In 2018, tech news has been dominated by seemingly endless stories of another “unicorn” raising a colossal round. These valuations are fueled by VCs raising huge funds earmarked for late stage companies. With increased access to capital, companies find staying private longer increasingly attractive. We decided to take a look behind these headlines and dig into the data.

We wanted to know how funding in 2018 compared with that of previous years. We analyzed aggregated and anonymized data for a subset of companies on Carta. We looked at data from Q4 2017 through Q3 2018. Here are our key findings:

-

Median post-money valuations have increased for all stages of companies between 2017 and 2018

-

Series D companies are giving away less of their company for higher valuations than ever before

-

Companies are taking longer to raise Series A rounds

Valuations by round

If you just look at the headlines, it seems like every startup that’s been around for a few years is valued close to or above a billion dollars. To get a sense for how valuations are actually changing over time, we looked at 6,627 primary financing rounds raised by 4,565 US-based, venture-backed companies.

There are a few key components to understanding fundraising and valuations:

-

Post-money valuation is the value of the company after cash is raised, and is simply the price per share multiplied by the company’s fully diluted shares.

-

Pre-money valuation is the value of the company before cash raised. This is determined by subtracting the cash raised in a round from the post-money valuation.

-

Percent sold is the portion of the company that investors in the latest round now own. A simple example: if $10 is invested at a post-money valuation of $100, 10% is the percent sold.

We looked at all of these data points year over year, from 2014 to 2018. Here’s what we observed:

-

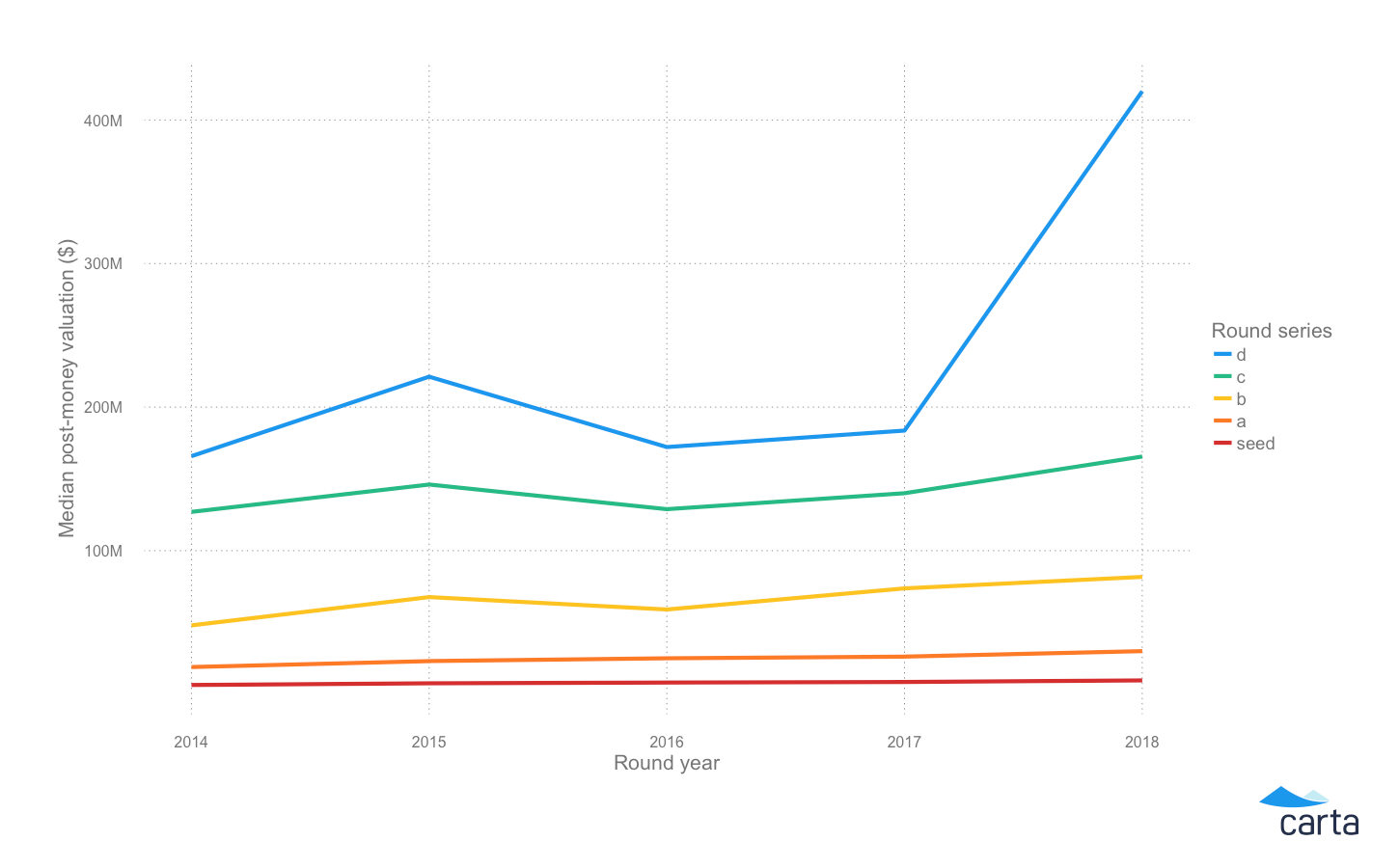

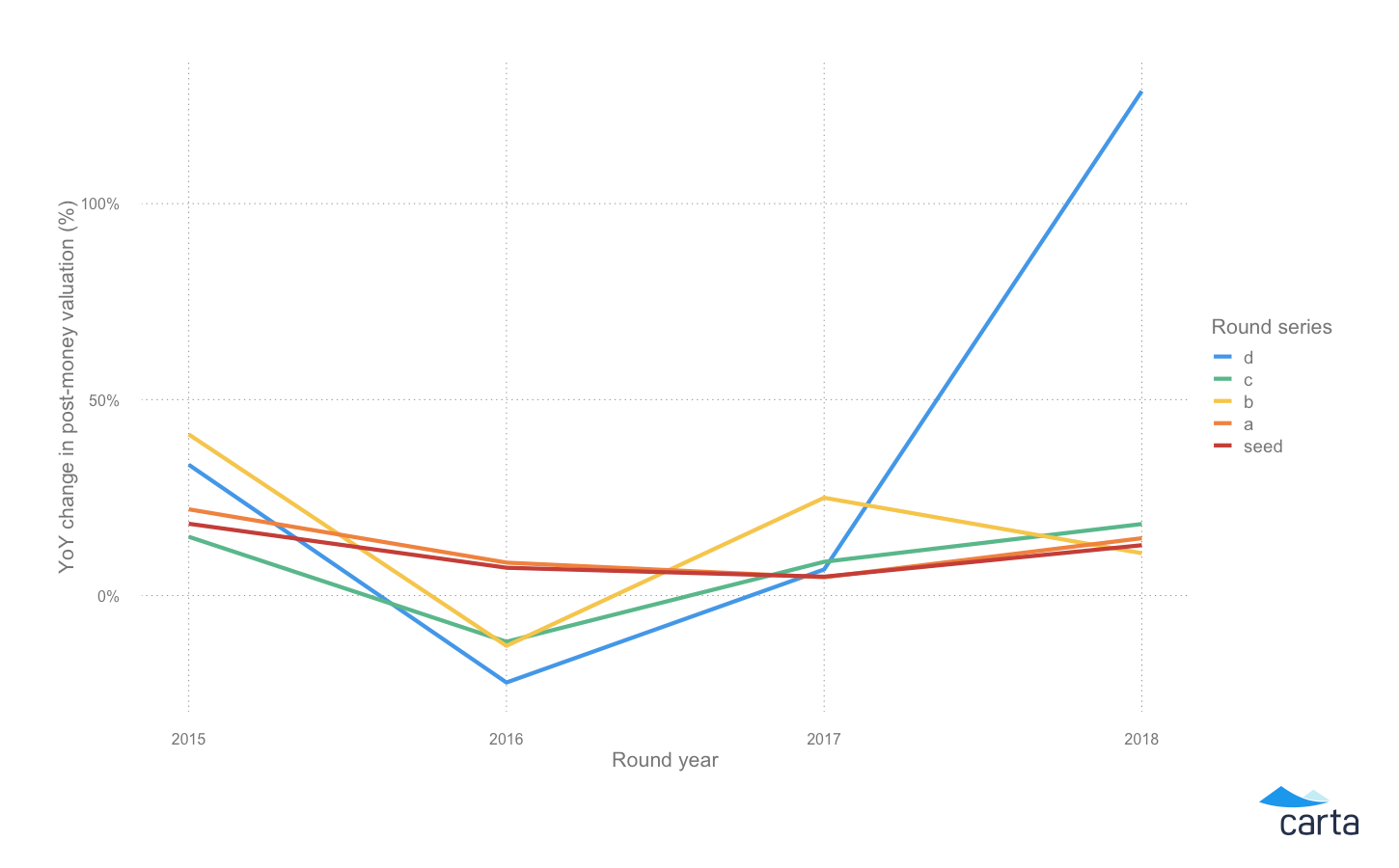

Median post-money valuations increased from 2017 to 2018 for all stages of venture backed companies (specifically from Series Seed to Series D)

-

Series Seed through Series C companies saw 10-20% growth in median post-money valuations

-

In 2018, Series D post-money valuations exploded. Median Series D valuations increased 128% from $183M in 2017 to $420M in 2018

-

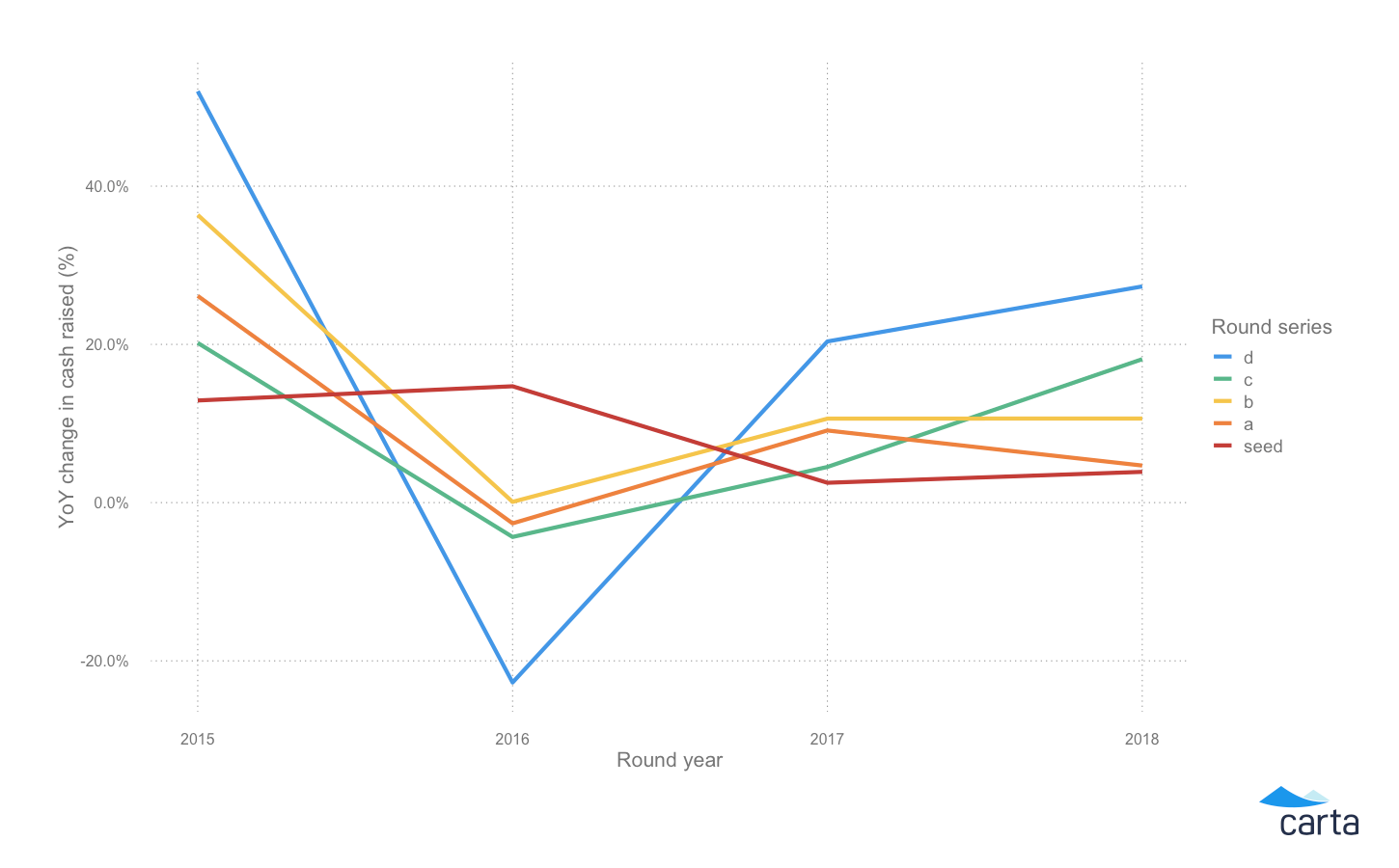

Median cash raised has increased for all Series since 2017

-

For Series Seed through Series B, median cash raised grew between 4-10%

-

For Series C and Series D, median cash raised grew by 18% and 27% respectively in 2017 and 2018

