We outgrew eShares so we renamed ourselves Carta. Let me explain why.

A bigger market

Ultimately property rights and personal rights are the same thing. -Calvin Coolidge

The investor criticism of eShares has always been “how big can the cap table market be?” It turns out much bigger than people thought.

We live in a world where everything is owned by a person, or more commonly, a group of people. Startups, office buildings, rental homes, railroads, railroad cars, railroad companies, debt for those railroad companies, antarctic territories, oil rigs, helicopters to access those oil rigs, farmland, farm equipment, rice paddies, irrigation equipment for those rice paddies, DAOs, ICOs, pharmaceutical companies, pharmaceutical patents…. it goes on and on. Everything in our world is owned by a person or a group of people.

Humankind’s greatest financial invention was the Corporation. The Corporation made it possible for people to group together and share ownership at scale. That vehicle for shared ownership has made S-Corps, C-Corps, LLCs, and LLPs the dominant form of business creation in the modern era. And new forms of shared ownership are being created today with ICOs, DAOs, and blockchain ownership ledgers.

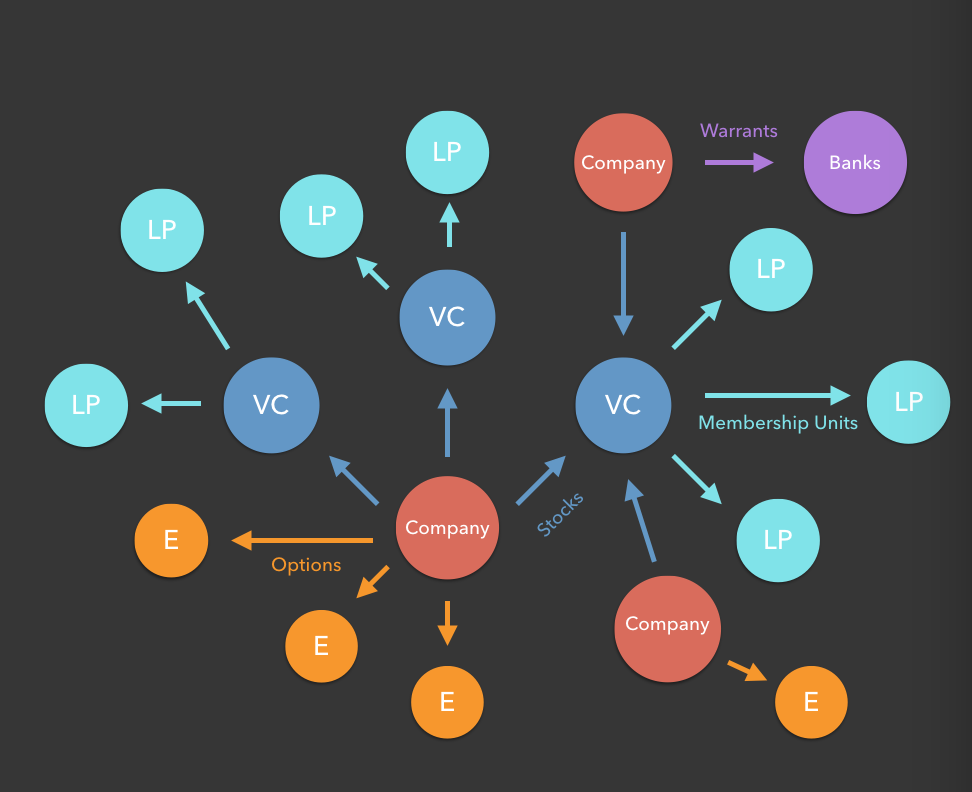

Fractional ownership is fractal. For example, a startup, which is usually a C-Corp is owned by a group of venture funds. Those funds, which are usually LLCs, also have a cap table of their LP membership interests.

Limited partners (LP) also have investors too. If you kept drilling up the chain (and back down it) you would run into endowments, pensions funds, private equity firms, large private companies, small private companies, public companies, real-estate firms, real-estate trusts, gas & oil territories, and on and on.

If you drill far enough into the ownership graph, through the pensions and real-estate trusts and all the shared ownership vehicles, you eventually get to a person. You reach their retirement plan or savings account or option grant or even a simple title representing their ownership interest. That is how our society works. The leaf nodes of the ownership graph must be individual people.

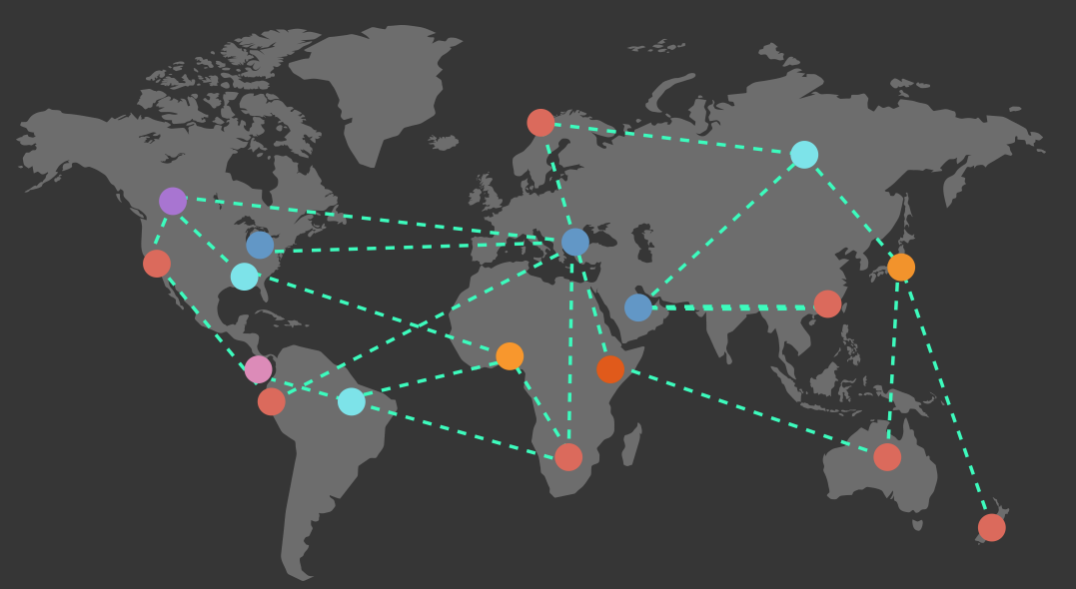

This ownership graph is large and hard to quantify. We don’t know how many corporations, properties, investment vehicles, and partnerships exist in the world. But we do know if you mapped the entire graph your leaf nodes would eventually represent every person in the world. There are 7 billion people in the world. That is a lot of leaf nodes. Who knew the cap table market could be so big?

Modern serfdom

In the middle ages, they took the name of serfs. Nowadays they are called wage earners. -Mikhail Bakunin

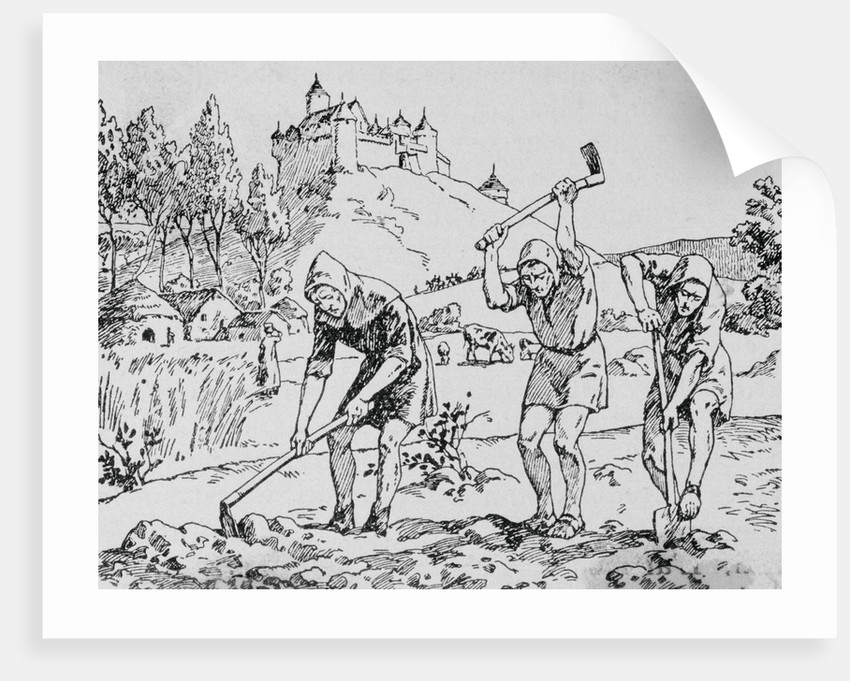

We live in a feudal economy. It is hard to see. Skilled labor and free capital markets disguise it. But the economics of medieval serfs and landowners is not much different than the economics of modern wage earning employees and the owners of the firms they work for.

A medieval landowner would receive ten grains of wheat for every grain a serf kept. Landowners could fire bad wheat pickers forcing them to find a new landowner. Hopefully the serf saved enough grain to feed his family while unemployed. A good serf could work for a landowner for 30 years and own nothing at the end. In contrast, the landowner kept the land, the profits, and rights to all future harvests.

Landowners needed serfs so they created institutions like manors, vassals, and the Church to produce them. Today, we create schools to teach science, engineering, math to create better wage-earners. We train teachers to tell future wage-earners that the path to a good life is to learn a valuable skill and get a good job. In other words, become good wheat pickers.

Medieval landowners donated to the Church but little of that money went to commoners. Modern landowners donate huge sums to universities. Most of it goes to new football stadiums and buildings with their names. By design, our academic institutions saddle students with debt that takes decades to payoff. Students need to become wage-earners to pay back the money they borrowed to become better wheat pickers. Nearly a $1.4 trillion of student debt needs to be paid back today.

Modern landowners even lobby the government for better tax treatment. Their wealth is created from compounding capital so they successfully campaign to make capital gains and carried interest tax rates half that of labor. Even worse, tax rates on labor are progressive — the more a wage earner earns the higher their tax rate. But taxes on capital are flat. Modern landowners pay the same tax rate no matter how much money they make.

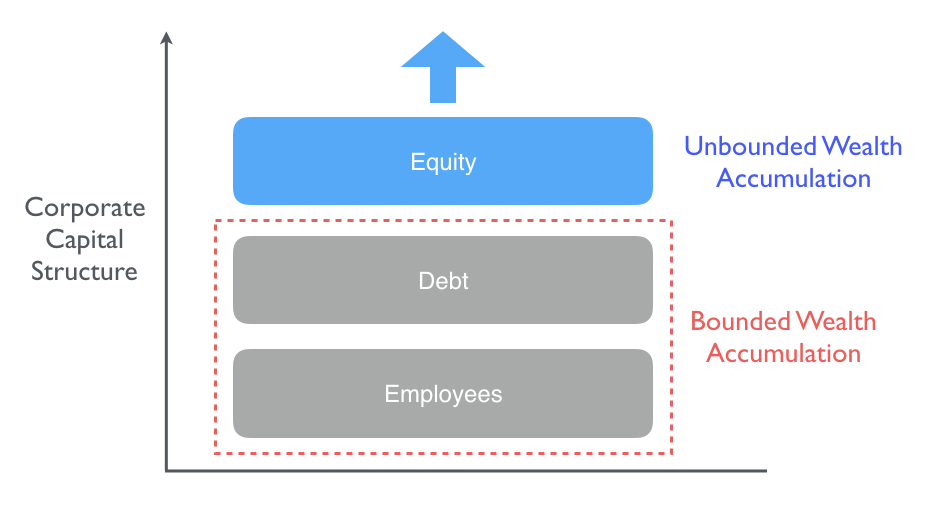

This is what is missing from the income inequality debate. A feudal system increases income inequality because, like landownership, capital is permanent and compounds while labor is transient and disappears with the laborer. Another way to think about this is that employees sit on the debt stack of a firm while owners sit on the equity stack. In a growing company, the equity stack accumulates wealth faster than the debt stack. In a growing economy, the equity-owning class accumulates wealth faster than the wage-earning class.

Creating more owners

The land is the only thing in the world worth working for, worth fighting for, worth dying for, because it’s the only thing that lasts. -Margaret Mitchell

When the Traiterous Eight founded Fairchild Semiconductor in 1957 they did it for equity. Their decision to leave Shockley Labs, where they received a salary, to start a company where they also received equity broke the mold. Robert Noyce, co-founder of Fairchild Semiconductor recalled: “Suddenly it became apparent to people like myself, who had always assumed they would be working for a salary for the rest of their lives, that they could get some equity in a company … that was a great revelation and a great motivation.” Today it is unimaginable for a tech startup to not issue equity to employees.

Unfortunately, it is still only unimaginable in tech. In 2015 and 2017, Curry, Green, Thompson, and Iguodala brought two championships to the Golden State Warriors increasing the GSW franchise value from $555M in 2013 to $2.6B in 2017. None of them have ownership in GSW. Once they stop playing basketball they will stop earning. They won’t realize any of the $2.1B in value they brought to the franchise. That value accrued to the owners of GSW.

There are recent examples of non-tech firms issuing equity to employees like Chobani and Zingerman’s. However, these are the exceptions that prove the rule. Like basketball players, the vast majority of electricians, nurses, accountants, waiters, fashion designers, construction workers will never own the firms they work for.

What if issuing equity were as easy and cheap as paying payroll? Could we make ownership as ubiquitous as salaries?

The largest private company in the world, Cargill, has 150K employees with less than 500 shareholders. In a flip of a switch they could create a 150K new owners who earn wages to feed their families today and earn equity to feed them tomorrow.

Cargill, like most large companies, has employees all over the world. Ownership is a global construct. Every world citizen, regardless of country, understands what it means to own something. Ownership transcends borders. And it transcends time. It can be passed to children, transferred to family, and even kept in an estate long after one’s death.

Carta is about creating more owners. To map and expand the ownership graph, democratizing ownership in the process. To reduce income inequality by expanding the ownership of productive assets. To pull more wage-earners out of the debt stack and into the equity stack. To make 7 billion people part of the landowning class.

Welcome to Carta.