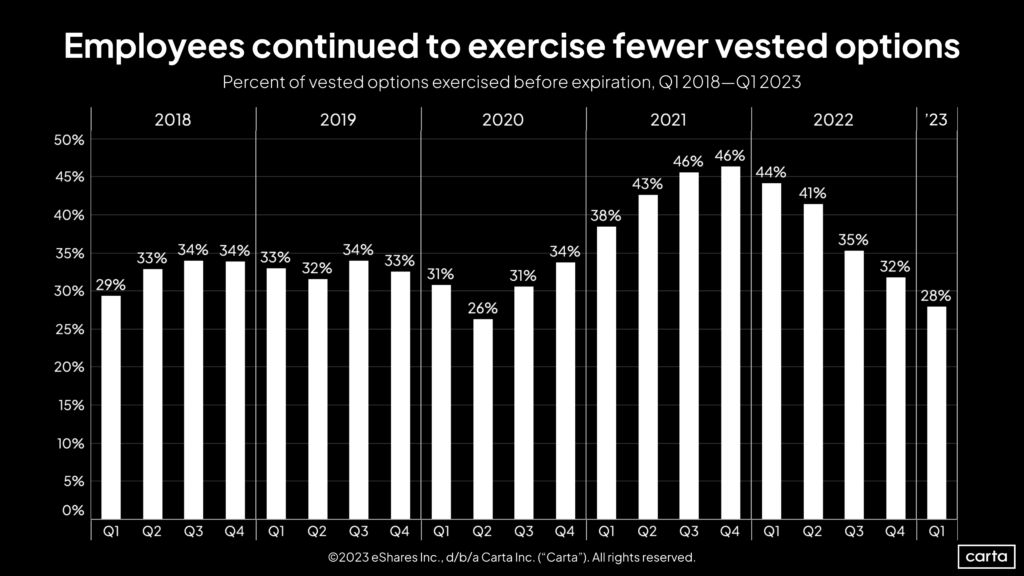

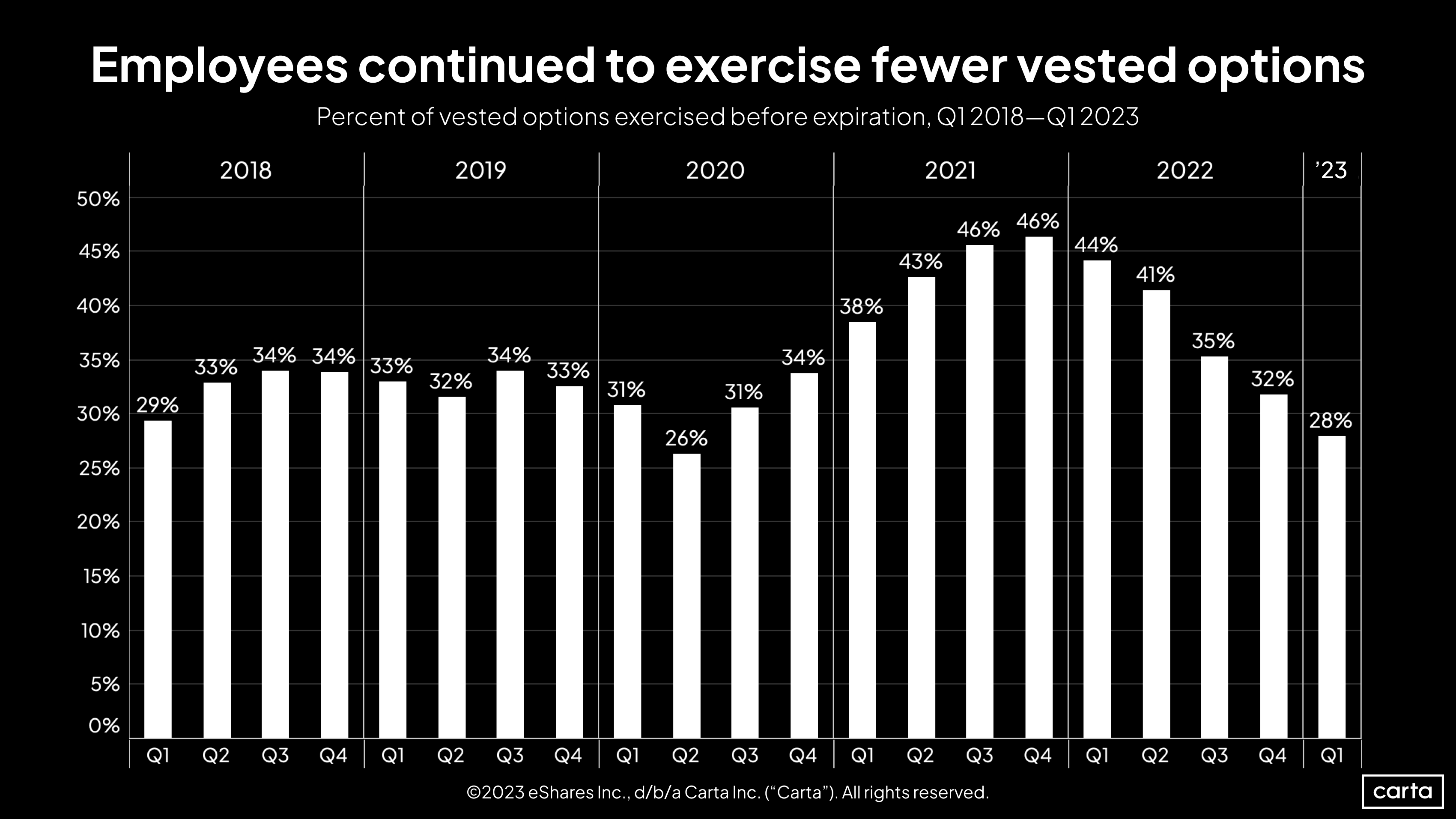

Stock options are a key part of compensation at many startups. But in recent months, fewer employees have been taking advantage of the opportunity to purchase an ownership stake in the companies where they work.

The rate of vested stock options that employees exercised fell to 28% during the first quarter of 2023. That’s the second-lowest rate since the start of 2018, trailing only Q2 2020, when the onset of the pandemic sent a unique wave of uncertainty across financial markets.

One year ago, in Q1 2022, employees exercised 44% of vested options before they expired, the third-highest rate of the past five years. (In both Q3 and Q4 2021, the rate hit 46%.) Just like in deal activity, valuations, and many other aspects of the startup landscape, the falloff over the past year has been swift and severe.

The rate of exercised options usually correlates to trends in the broader economy. When corporate valuations and consumer saving rates are high, as was the case in 2021, stock options tend to be more valuable, and more employees have the cash on hand to exercise their vested options. In an environment with lower valuations and lower savings rates, employees have less motivation and less means to exercise.

Considering the increase in down rounds that’s occurred over the past few quarters, some portion of the vested options that employees hold are likely underwater. If the price to exercise shares is now higher than the price those shares would fetch on the open market, the incentive to exercise is greatly reduced.

