What is a restricted stock unit (RSU)?

A restricted stock unit (RSU) is a form of equity compensation that companies issue to employees. An RSU is a promise from your employer to give you shares of the company’s stock (or the cash equivalent) on a future date—as soon as you meet certain conditions. These conditions are the “restrictions” placed on the award, and the process of meeting the conditions is called vesting.

RSUs are an alternative to stock options (like ISOs or NSOs), which give employees the chance to buy company stock at a set price. With RSUs, you don’t have to pay anything to get the stock. Instead, you are usually only responsible for paying the applicable taxes when you receive the shares. Unlike with restricted stock awards (RSAs), you won’t acquire the shares underlying the RSUs until they vest.

You typically don’t get to choose which type of stock award you receive; instead, what you receive depends on your role and the size, stage, and preferences of your company. RSUs are more commonly issued by larger, later-stage companies. Learn more about RSUs vs options here.

How do restricted stock units work?

In order for you to receive your RSUs, you have to meet the vesting conditions outlined in your RSU agreement. These restrictions on the award may be:

-

Time-based (e.g., you must stay at the company for a certain amount of time. )

-

Milestone-based (e.g., your company must IPO or be acquired, or you have to complete a performance milestone or project)

-

A combination of the two

Double-trigger RSUs vs. single-trigger RSUs

If time-based or milestone-based vesting is the only restriction, the grants are considered single-trigger RSUs. Grants that use a combination of the two are called double-trigger RSUs. Most RSUs issued by privately held companies are double-trigger RSUs.

When you meet the conditions outlined in your RSU grant, your RSUs vest and you receive your shares.

When can I sell my RSU stock?

When thinking about whether to sell your RSUs, consider things like:

-

Your company’s trading policy

-

How you think the stock will perform in the future

-

Your cash-flow needs

-

How much you’ll be taxed

-

How diverse you want your portfolio to be

Public company RSUs

If your company is public, you can usually sell the shares you receive from your RSUs as soon as you meet the vesting criteria and get your shares, as long as you comply with your company’s trading policy (e.g., with some companies, you’re only allowed to trade stock during certain times of the year).

Private company RSUs

If your company is private, you’ll need to wait for a liquidity event (like an acquisition, IPO, or company-led secondary transaction, such as a tender offer, to sell your shares). Or, if your company approves the transaction, you can find a third-party buyer to buy your shares.

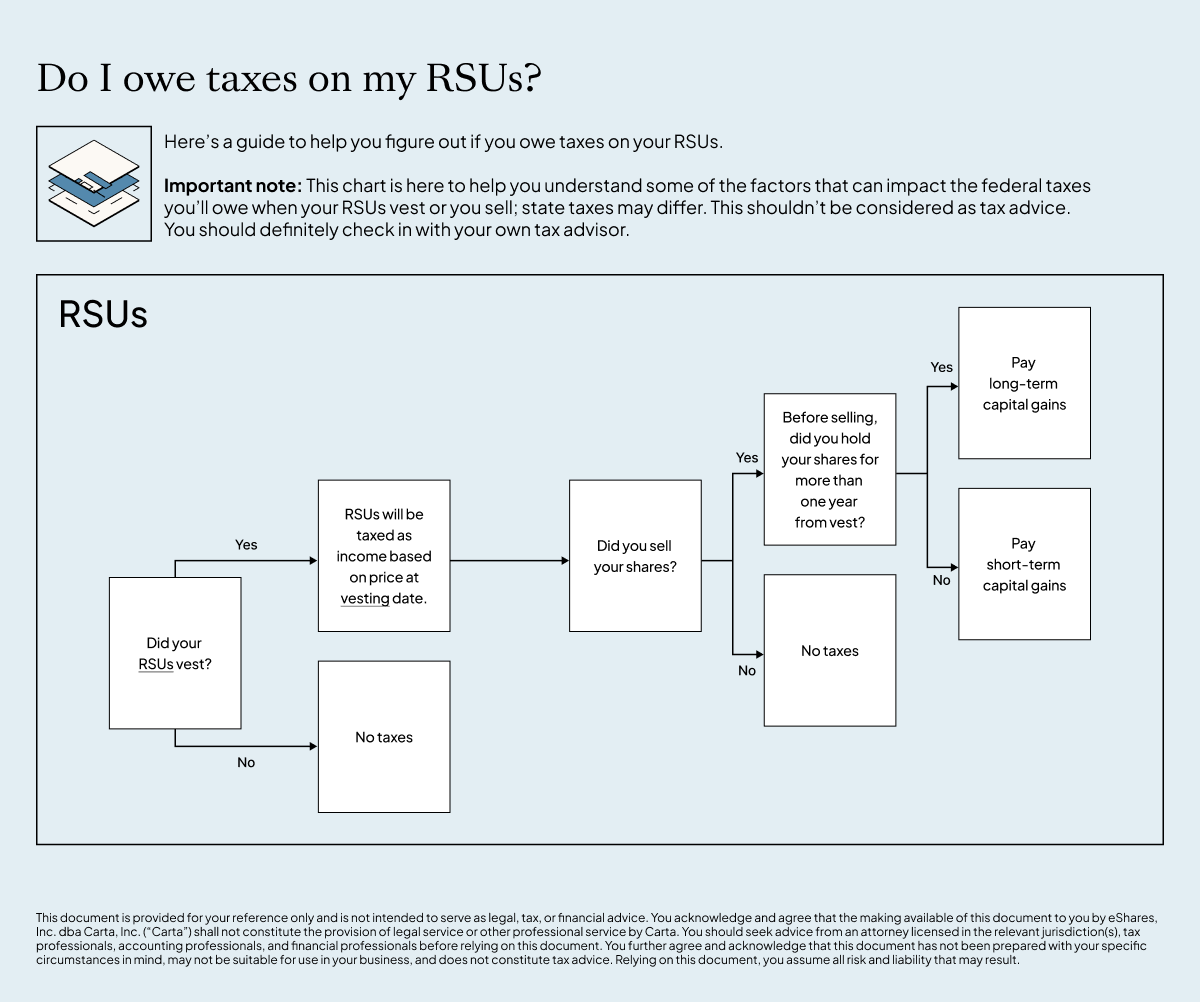

RSU tax treatment

Unlike ISOs (where you sometimes don’t pay taxes until you sell your shares) and NSOs (where you pay taxes both when you purchase and sell your shares), with RSUs, you usually have to pay ordinary income tax on the fair market value (FMV) of the shares when you acquire them, which is usually as soon as they vest.

|

Action |

Tax implication |

|

Your company gives you an RSU grant. |

No immediate tax implication. |

|

Your RSUs vest and are settled. |

You’ll owe ordinary income tax on the FMV of your shares at the time of settlement. |

|

Your RSUs are settled and you sell the shares immediately. |

You’ll owe ordinary income tax on the FMV of the shares you acquired and no capital gains tax on the sale of the shares (because the sale price was the same as your tax basis). |

|

You sell your shares within one year of receiving them. |

You’ll owe ordinary income taxon the FMV of your shares at settlement. If you sell at a price higher than the FMV of your shares at vesting, you’ll also likely owe short-term capital gains taxon the difference. |

|

You sell your shares after holding them for more than a year. |

You’ll owe ordinary income tax on the FMV of your shares at settlement. If you sell at a price higher than the FMV of your shares at vesting, you’ll also likely owe long-term capital gains tax on the difference. |

Supplemental income tax

Employers are required to withhold 22% for federal income taxes on the first $1M in supplemental income for employees, and 37% of any amount exceeding $1M. Your RSU shares, along with any bonuses you receive, are initially taxed as supplemental income.

You may end up owing more in income tax on your shares depending on your effective tax rate: If it’s higher than 22% for the year you vest your shares, you’ll owe more than your employer has withheld. In addition, you’ll owe Social Security, Medicare, and state income taxes on your shares.

Sell to cover

Your company may allow you to sell a portion of your vested shares to cover the tax obligation your employer must withhold. Then, you can choose whether to hold the remaining shares or sell them right away.

Capital gains tax

When you sell, you may also need to pay capital gains tax on the spread (the increase between the FMV of the shares when you received them and the sale price). How long you hold the shares usually determines whether you will pay short- or long-term capital gains tax. If you sell right after your shares vest, you probably won’t experience a gain and may not have to pay additional tax.

What happens to my RSU stock if I leave the company?

If you leave your company, you’ll get to keep your fully vested shares.

With double-trigger RSUs, you’ll usually lose any shares that aren’t time-vested when you leave. In addition, it’s possible for your time-vested shares to expire before they “fully” vest (by meeting the milestone-based conditions of the second trigger, such as a liquidation event). Your RSU agreement should indicate if and when unvested double-trigger RSUs will expire.

Carta offers equity advisory services to employees of participating companies. Founders and leadership teams that want to help employees make informed decisions about their equity ownership can reach out for a demo.