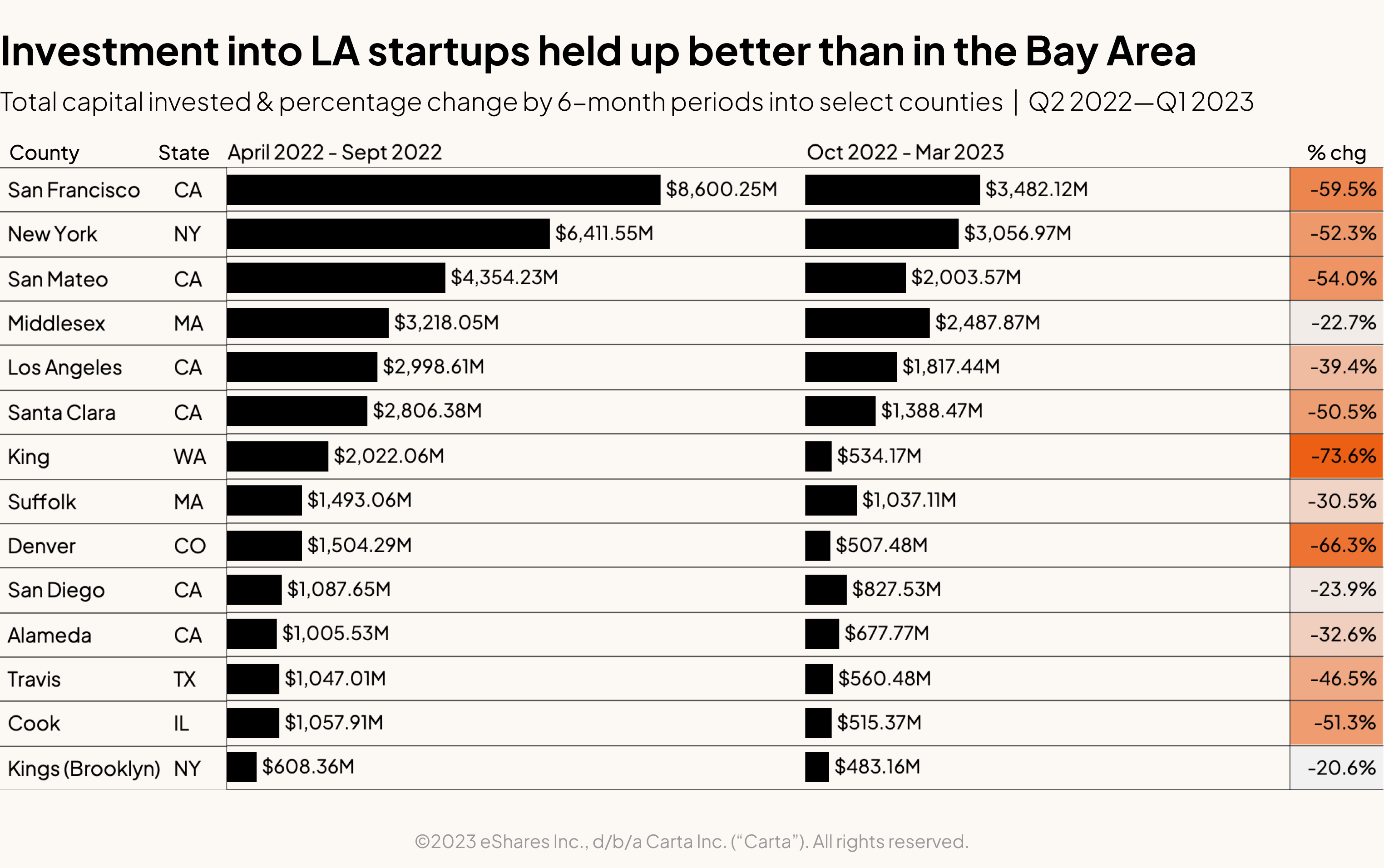

Los Angeles certainly hasn’t been immune to the contractions in venture funding. But the City of Angels has proven more resilient than other metros, with a less severe drop in startup fundraising since the 2021 peak relative to bigger tech hubs like New York and the Bay Area. As of this writing, the venture ecosystem in LA is still stronger than it was in 2019 and 2020.

