Last fall, we partnered with the investment collective #Angels on a report about the gender gap in equity compensation, or “The Gap Table.” We found that female employees own just 47 cents in equity for every $1 that male employees own.

Our CEO, Henry, leads with a core belief in fairness, and while we worked on The Gap Table he worried that we had relied too much on gut decisions when issuing equity to employees in the past. So my team and I set out to reevaluate the equity we’d issued and build a fairer, more data-driven process.

To get started, I reviewed how companies and investors I admire think about this problem, from Salesforce and my former employer, Google, to Mark Suster. While this process began as a project to remove gender bias from our historical equity distributions, it ended up creating a fairer system for everyone.In the end, we asked for and received a total of 7.25% of fully diluted shares to be added to the employee option pool. Although it’s an ongoing process and we’re still learning, we want to help other companies address their historical equity imbalances too.

Here’s how we did it—and what we learned in the process. For an example of how to do this at your company, download our template.

Download the equity leveling template

How we did it

Defining roles and establishing levels

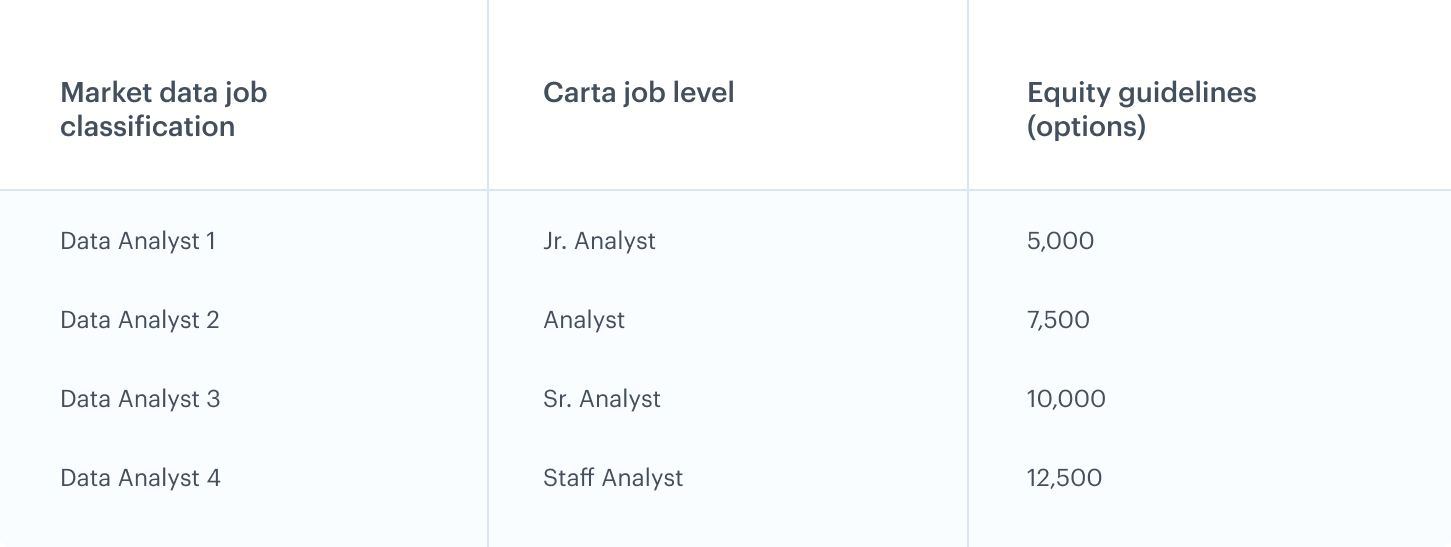

First, we worked to define everyone’s job at Carta and established levels for each job family company-wide. This is an evolving exercise that is still imperfect and a work in progress, but it’s a vital foundational step. Creating a standard set of levels helped us compare each employee’s equity compensation against the appropriate peer group using external market data.

To guide our thinking, we licensed benchmark data from a third party, which wasn’t a perfect fit for our circumstances, but gave us a place to start. This data informed our own standard set of levels for each team at Carta.

Determining a target equity allocation for each level

We decided to target the 50th percentile for equity for each level, including the most senior roles at Carta. The 50th percentile might not be right for every company. For us, this made sense when we factored in our company stage the size of our option pool, and—most importantly—our trajectory and the projected value of our equity.

