With 30,000 companies relying on Carta to transact and value their equity every day, we often hear directly from our customers who need to know how to help their employees make better tax decisions.

Taxes on equity compensation like ISOs, NSOs, and RSUs are complicated, and every employee of all 30,000 of those companies has a unique financial situation, tax status, and equity grant. Online education is a great entry point to start learning, but employees have nowhere to go with specific questions and actionable advice. Making the right decisions can have a real impact on their financial future. Making the wrong decisions can lead to extra—and often unexpected—tax obligations.

This information gap is hard on employees and hard on companies.

-

Employees make significant financial decisions based on general information that may not pertain to their situations.

-

Employees often don’t think about tax implications until there’s a liquidity event, which can lead to a larger tax bill.

-

Founders and CFOs don’t have the resources to help their employees create effective tax strategies—or even to triage all of their questions—as companies grow.

Today, we’re introducing Equity Advisory for employee equity. Now, any Carta Cap Table customer can provide their team with the personalized tax advice they need. We help your employees understand, value, and make important financial decisions around their equity and its taxation— saving you time and effort.

Expert tax advice for all employees

Equity grant details pulled straight from the cap table

Equity Advisory is directly integrated with your cap table. Our Equity Tax Advisors go into every session understanding each employee’s exact grant, strike price, and vesting status—along with accurate information about your company’s cap table and latest 409A valuation. This connection lets Carta model specific potential tax scenarios. When employees talk to an Equity Tax Advisor, they get tailored tax advice—with less time spent gathering financial documents beforehand.

A team with equity experience

Taxes on equity can be complex. Deep professional understanding of current tax law and how it can apply to a number of different financial situations is key. That’s why Carta’s Equity Tax Advisors have proven experience in accounting as certified public accountants, enrolled agents, or holders of juris doctor degrees.

But tax advice isn’t helpful if it can’t be understood. Carta’s team has provided tax advice for more than 1,000 individual sessions with employees so far—helping them understand the tax impacts of exercising and selling their equity at different moments and walking them through the specifics of tax treatments like capital gains and the alternative minimum tax (AMT). Those sessions have a near-perfect 4.9 customer satisfaction score.

Tax advice when employees need it

Because it’s integrated with your cap table, there’s no setup required if you’re a Carta customer. Once you’ve signed up, your employees will automatically be able to book time with an Equity Tax Advisor—right from their existing Carta account. The team will also check in with you to help you tailor your tax education program, if you like.

Equity Advisory has two main components:

Companywide education

Twice a year, your Equity Tax Advisors will host webinars that walk your employees through an introduction to equity and the fundamental tax implications of your company’s particular plan. Employees will walk out with a clear understanding of the basics of equity and the need to make thoughtful tax decisions.

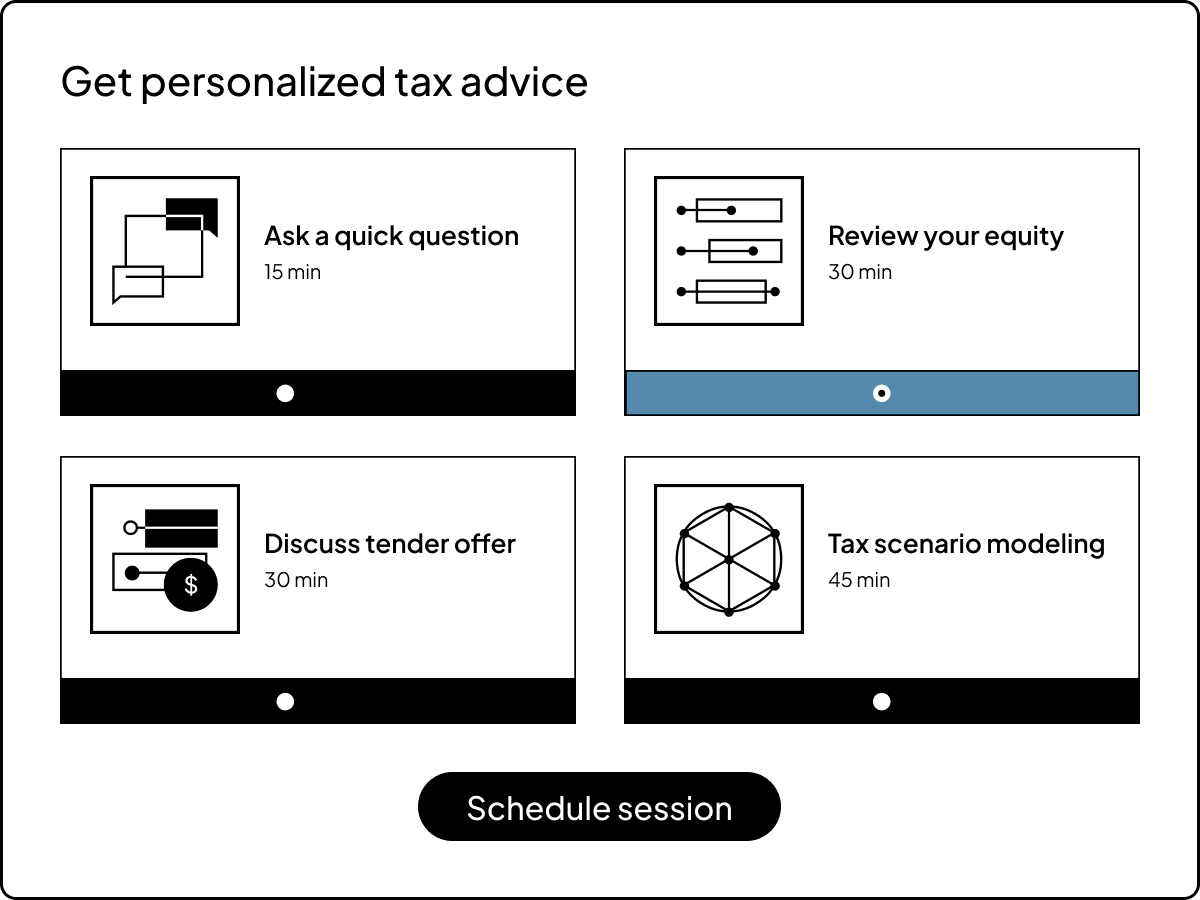

Unlimited, confidential 1:1 sessions

We provide personalized equity compensation tax strategies for each employee. Employees can choose from four different types of sessions with a dedicated Equity Tax Advisor—as many as they need throughout the year. We reach out to employees before events like vesting milestones so they have time to take action.

We have all the equity information we need to start giving guidance from day one, right from the cap table. If an employee wants to dive deeper, uploading personal financial documents is also fast and easy.

Carta Equity Advisory helps employees make informed decisions about their equity and taxes—powered by Carta’s cap table management software. Learn how you can help educate your team.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. ©2022 eShares Inc., d/b/a Carta Inc. (“Carta”). All rights reserved. Reproduction prohibited.