The LA venture capital ecosystem in context

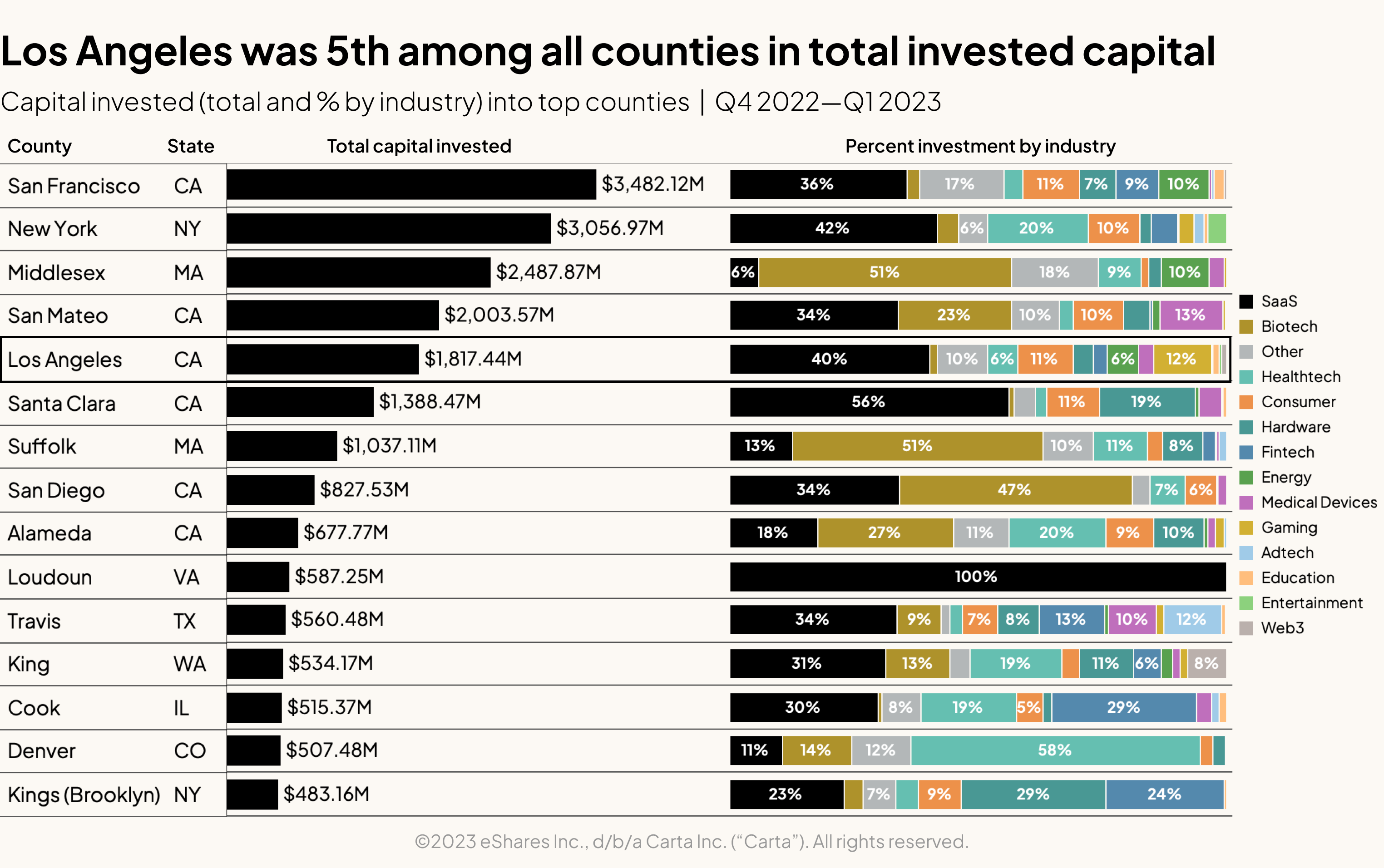

Across Q4 2022 and Q1 2023, Los Angeles County was the fifth-busiest county for venture investment in the U.S., according to Carta data, with more than $1.8 billion in capital raised.

