One platform, unlimited potential

Carta’s platform of software and services lays the groundwork so you can focus on building the future.

Trusted by

2,391,436

Equity owners

$2.5T

Assets on platform

$126B

Assets under administration

40,000

Companies

Support to drive your business forward

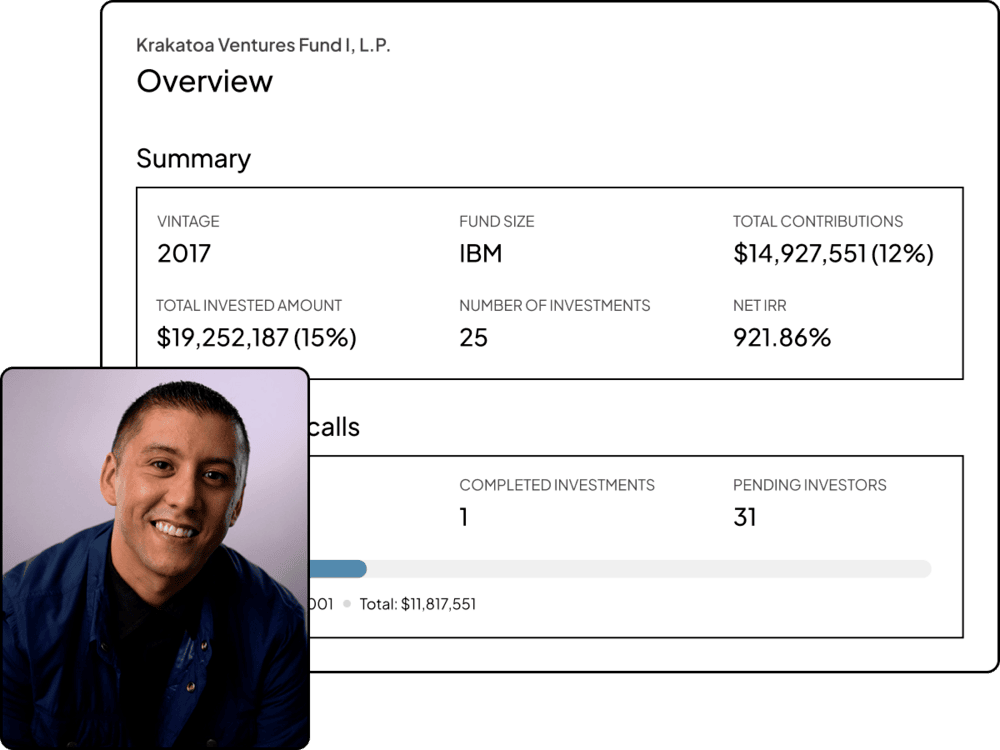

Venture Capital

Automate your back office and stay focused on deals with full-service fund administration, formations, valuations, audit and tax support, and portfolio insights.

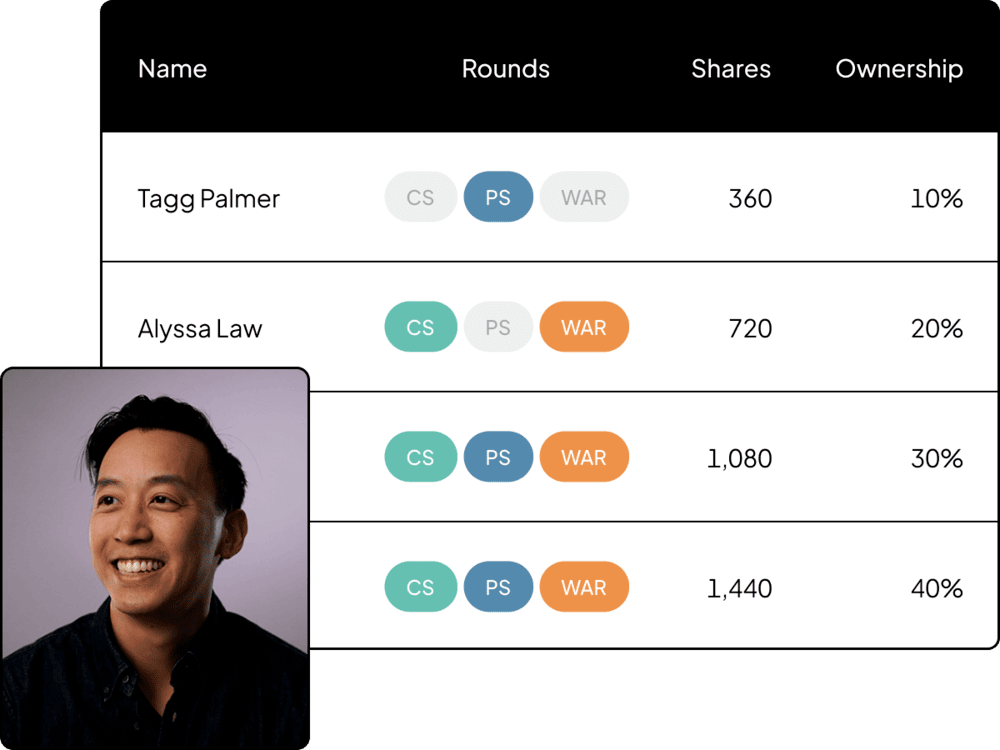

Equity Management

Manage all things equity in one place, including cap tables, valuations, fundraising, issuing shares, expense accounting, and equity planning.

