Last year, when we changed our name to Carta, Henry, our CEO, wrote “We don’t know how many corporations, properties, investment vehicles, and partnerships exist in the world. But we do know if you mapped the entire ownership graph, the nodes would eventually represent every person in the world. There are 7+ billion people in the world. That is a lot of nodes. Who knew the cap table market could be so big?”

At the close of 2018, we’ve graphed 700,000+ nodes. This is a great start, but we are still a long way from mapping the entire ownership graph.

To achieve our goal of creating more owners, while increasing transparency and liquidity between them, we’ve raised additional capital. In 2018, we raised $80 million dollars and closed our Series D, led by Meritech and Tribe Capital, with participation from existing investors. With this new capital, our investors now value Carta at $800 million.

Expanding our support for investors and public companies

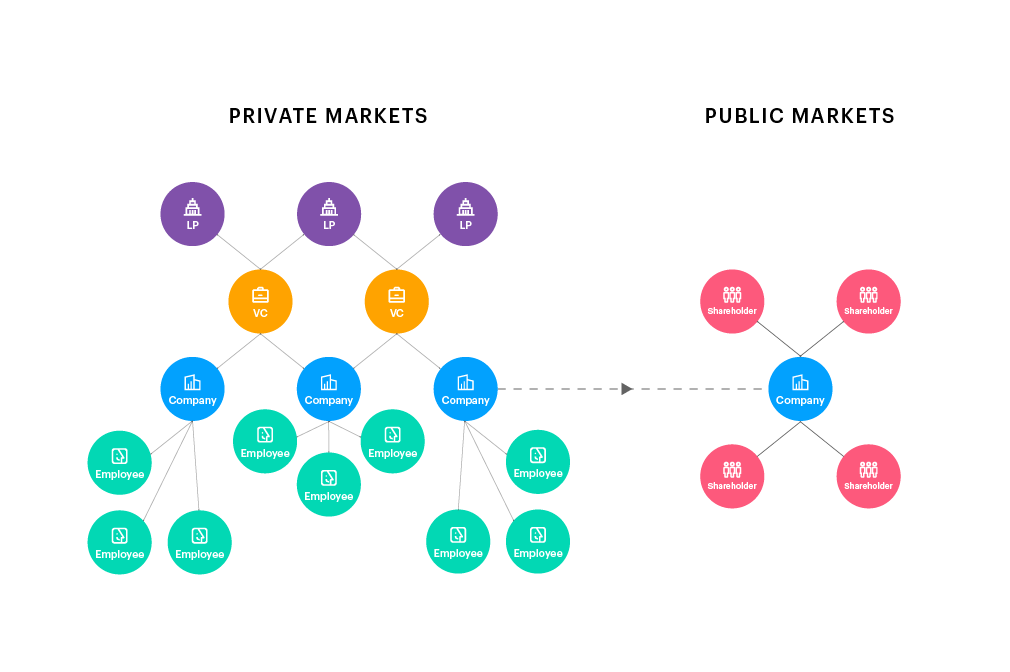

We’ve come this far by changing how ownership management works for private companies—popularizing electronic securities and cap table software, combined with audit-ready 409As. But our ambitions go far beyond supporting privately-held, venture-backed companies.

With our new funding, we will continue expanding our focus to transform how ownership management works for investors and public companies. We will launch additional products for investors, especially for collecting data from their portfolio companies and managing their back office. We’ll also continue to develop our transfer agent and equity administration products and services, so when private companies using Carta go public, they have a smooth transition to a best-in-class product.

Ownership network

A quick look back at 2018

We had a big year beyond our fundraising. Here are some other highlights from 2018:

-

Our customers now manage $500 billion in equity on the Carta platform.

-

We made it easier for VCs and portfolio companies to work together, with our new Board Management and Portfolio Insights products.

-

In our first year with a product for public companies, our software helped some of the most interesting companies go public, including Tilray. Tilray is the first cannabis company to trade on Nasdaq.

-

We completed more 409A valuations than any other provider.

-

We published a groundbreaking study on the gender gap in equity, covered in the Wall Street Journal, Fast Company, Bloomberg, and more than 60 other publications.

-

We grew from 310 employees to 450 employees.

Looking ahead to next year

In addition to expanding our products and services for investors and public companies in 2019, there’s a lot more to look forward to:

-

We anticipate that companies will continue to stay private longer. This will cause an increase in the number of companies who offer liquidity to employees and early investors on Carta.

-

That said, we also anticipate a large number of IPOs next year, and we hope to support those customers too.

-

Our experience for employees is already best-in-class. Even so, in 2019 we are doubling down on educational content and product enhancements for employee shareholders.

-

We’ll continue to develop partnerships with lawyers and venture capital firms to better support companies as they scale.

-

And of course, we’ll be scaling the Carta team. If you’re excited by what we’re doing, please reach out.

“There are no great companies today that are tackling capital markets, that are truly taking on Wall Street financial infrastructure. We are going to be that company.”

Thank you to our customers

None of this success would be possible without you, our customers and owners. It’s been amazing to see you all grow alongside us, and we appreciate your continued support and partnership.

Since we originally published this post, we’ve released our Series D pitch deck. If you’re interested, you can read more about it here.