Carta is the nation’s leading 409A valuation provider, and we understand that your ultimate goal is to receive a fair and reasonable 409A valuation in a timely manner, stay IRS compliant, issue options to your employees quickly, and focus on growing your business. Our team of analysts combine their Big 4 backgrounds and decades of valuation experience with Carta’s proprietary software to deliver timely, cost-effective, and accurate 409A valuations.

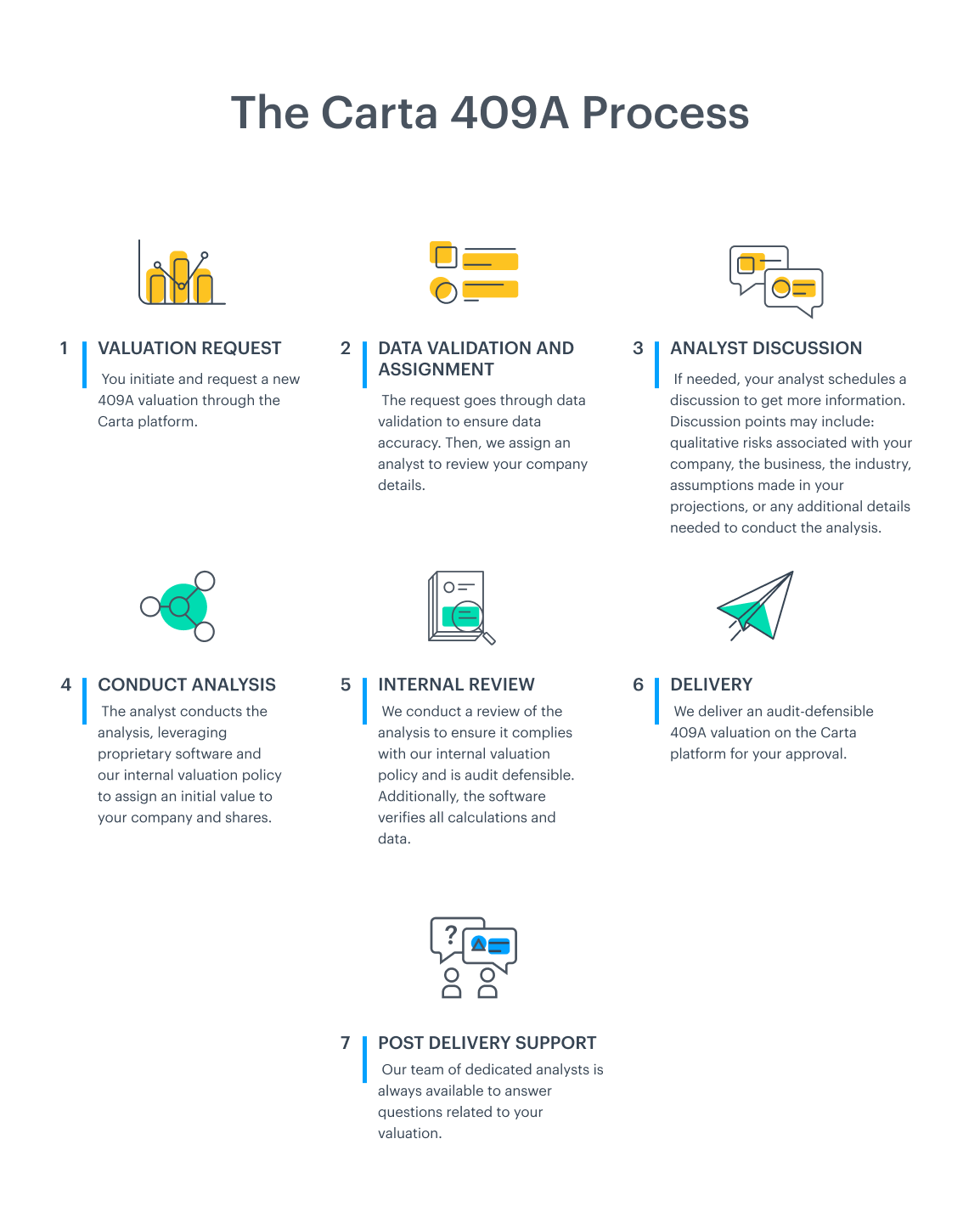

At Carta, we tailor your 409A experience to your specific needs. We believe transparency makes auditor conversations easier and turnaround times clearer, ultimately giving you a deeper understanding of how we came up with your company’s valuation. Here’s how a typical 409A valuation with Carta works.

What to expect from the Carta 409A process

-

When your company is ready for a 409A valuation, we make sure your cap table on Carta is up to date and verified. Since your cap table includes many of the details needed for a valuation, we save a lot of time in this step. We also import some additional information, like financial statements and projections, through our XeroTM and QuickbooksTM integrations.

-

Next, an analyst reviews your information and uploaded documents. If needed, we will reach out and confirm certain details or schedule a discussion. This call is used to capture additional context not included in the request details, qualitative risks associated with the business, industry specific information, and assumptions made in the projections.

-

After gathering the information above, the analyst puts together their preliminary analysis and uses Carta’s proprietary software to assign an initial value to all share classes. Our software includes a comprehensive set of checks to ensure the data is accurate and reduce the likelihood for data-based mistakes. But this is not the only step we take to ensure accuracy.

-

We review the valuation analysis internally and check against our valuation policy, which is set by our team of industry experts. This secondary review tests the underlying qualitative assumptions of the valuation analysis, just like an external auditor would.

Using the same provider for cap table management and 409A valuations saves you time and improves audit-defensibility. While our valuations team is independent from the cap table management business, our analysts are able to use your cap table data on Carta and leverage our valuation software to automate the manual and time-consuming calculations that other 409A providers spend hours to complete. This allows us to spend more time understanding the specifics of your company and focusing on the valuation analysis.

Request a new 409A here or contact our sales team at 1-833-403-5468 for additional information.

–

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.

All product names, logos, and brands are property of their respective owners in the U.S. and other countries, and are used for identification purposes only. Use of these names, logos, and brands does not imply affiliation or endorsement.