Streamline how you manage equity

Trusted by over 40,000 private companies and counting

We’re changing how equity is managed

Managing equity can be time consuming, complicated, and expensive. At Carta, we simplify the process.

Understand your most critical tax considerations and manage IRS compliance requirements for you and your employees with easy-to-generate Form 3921 and 83(b) documents, and Rule 701 disclosures.

Carta gives you a better understanding of how fundraising will impact dilution and payouts. Create round-modeling worksheets, pro-forma cap tables, and detailed waterfall payouts right in our platform.

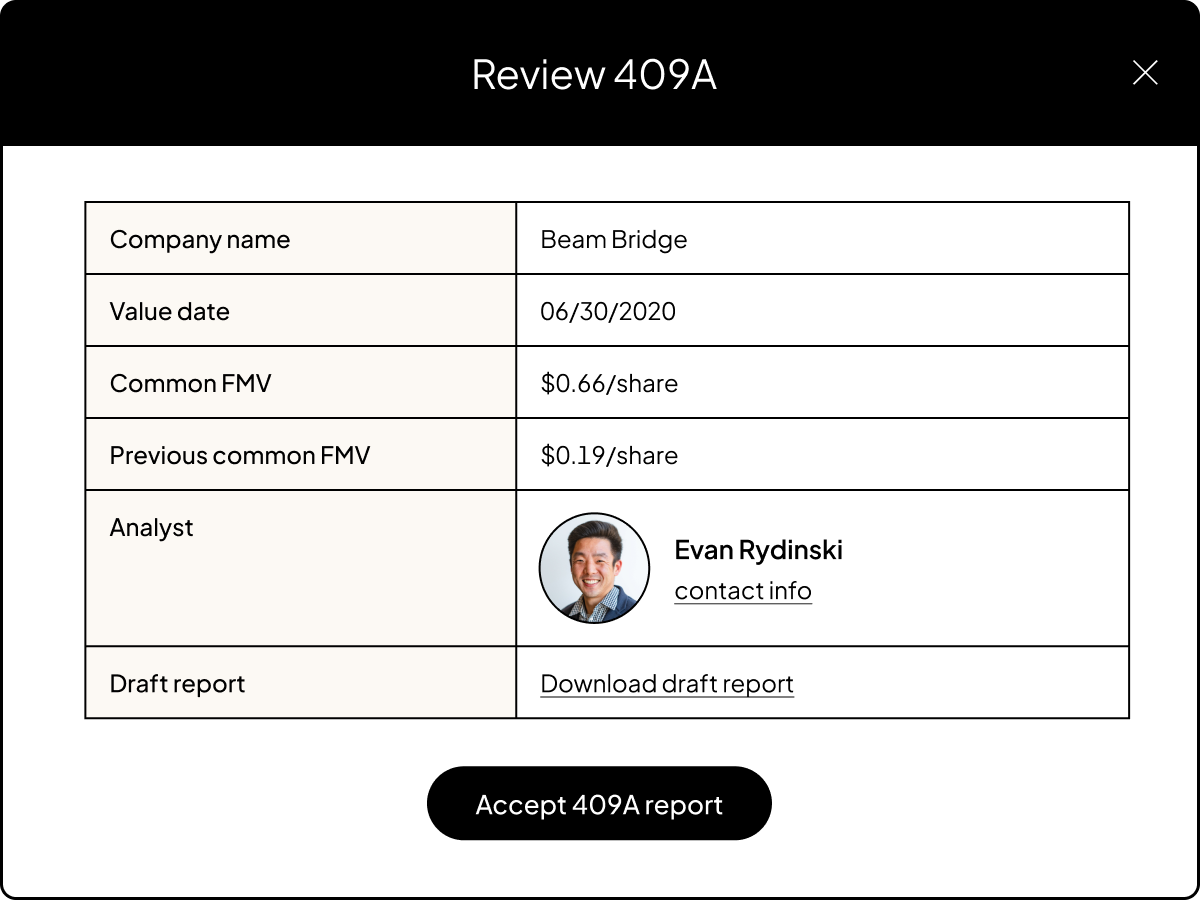

80% of VC-backed companies rely on Carta for audit-ready 409A valuations. Our experts ensure the nuances of your business are accounted for and leverage our proprietary software to deliver fast, cost-effective, accurate 409As.

See how Immunomedics manages their equity through key milestones on Carta.

The road to IPO

Hear from industry experts from Carta, TriNet, Moss Adams, and FLG Partners as they discuss best practices for companies considering an IPO.