As the managing general partner of Energy Capital Ventures, Vic Pascucci spends his days working with energy startups that want to change the world. He’s learned to be patient.

Engineering new molecules, building new grid infrastructure, harnessing the power of the sun—these sorts of things tend to require more time (and more capital) than writing code. Compared to other common startup sectors, the road to success in renewable energy can take quite some time to travel.

“If you want to make this game-changing impact, five years is like a week,” Pascucci says. “This isn’t SaaS. It’s a little different.”

But that long-term outlook didn’t insulate the renewable energy industry from the short-term effects of the ongoing venture capital slowdown. In fact, during the fourth quarter of 2022, the slowdown was even more extreme for energy startups than most other sectors.

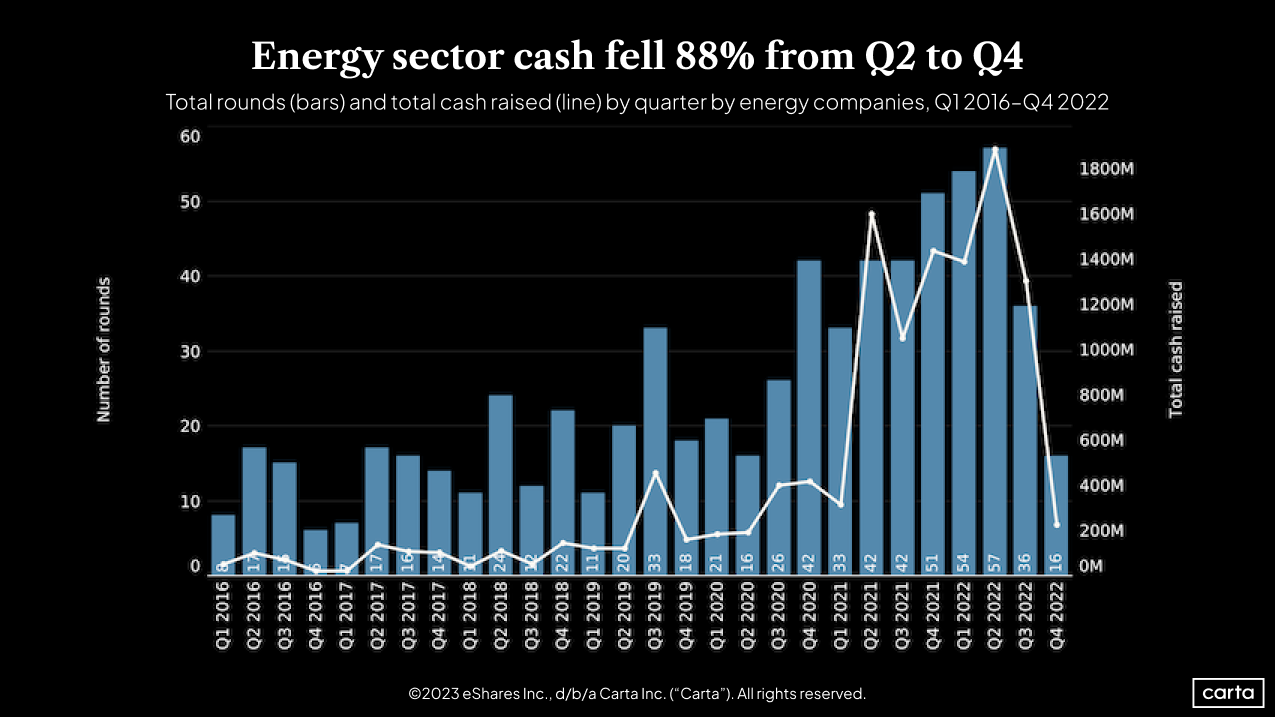

Renewable energy companies on Carta raised $226 million across a scant 16 investments during Q4. That deal value was down 88% from six months earlier, in Q2 2022, and deal count was down 72% over the same span. The average round size, meanwhile, dropped 57%, going from $33.1 million to $14.1 million.

Those metrics also declined in the broader venture ecosystem, but the fall was not so steep. Across all sectors, overall deal value was down 63% from Q2 to Q4. Deal count was down 41%. And average round size was down 36%.

The lull in energy activity has been most noticeable at later stages: Just one of the 16 energy deals that occurred in Q4 was at Series D or later. To Pascucci, whose firm typically invests at Series A, this relative lack of late-stage investors is a major reason for the sector’s recent slide.

“It’s definitely tempered down a little bit,” Pascucci says. “ESG [companies] tend to be a little more capital-intensive. And so when a lot of these later-stage capital sources back out of the market, it does cause some concern.”

Extending the runway

Pascucci and ECV focus their strategy on startups using new technologies to decarbonize the natural gas industry. One portfolio company called Cemvita Factory is a synthetic biology startup that’s using custom-built molecules to turn spent oil and gas wells into sources of clean hydrogen.

ECV closed its first fund in October 2022 with $61 million in commitments. Amid this slower-moving venture environment, the firm’s plans for deploying that capital have slightly shifted.

“What we’ve been doing is writing larger checks earlier on, in order to keep companies out of the market for longer until they have to do their next big raise,” Pascucci says. “Fundings that will last the company 24, 36, 48 months, [where we are] coming in earlier and taking a bigger bite, taking a bigger swing. Because we think that’s kind of the right way to do it with valuations having come down.”

Providing startups with longer runways is also in line with the longer-term nature of building a renewable energy startup. Without the need to fundraise so often, founders can spend more time on more technical parts of the job.

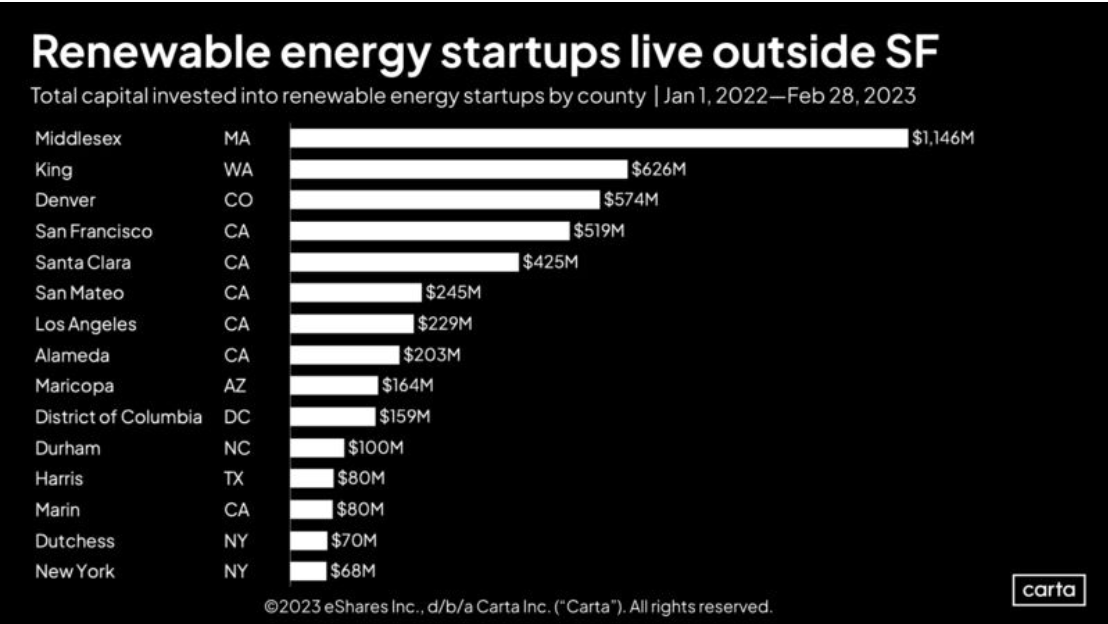

Where renewable energy deals are getting done

Since the start of 2022, the busiest hub for investment in the renewables space has been Middlesex County in Massachusetts—home to a bustling research community centered on schools like Harvard University and the Massachusetts Institute of Technology. San Francisco checks in at fourth on the list, trailing the home counties of Seattle and Denver.

During his meetings with companies in recent months, Pascucci says that he’s been struck by the geographic diversity of the renewable energy space. It’s one reason he’s optimistic about what’s to come.

Larger energy trends may drive more entrepreneurial innovation in the years ahead. The Inflation Reduction Act of 2022 earmarked $369 billion for investment in clean energy, mostly in the form of tax incentives aimed at areas such as clean hydrogen, carbon sequestration, and nuclear power production. Scientific breakthroughs in fields like nuclear fusion and green hydrogen continue to open new commercial avenues. And Pascucci says Europe’s energy crisis has driven “a lot of education” among investors and founders about the importance of developing new energy sources and maintaining energy security.

Deal activity has slowed down for now. But the pipeline of companies looking for funding is full.

“The volume of companies that we’re looking at, it’s accelerating every month, beyond what I ever expected. We’re looking at over a couple hundred a month now that are coming from all over,” Pascucci says. “That’s why I still think it’s early days. Because you’re seeing the brightest technologists and scientists teaming up with experienced industry executives to form these companies. These kids come out of school, and they want to solve this problem.”

Learn more

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: