Carta has gone public—to clarify, we’ve entered the public markets with our latest product.

Over the past few years, we’ve transformed how private companies manage equity, moving venture-backed startups from paper certificates and inaccurate spreadsheets to Carta’s platform. We’ve fixed a lot of cap tables, streamlined the 409A process, helped companies stay compliant, and simplified tender offers and financings—and we still have a lot more to do for private companies. In addition, we plan to transform how public companies manage equity and ownership.

While equity management for public markets is a more crowded and mature space than when we entered private markets, we still think there’s a lot of work to be done. We believe we can bring something new—and better for companies—to the table. To get started, we’re offering both equity plan administration software and transfer agent services in one place.

From cap tables to transfer agents and equity plan administration

When a company goes public their cap table splits in half. Non-employee stock, also known as the stock ledger, goes to a transfer agent. The other half of the cap table, the employee stock, goes to an equity plan administrator. But all stock comes from the same pool, regardless of who owns it.

So, why, if stock comes from the same pool, do you need two vendors? It’s costly, time consuming, and inefficient; it doesn’t make sense. We’ve fixed this by combining transfer agent services and equity plan administration, and we’re passing the cost savings onto customers by making our basic transfer agent services free.

Grow with Carta

If you’re about to go public or you’re already public, don’t use two tools. If you’re already a Carta customer, you can continue to use Carta as you grow, without needing to migrate your data. It’s a lot easier than switching providers.

Over the past few months, 60+ (very happy) public company customers have joined the Carta platform. We’re now ready to bring more companies onto Carta.

Features

Transfer agent automation

As a publicly-traded company, you need an SEC-registered transfer agent. Our offering includes annual meeting support, proxy services (including e-Proxy/Notice & Access), and secure online 24/7 access to stockholder information and reports.

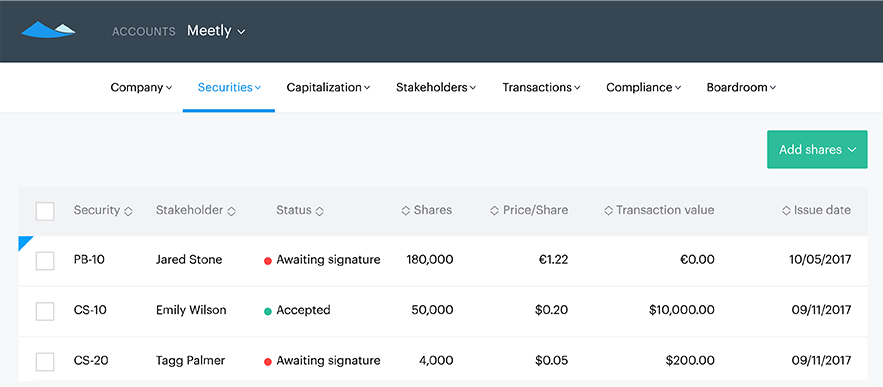

Equity plan administration software

Carta was built to support every type of equity award and plan type. We offer products and support for traditional stock option plans, restricted stock awards (RSA), restricted stock units (RSU), 10b5-1 trading plans, and more.

The Carta platform was designed with participants in mind. Employees and shareholders can easily log in, enroll in employee stock purchase plans (ESPP), and execute trades in minutes.

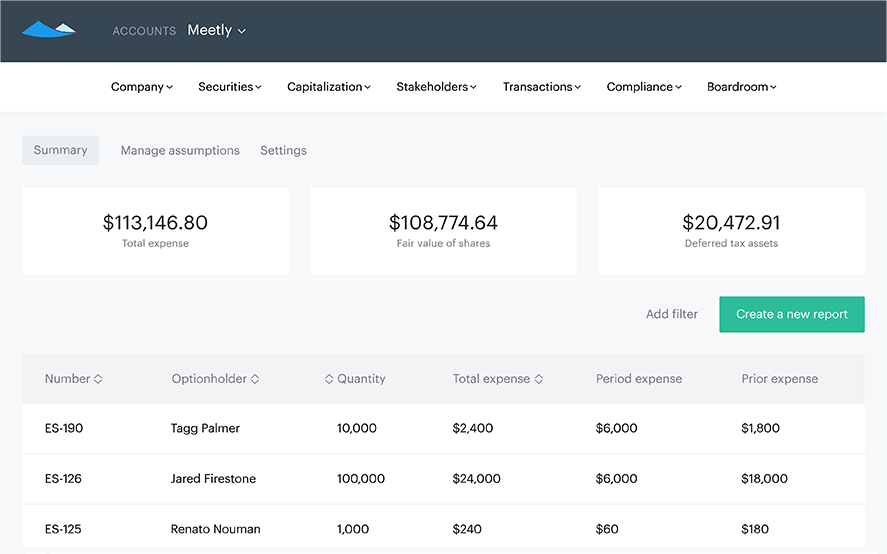

Reporting

Because Carta integrates equity plan administration and transfer agent services in one platform, you can generate a wide range of accounting and equity reports in real-time. This includes ASC 718 expense accounting, financial footnote disclosures, earnings per share, and custom equity plan reporting.

Managing equity can be time consuming, complicated, and expensive. At Carta, we hope to simplify the process and change how equity management works. We’re looking forward to continuing to work with some of our most successful private companies as they move onto their next chapters as public companies. We also look forward to working with new companies who are already public. We hope you’ll be among the first 100 customers to join us.