Simplify ownership and equity management with Carta

Manage your cap table, issue securities, get fundraising & compensation data, raise via SAFEs, get 409A valuations & stay compliant with Carta.

If you are a company with up to 25 security holders and less than $1M raised, get access to Carta’s free plan Launch. If you don’t qualify for Carta Launch, talk to us about receiving a discount for a paid plan.

Trusted by more than 40,000 companies

A plan for every company

We offer competitive pricing based on stakeholder count and plan. If you have any questions, please contact partners@carta.com

- Cap table management

- SAFE and Priced Modeling

- Fundraising benchmarks

- Everything in Launch

- White glove onboarding

- Premier support

- Everything in Build

- 409A valuations

- 83(b) electronic filing

- Everything in Grow

- GAAP Financial Reporting (ASC-718)

- IFRS Financial Reporting

Want help deciding? Call us at: 1-833-403-5468

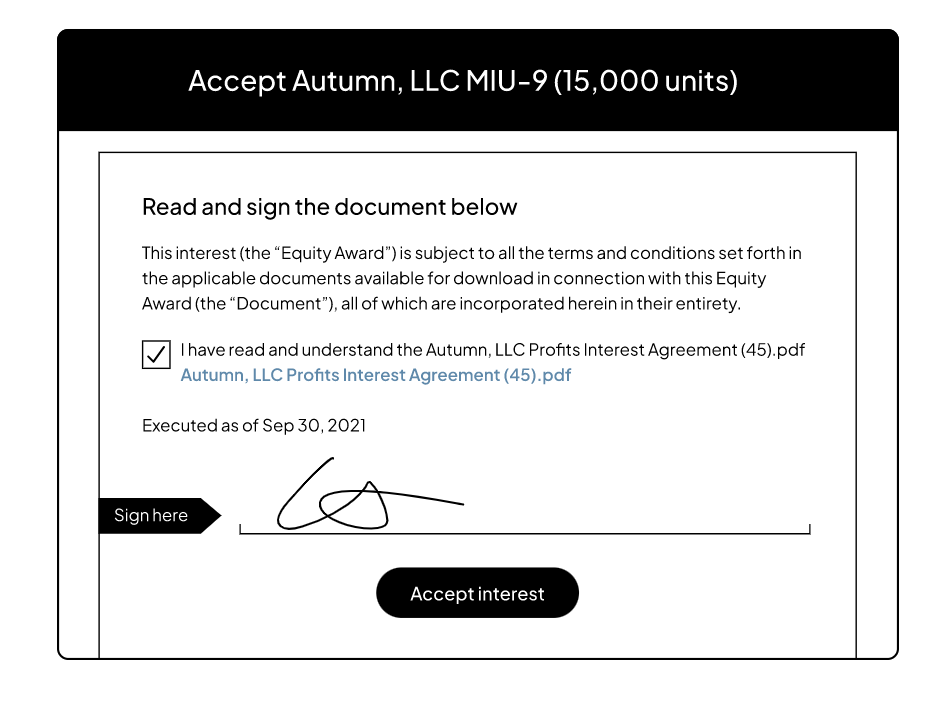

Issue interests, receive valuations, tackle distributions, and centralize document management with a platform purpose-built to support diverse ownership structures.

Get started with Carta

When you standardize on Carta, you’ll have a single source of truth for equity management. You can issue, approve, and accept option grants, keep track of cap tables, and stay compliant.