Carta easily scales with you from incorporation to IPO. Begin with our Build plan, which includes issuing securities, cap table management, and 409A valuations. Your cap table will stay up to date as you scale, with less effort.

We aren’t your average cap table provider. Carta is changing how private markets operate and we’re constantly improving our products and services. We’re the leading provider of 409A valuations and have over 40,000 companies on our platform.

Shareworks Startup Edition is owned by Morgan Stanley. With a mission to change how private markets operate, Carta relentlessly innovates and provides the best equity management experience for your organization.

With over 15,000 valuations completed, late-stage companies on Carta can be confident that our dedicated, in-house team of analysts will provide exceptional service and audit support when delivering a 409A valuation.

When you need to modify a security, you can easily update on your own without calling support. If you do need assistance though, Carta’s extensive and professional services staff is eager to help.

Hey early-stage founders, there’s a free plan to help companies with less than 25 stakeholders and less than $1M raised in funds issue equity, fundraise, and find support along the way.

Want help deciding? Call us at: 1-833-403-5468

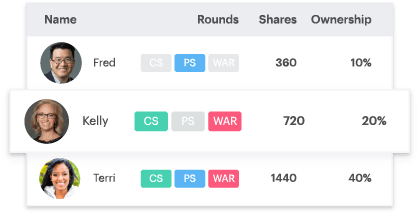

Advanced cap table management

With Carta, when you issue securities, your cap table updates automatically. On Shareworks Startup Edition, your cap table doesn’t always update automatically, which leaves room for human error and wastes time.

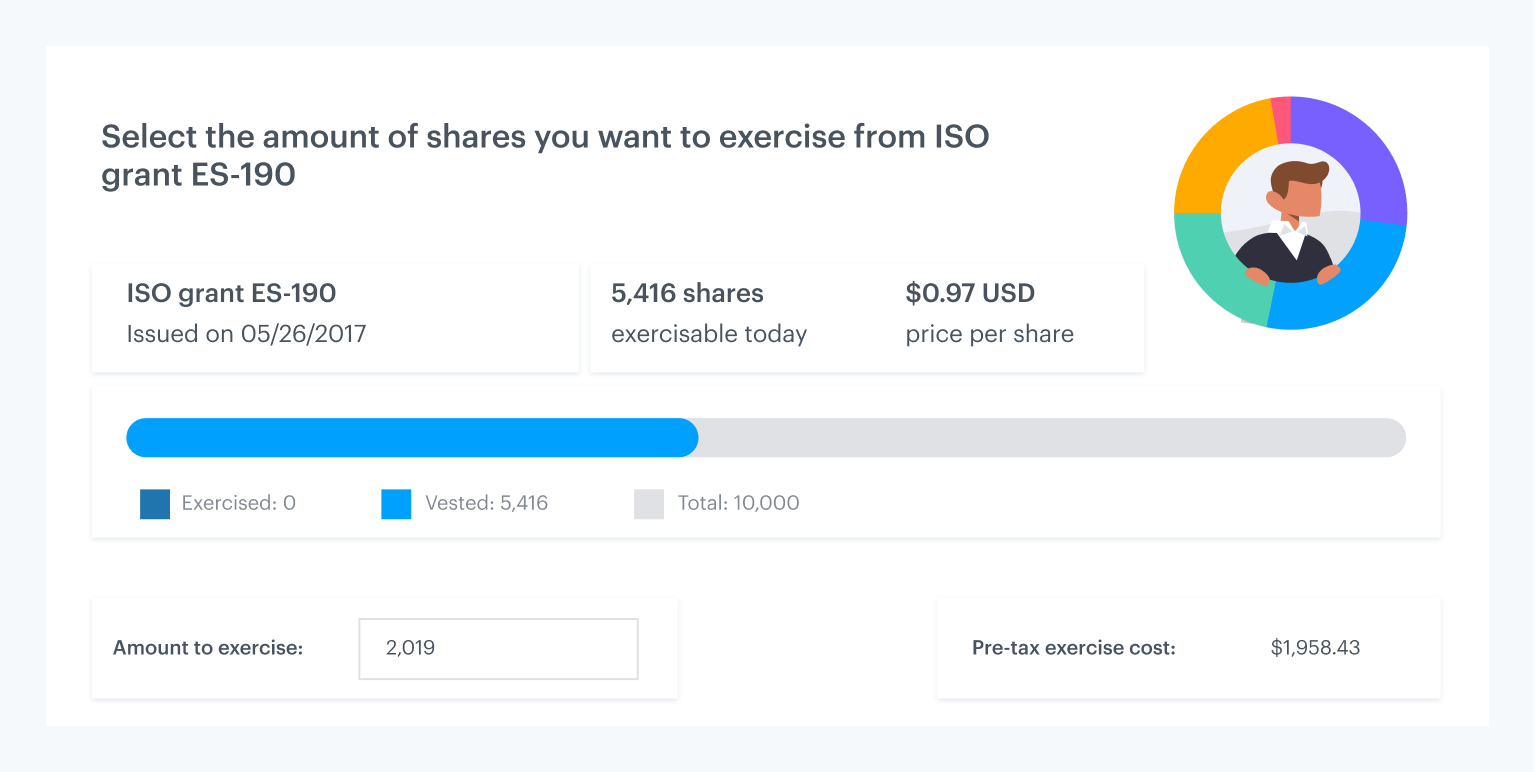

Employees can exercise options in-app

Employees love Carta—they can accept securities, exercise options, and view vesting progress from the web or our iOS app. On Shareworks Startup Edition, exercising is harder for admins and employees, who can only exercise manually.

Built-in compliance features

From 409A valuations, to Form 3921, ASC 718, and Rule 701 management, Carta helps you stay compliant all in one place. Because Carta stress tests cap tables for completeness accuracy, Carta can better leverage your data to help you meet compliance requirements such as needing a 409a valuation or 718 expense report.

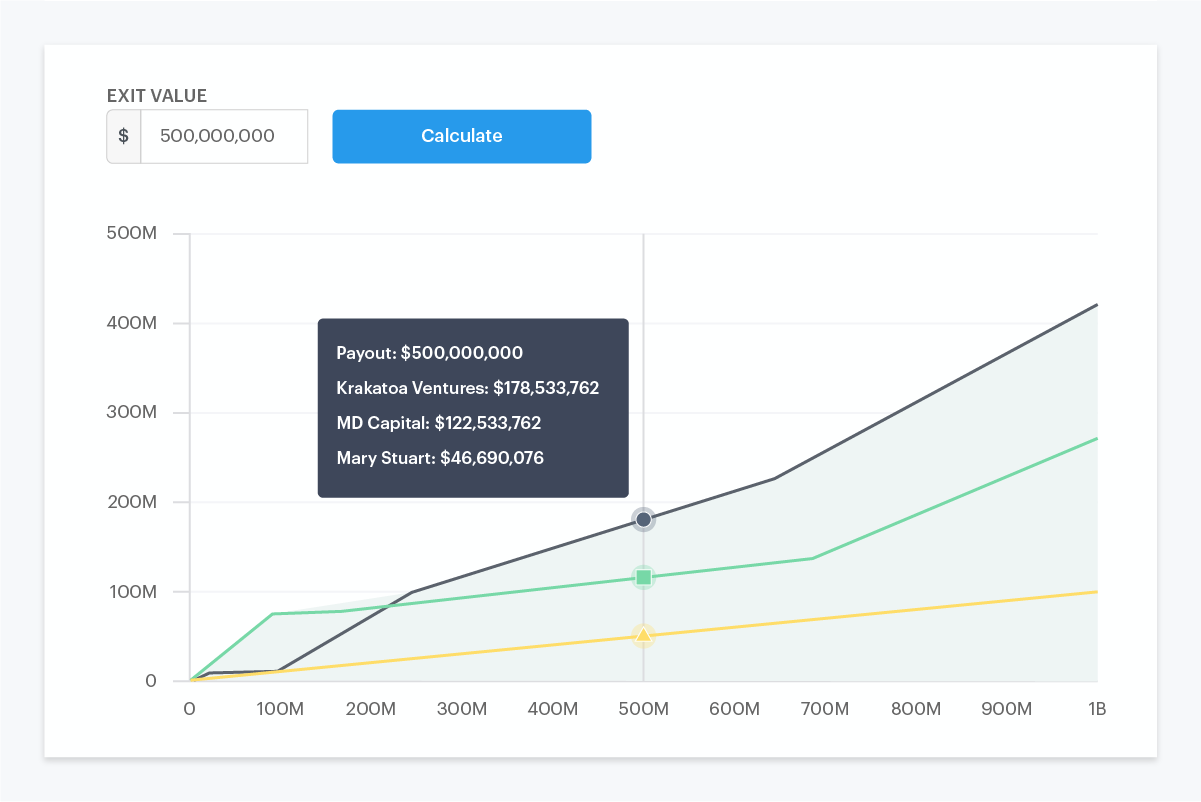

Model your next round before you sign

We pull your existing cap table data into our scenario modeling tool, so it’s faster to model financings and exits. Our easy-to-use tools include sensitivity and breakpoint analysis, payout and dilution modeling, and pro forma cap tables.

Streamline tender offers & option exercising

Carta transacts $250 million+ in option exercises, repurchases, and tender offers per month. With Carta, your employees can exercise on web or mobile. And you can run a tender offer or custom liquidity program that will automatically update your cap table. Shareworks Startup Edition doesn’t support tender offers.Learn more about liquidity >

At Carta, we spend a lot of time educating employees about private company equity. The best time to give equity information to employees is before they start, in their offer letter. Our offer letter template will better educate candidates on their equity.