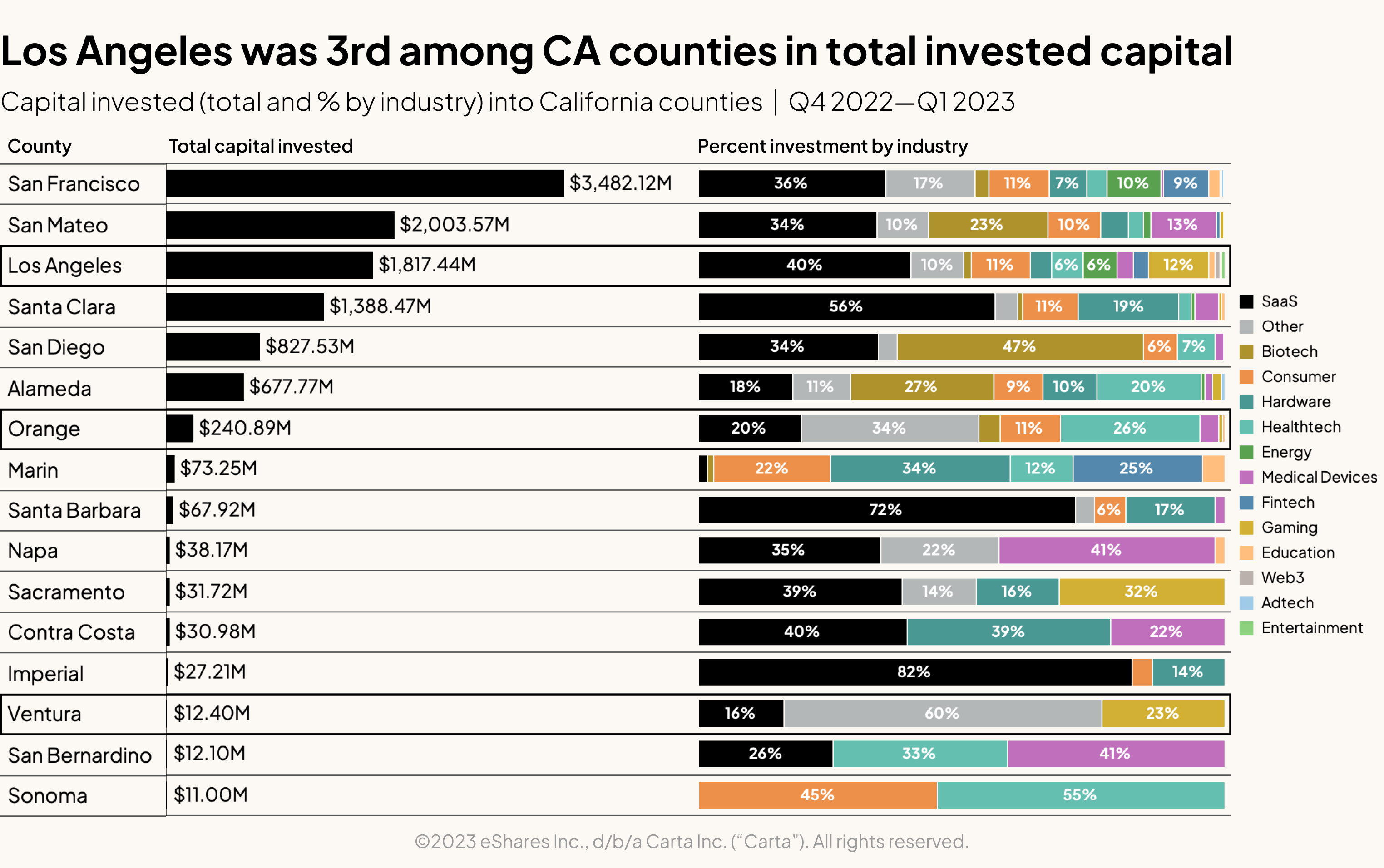

California counties still dominate

Over the same span, Los Angeles was one of only seven counties to top the $1 billion mark in direct venture capital investments on Carta. LA ranks between San Mateo County and Santa Clara County, which together encompass the geographical center of Silicon Valley. In all, six of the nine counties with the most capital raised in Q4 and Q1 are located in California.

