The private investment and venture community has adapted and changed securities over the years to meet the changing needs of deal-making. Securities in their current form represent decades of innovation and iteration in capital allocation decisions.

As of the first half of 2020, we are witnessing a moment of change in convertible securities. For many years, convertible notes were the dominant convertible security investors used to make investments in companies. But with the introduction of the SAFE in late 2013 and the KISS in mid-2014, companies and investors have potentially appealing alternatives to convertible notes. These new securities, while similar to convertible notes, are not debt nor do they accrue interest like debt securities.

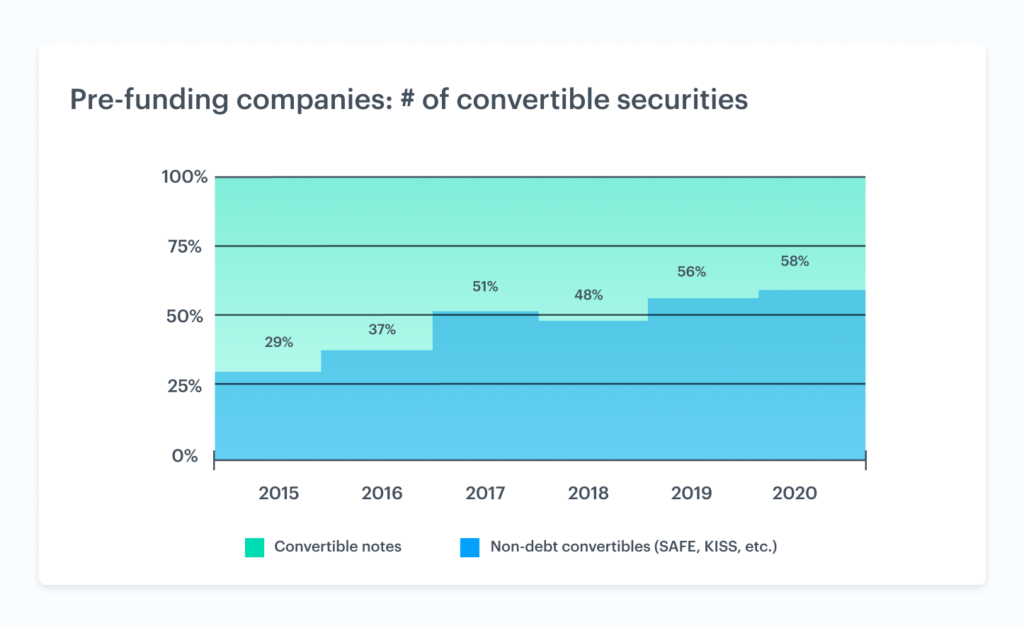

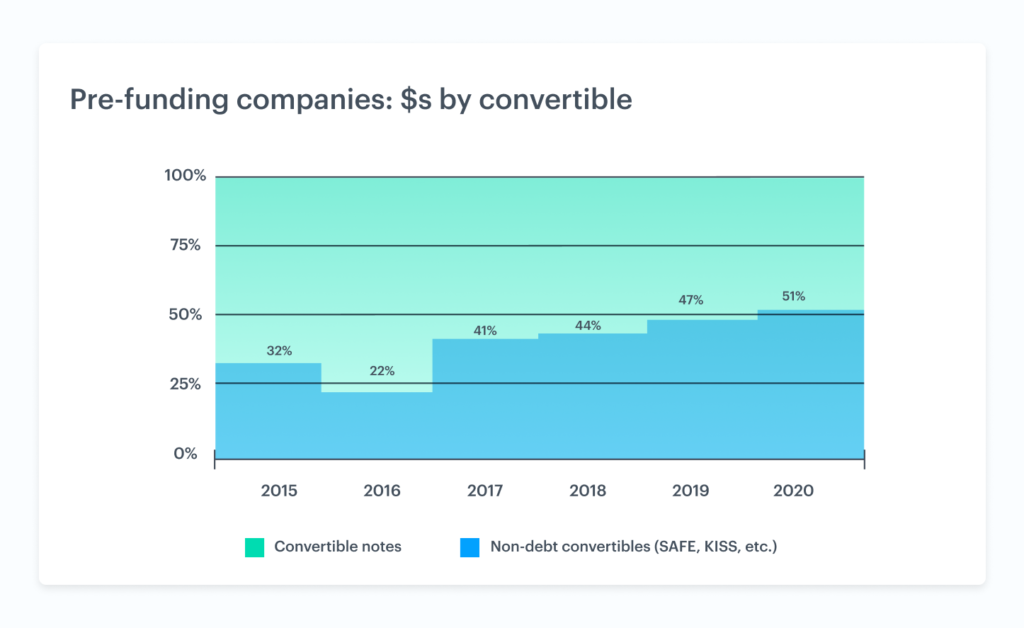

Since we have unique insights into private company security issuance, we decided to see how these innovative securities have performed in the market. In short, our data1 shows that convertible notes are no longer dominating the convertible securities market. In 2017, non-debt convertibles like SAFEs and KISSs reached parity with debt convertible securities in terms of number of securities issued amongst pre-funding companies. In 2020, they reached parity in total dollars invested as well.