-

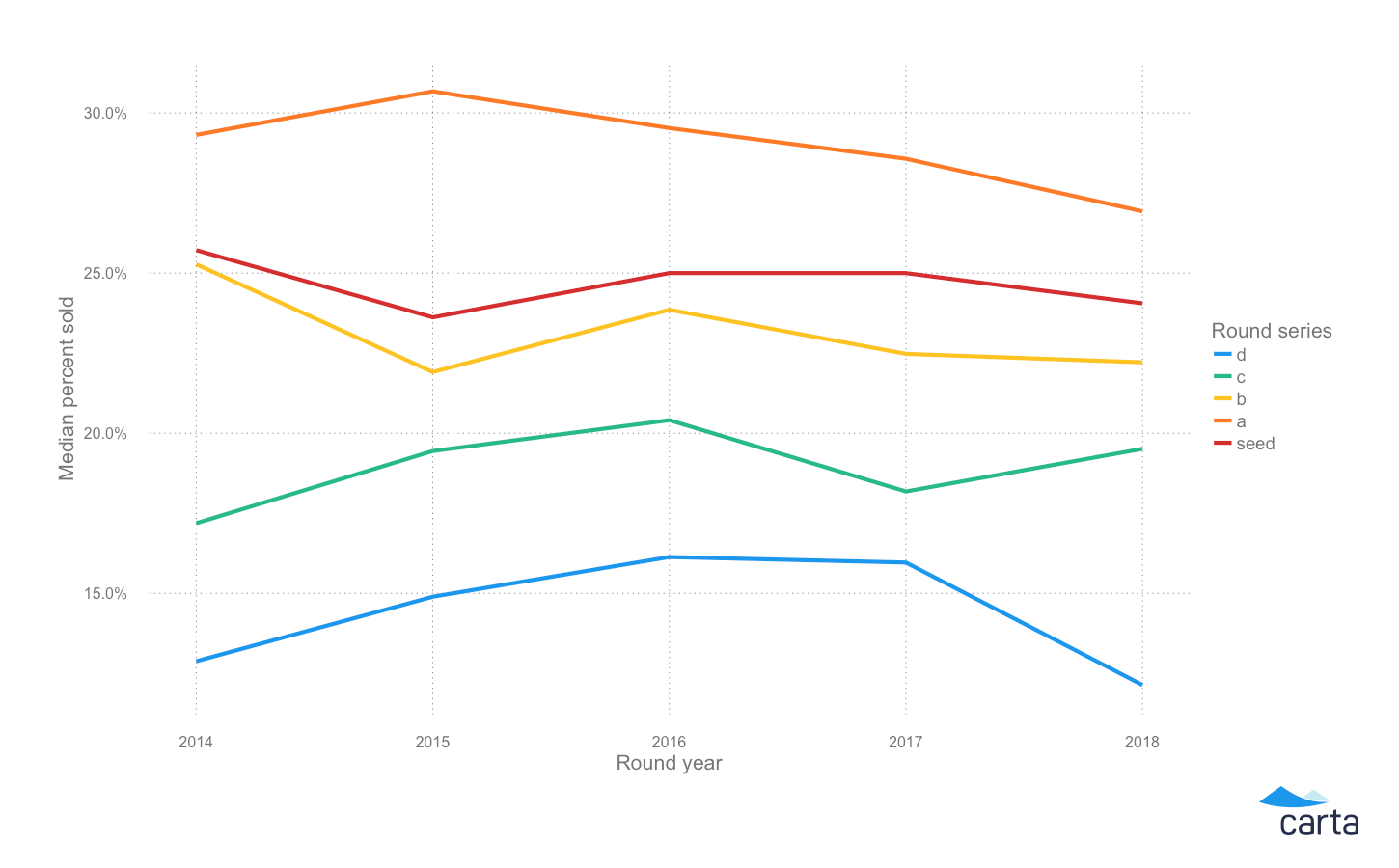

Percent sold has hovered around 25% for Series Seed companies since 2014

-

Series A percent sold has been steadily decreasing from 30% in 2015 to 27% in 2018

-

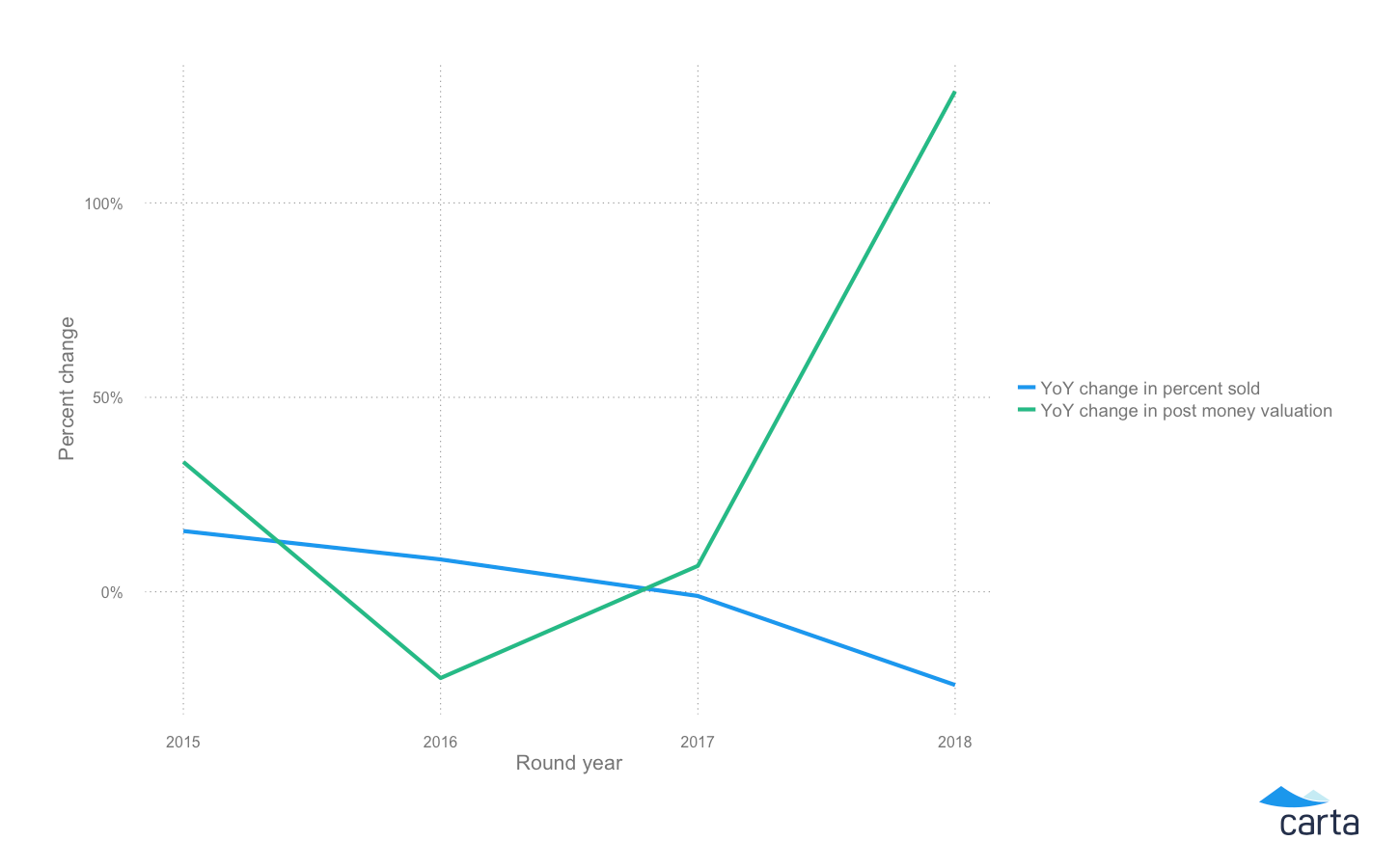

Series D saw a substantial 29% decrease, from 17% to 12% from 2017 to 2018

-

Median cash raised for Series D companies increased significantly from $35.3M to $45M (27%) however this was not as significant as the percent growth in post-money valuation from $183 to $420M (128%)

-

Median percent sold decreased in 2018, while post-money more than doubled for Series D companies

-

Growth in median post-money valuations has outpaced growth in cash raised for all Series except for Series C

When you put all these numbers together, our biggest takeaway is that late stage companies are giving away less of their company for higher valuations than ever before. Meaning, percent sold has gone down, cash raised has moderately increased, and post-money valuations have skyrocketed.

Company age at fundraising round

Given the seeming surplus in venture money available for startups, we hypothesized that companies may be raising earlier than before or closer to the previous round in order to take advantage of the current market.