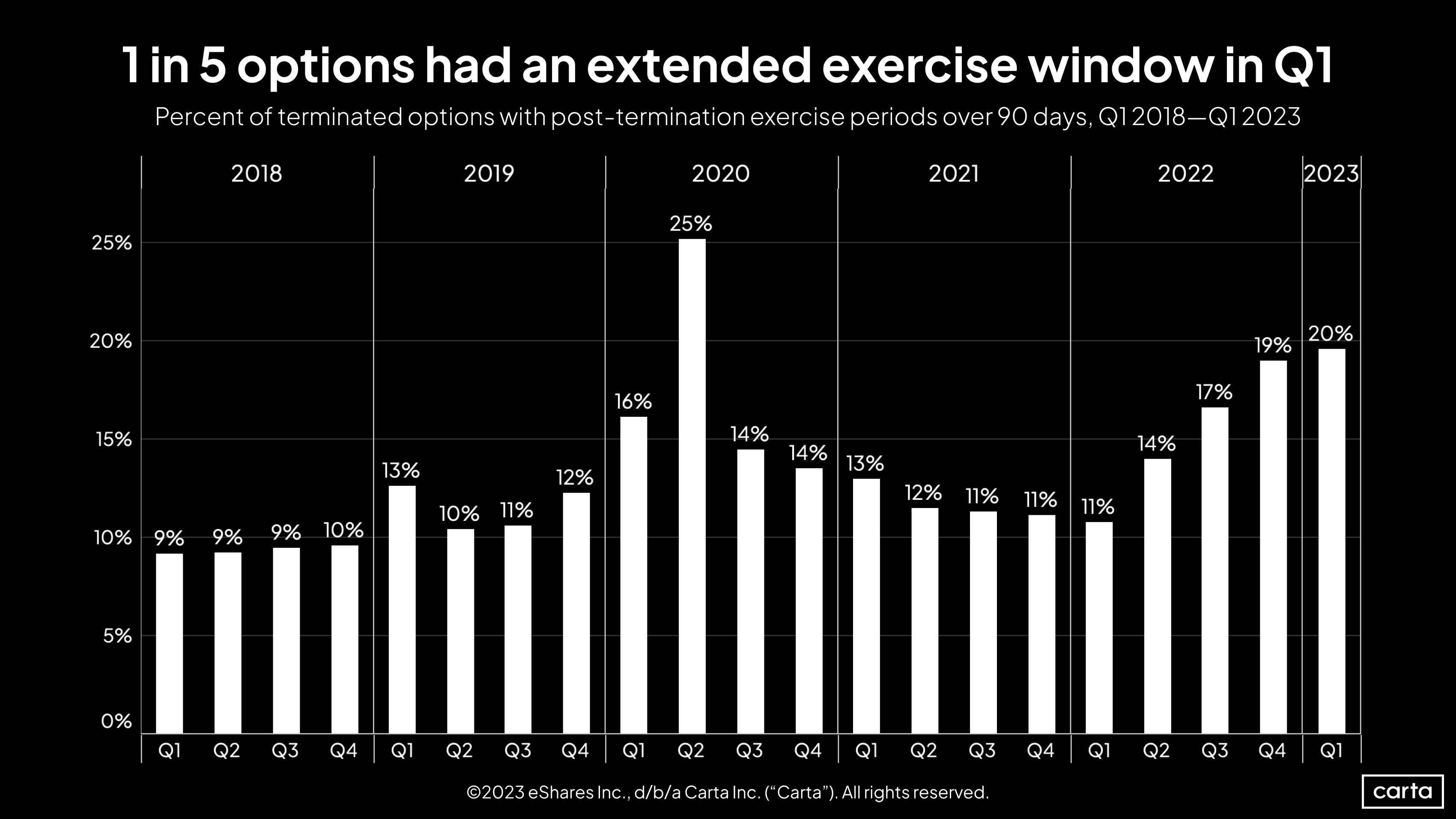

An inverse trend in PTEP

When an employee leaves their job, either by choice or through a layoff, they typically have three months to choose whether to exercise any vested options. In Q1, however, companies offered an extended post-termination exercise period (PTEP) on 20% of options for terminated employees. That’s the second-highest rate of the past five years, again trailing only the early pandemic stretch of Q2 2020.

Historically, the rate of extended exercise windows moves inversely with the rate of exercised options. A bullish market can mean employees have more cash on hand, which makes them more likely to exercise their valuable options. But a common reason for offering extended PTEP is to give employees more time to pull together the cash to be able to exercise. When the economy is stable and the job market is more friendly to workers, companies might be less likely to extend PTEP.

The recent rise in extended PTEP also correlates to the surge in tech layoffs that occurred in 2022 and early 2023. Companies often offer laid-off workers a longer PTEP to help reduce the turmoil of an unexpected job loss and income uncertainty, so increased layoffs can lead to higher rates of extended PTEP.

The number of workers on Carta who were laid off reached a recent high in January, topping 16,000. But that figure fell significantly in February and again in March, dropping to just below 10,000. Whether this is an end to the recent wave of tech layoffs—or just a trough before the wave crests again—might depend on how valuation and fundraising trends shift in the months to come.

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: