Investors

August 2022

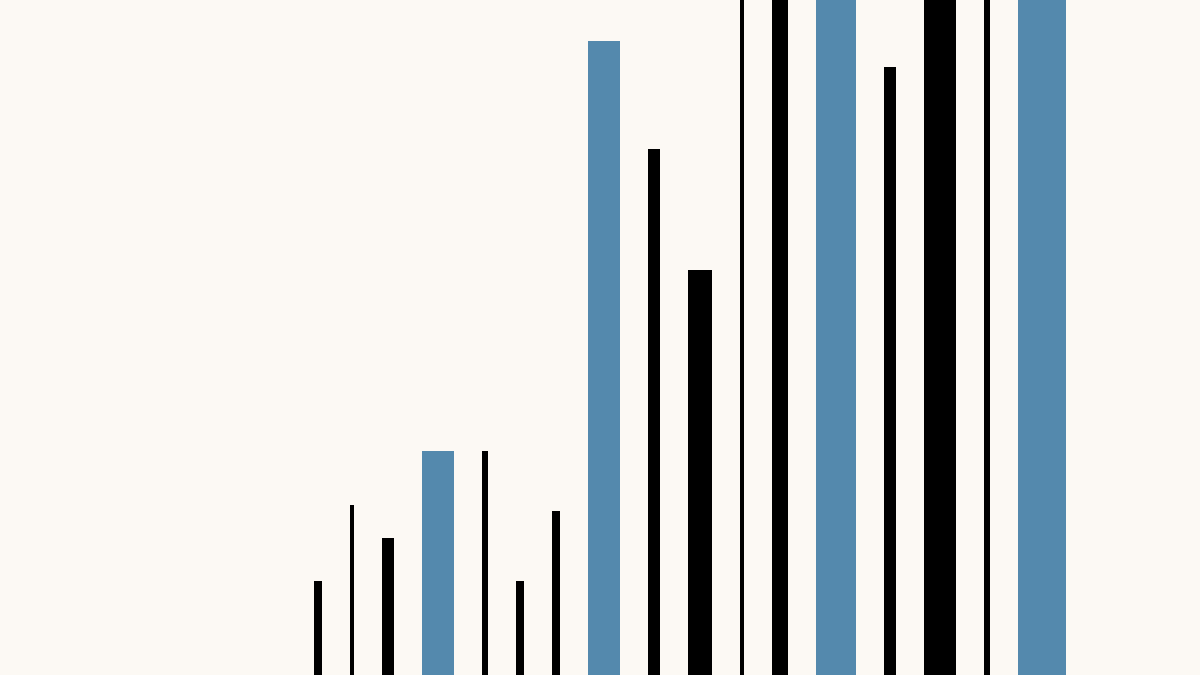

Venture capital fund structures

Thinking of starting your own venture capital fund? Learn the legal vocabulary of VC fund structures, including LPs,...

View

Fund Administration

June 2023

Fund administration

Fund administration is a third-party service that handles venture fund accounting, LP reporting, asset valuation,...

View

Investors

September 2023

Investment thesis

An investment thesis clarifies how you’ll make money for your fund’s LPs. Learn how to write a great thesis so you can...

View