Like in many other regions, SaaS companies in LA raised more than any other industry during this six-month stretch. Unlike in other counties, gaming startups garnered a significant chunk of funding in LA, at 12%—the highest in any of the top 15 counties.

While venture funding in the Bay Area is spread across a few different counties, the bulk of venture capital in Southern California is concentrated in Los Angeles County. Among LA’s neighbors, startups in Orange County raised much more capital than in Ventura County. (LA also outpaces its neighbors in venture capital raised per capita: There are roughly 10 million people living in Los Angeles County, 3 million in Orange County and 800,000 in Ventura, according to the 2021 American Community Survey.)

How has LA performed through the venture downturn?

Nationally, startup funding was down more than 60% in Q4 2022 and Q1 2023 compared to the prior two quarters combined. Activity was down in LA, too—but it wasn’t hit as hard as in other major hubs.

While investment in Los Angeles County declined by 39.4% from the previous six months, San Francisco County was down 59.5%. San Francisco still raised 1.9x more capital than Los Angeles in Q4 and Q1, but that’s a much closer gap than the 2.9x multiple from Q2 and Q3 2022. New York, San Mateo, and Santa Clara counties were also all down more than 50%.

The biotech buoy

Notably, San Diego County in California and Middlesex and Suffolk counties in Massachusetts—all markets where biotech dominates—were affected far less than other tech hubs in Q4 and Q1. Middlesex and Suffolk, where 51% of money went to biotech, saw a 22.7% and 30.5% decline. Looking south of LA, the same was true in San Diego: With 47% of cash raised going to biotech startups, San Diego saw a relatively modest 23.9% decline.

