Executive summary

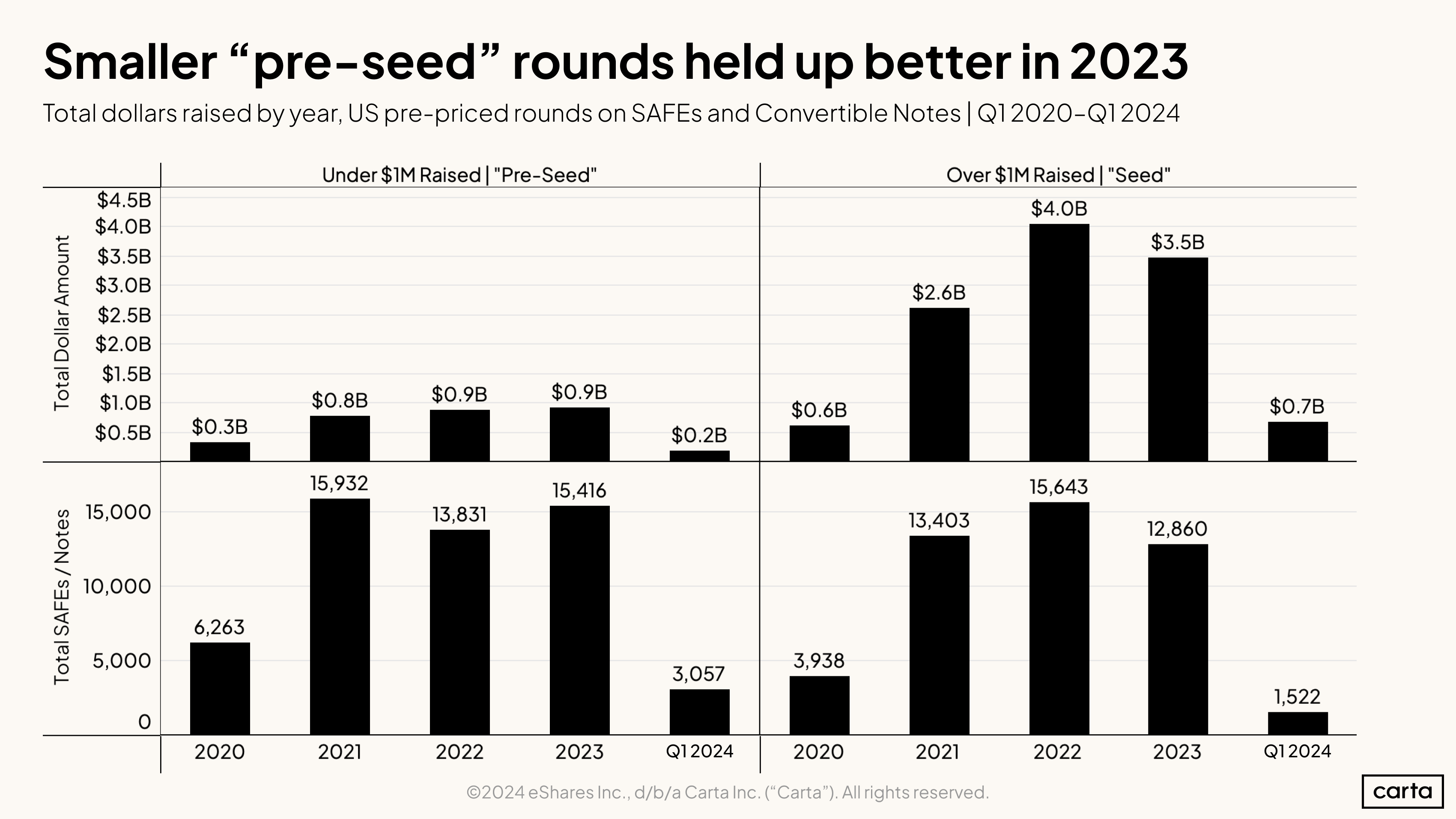

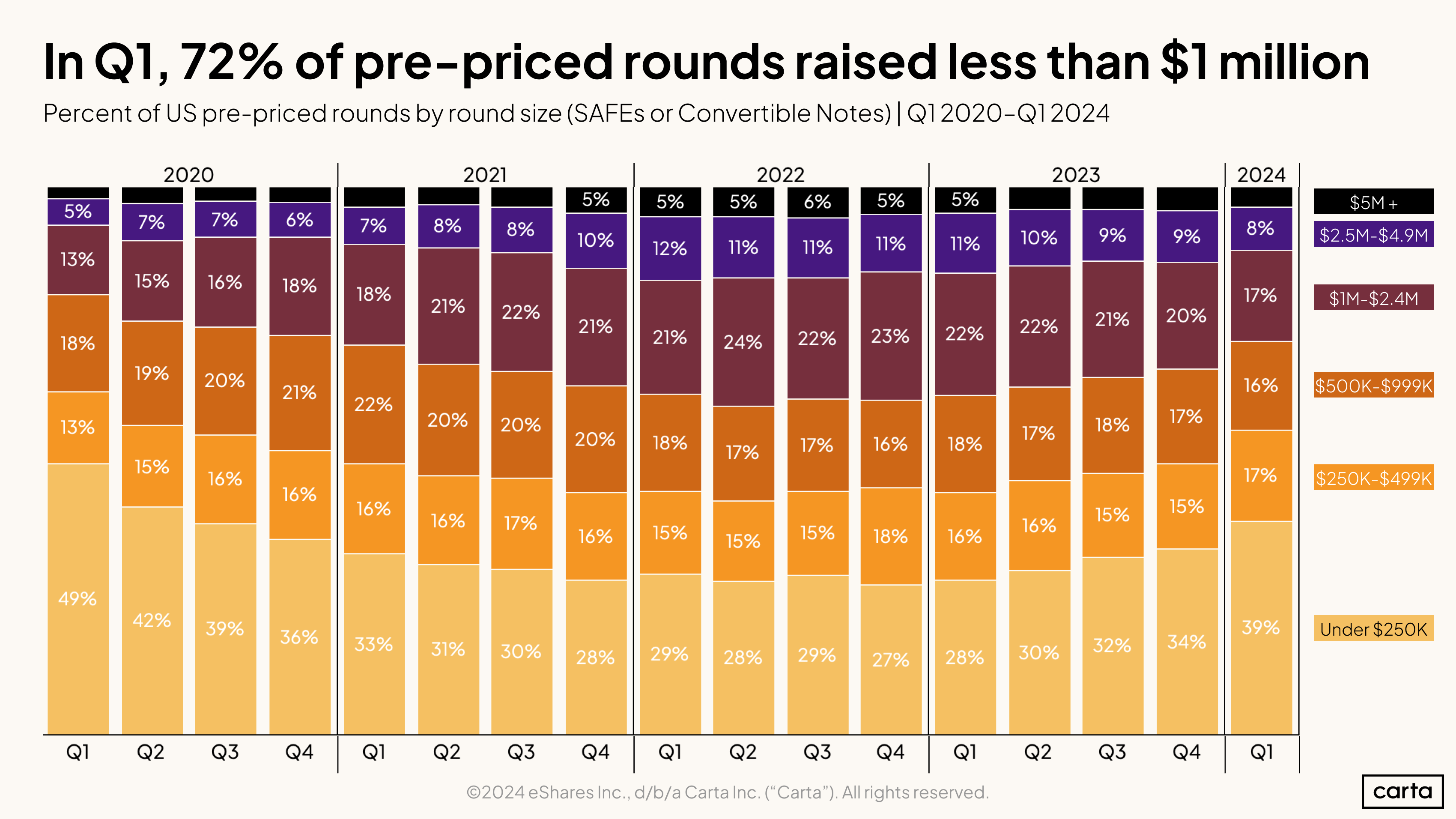

What is a pre-seed round anyway? Many startups will begin their fundraising journeys in this stage, but there are no consensus definitions in this part of the venture market.