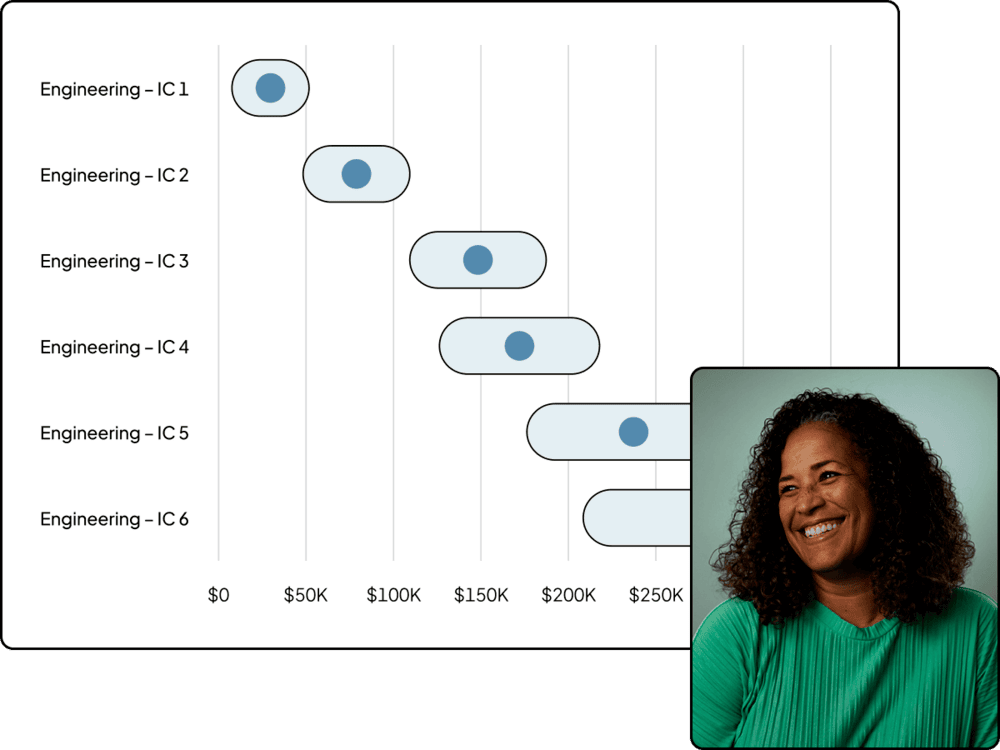

Compensation

Take the guesswork out of compensation with the industry’s most robust data set and real-time market intelligence powered by machine learning.

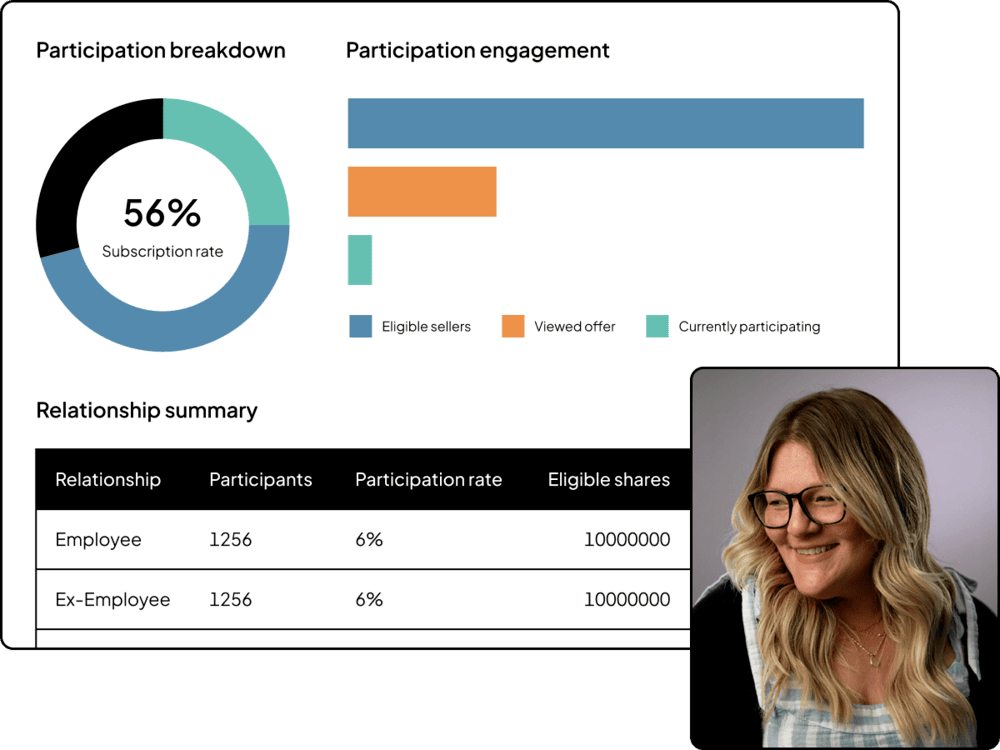

Liquidity

Simplify equity sales for employees, stakeholders, and investors with an integrated platform and automatic cap table updates.

Built for the builders

From idea to IPO, Carta supports innovators and investors at every stage and in every role.

Investors

Manage your fund on Carta so you can spend more time on deals and less time dealing with your back office.

Founders

Over 40,000 companies use Carta to fundraise, issue equity, and stay compliant.

Finance

Grow and plan for the future with tools and services that help you with everything from receiving fast valuations to managing burn to running liquidity events.

HR

From extending offers to answering employee equity questions, find the tools and team to support you.

Law Firms

Help your clients issue equity, raise funds, and stay compliant, all in one place.

Focused on the future

Innovation starts from within, so we’re always evolving our suite of products to keep you moving forward.

They are bold, daring, and unafraid to challenge the status quo, showing that innovation comes from many places.