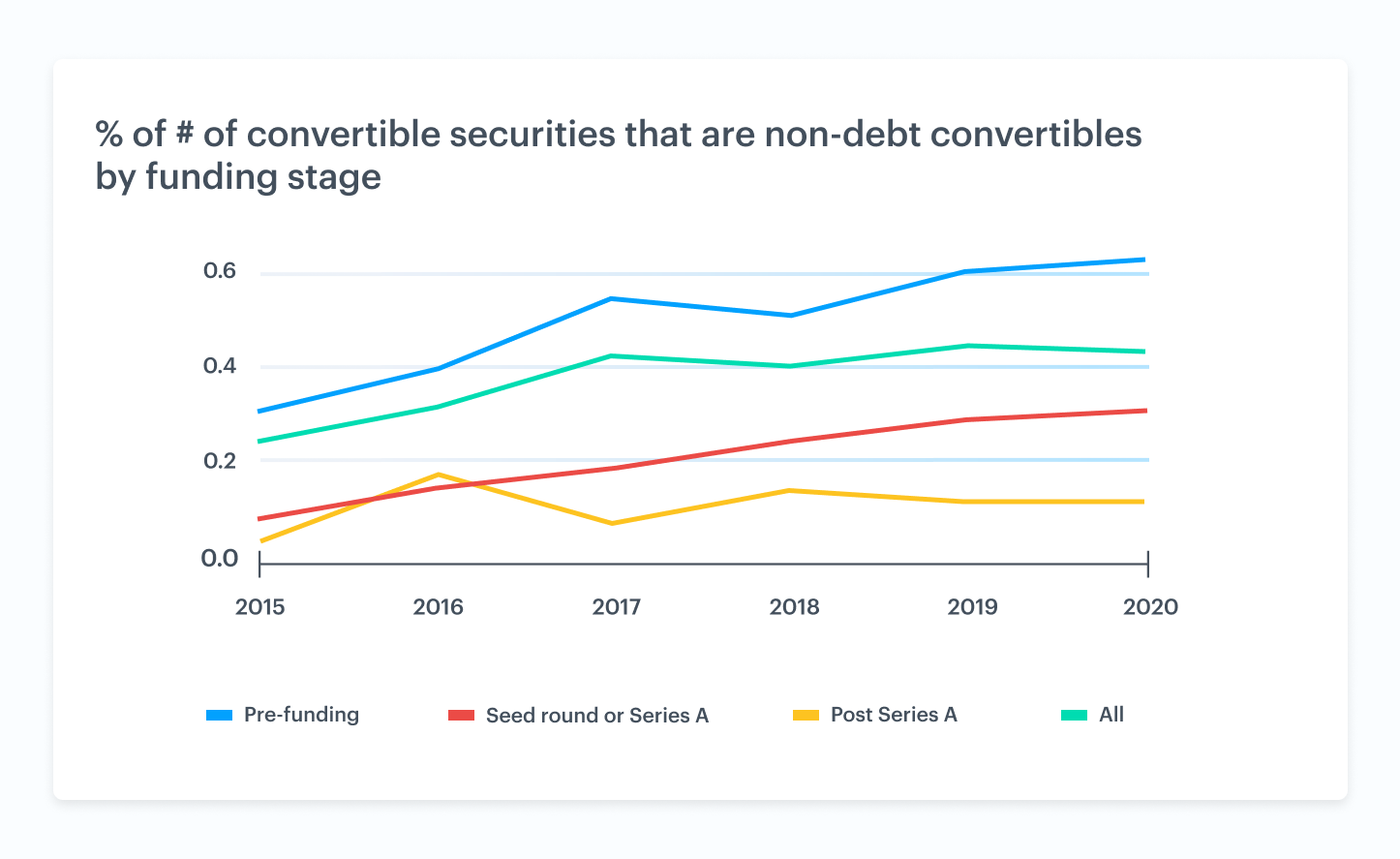

We’re also starting to see clearer trends around when different types of convertible securities are used. Non-debt convertibles are becoming the norm early in the funding life of companies, while convertible notes are becoming the norm for later stage convertible investments.

What is a convertible note?

Convertible notes allow investors to put money into a company quickly and then figure out ownership later if and when the note converts into equity. The debt and interest of the note generally convert into equity with some sort of discount to account for the risk the investor took putting money in before the priced round.

Because convertible notes are often faster and more straightforward than equity investments, they can be deployed in a number of situations, including:

-

Raising money before a priced round.Some founders use them to raise money before venturing into the world of priced rounds. If the company makes it to an equity financing round, the notes convert into ownership as determined by the terms of the round and the notes.

-

Bridge financing.Other founders use convertible notes to bridge a financing gap between rounds.

-

Larger rounds. Still other investors use convertible notes to balance the risk and returns of larger investments. They are willing to write larger checks but prefer the downside protection that convertible notes offer in the form of debt.

What is a non-debt convertible security (SAFE, KISS, etc.)?

In December 2013, Y Combinator announced a new type of convertible security: the Simple Agreement for Future Equity (SAFE). This new security aimed to make it easier for founders and early stage companies to raise capital. The group simplified the agreement to a single page (this is the “simple” in its name) and made it downloadable on its site.

Convertible notes agreements can be hundreds of pages long, and most equity rounds run even longer. The goal of SAFEs is to drop the debt covenants and interest payments seen in convertible notes, as the debt burden of notes often feels like a drag on founders right out of the gate. Instead, SAFEs allow investors to give companies money and convert that principle into equity later at a discount, while removing interest accrual and the overhead of debt.

Non-debt convertibles quickly grew popular among pre-funding and early stage companies, especially as other groups launched their own securities, like 500 Startups’ Keep It Simple Security (KISS). However, it wasn’t yet clear if they could become mainstream outside of this audience. Only time would tell.

Carta is uniquely positioned to understand the marketplace for convertible securities

At Carta, we build software to help both companies and investors manage their ownership, giving us unparalleled insights into the fundraising environment. Companies can issue both debt and non-debt convertible securities on the platform. This lets us see whether these securities are catching on and, if so, among which segments.

I worked with Ray Raff of our data science team to dig into this evolving convertibles marketplace. Ray looked at the convertible securities that have been issued on the Carta platform and categorized whether they were debt (like traditional convertible notes) or non-debt (like SAFE and KISS instruments). Additionally, he looked at the principal amounts of each type of security and the types of companies that employed each. Below are our findings.

Non-debt convertible securities have caught on—particularly amongst pre-seed and seed stage companies

2020 is the first year non-debt convertibles were as prevalent amongst pre-equity financing companies as their debt counterparts measured by both dollars invested and the number of securities issued. This is impressive considering they’ve been around for less than a decade.

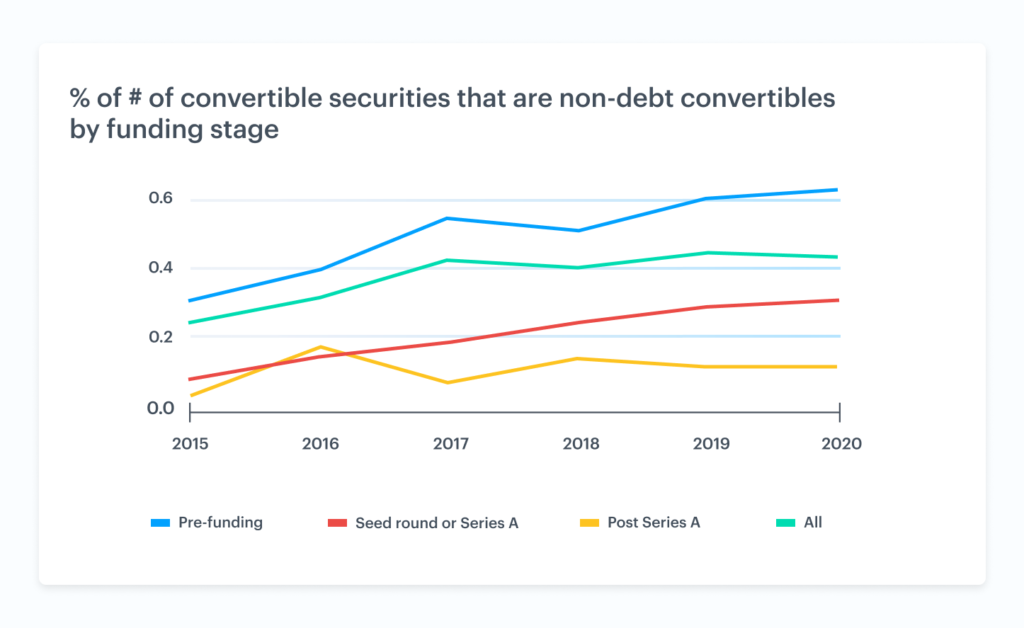

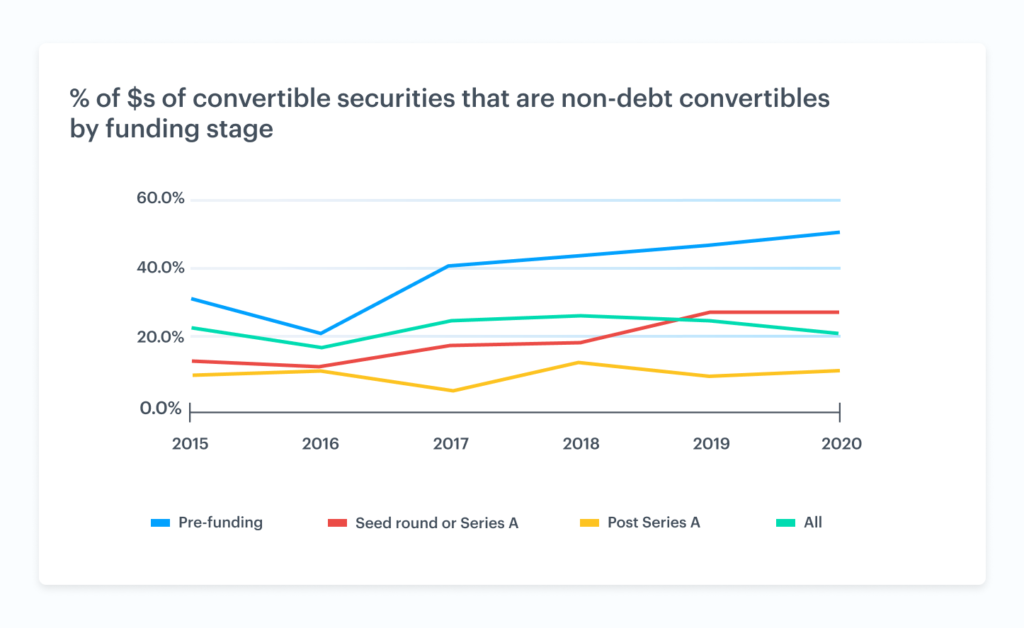

Early stage companies are more likely to use non-debt convertibles

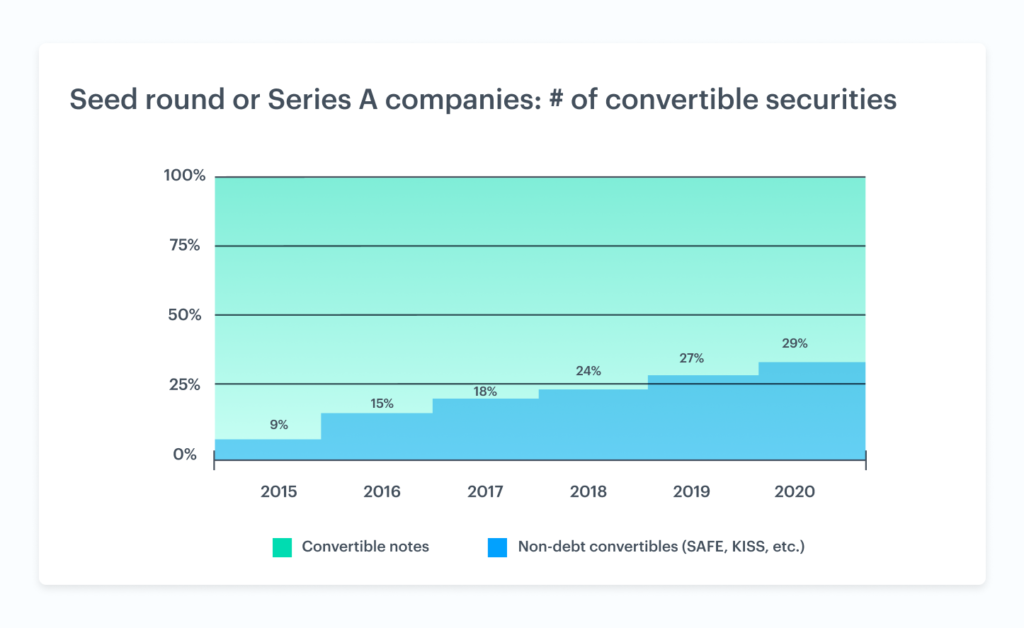

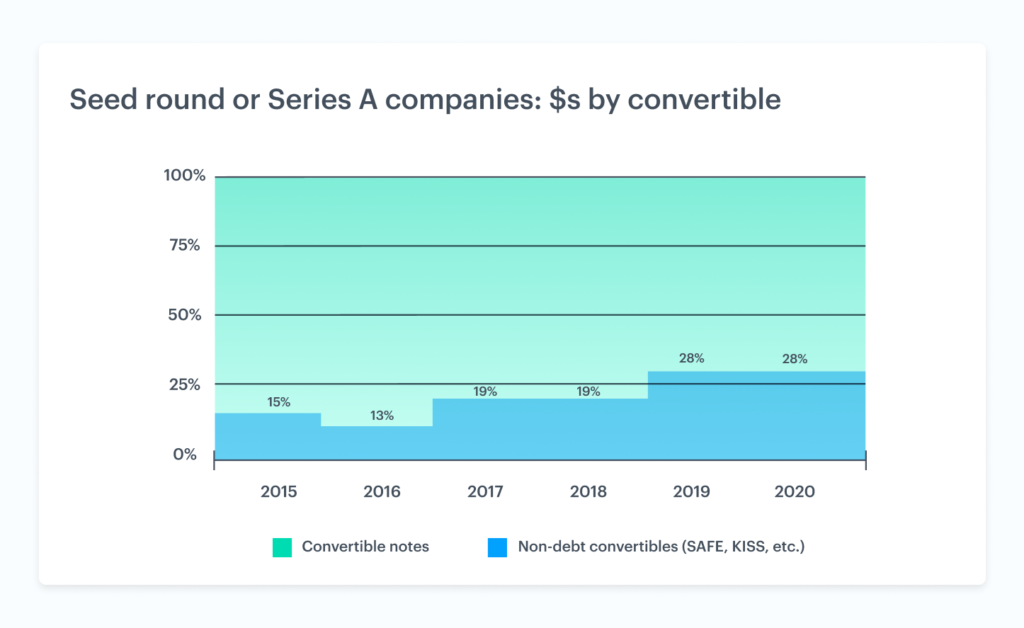

While non-debt convertibles have grown rapidly amongst early stage companies, companies tend to use them less as they continue to grow. When we looked at convertibles that converted into Series Seed and Series A preferred rounds, we began to see a marked drop in the usage of non-debt convertibles. While still less than half of this segment, the number of non-debt convertible securities and $ value of these securities is growing.

The number of non-debt convertibles issued post-Series A has remained flat at around 12%. This suggests that non-debt convertibles are popular pre-funding or are becoming more popular amongst companies in their early stages prior to a priced Series Seed or Series A, while convertible notes remain prevalent amongst more mature companies (post-Series A). This maps to evidence suggesting non-debt convertibles are heavily used in accelerator and incubator communities. Meanwhile, convertible notes remain popular for larger investments and bridge rounds used by more mature companies.

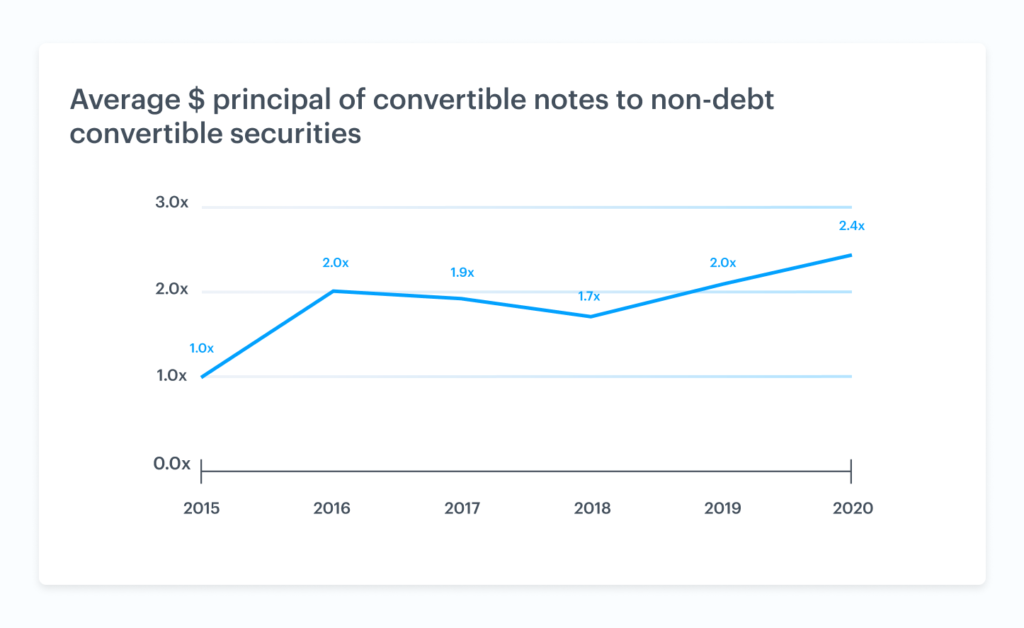

The principal of convertible notes is higher than that of non-debt convertibles—and the gap is growing

To vet our hypothesis, we also looked at the principal dollar amounts of all convertible notes and non-debt convertible securities. In 2015, the principal amounts were largely the same. However, we’ve seen the average principal of convertible notes increase relative to the average principal of non-debt convertible securities. So far in 2020, the principal of convertible notes is 2.4x that of non-debt convertibles. This once again suggests that non-debt convertibles are finding their sweet spot in smaller fundraises.

At Carta, we aim to support companies through all phases of their growth. While we’ve supported issuing both convertible notes and non-debt convertibles like SAFEs and KISSs for years, we’ve also heard from our early-stage customers that they want more tools to help them understand these instruments. That’s why we recently launched a free SAFE and convertible note calculator to help companies. As the market we support changes, we want to make sure we always have the best tools available for founders.

1 Companies who have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.