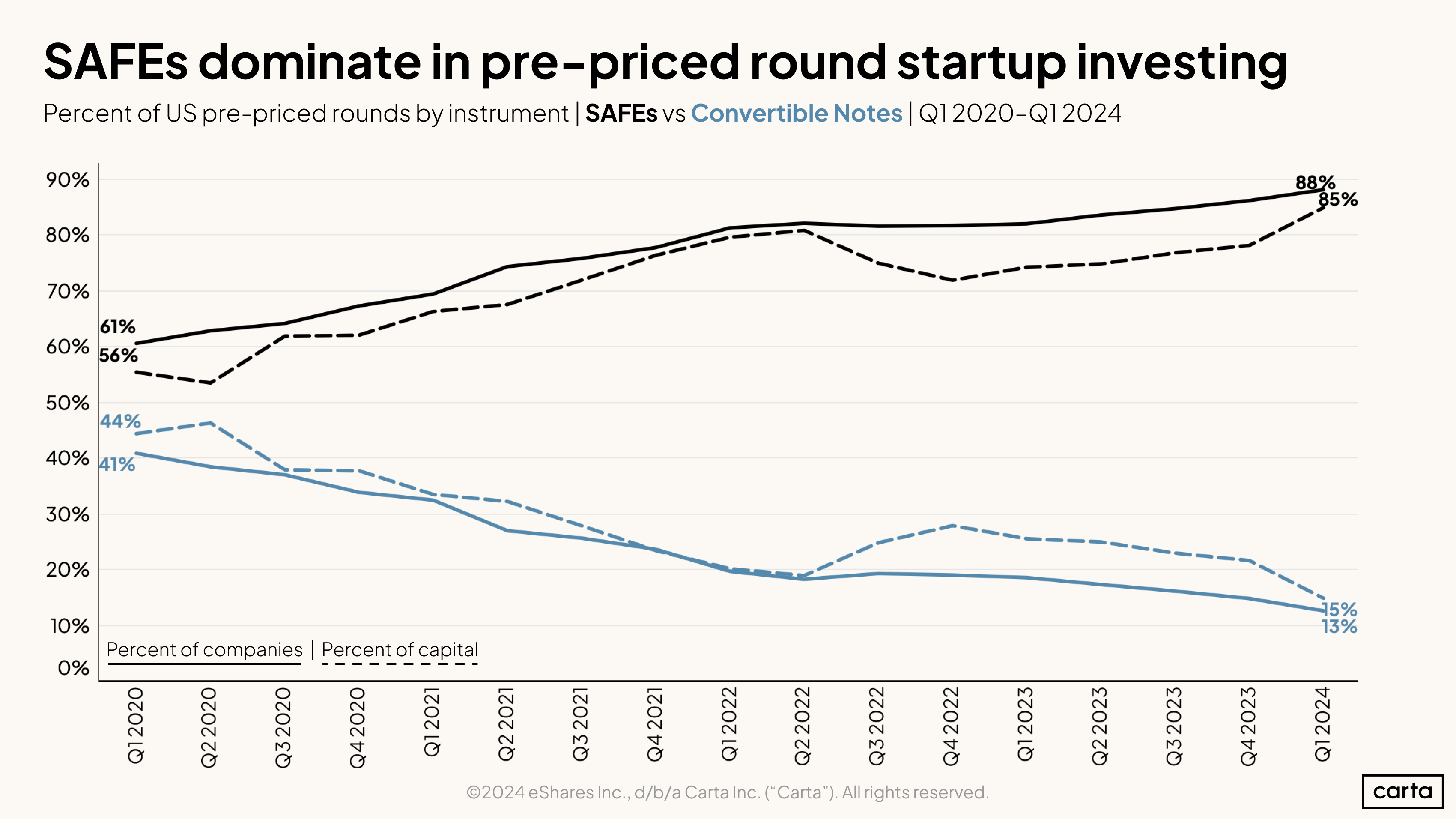

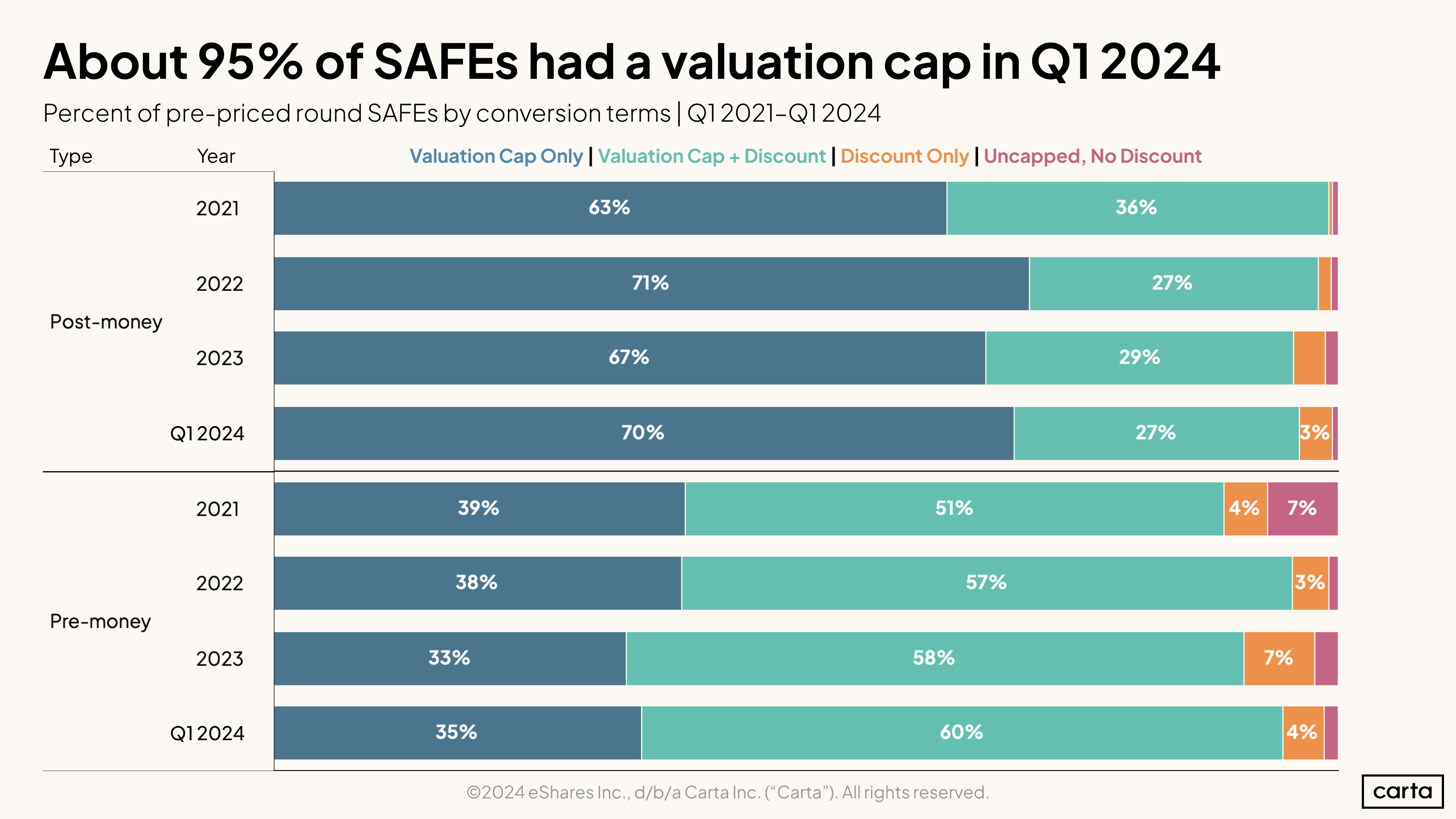

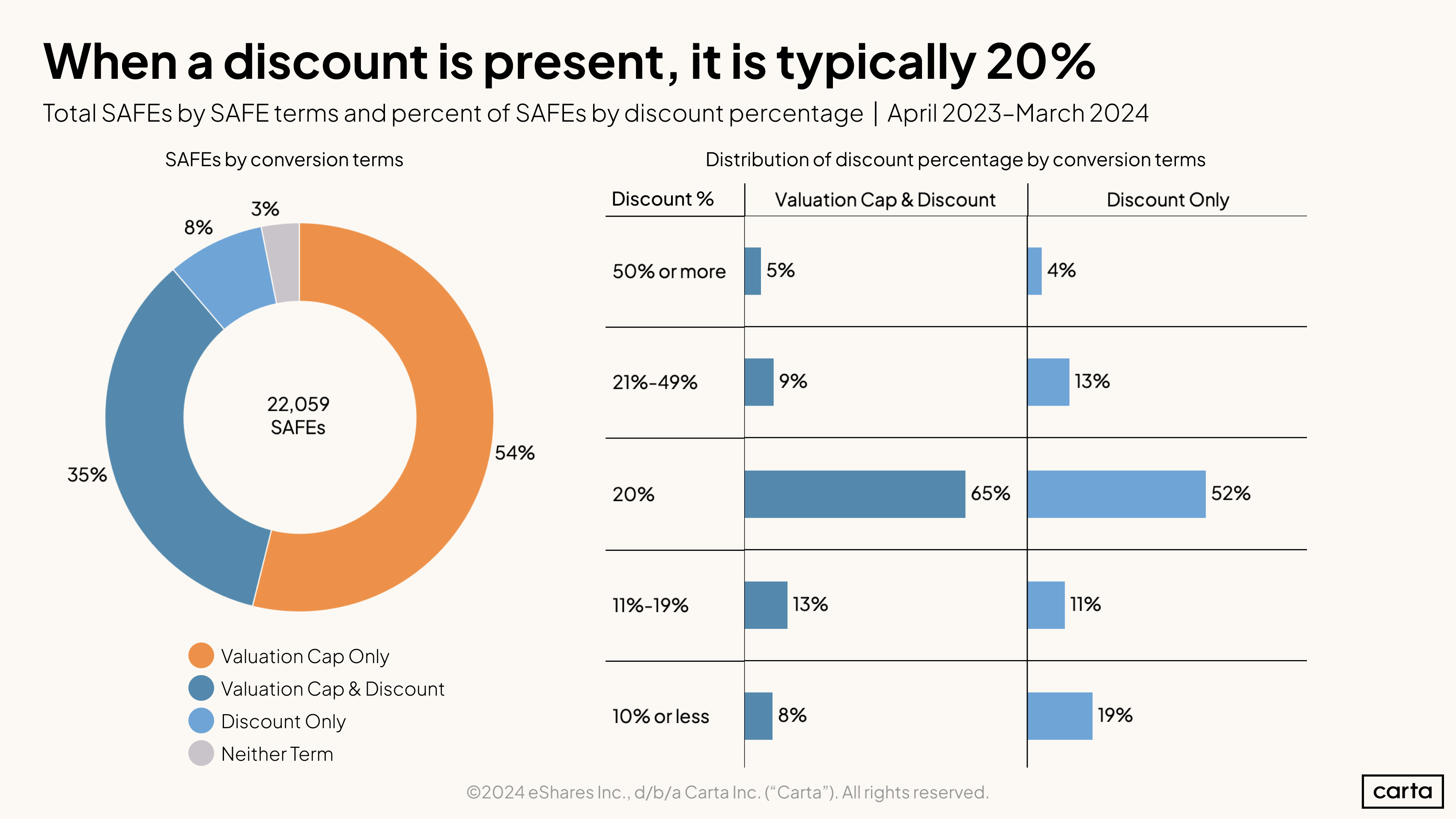

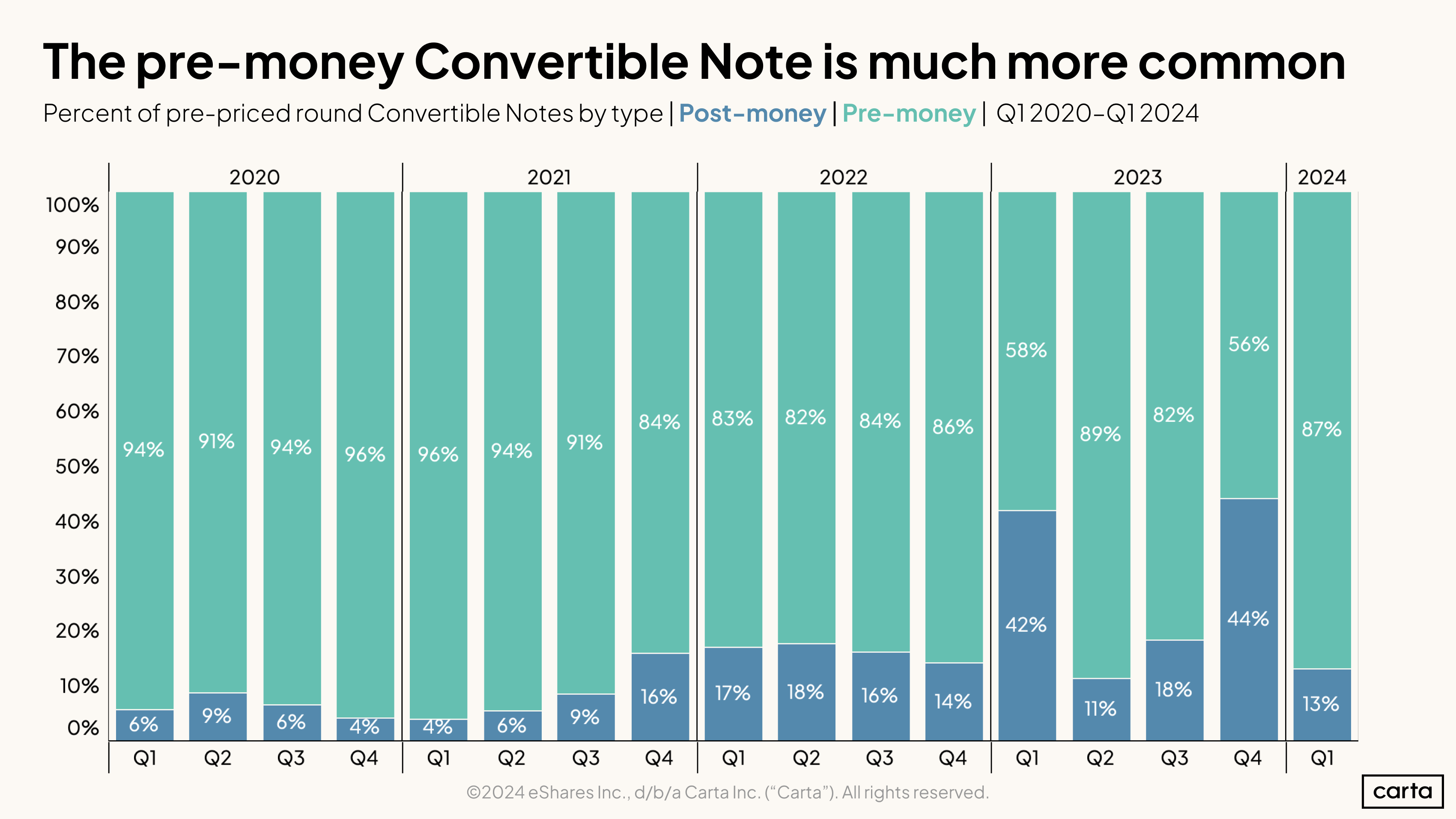

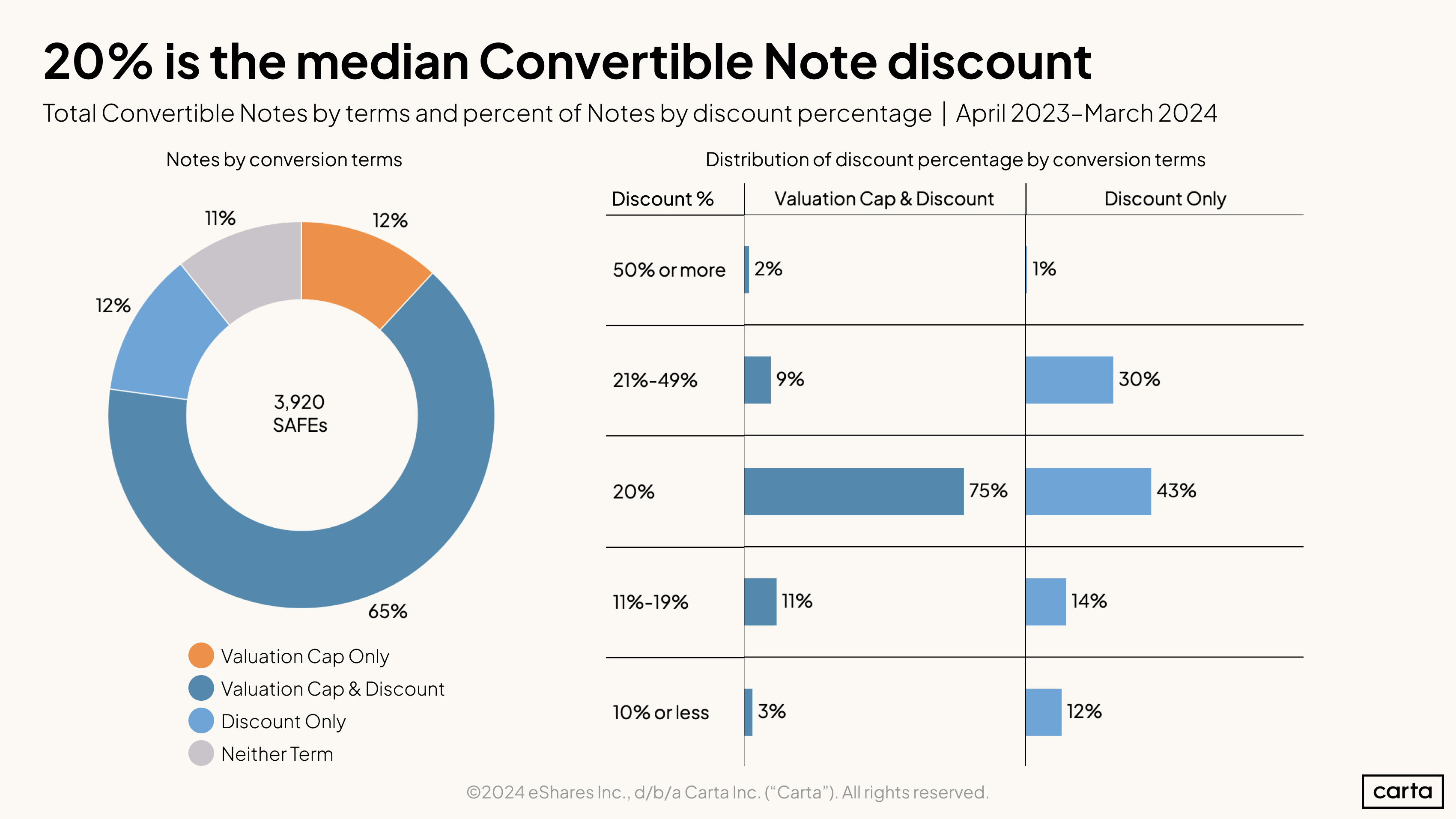

