Prepare for tax filing season

Prepare for tax filing season

Carta can help your company and employees understand key tax filing dates and provide resources to guide your employees this tax season.

Carta can help your company and employees understand key tax filing dates and provide resources to guide your employees this tax season.

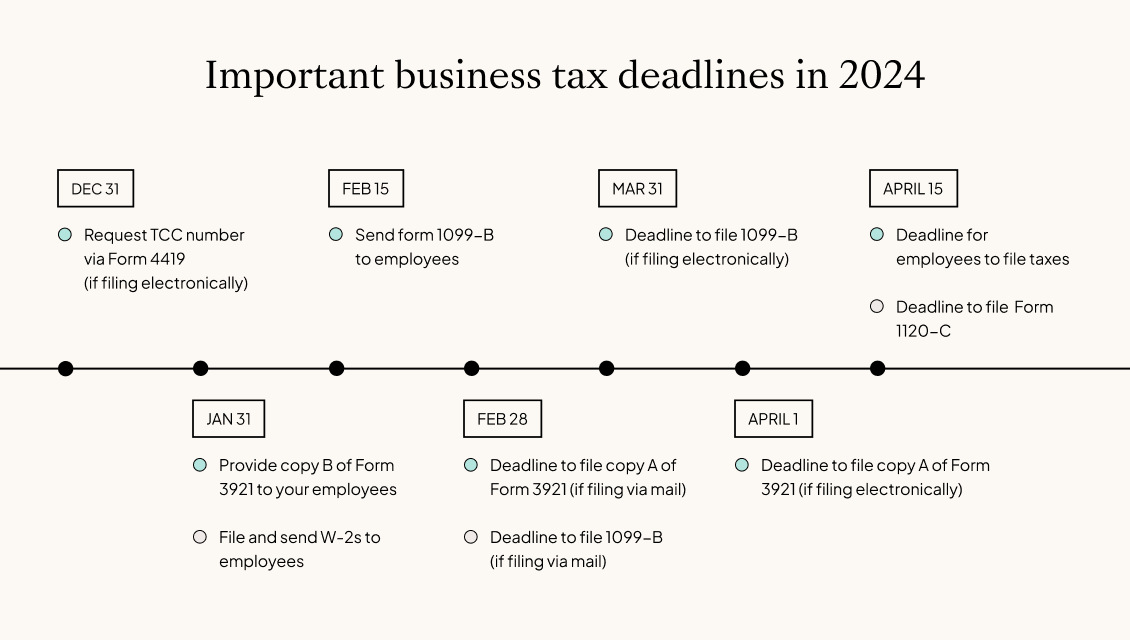

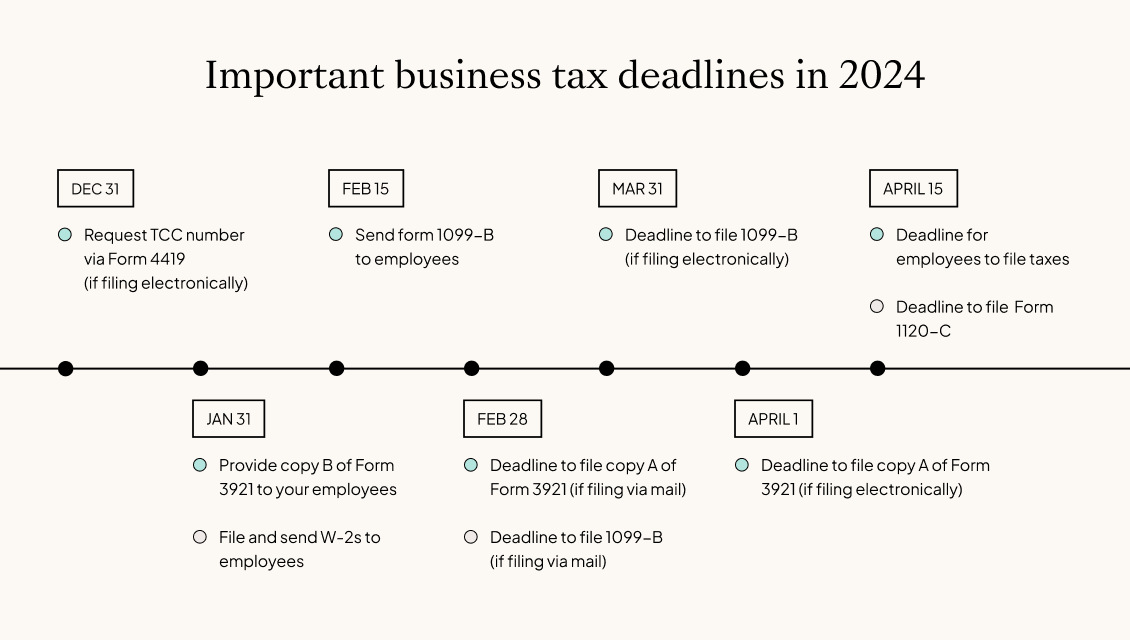

The first step of filing taxes correctly is to be aware of what forms you need to submit to the IRS and when they need to be submitted.

Our Equity Advisory team will determine your QSBS eligibility, provide attestation letters for tax filing, and develop personalized tax strategies for you and your employees.

Understand what tax forms are due to the IRS if you issued ISOs, NSOs, RSUs, or RSAs.

Help your employees prepare for tax season with the tax infographics below.

If employees exercised and/or sold options this year, here’s what they need to know.

Equity Advisory helps employees understand how their equity compensation is taxed via webinars, personalized 1:1 sessions and on-demand content – saving your company time and resources.

Carta Equity Advisory helps employees make informed decisions about their equity and taxes, on the same platform they already receive equity.