Venture capital in Los Angeles County vs. Orange County

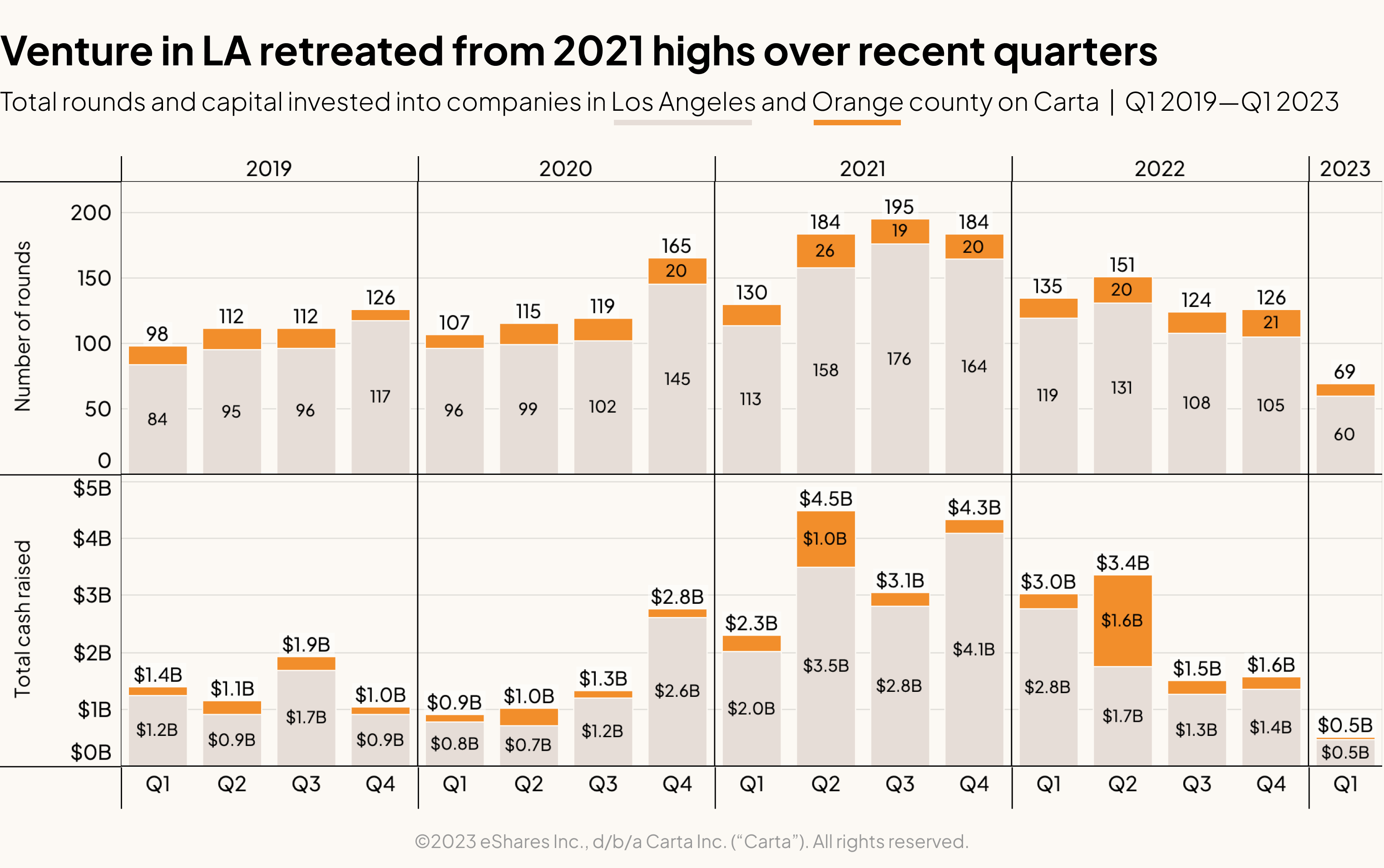

In 2021, the number of VC investments in Los Angeles rose 38% from the year prior and capital raised climbed 133%. In 2022, the number of investments fell 24% from 2021 levels, while capital raised fell 41%.

While the comparison to 2021 is certainly unfavorable, the number of deals in 2022 outnumbered those in 2019 and 2020. Likewise, total funding raised in 2022—$7.2 billion—far outpaced the $5.3 billion raised in 2020 and the $4.7 billion raised in 2019. In other words, last year was still a good year in LA, by non-2021 historical standards.

Funding by stage in Los Angeles

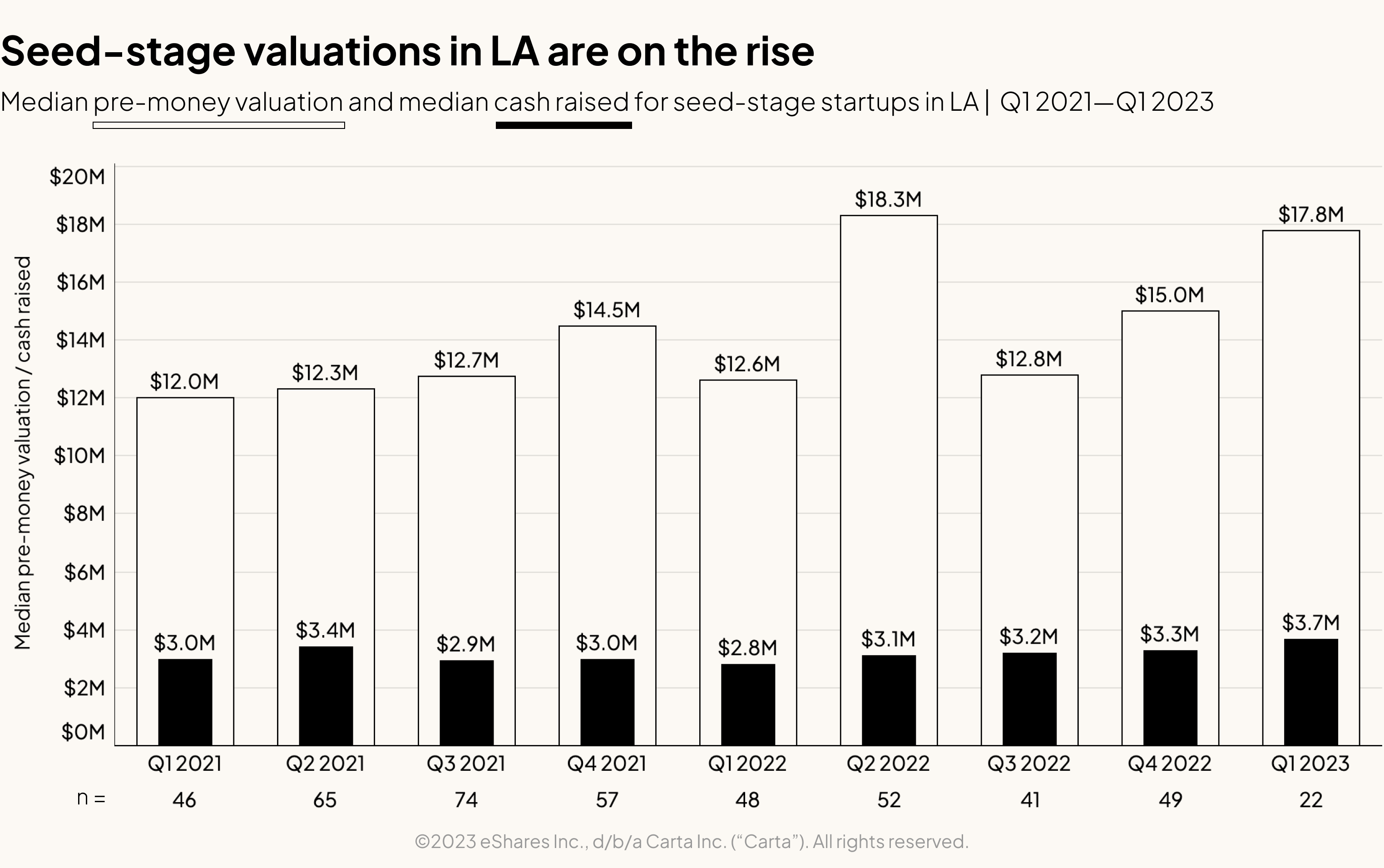

Like every other market in the U.S., Los Angeles has felt the sting of the recent venture slowdown, with major deal metrics mostly trending downward. But the seed stage in LA is proving to be an exception.

Seed stage

Both the median cash raised and the pre-money valuations of seed-stage companies in LA have been trending upward for the last two quarters. However, total deal count fell by more than half in Q1 2023 from 49 deals in Q4 2022 to 22 reported so far (some deals made in Q1 may be recorded later).

Lower deal counts at higher valuations could be a signal that seed investors in the LA market are getting choosier. They are still investing in the companies they are most excited about—and at relatively high valuations. But other startups that could have raised capital at a lower valuation in a different environment might now be struggling to raise any capital at all. If that’s the case, it’s a trend that’s developed only recently: Seed deal count in LA had increased in two of the previous three quarters.

LA seed funding in context

Over the past two quarters, median seed valuations and round sizes in LA have both trended well above the national medians:

|

LA median seed valuation |

National median seed valuation |

LA median seed round size |

National median seed round size | |

|

Q4 2022 |

$15M |

$13.6M |

$3.3M |

$3M |

|

Q1 2023 |

$17.8M |

$13.2M |

$3.7M |

$3.1M |

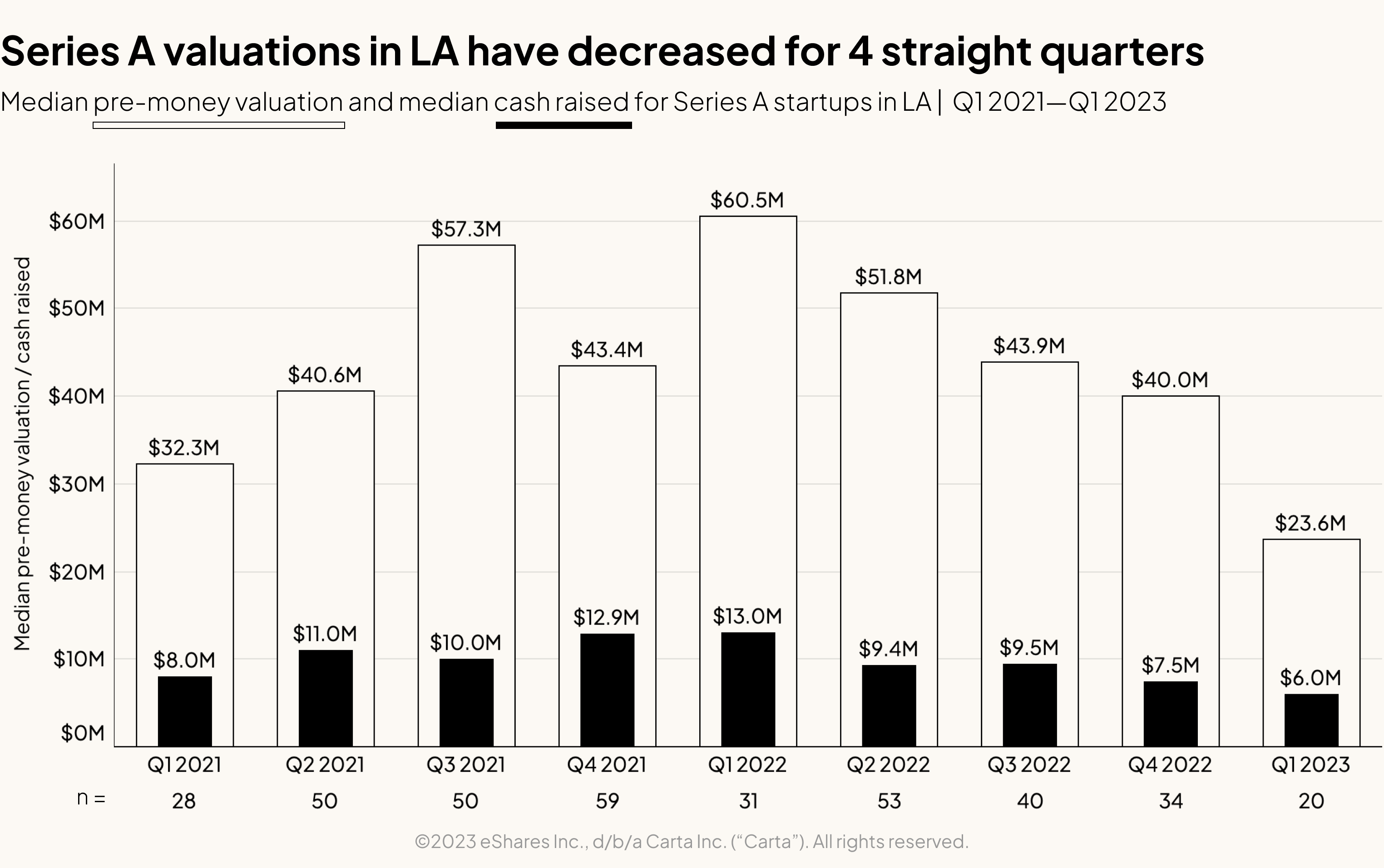

Series A

The median Series A valuation in LA had already declined for three straight quarters after peaking in Q1 2022. But it fell more sharply in Q1, dropping 41% compared to Q4 2022.

The median Series A valuation in LA was higher than the national median in Q4 2022, but it fell to barely half the national median in Q1. Round sizes in LA, meanwhile, have been slightly lower than the national median the past two quarters:

|

LA median Series A valuation |

National median Series A valuation |

LA median Series A size |

National median Series A size | |

|

Q4 2022 |

$40M |

$36.8M |

$7.5M |

$8M |

|

Q1 2023 |

$23.6M |

$40M |

$6M |

$6.4M |

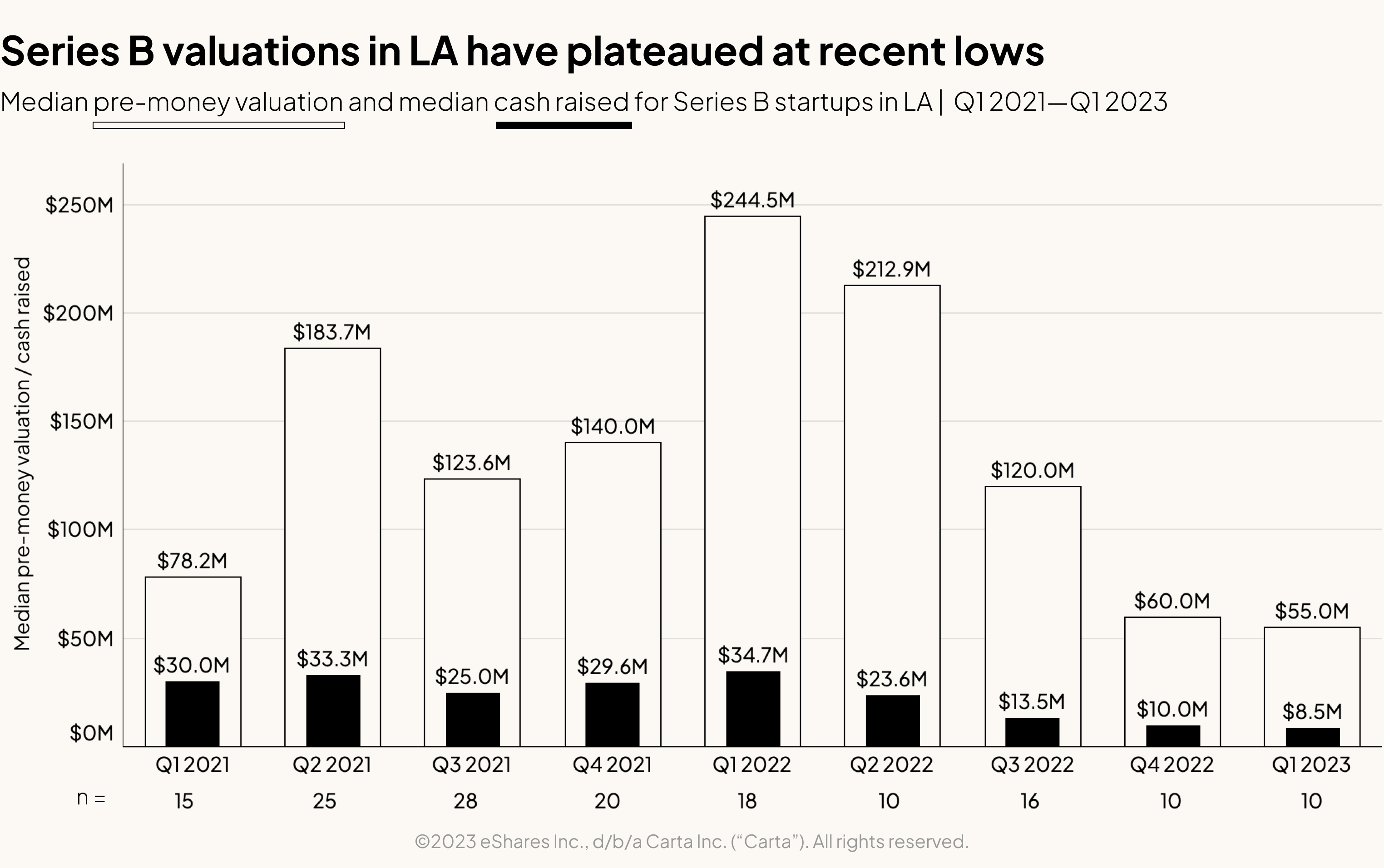

Series B

The median Series B valuation in LA declined by around 8% between Q4 2022 and Q1 2023, while the median round sizes declined in Q1 for the fourth straight quarter. The median Series B raise of $8.5 million is lower than what Series A raises were from Q2 2021 to Q3 2022. This tracks with national data on the increase in down rounds.

Poised for growth

The LA venture ecosystem still has a long way to go before it rivals the Bay Area as the top metro for venture investment. But over the past several years, the region has solidified its status as one of the Big Four venture metros. The San Francisco Bay Area and New York Metro Area still stand in a tier of their own, but a second distinct tier has emerged: the Boston and Los Angeles metros. Venture capital invested in these two regions is distinctly greater than the totals raised by a third tier of emerging venture hubs in Austin, Denver, Seattle, Chicago, and Miami.

With the surge of first-time funds a few years ago and a bumper crop of seed-stage companies outperforming the national median valuation, the Los Angeles venture capital ecosystem is well-positioned to continue its impressive growth.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: