Today Carta is making four announcements about 409A valuations.

TLDR;

-

We are open sourcing all 409A valuation models

-

409A report turnaround time is one business day

-

We are lowering 409A pricing

-

409A reports include all waterfall and valuation models

It is an oddity that knowing the value of any public company is free (see Google Finance) but knowing the value of your own private company is not.

The biggest problem with 409A has been the industry itself. Providers have greedily overcharged companies. But worse, they created a culture of secrecy around how companies are valued and what those valuations mean.

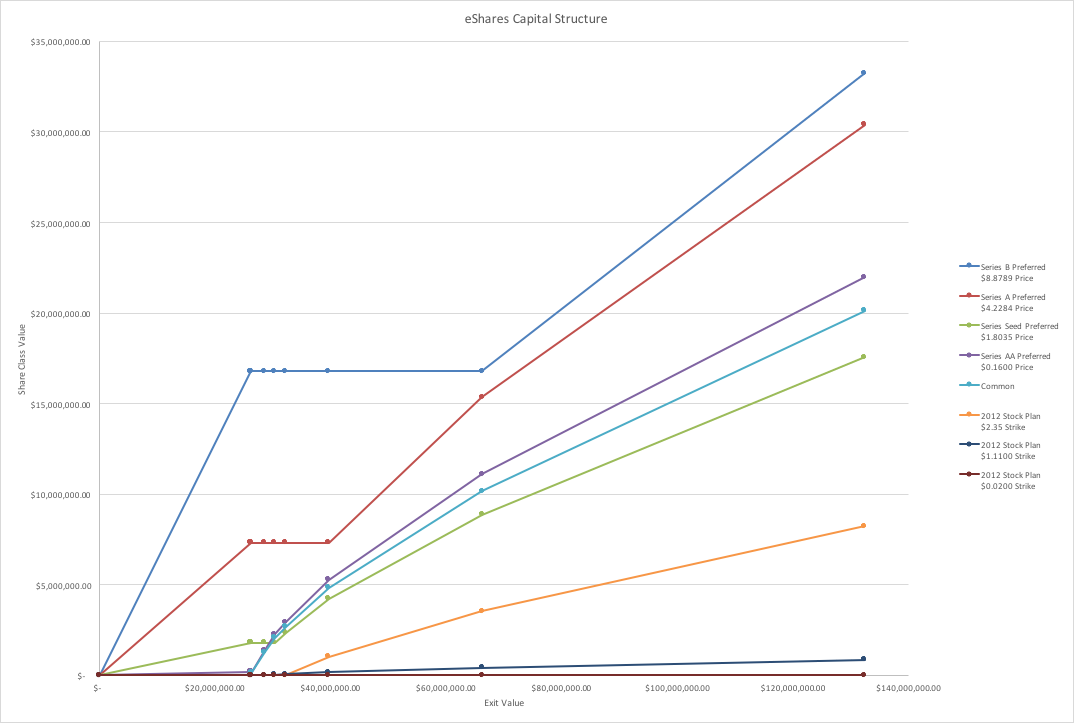

