Employee compensation doesn’t end with an offer letter. The market changes quickly—and if your company is too slow to react, you risk losing high-value employees, being turned down by top talent, or burning through cash more quickly than you need to.

Why should you review your employees’ compensation?

It should be part of your people strategy to regularly evolve your compensation plan based on factors like the market value of specific roles and inflation.

By doing this, you’re laying the foundation for continued growth. It’ll help you to stick to your compensation philosophy, hire quickly and successfully, reduce employee attrition, and address issues of employee equity.

What to consider as you review compensation

1. Audit your job levels, role descriptions, and compensation bands

Accurately assigning job levels to each employee helps set expectations about their role and opportunities for advancement. Does each description accurately describe each employee’s job responsibilities? Have this conversation with your employees, because these job levels will need to correspond to a compensation band. Getting these details right will save you time as your team continues to grow.

Even when it’s not time to move up a job level, employees should understand that there’s opportunity to move up within their compensation band. Keep moving top performers up within their band as an incentive to stay. As they get closer to the top end of their band, you’ll want to have a clear plan to help them be promoted to their role’s next job level.

2. Research salary and equity against the market

Once you have your job levels in a good place, make sure that existing salary and equity ranges, or compensation bands, are still relevant for your employees’ location, industry, and role. You can do this by using Carta Total Comp, which uses data from our database of customers along with machine learning to establish salary and equity ranges.

These are some of the factors that contribute to compensation benchmarks:

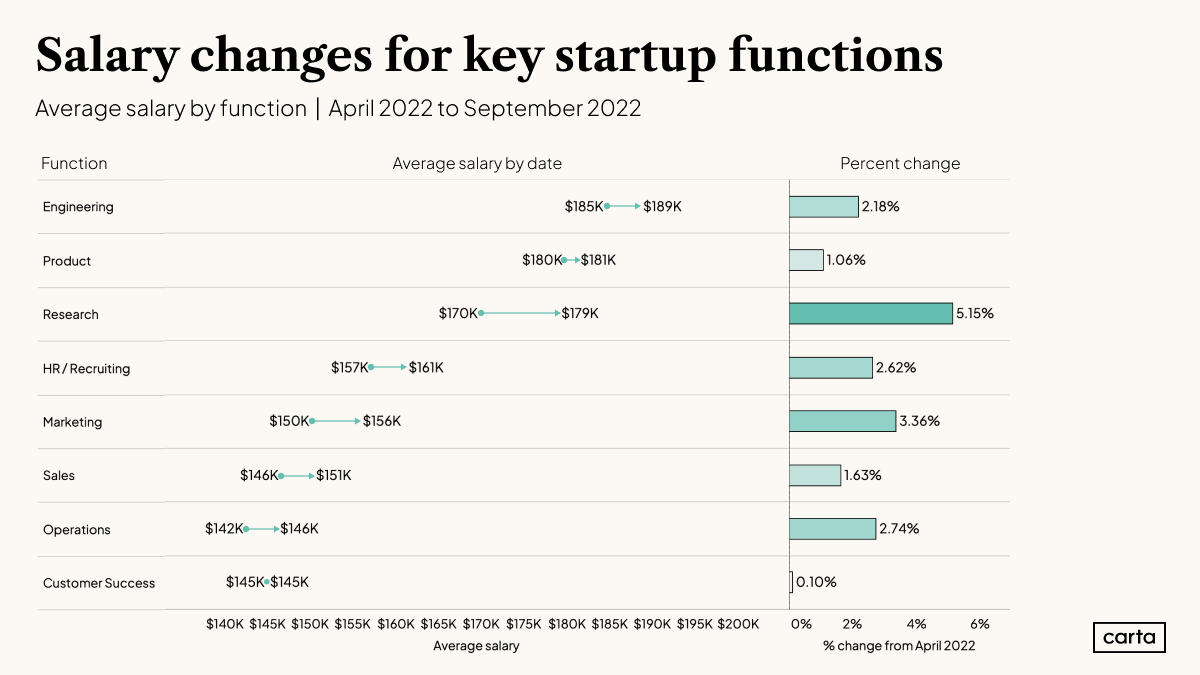

Market value of industry and job function

The market for roles within an industry or job function can change even over a short time. While salaries for most functions increased modestly during the second quarter of 2022, Research salaries increased by more than 5%.

Image description: Bar chart showing the average change in salary for each job function. Most job functions, with the exception of Research, increased 1-3% in Q2 2022.

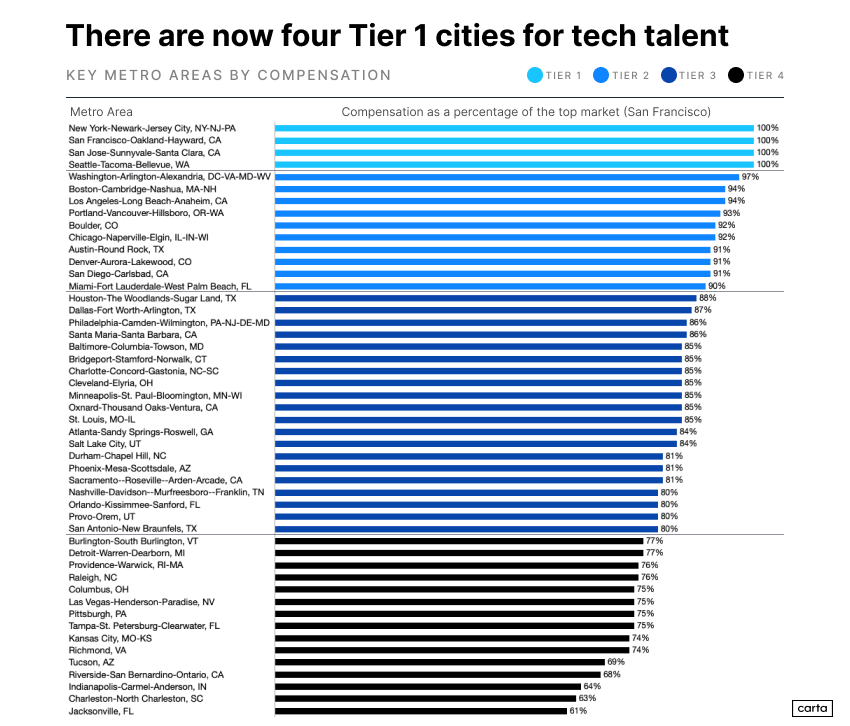

Cost of labor

Most companies adjust compensation based on a region’s cost of labor. A competitive compensation package will always use an employee’s location as a starting data point, since the cost of labor can vary widely between cities. You can find cost of labor trends through the U.S. Bureau of Labor Statistics. You can also use a tool like Carta Total Comp to calculate compensation based not only on cost of labor, but also on industry and company size.

Image description: Bar chart showing the rate of compensation by metro area in Q2 2022. Data is expressed as a percentage of the highest paying regions and each city resides in one of four tiers.

Inflation

In 2022, the Consumer Price Index rose to its highest level since 1981 and inflation is at 8.2%. In response, salary budgets are projected to increase just over 4% in 2023, a significant rise from the flat 3% increase we’ve seen for the past decade.

Your compensation plan doesn’t have to change with every movement in the economy—it’s a big attrition risk for employers to revise salaries lower, even if market conditions worsen. But economic volatility can quickly make your annual budget outdated, and you could lose candidates or waste money if you’re not responsive. Scenario planning—creating plans based on specific events, like what your allocation for new hires would look like if inflation rises—can help your team make those decisions in advance.

3. Reward your high-performing, high-value employees

Employees who feel like they’re not compensated fairly are more likely to quit. Your best employees should feel recognized and rewarded for their hard work. Since it can cost up to twice their salary to replace them, compensating fairly saves money and time.

If your compensation review process follows your performance review cycle, you’ll have a good sense of who your top performers are and easily adjust their compensation. You want these employees to stay, and moving them up in their compensation range showcases that they have a ladder to future success at your company.

You should also review your current employees’ compensation along with your plans for new hires. Employees notice when their salaries and equity grants are lower than those given new hires, which can lead to low morale and attrition. More states are implementing pay transparency legislation, which makes these discrepancies even more noticeable.

4. Plan for employees with vested equity

Equity compensation often comes with a time-based vesting schedule. It’s a way to motivate employees to stay, since they’ll only gain access to their equity as time passes. Often, new hire grants vest fully after four years. As employees approach that four-year mark, their lack of unvested equity can be a retention risk.

You’ll want to consider an equity refresh to keep longtime workers motivated. You can consider a strategy like boxcar vesting, where the refresh grant is given in advance but only starts vesting after the new hire grant has fully vested. Carta uses boxcar vesting as part of our equity refresh program.

When should you do a compensation review?

Many companies review compensation each year to coincide with their annual budget planning, `but there are some other situations where you might need to review compensation:

-

With annual performance review cycles, to closely link job levels and compensation

-

When your industry is booming and you’re competing for the best talent

-

To prepare for upcoming pay transparency legislation that will affect your company

-

Whenever you need to address pay inequality, internal transfers, or company restructuring

If you’re in the tech industry, for example, competition for talent and a low unemployment rate relative to the overall market means you might want to review every six months. For example, you could conduct performance reviews and adjust compensation in Q4 to retain employees, and then do another review in Q2 to make sure you’re up to date with industry benchmarks.

How Carta Total Comp can help

Updating your compensation plan can help attract top talent and retain high performers—and it doesn’t have to take a lot of time. Carta Total Comp uses data from over 120,000 employees across Carta’s customer base to help automate your compensation planning. Schedule a demo to see how Carta Total Comp can work for your company.