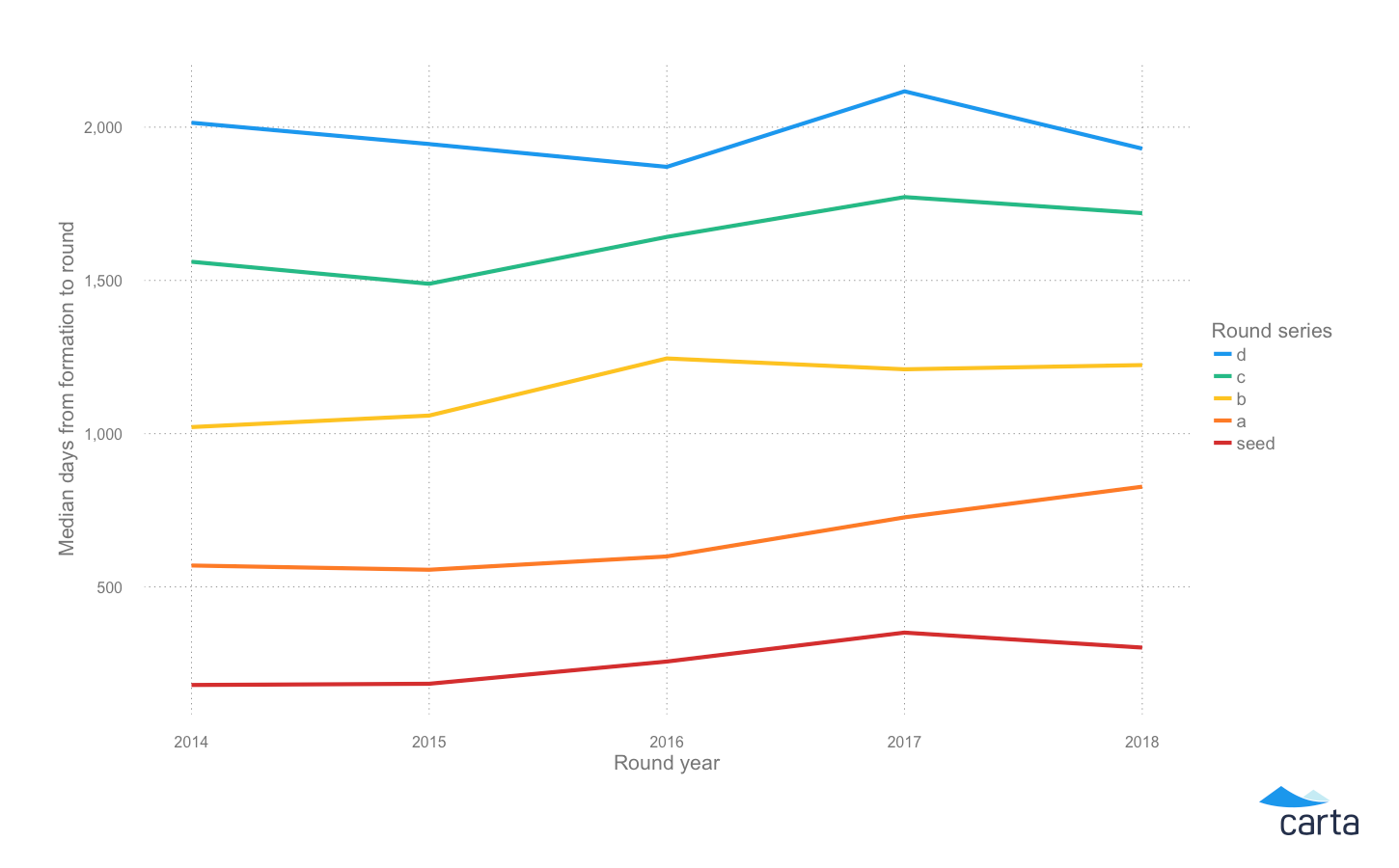

So, we looked at the same set of companies to see if there were any key changes in the timing of each round raised. We used median days since incorporation to determine company age. In other words, we wanted to know if companies are raising each round earlier than before.

Increasing time between Series Seed and Series A

-

Series Seed companies are raising earlier in their lifecycle, while Series A is happening later. This also means that the average time between Series Seed and Series A is greater.

-

Company age at Series A fundraising increased by 14% from 2017 to 2018, while company age at Series Seed decreased by 9%.

-

Median cash raised for Series Seed companies has increased since 2014 from $1.5M to $2.1M in 2018. Perhaps the additional cash has provided a longer runway to build product before a Series A is needed.

-

It’s possible that increased convertible notes and SAFEs between Series Seed and Series A may have an effect as well. We do not currently have data to validate this particular trend.

Late stage companies are raising earlier

-

Median company age at Series D decreased by 14% from 5.8 years in 2017 to 5.3 years in 2018.

-

Contrastingly, company age at Series B and Series C fundraising remained relatively unchanged.

-

We hypothesize that this decrease is an indication of a favorable environment for late stage companies to raise money.

Age at funding also helps tell the story of the changing landscape in fundraising. The way companies approach early stage funding may be in transition, with more time between Seed and A. Later on at Series D, it seems that investors are eager to deploy funds earmarked for late stage investments. Taken together, the relatively mild growth in cash raised compared to valuations, as well as the 6 month decrease in company age at Series D, may indicate that founders’ appetite for capital hasn’t increased as dramatically as that of investors. Founders may be taking advantage of the opportunity to raise capital at huge valuations with relatively low dilution. We hypothesize that supply is greater than demand.

Fundraising round seasonality

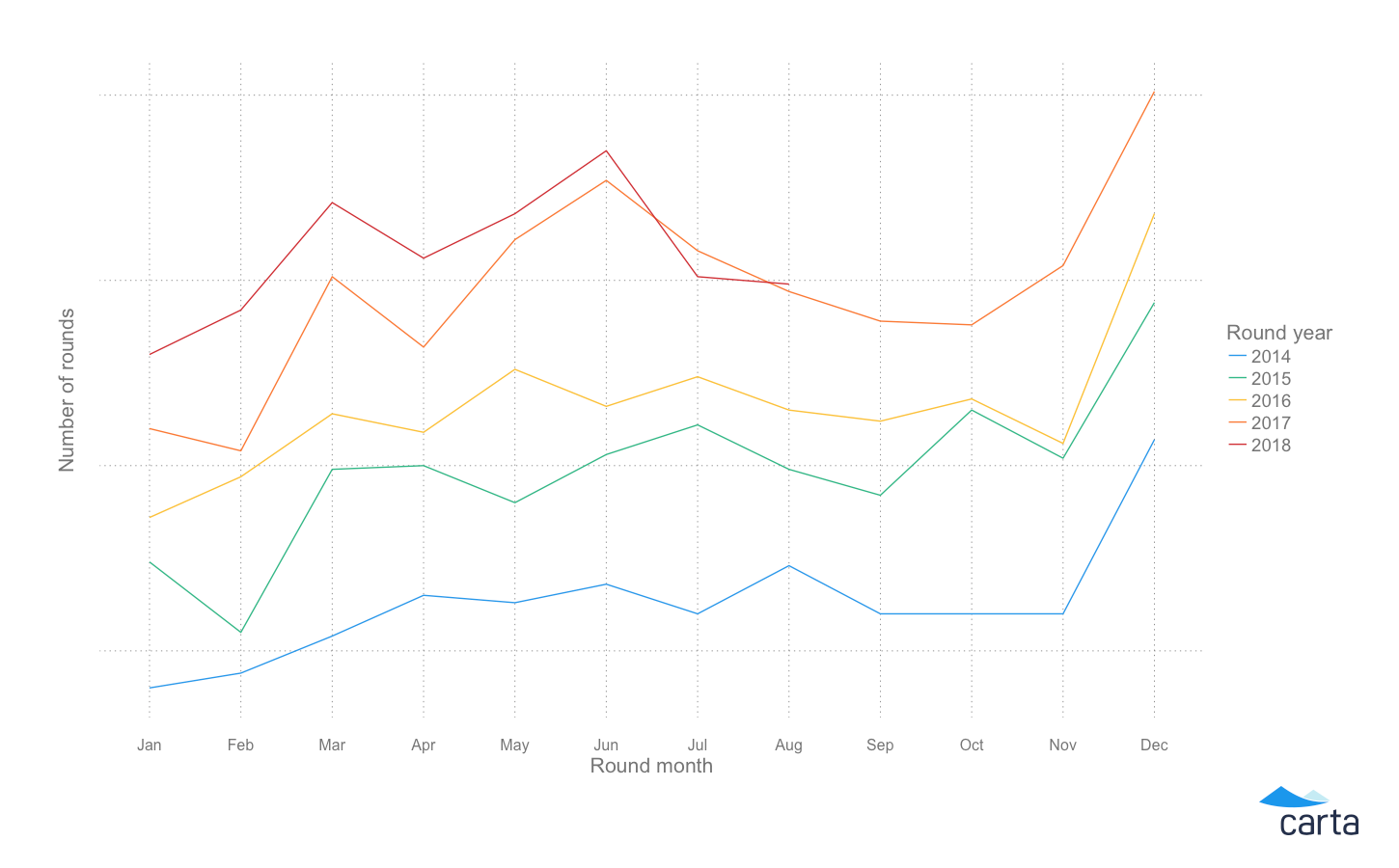

Funding spikes in December

-

There is a clear increase in funding rounds in December, which is likely indicative of increased fundraising occuring in the fall—pitching investors and closing a round takes time.

-

We hypothesize that many term sheets have been signed earlier in the year, but the rounds haven’t actually been closed. The end of year puts a “deadline” on these deals to close.

-

We also associate part of this late year spike with planning efforts for the following year. By December, companies have a clear understanding of where they are going to land at the end of the year in revenue and cash burn, and begin planning for the following year. VC forecasts might indicate that they need more capital to get through the next year.

Still, it’s somewhat surprising to see this end-of-year fundraising spike. One would imagine that strong end-of-year numbers and year-over-year growth would cause companies to go out early in the year and show off their previous year numbers to investors.

Given the trend, we expect to see a rise in fundraising announcements in January, as companies tend to wait to announce December news until then. But then, we expect to see a Q1 dip. This likely won’t be an indicator of a softening of fundraising, especially for late stage companies, but more likely a result of seasonality. Given the amount of capital VCs have for late stage companies, we imagine post-money valuations will stay high at least in early 2019.

Special thanks to Ray Raff for the analysis.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.