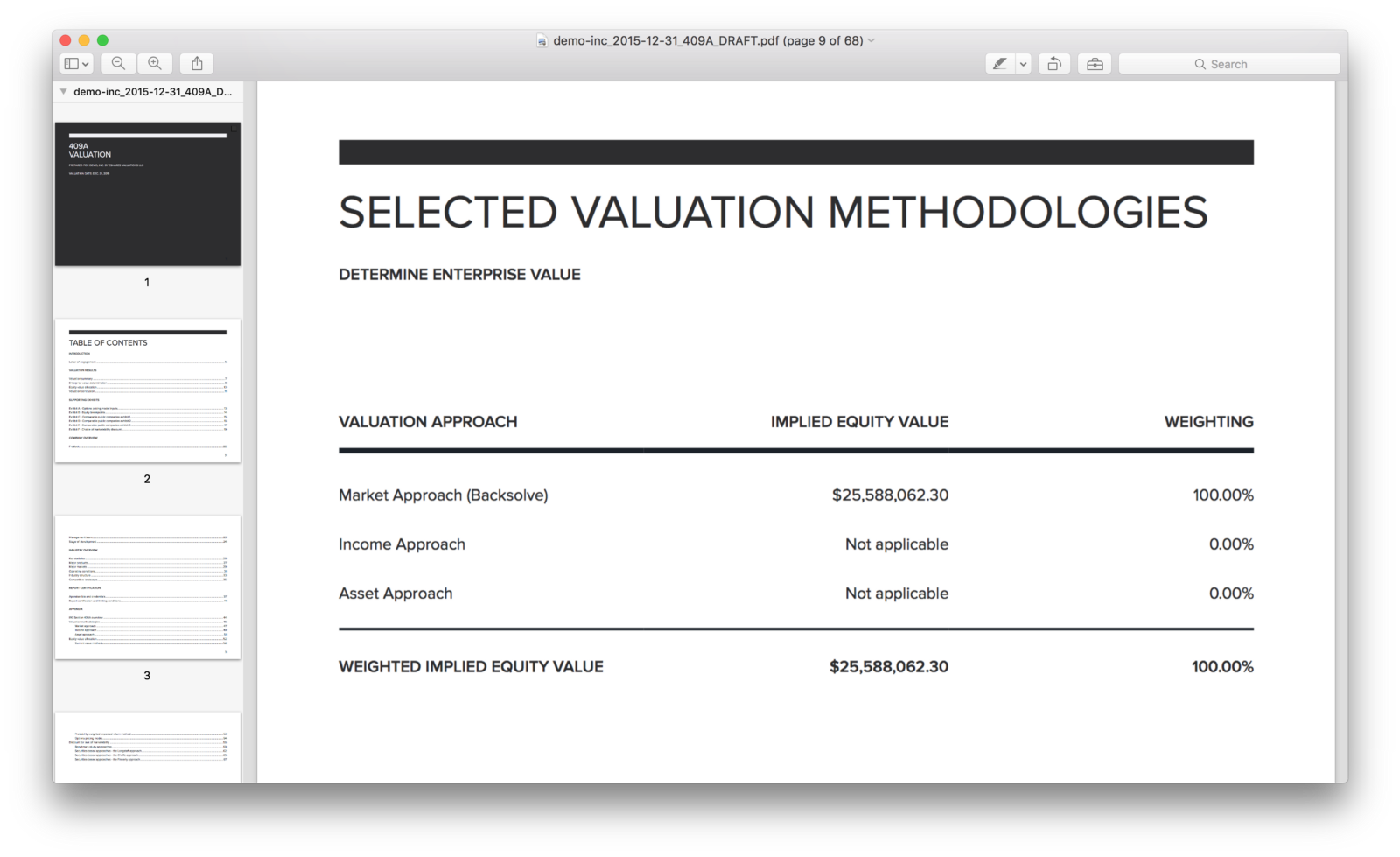

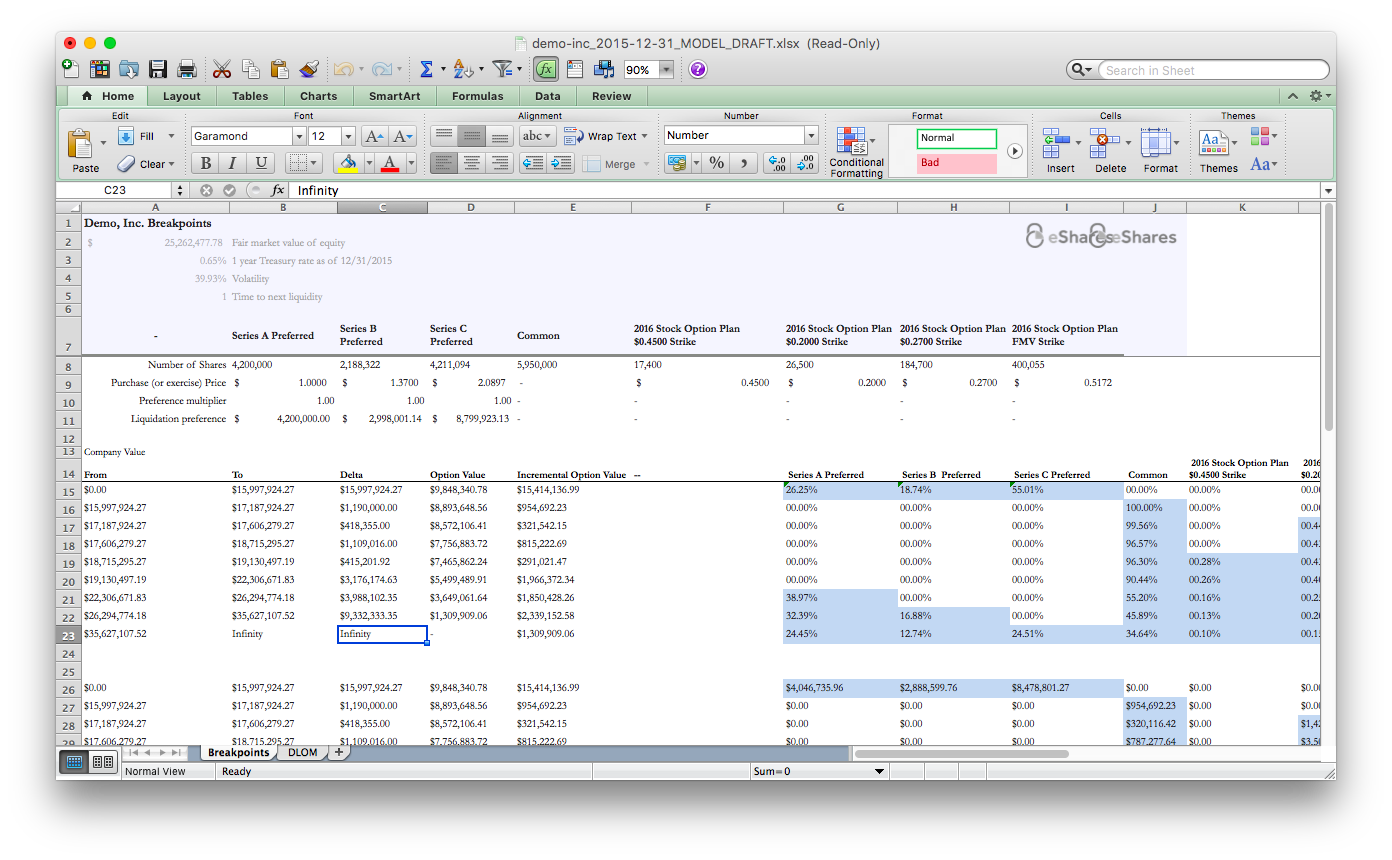

A proper 409A creates a waterfall on the capital structure of the company. The waterfall is the most important piece of a valuation because it captures the embedded liquidation preferences. This is hidden in most reports. It should not be. CEOs and Board Directors should see their company’s waterfall in their 409A report.

At Carta we share our capital structure beyond our Board. For example, we include our waterfall in our offer letter directly pulled from our 409A valuation.

We have four announcements to help companies value their stock and understand their capital structure.

-

We have open-sourced all 409A valuation models. Companies have everything they need to value themselves and create their own waterfall.

-

Our turnaround time for a 409A report is one business day.

-

We lowered 409A subscription prices to make them affordable for all companies. Learn more here.

-

We include the actual financial models used in every 409A report so CFOs, Board Directors, and Auditors can verify the report.

The days of valuing private company stock as an opaque administrative exercise are ending. We need to understand what these assets are worth. This is a step in that direction. We will continue to drive transparency and education. Stay tuned.