Completing a successful round of fundraising might feel like reaching a finish line, but figuring out how to manage the new funds is just as important. Smart spending comes down to knowing and managing your company’s cash burn rate.

Below, we’ll explain what cash burn rate is, why it matters, and what you need to do to manage your burn for better growth.

What is a burn rate?

Cash burn rate is the rate at which your company spends money, taking into account the company’s positive cash flow or revenue. It’s unlike monthly expenses, which only measure spending.

Burn rate also gives you another crucial piece of information: your cash runway. If your burn rate is $100,000 per month and you have $2 million in funding, your runway is 20 months. That’s the total amount of time you can finance operations before you run out of cash.

Your cash burn rate effectively tells you:

-

How much it costs to finance company operations

-

How long you can maintain your current spending before you need more funding

-

How much time (and cash) you have to continue experimenting with your product

-

How your spending translates to output

-

How much revenue you need to bring in to start generating a profit in the near future

Why burn rate matters

A burn rate isn’t a perfect measure of your company’s sustainability—a lot of factors go into that, including the market, your business strategy, and your product-market fit. But knowing your monthly burn rate is a really helpful way to make informed decisions about how fast you’re spending money and when to plan for your next round of funding.

How to calculate your cash burn rate

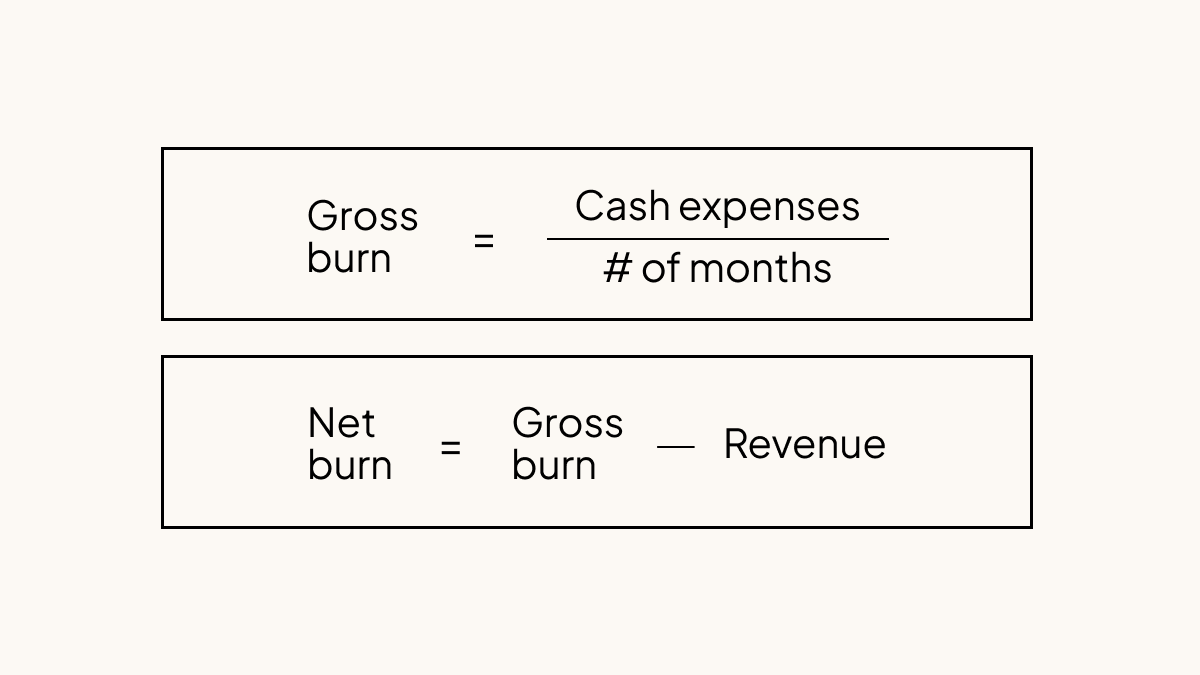

There are two ways to calculate your burn rate, depending on your company’s current growth stage. If you’re not generating revenue yet, you just need to calculate your gross cash burn rate. If you’re generating revenue, you’ll want to look at your net cash burn rate as well.

Gross burn rate vs. net burn rate

Gross burn is your company’s total monthly expenses. Calculate gross burn by determining your average monthly spend over a time period that is representative of how long you want your company to keep functioning. For example, if your company spent $750,000 over the last 12 months and you want to continue business for another 12 months, your gross burn would be $62,500.

Net burn, on the other hand, is your gross burn minus revenue. Calculate net burn using this formula: Net burn rate equals (=) gross burn rate minus (-) monthly revenue.

Using the example above, if your gross burn is $62,500 and you’re bringing in $20,000 in revenue each month, your net burn would be $42,500.

Ready to move on from hypotheticals? Early-stage founders can put their monthly cash balance into our burn rate calculator to get a clear picture of cash runway.

What is a good cash burn rate?

There’s no such thing as a single standard or acceptable burn rate. Your company’s burn rate depends on several different factors that work together, including:

-

Your industry

-

Your business model

-

The state of the market you want to enter (such as a market downturn)

-

How much funding you’ve raised and cash reserves

-

Operating expenses

-

Your company’s current growth stage

-

What your investors expect from you

-

How much you need to spend to hit your goals and milestones

It’s not always the case that you’re aiming for a low burn rate. If you don’t spend as much as you need to do business, you could fall behind schedule to deliver your product or not be able to market your business effectively.

Instead of trying to keep your burn at an arbitrary threshold, it’s better to focus on knowing what you’re burning and managing your current cash wisely—and ensuring your burn rate continues to benefit you.

Understanding your cash burn rate

When your investors ask about your burn rate, what they really want to know is: What are you spending their money on, where is that money taking the company, and when will they see a return on their investment?

Put another way: How well are you hitting your targets and maximizing your funding? A reliable accounting system is critical to answering these questions, because it allows you to stay on top of your budget and prevent a high burn rate. Review your income statement, balance sheet, negative cash flow, churn, and statement of cash flow every month in detail. You’ll want to know how much you’re spending on business-critical expenses such as:

-

Customer acquisition cost

-

Revenue growth

-

Product features

-

Shipping speed

This will give you a clear picture of what you’re spending and where you’re spending it.

Fixed vs. variable expenses

As you start earning revenue or as your revenue grows, your expenses might become more complex. Understanding and tracking your company’s various fixed and variable costs can keep you adaptable as you evolve.

|

Fixed costs (overhead costs) |

Variable costs | |

|

Definition |

Costs that stay the same each month regardless of your output or revenue |

Costs that fluctuate from month to month |

|

Examples |

Salaries, office rent, software subscriptions |

Marketing and advertising, inventory, consultant fees, contractor labor |

It’s a good idea to track both your fixed and variable expenses to see how they’re tied to your company’s growth. As you acquire more customers, for example, you may need to order more inventory, increasing your variable costs. Or you may need to hire another engineer to build out new product features, bumping up your fixed costs.

Regularly reviewing your expenses can tell you whether you’re overspending and stretching your burn rate—and if you are, where to cut back. If you can’t afford to scale back on variable costs like marketing, for example, you may have to consider adjusting your fixed expenses, like office rent. Your burn rate (and amount of cash runway) will change as a result, but that’s OK as long as you’re prepared for the shift.

Balancing your cash burn rate

Managing your burn rate is about figuring out what works for your company—and that takes trial and error. You and your team are ultimately the best judges of your spending, so don’t be afraid to reevaluate your strategies and adjust your burn rate to make it work.

Your company’s burn rate is a good indicator of your spending habits and runway, but it’s not the only metric to look at when evaluating your company’s growth. To optimize your burn rate, you also have to consider your company’s goals, your team’s time and energy, and your company’s potential financial future.

By looking at your cash burn rate from all angles, you can set yourself up for efficient company growth—and make sure your burn rate doesn’t burn you.