As a company focused on creating more owners, we’re proud to grant equity to all full-time employees. That said, this benchmark ensures our option pool has enough shares for yet-to-be-hired employees and to reward our top performers with refresh grants. Startups often have trouble striking this balance—the 50th percentile is our pragmatic solution. The most important thing here is to select a percentile and apply it consistently.

Calibrating employees to each level, and against the market

Next, we worked with our leaders to calibrate each employee to the levels we established. Then we evaluated our levels against the external market.

This step required more effort than one might expect. Some types of jobs (such as those in engineering) track closely to market trends, but others—for example, the fund accounting team at Carta—take on more responsibility and volume than they would in a similar job elsewhere. We took these factors into account when assigning levels.

Evaluating current equity compensation against new targets

Comparing equity is more challenging than comparing base salaries because you have to account for the company’s changing valuation over time. Five shares granted during a company’s Series A reflect more value than five shares granted during its Series C.

Extending fix-it grants to employees who need them

At this point, we confirmed Henry’s suspicions that we didn’t consistently distribute equity in a data-driven way in the past. We had gotten this right for most, but not all, of our employees. So we gave fix-it grants to the employees who were below the 50th percentile in equity compensation. 40% of the women at Carta received an equity fix, compared to 32% of the men; overall, this affected about 35% of the company. While we can’t go back and change how we initially granted equity, we can work to close the gender gap in equity-based compensation now and in the future.

We didn’t take any shares away from employees as part of this process. When we issue refresh grants in the future, we will take into account whether employees are already above the 50th percentile for their level.

Here’s what employee equity distribution at Carta looked like before and after the leveling:

Communicating findings and planning next steps

Our CEO Henry Ward announced the findings in an all-hands presentation. He explained how we’d distribute fix-it grants and laid out our plan for the future. The team’s response was overwhelmingly positive.

Now that we have consistent levels and benchmarks across the team, we’re focused on ongoing maintenance for top performers, future hires, and internal promotions. We will reevaluate everyone’s compensation regularly—accounting for gender bias, negotiations, and other factors—to make sure we have internal parity among peers.

What we learned

Here are the biggest things we learned during this process:

-

Equity leveling is easier earlier.In an ideal world, startups would use consistent levels and benchmarks from the very first grants they issue. But wherever you are in your company lifecycle, start now. It’ll never get easier.

-

Get your board on board. Adjusting equity requires that your board agrees to take some short-term dilution. Show them that fair compensation is the right thing to do, and the smart thing to do in the long run—employees who are paid fairly are more likely to put in extra effort and improve their job performance.

-

Review regularly.When company valuations change, so should your approach to equity compensation. We spoke about our equity in percentages from seed stage to Series B, then transitioned to talking about our equity in dollars. It makes more sense for later stage companies to speak in monetary amounts as valuations get larger, because the value of these options may be de-risked.

-

It was worth it. Since we announced the new fix-it grants, we’ve seen signs that employees appreciate it even if they didn’t personally receive grants:

-

Our rate of regrettable attrition has been extremely low

-

Our employee Net Promoter Score (eNPS) historically hovered around the teens. After we announced the new stock grants, it shot up to 25 (scores between 10 and 50 are considered good).

-

Our rate of regrettable attrition has been extremely low

-

Our employee Net Promoter Score (eNPS) historically hovered around the teens. After we announced the new stock grants, it shot up to 25 (scores between 10 and 50 are considered good).

-

Compensation is only part of the equation when it comes to removing bias at work, and this is an ongoing and evolving process. After all, the value of an individual option changes over time, requiring us to continually reevaluate if our system is fair. But we believe that taking this first step will have a lasting impact for our employees—and we are proud to do our part to set a new tone for how equity is issued in tech.

How you can do it

We hope companies will use this information to run their own equity analysis and adjustment. Download our template of a leveling example to help.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.This post contains links to articles or other information that may be contained on third-party websites. The inclusion of any hyperlink is not and does not imply any endorsement, approval, investigation, or verification by Carta, and Carta does not endorse or accept responsibility for the content, or the use, of such third-party websites. Carta assumes no liability for any inaccuracies, errors or omissions in or from any data or other information provided on such third-party websites.