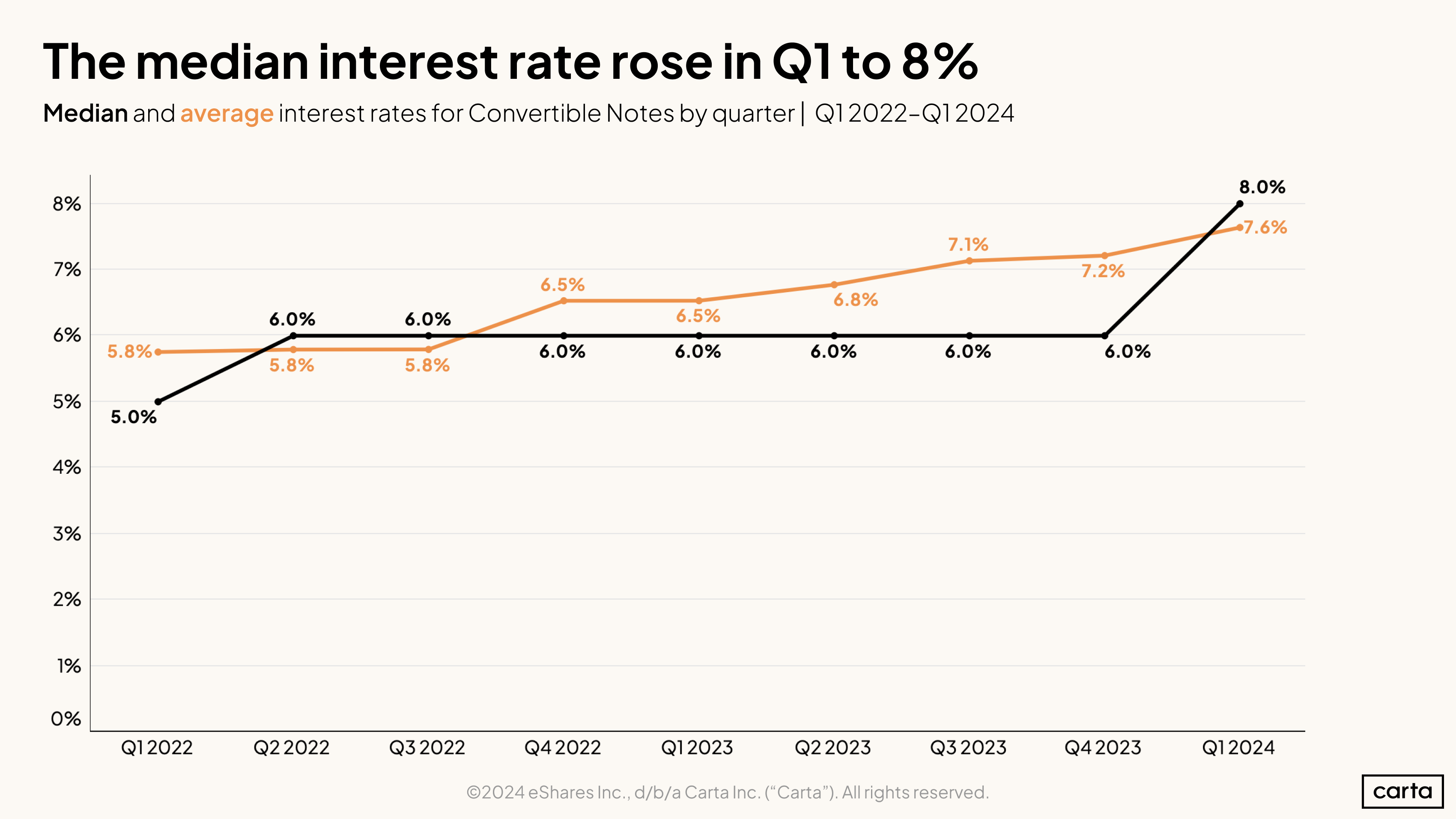

There is one clear trend: Companies at this stage are fundraising using SAFEs (Simple Agreement for Future Equity) and convertible notes as opposed to the standard priced venture rounds.

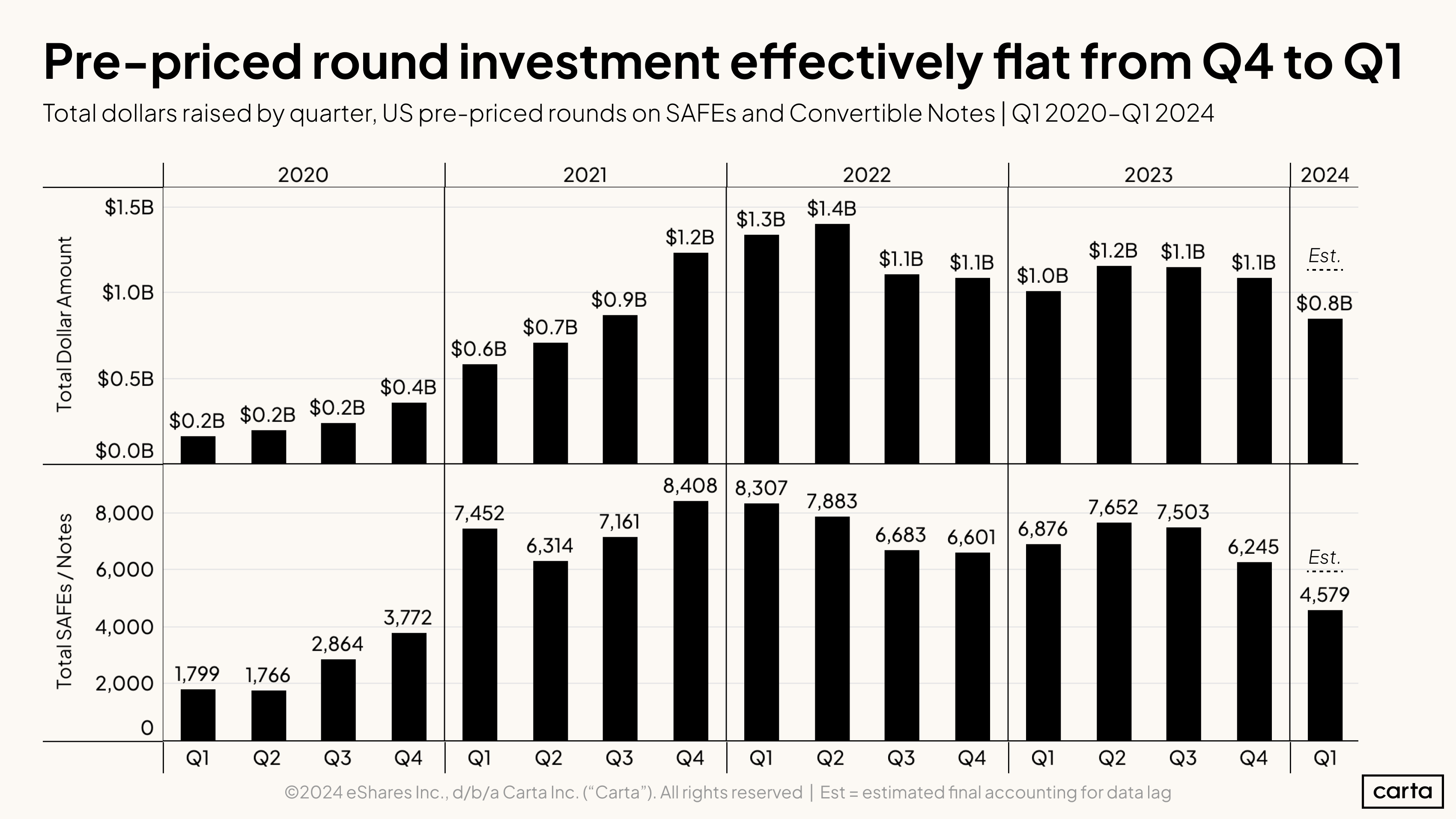

Given this trend, we think our data set can help founders make sense of the ambiguity. Since 2020, companies on the Carta cap table platform have signed 101,865 individual SAFEs and convertible notes before raising any priced funding. That’s $14.5 billion invested into the earliest startups.

Of course founders on Carta who have yet to raise a million dollars have access to our cap table platform for free through Carta Launch, which also includes tools to create and fund SAFEs in a few clicks.

If you’d like a high-res deck of all the slides below PLUS five extra graphics breaking down SAFE rounds by industry— download that here.

Q1 highlights

-

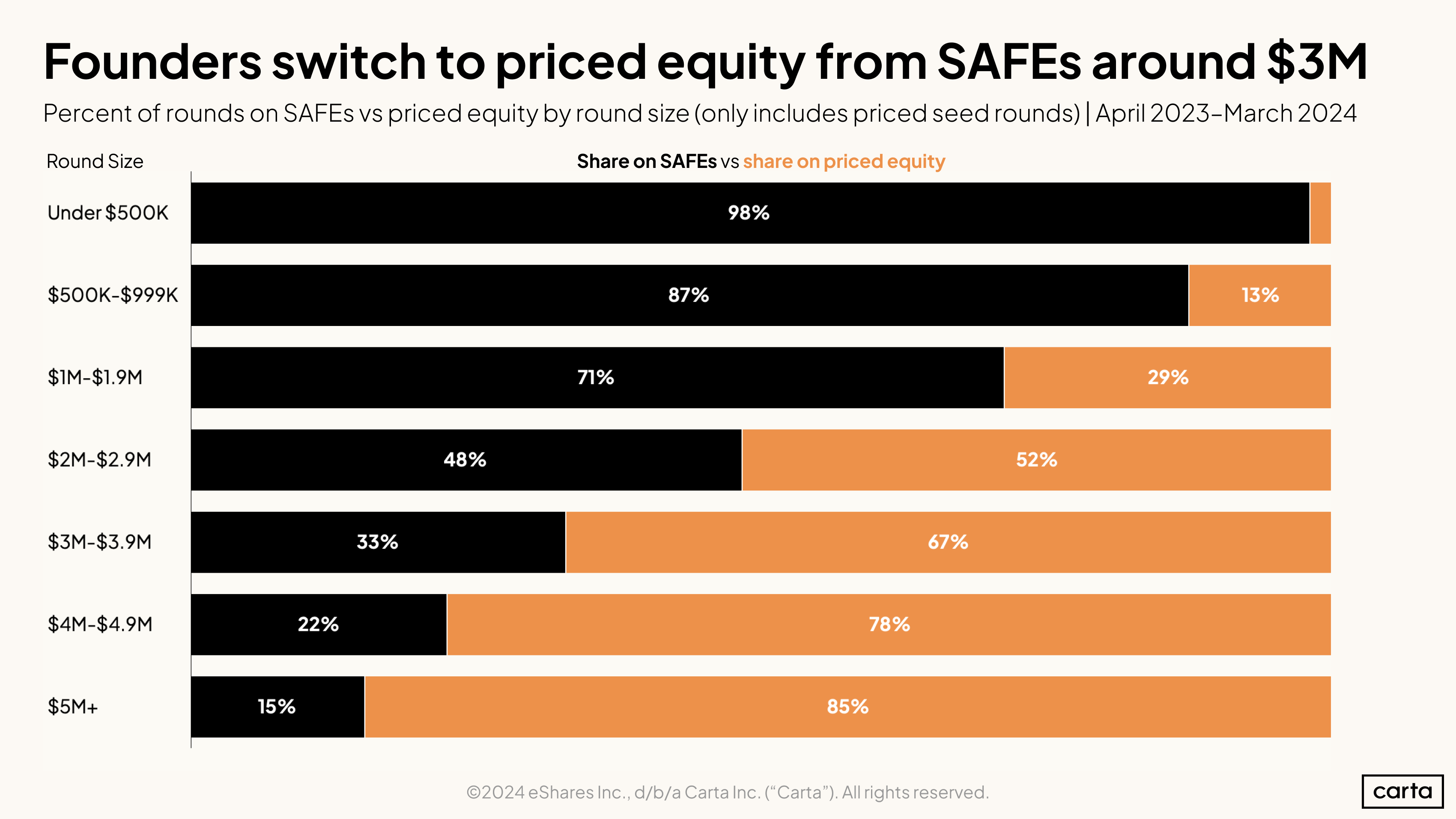

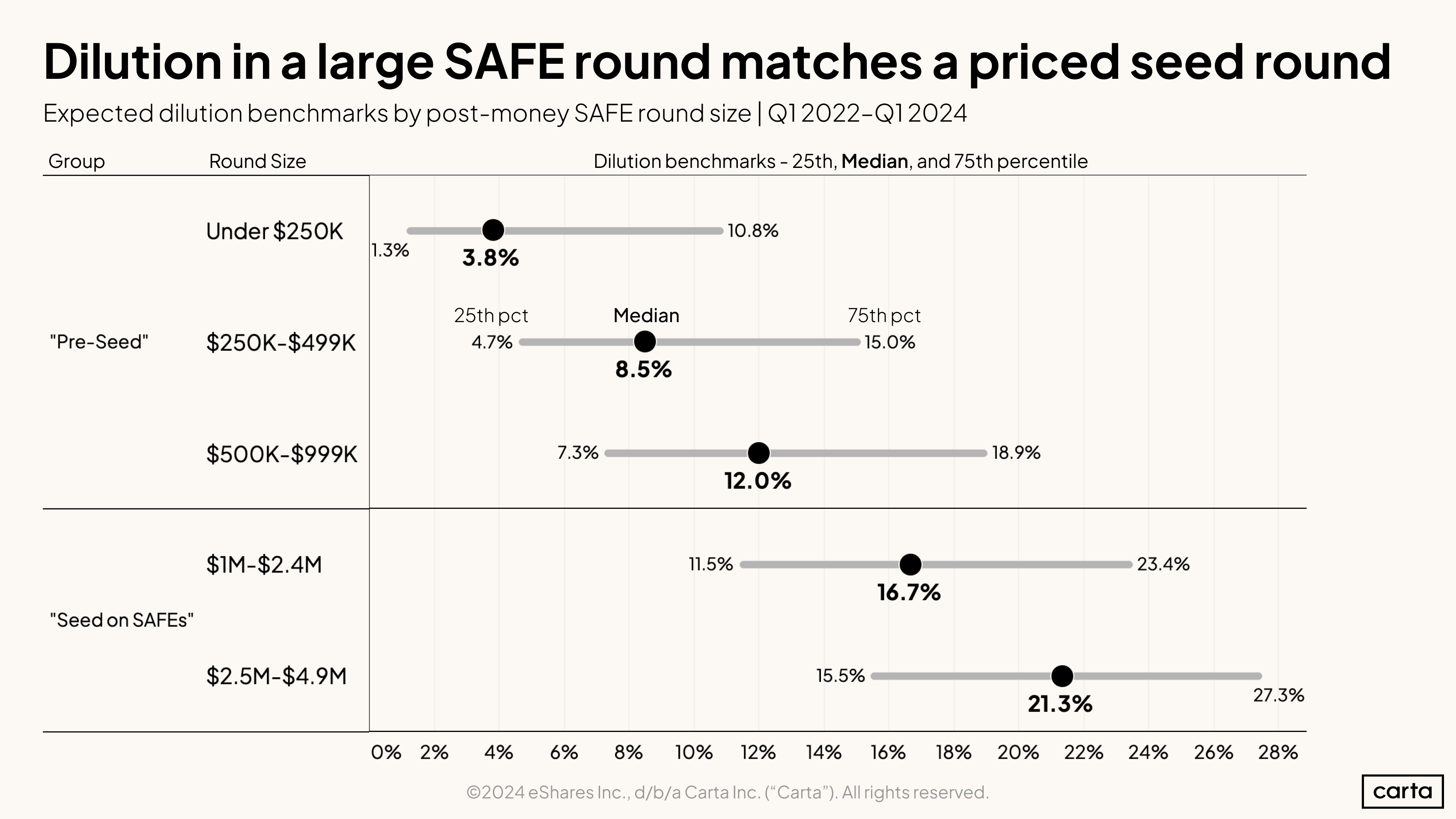

SAFEs have eaten more of the early-stage market: SAFEs are now the preferred investment instrument for all rounds under $3 million.

-

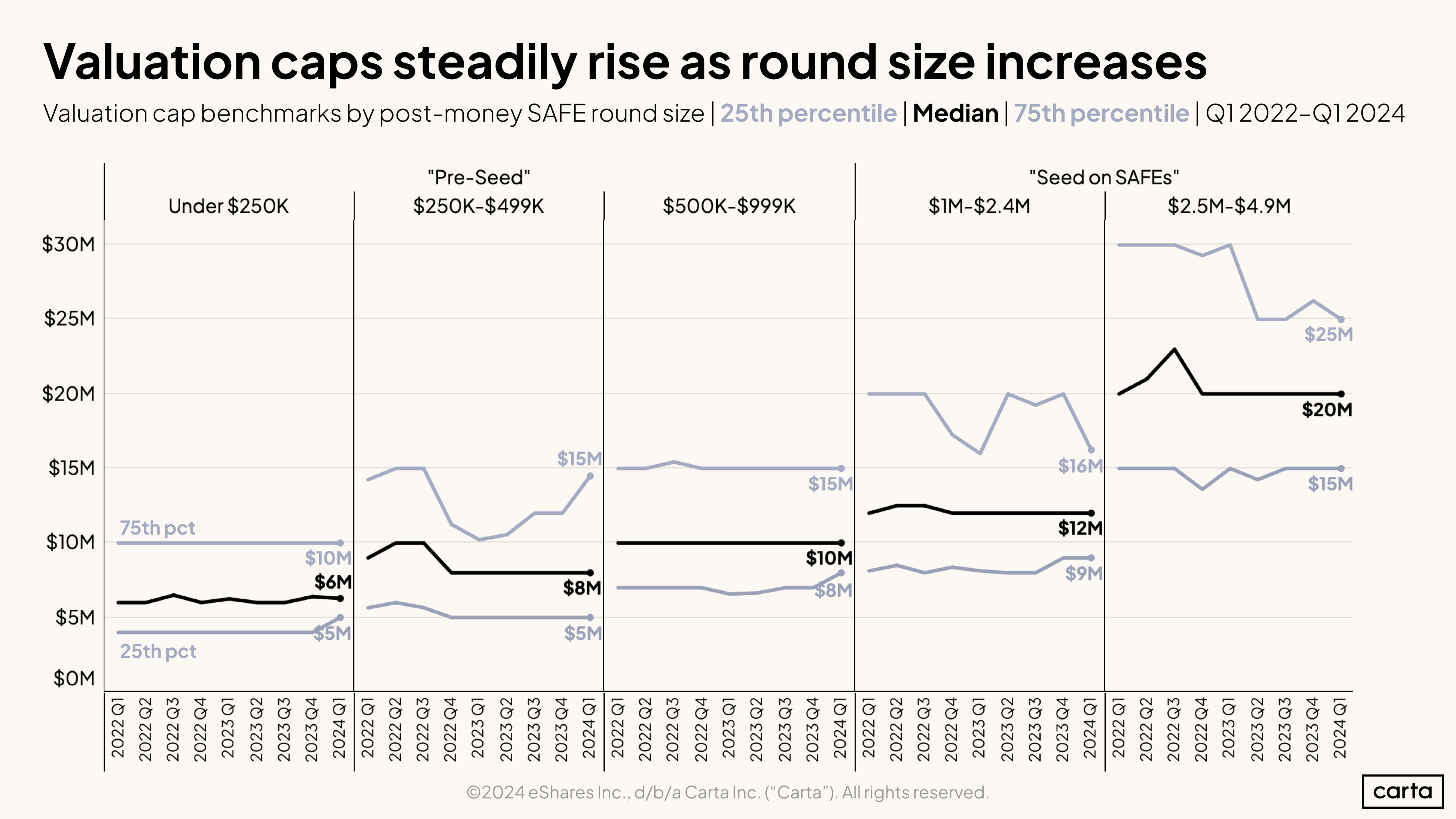

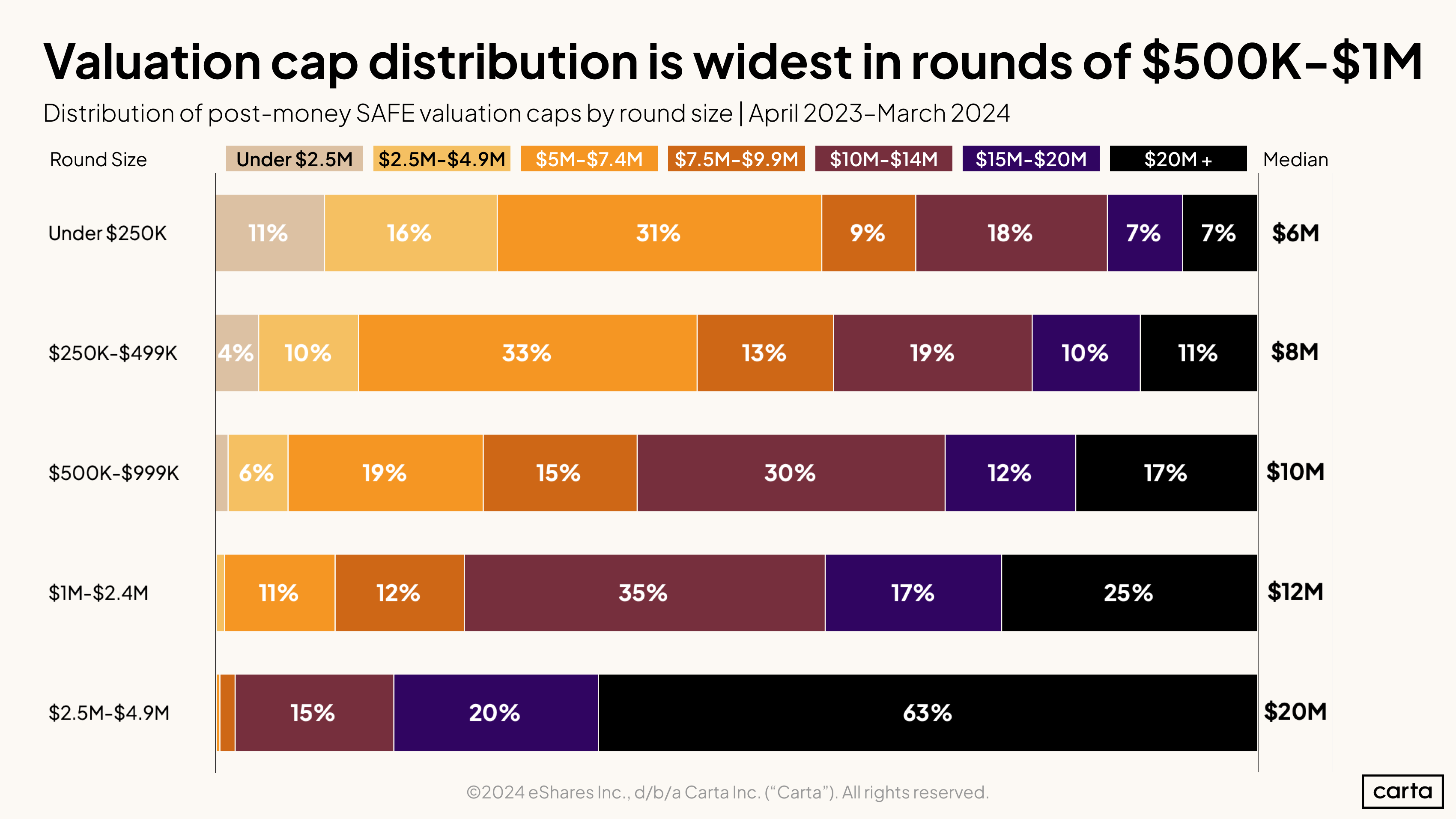

Valuation caps stayed flat in Q1: The SAFE round valuation caps have shifted less frequently than the full priced round valuations.

-

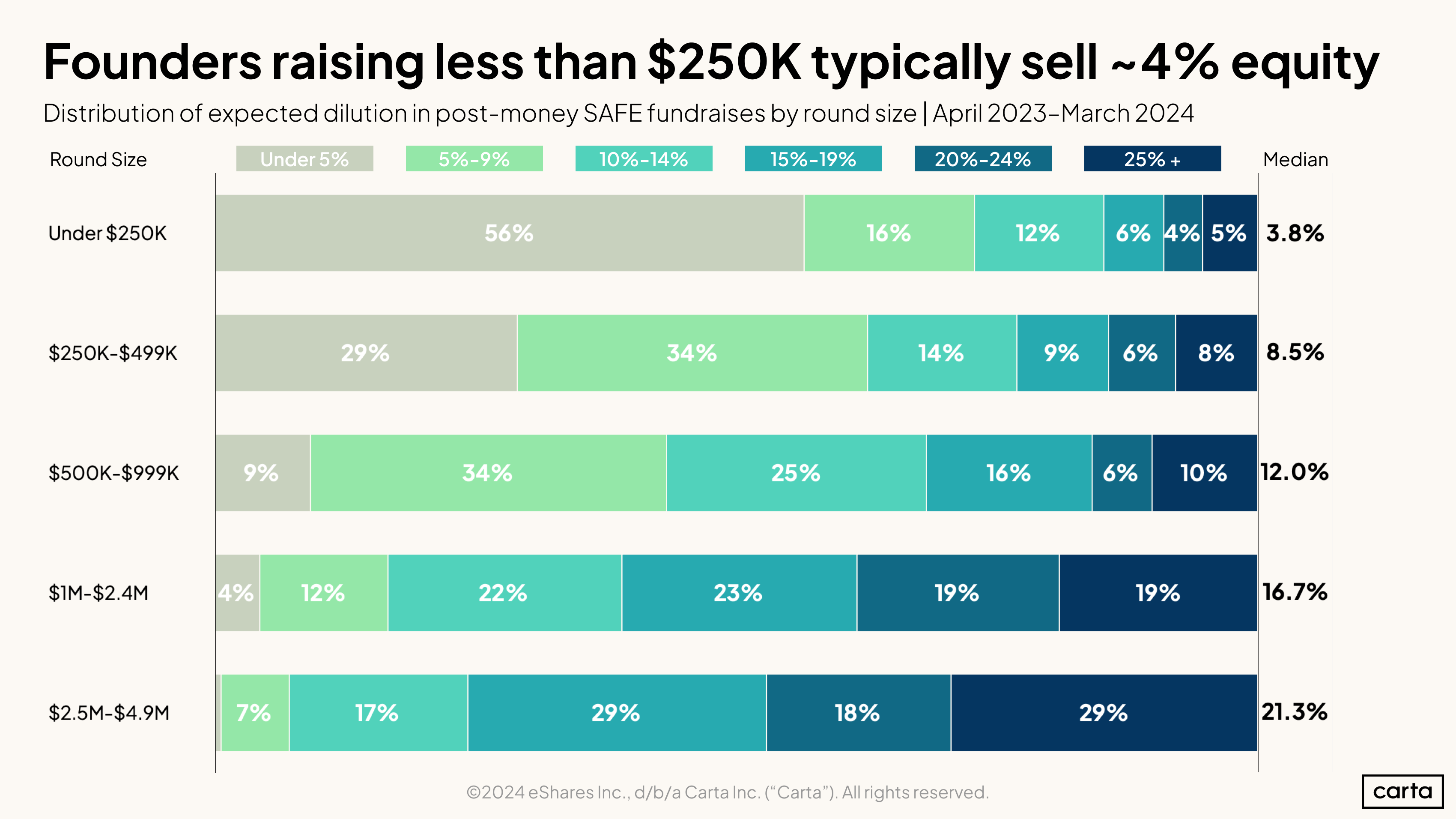

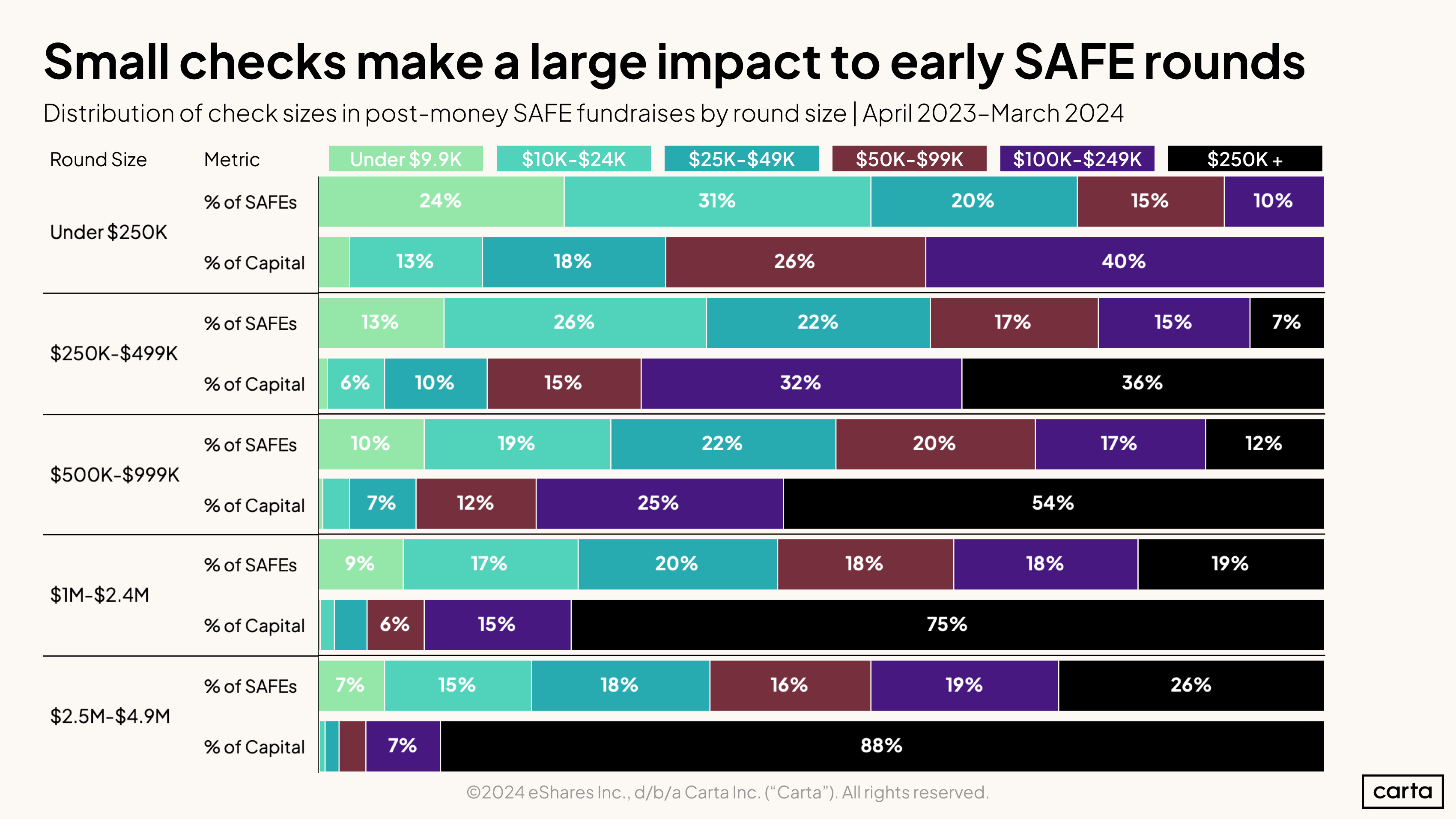

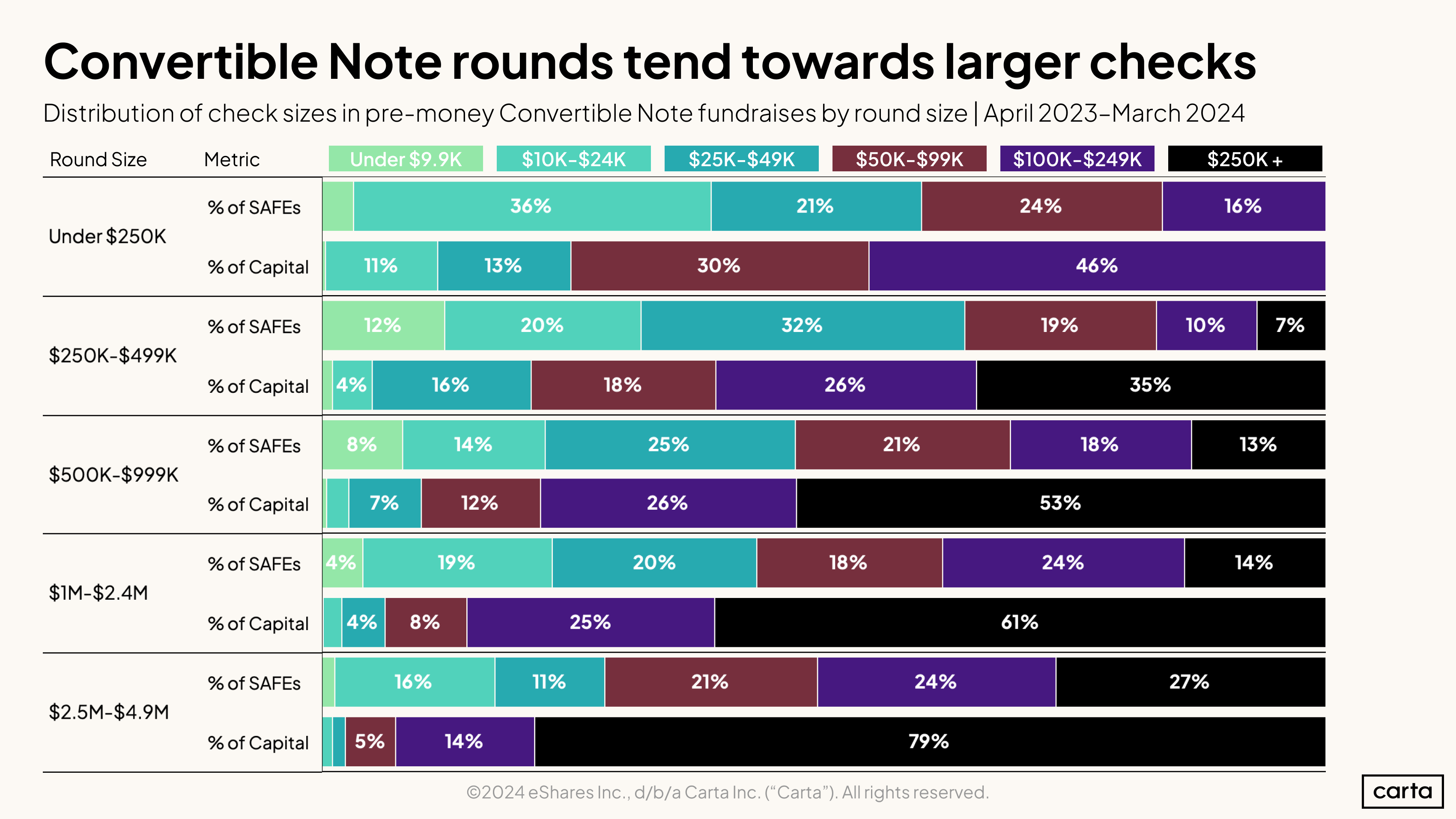

Small checks made an impact: 41% of checks in SAFE rounds under $1 million were below $25,000.

