What is a private company worth? How do you decide? Stephanie Choo thinks about these questions a lot. Lately, the answers have been getting more complicated.

Choo is a partner at Portage, where she runs the firm’s investment team in North America. Over the past 18 months, she’s watched the most bullish venture market in a generation morph into something much more bearish, with venture-backed valuations plunging across every sector and every stage of the startup lifecycle.

What is a private company worth? How do you decide? It depends on when you ask.

“It’s been very tricky in this world now, where, in my opinion, the last round of valuations are kind of irrelevant,” Choo says, “because the market has corrected so dramatically. How do I value a company that raised a large round in 2021? It’s really hard.”

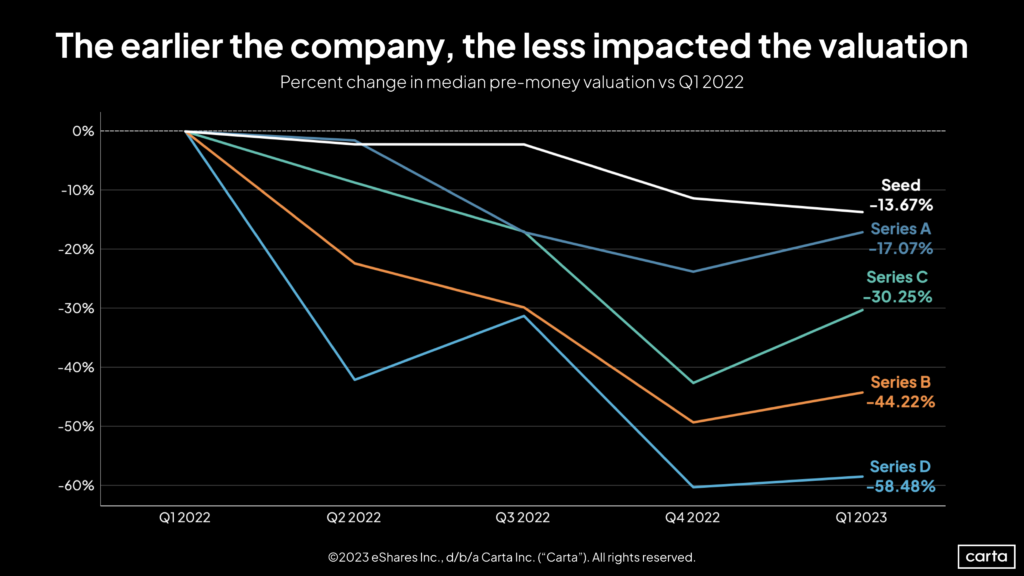

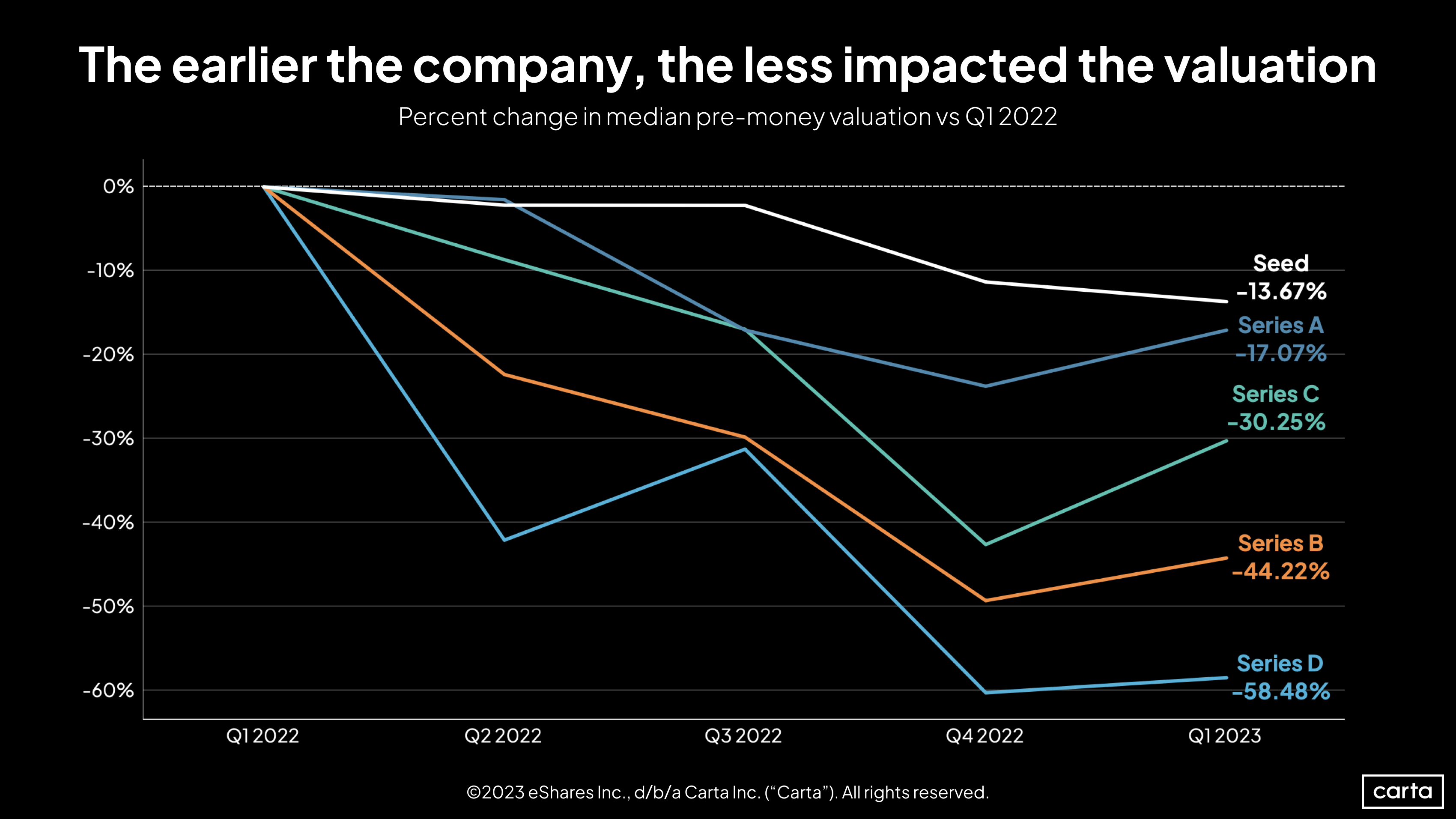

The figures are striking. In Q1 2023, the median Series D valuation on Carta was 58% lower than a year earlier, in Q1 2022. The median Series B was down 44%. Seed valuations were more resilient than other stages, but they’re still down 14%.

Compared just to the prior quarter, valuations trended slightly up in Q1 at every stage from Series A to Series D. Yet that uptick barely made a dent in the longer-term declines.

This startup valuation reset has been linked to rising inflation, rising interest rates, falling valuations in the public market, and other political and economic developments. It’s much more about those macro trends, Choo says, than any major changes in the operations or finances of most startups themselves.

In fact, she’s been struck by how little things have changed internally at many startups that are facing reduced valuations. When it comes to valuing a private company, context is everything—depending on the rest of the market landscape, the same set of figures on a balance sheet might mean very different things.

“Have some of these companies fundamentally changed their outlook in terms of numbers? I don’t really think so,” Choo says.

Alexander Civetta is an associate at Mintz who helps startups negotiate new funding rounds. It’s part of his job to help explain to founders why raising capital in 2023 is so different than in 2021. For the most part, he says, they seem to understand the shift that’s taken place.

“People have always been focused on valuation, and how much money you raise relative to valuation,” Civetta says. “But everyone’s expectations have been lowered on that front, and people are willing to do a little bit more on the margins to be flexible.”

That flexibility comes in different forms, with companies pursuing various paths to mitigate the market’s impact on their valuations.

In recent quarters, there’s been a marked increase in the number of venture-backed companies raising SAFEs and convertible notes as an alternative to a new priced round. These fundraising mechanisms allow companies to bring on new capital without changing their valuations.

Other startups are trying to protect their valuation by giving ground to VCs in other areas of a term sheet. There’s been a recent spike in the percentage of priced venture rounds that include investor-friendly deal terms such as participating preferred shares and cumulative dividends—a sign that the balance of power in negotiations is continuing to shift.

“There is always a give and take,” Civetta says. “There’s just a little bit more give and take now than there was 18 months ago.”

In addition to sinking valuations, Choo points to another reason venture investors might have more leverage these days: The departure from the market of some non-traditional startup investors, such as hedge funds, mutual funds, and corporations.

During 2020 and 2021, when interest rates were low and startup valuations were high, these sorts of investors flooded the VC market with capital, seeking better returns than they could find in other asset classes. Now, with higher interest rates and lower startup valuations, some are moving on to other pastures.

“Investors now have a whole lot of other potential choices to invest their money,” Choo says. “Credit and fixed income all of a sudden look a lot more attractive. Money is no longer free. So there aren’t as many dollars chasing yield as there were in the previous decade.”

Faced with lower valuations, less attractive deal terms, and fewer dollars to go around, a founder might be inclined to sit on the sidelines and wait to raise capital until the market is friendlier. Considering the decline in deal activity that’s occurred in recent quarters, it seems like that’s exactly what many are doing.

But patience brings its own risks. Everyone has a theory about where the market might go from here. Nobody knows for sure.

“Almost every single company that we work with has gotten counsel from investors that you should fill up with as much gas as you can when you’re at the station now,” Civetta says. “Because we don’t know how bad it’s going to get.”

Learn more

-

The 2023 Enterprise Tech 30 list: How does the ET30 universe compare?

-

In late-stage VC valuations, what went up has come down—and then some

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here: