At Carta, we spend a lot of time figuring out how to better educate employees about startup equity and how to calculate the equity in a job offer. We realized that the job offer letter itself was a good place to do this, so in 2016, we decided to reinvent the offer letter—and we’ve made improvements over the years.

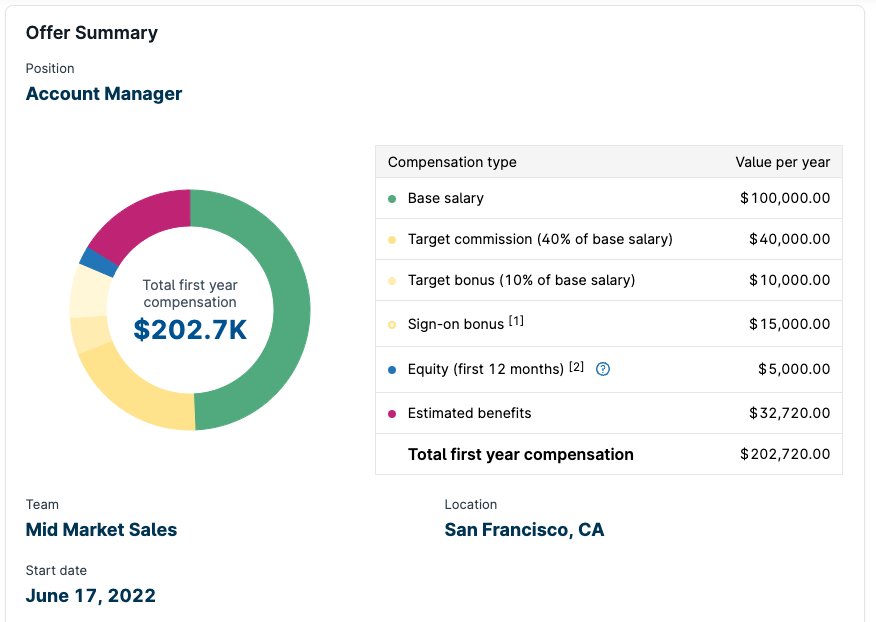

Here’s a tour of the better offer letter. You can download a sample offer letter template using the form below or schedule a demo to tour the full offer letter product that’s displayed in the screenshots in this article.

Easy-to-read design

Starting a new job can be overwhelming, and having to go through pages of legalese doesn’t help. Instead of a dense document, the better offer letter breaks all the details into digestible chunks to help the candidates understand everything they’re reading—especially the equity compensation offer.

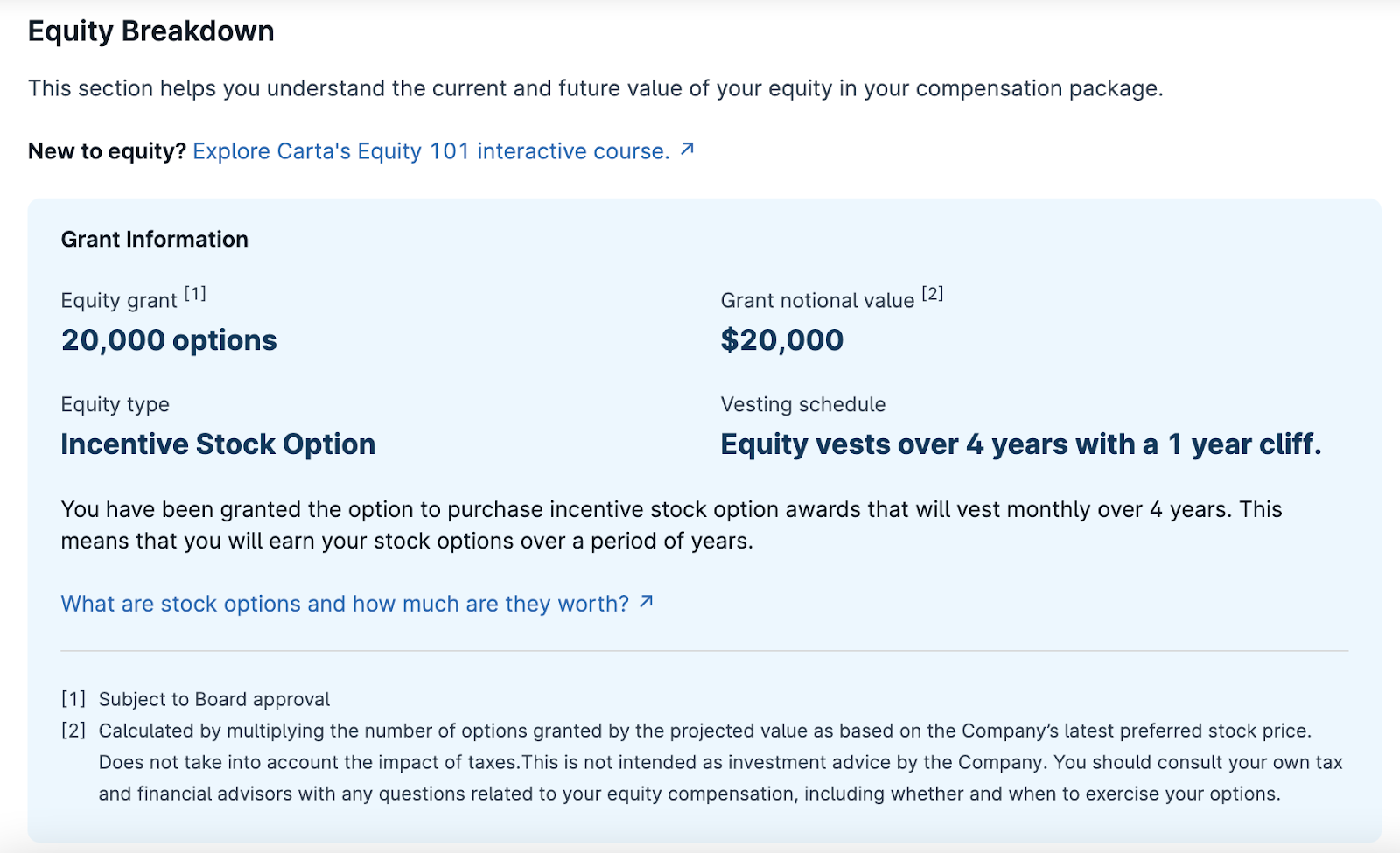

Equity education

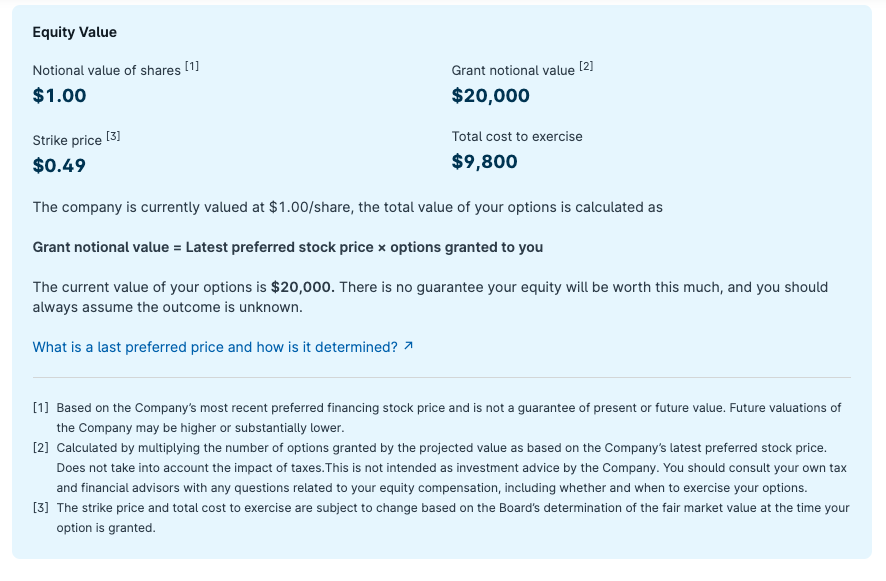

Equity can be complicated, but often, it’s what really separates job offers. This is why it’s so important for candidates to understand what they’re being offered. Instead of just telling them how many shares they can buy, we explain how vesting works, how to think about the value of their equity, and more.

Helpful context about the offer

Create your own offer letter

We hope this example will encourage other companies to better explain equity in their employment offer letters. As it’s a key driver of wealth in tech, we think it’s crucial to level the playing field by making sure everyone understands how equity works.

If you’d like to see the rest of the letter and use a sample as a template for your own, you can download it (and find instructions for implementing it) above.

Use your ATS with the offer letter template

The process might vary depending on your applicant tracking system (ATS), but here are the general steps you should take:

-

Download the template using the form above. We include PDF, Word, and Pages versions in the zip file.

-

Update the template to reflect your company branding and the fields your ATS requires to generate the offer letter (e.g., “annual salary” should say something like {salary_amount}, not $100,000).

-

Upload your new template to your ATS (we use Lever).

-

Create the offer for your specific candidate in your ATS, adding the specific offer terms.

-

Save the final version as a PDF and send to the candidate for their signature.