Key trends

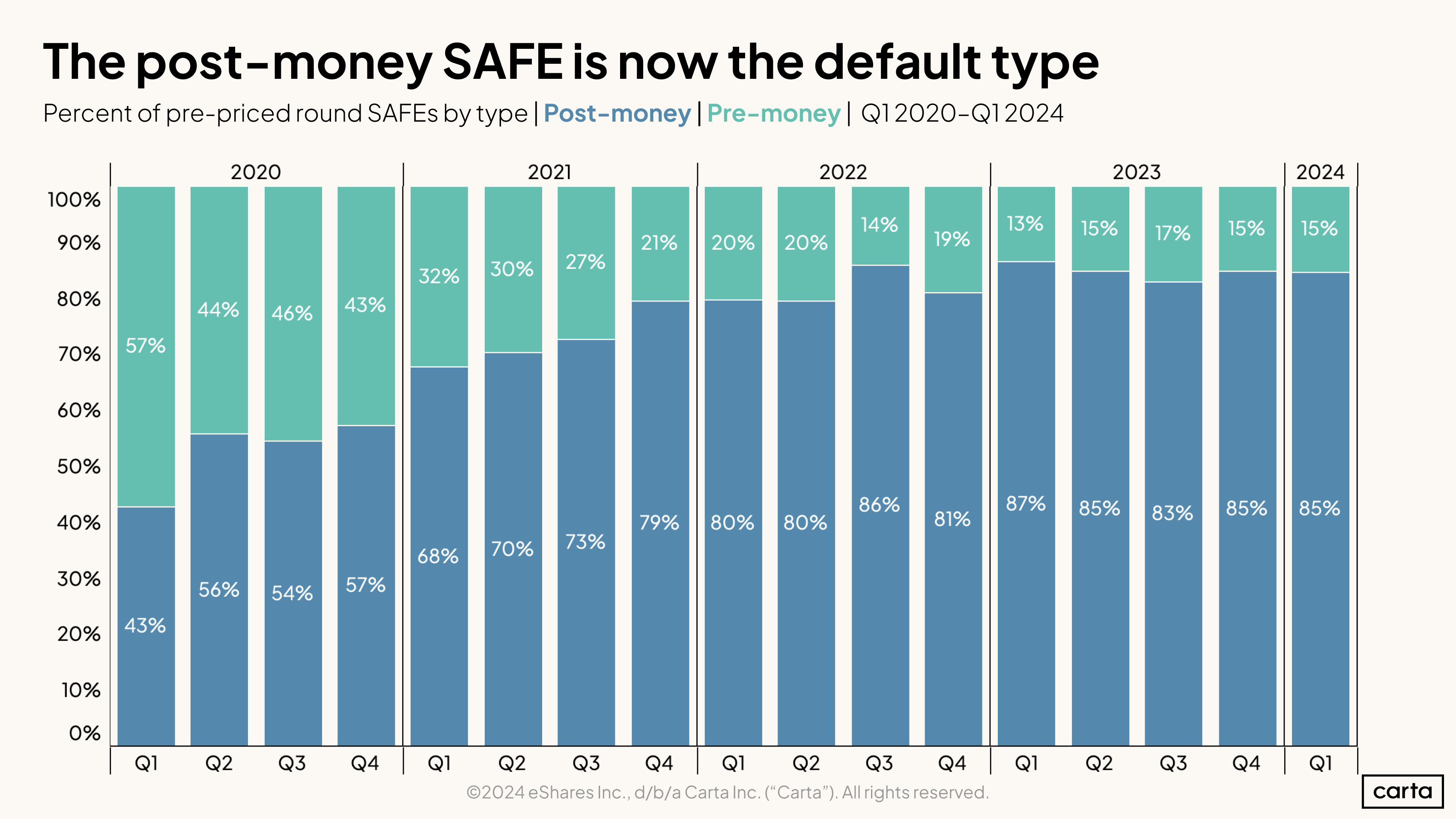

SAFEs

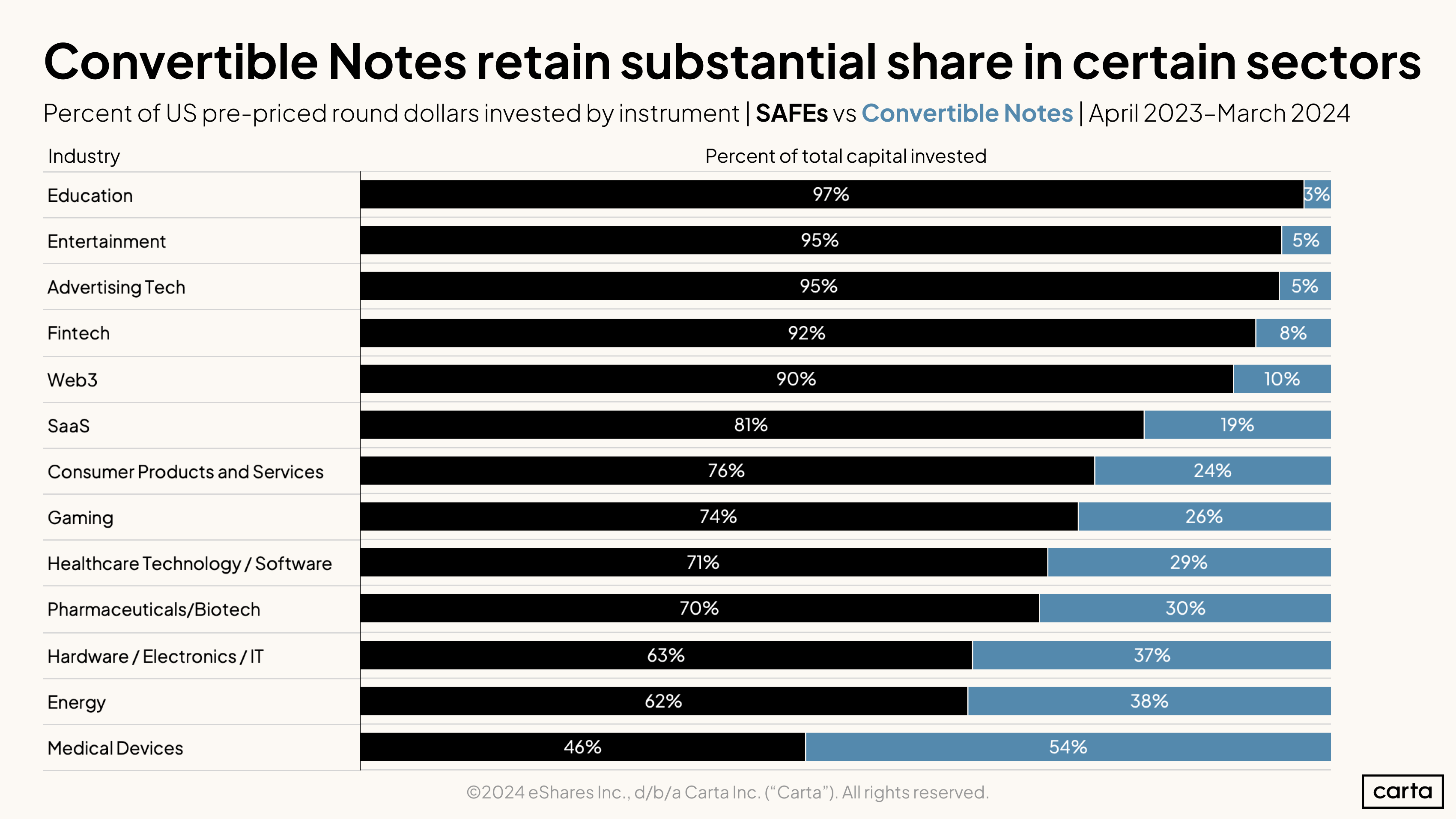

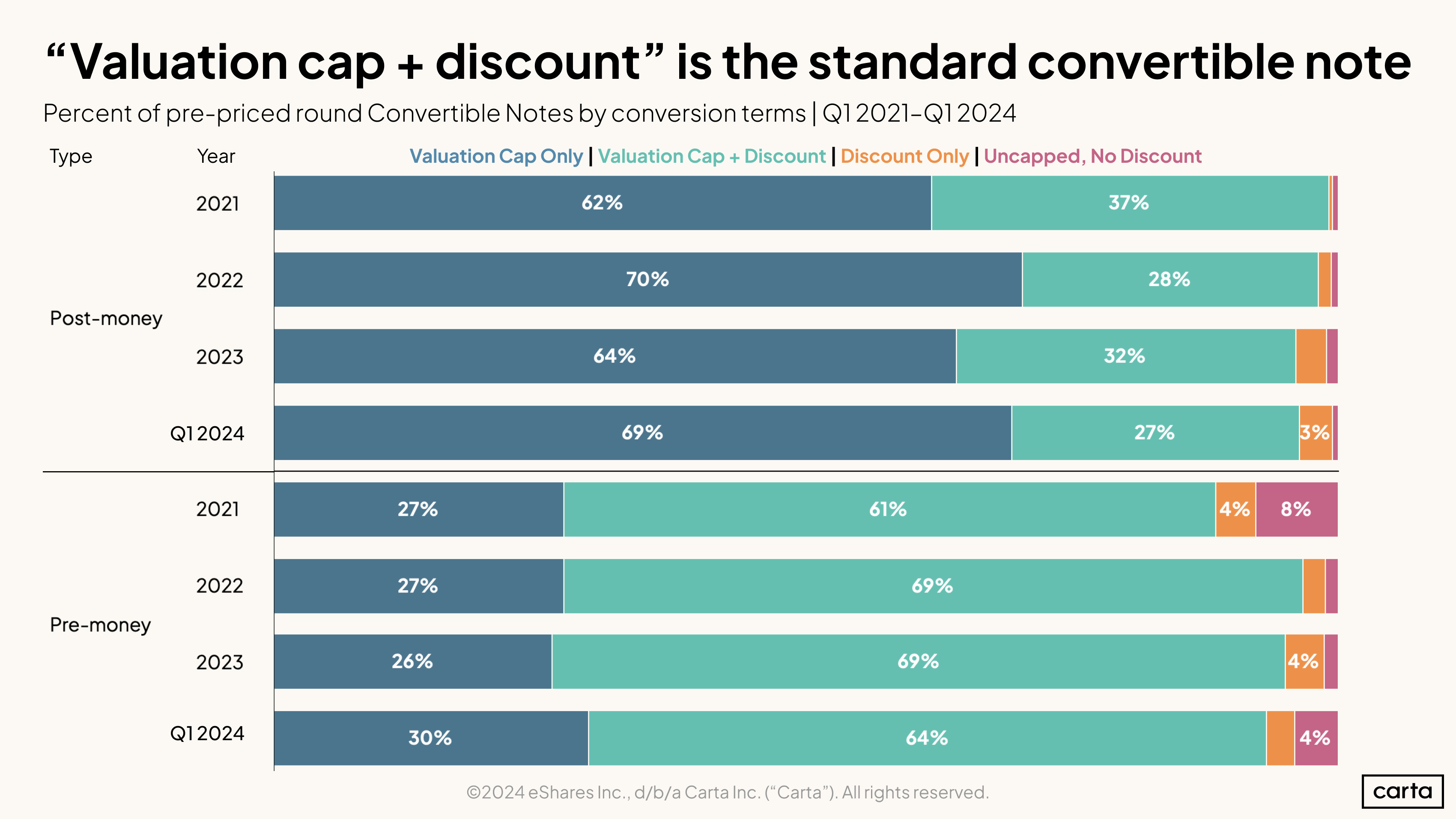

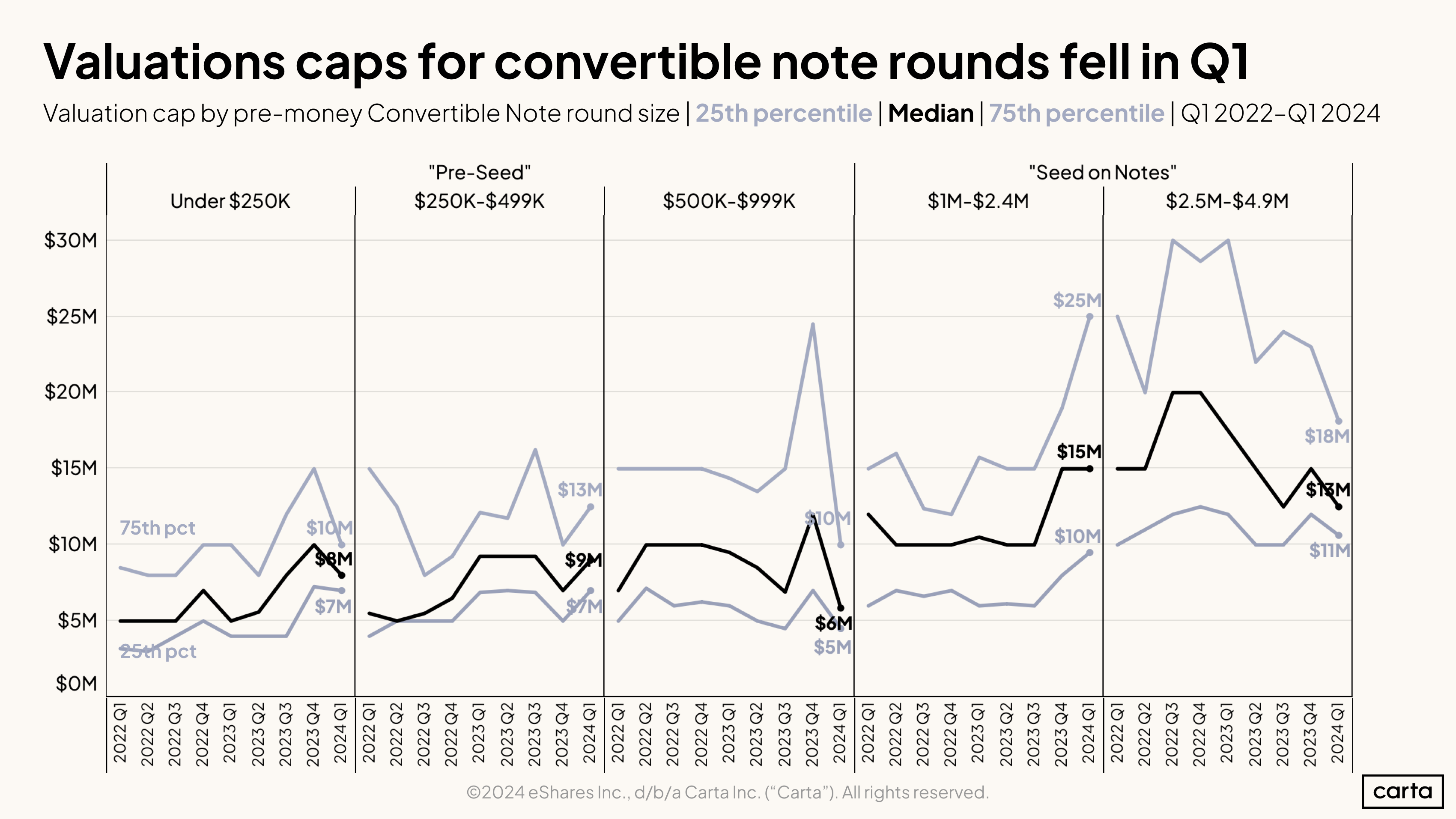

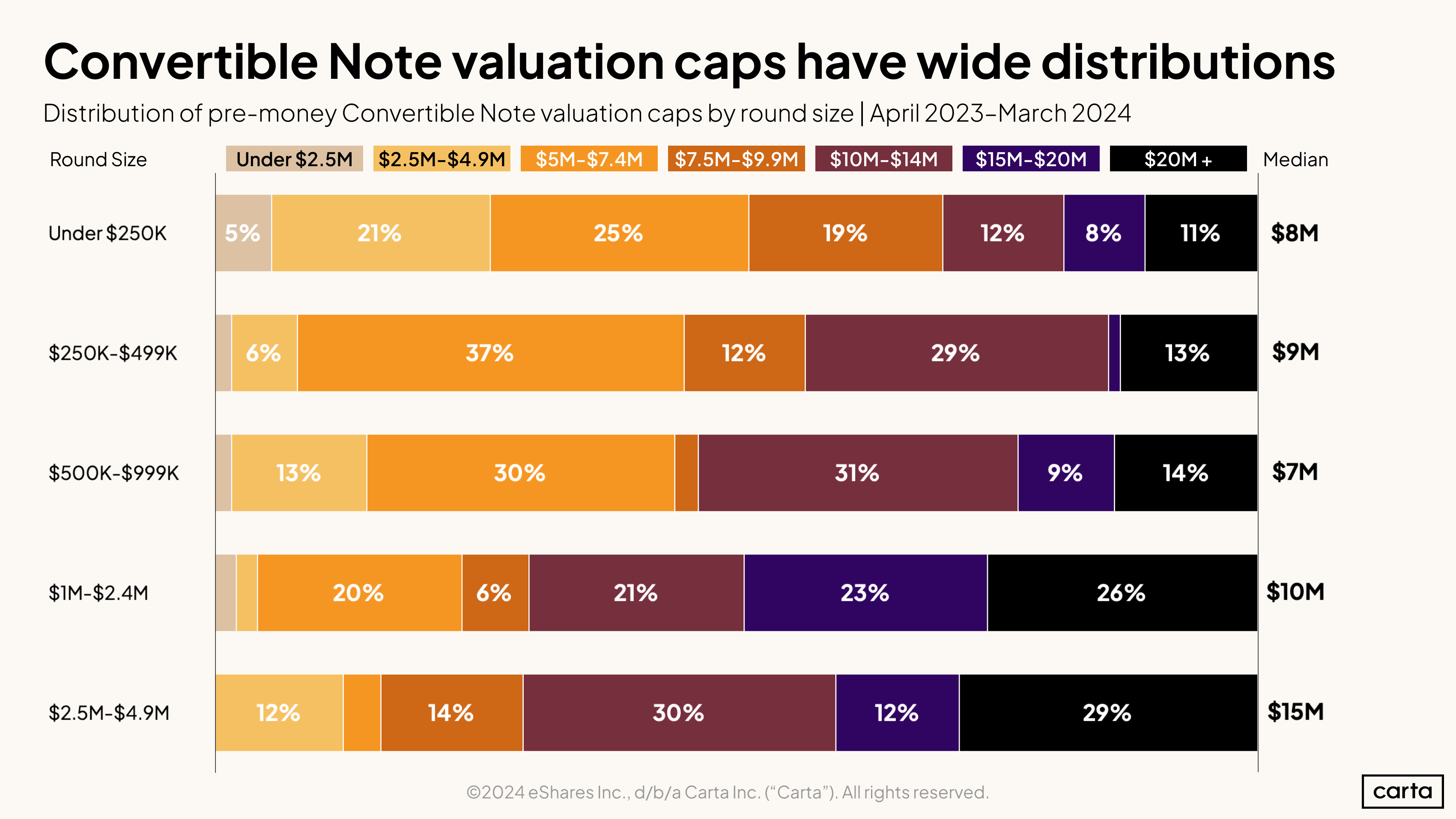

Convertible notes

Read the full report

For the full deck and industry-specific views, download the full report here:

Methodology

Carta helps more than 43,000 primarily venture-backed companies and 2,400,000 security holders manage over $3.0 trillion in equity. We share insights from this unmatched dataset about the private markets and venture ecosystem to help founders, employees, and investors make informed decisions and understand market conditions.

Overview

This study uses an aggregated and anonymized sample of Carta customer data. Companies that have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.

The data presented in this private markets report represents a snapshot as of April 15, 2024. Historical data may change in future studies because there is typically an administrative lag between the time a transaction took place and when it is recorded in Carta. In addition, new companies signing up for Carta’s services will increase historical data available for the report.