Our CEO, Henry, presented Carta’s Series D pitch deck at SaaStr Annual to a packed room of hundreds of people earlier this month.

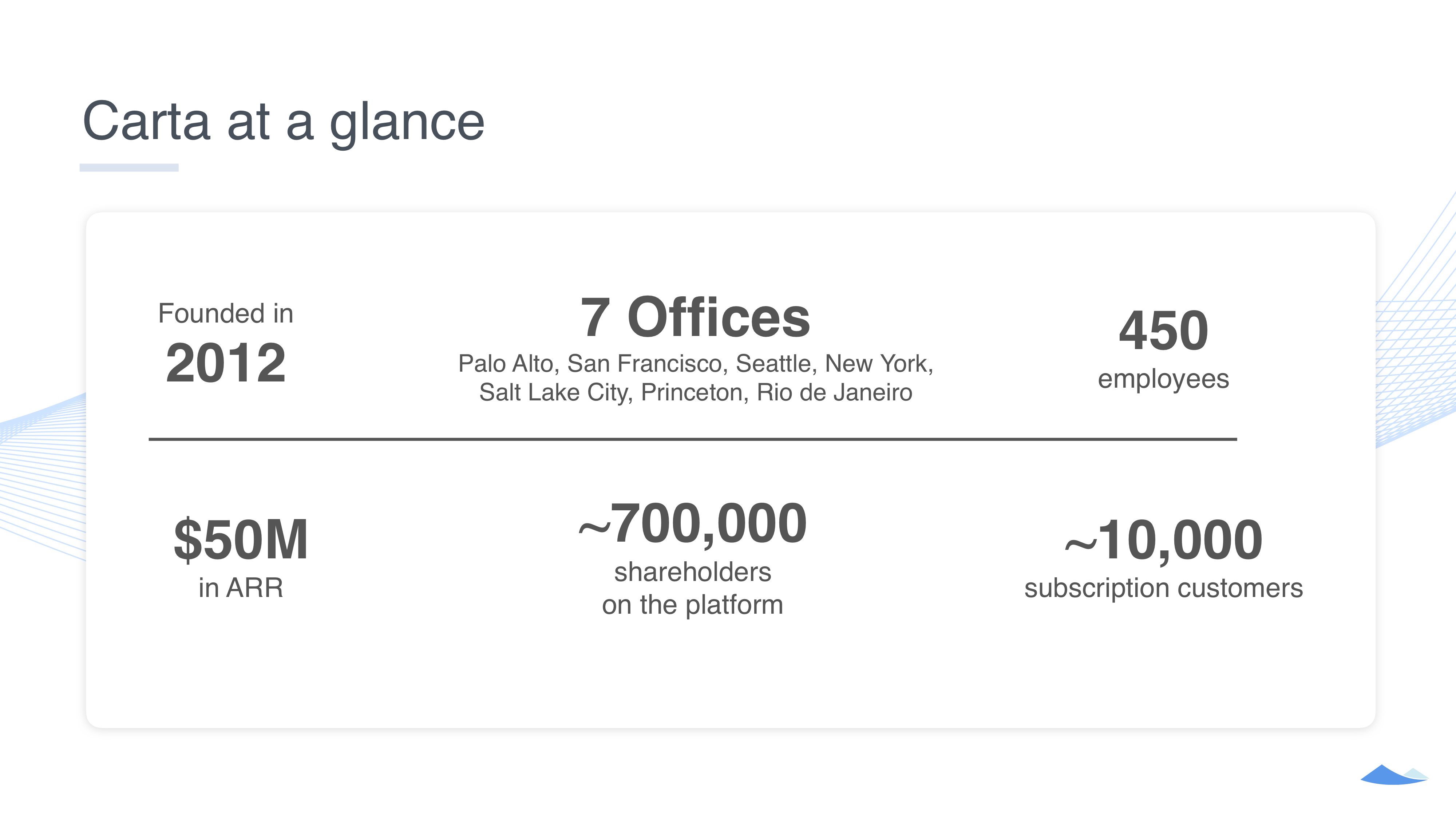

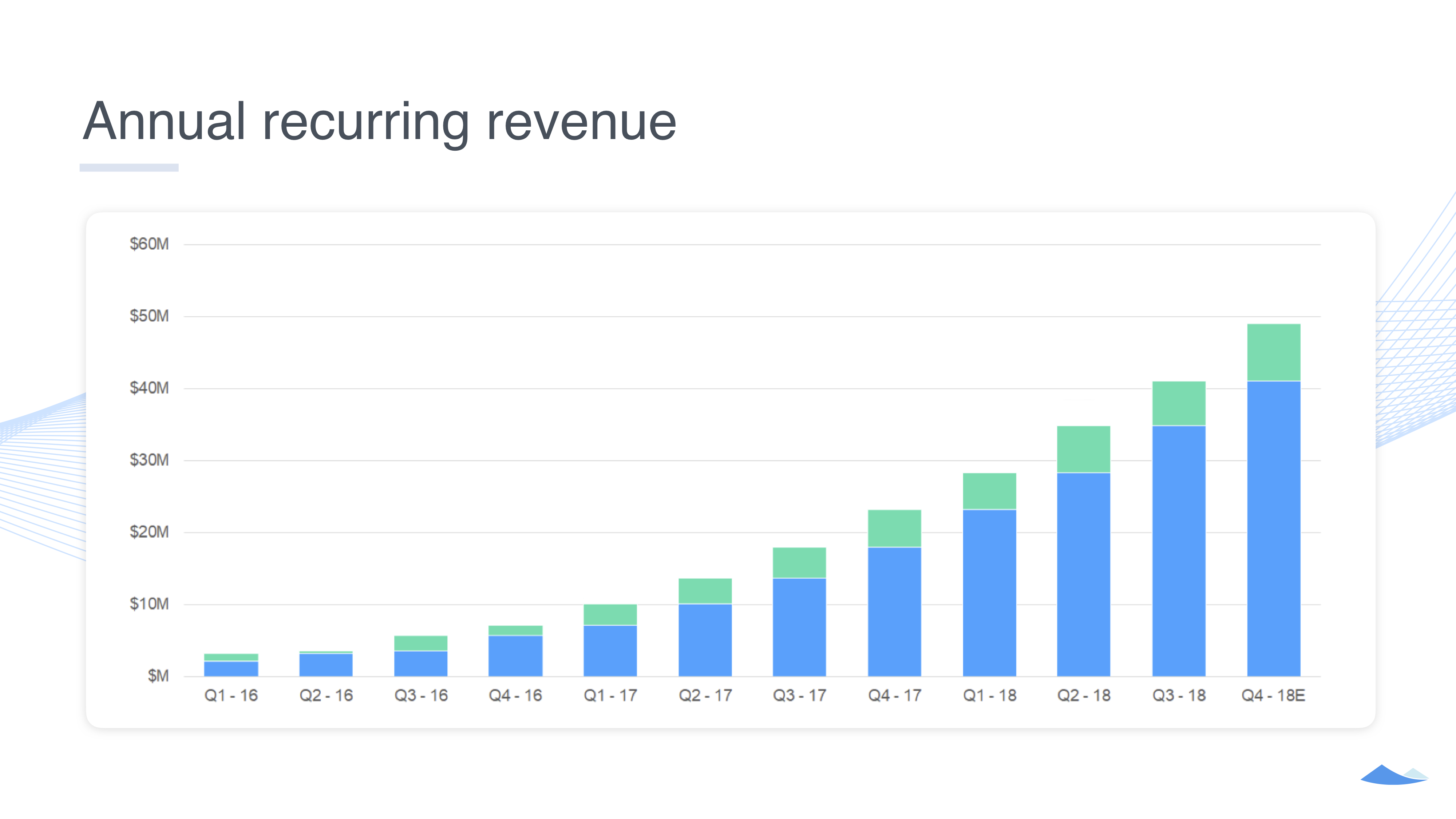

This presentation came on the heels of Carta announcing that we had hit $50M in annual recurring revenue (ARR) just a few weeks ago, up from $23M ARR in 2017. During the presentation, we revealed not just our ARR numbers, but also customer count, shareholder count, payback period over time, and more.

Typically, fundraising pitch decks are confidential, and even some Carta employees wondered whether we were being too transparent. But transparency is core to Carta, and we think sharing this will help other founders.

See the whole Series D deck

Henry told Business Insider , who also published our deck, “I always hate it when people are like, ‘I’ll show this stuff, but the actual important stuff, I want to hide that.”

We first shared our pitch deck in 2015, when we raised our Series A (we were then known as eShares). The deck we’ve shared here is our Series D deck, which evolved from our Series B and C decks. Numbers are through Q3 2018, with estimates for Q4. We hope you’ll check it out, and see how our story, business, and brand have evolved.

As we told employees when we shared the Business Insider story, “We believe in transparency and we’re proud of our growth—we don’t think it’s something to hide.”

Key slides from our pitch deck