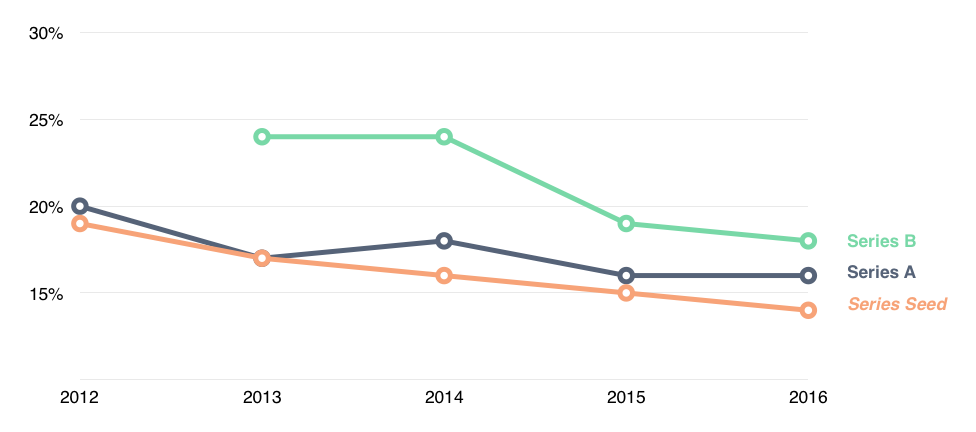

When I arrived in Silicon Valley in 2010, I was told standard employee option pools were 15% of the post-money fully diluted. A couple of years later, I was told the standard was 12%. Now I hear 10%. It feels like employee option pool sizes are decreasing and the Carta data backs this up.

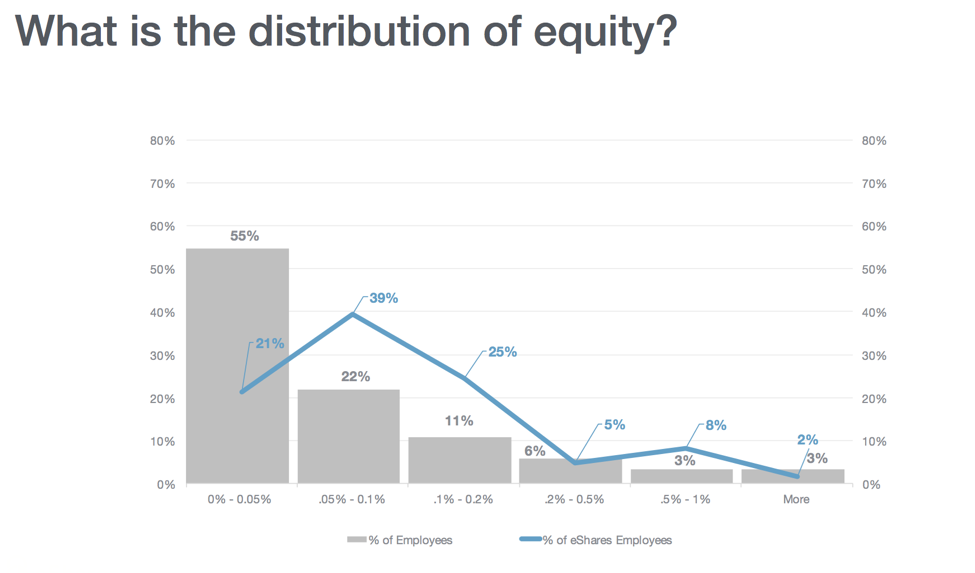

Equity allocation is a zero-sum game between investors and employees. Equity-hungry investors buy equity while equity-hungry employees earn it. Both care deeply about every point of equity but for different reasons.

Investors care about equity because it’s their business model. While CEOs have discretionary authority to spend millions of dollars of operating capital, issuing one option grant worth $0.10 requires Board approval. This is how important equity ownership is in the venture capital business model. Employees care about equity because of scarcity — there’s little to go around so every bit counts.

CEO/Founders tend to be equity-neutral in cap table negotiations. Their ownership stake is set at founding and rarely changes. And the relative size and cost basis of their ownership means small changes in the cap table become rounding errors in their personal economics.

The CEO negotiates term sheets with investors and offer letters with employees. But they are a middleman without a personal stake in the equity allocation decision. Investors and employees mistakenly believe they’re competing with the CEO for equity because that is who they negotiate with. But economically they are competing with each other. This undercurrent is the single most misunderstood driver of tension on the cap table.

Employee ownership is decreasing because these equity decisions are made in board meetings, where investors have a seat and employees don’t.

Appendix A

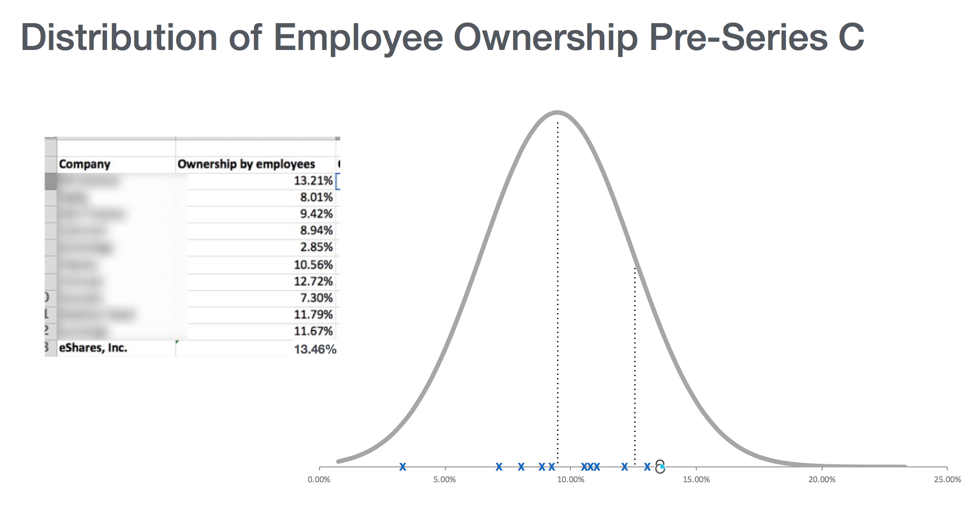

Last October we did an analysis of how Carta employee ownership compared to 10 randomly chosen Series B SAAS or Fintech companies. Below are the high-level results. A great question for employees evaluating startups is to ask how much of the company is already employee owned.