Offering employees equity as part of their compensation helps them share in your company’s successes and incentivizes them to build great things. But if your employees don’t understand how stock options work or how they’re taxed, they may end up making hasty decisions or miss out on opportunities to grow their wealth, which can lead to employees feeling undervalued and choosing to leave the company.

In our first annual Employee Stock Options Report, we looked at Carta’s data from more than 1.5 million U.S.-based employee stakeholders who have been issued equity via the Carta platform and conducted a survey of employees with grants on Carta to try to answer two main questions.

First, how employees are exercising their options: Who is choosing to exercise, when are they doing so, and what does it cost them? Second, why employees are exercising stock options: How confident are employees at making decisions around their equity, and how much do they expect their company to support them?

Key insights:

-

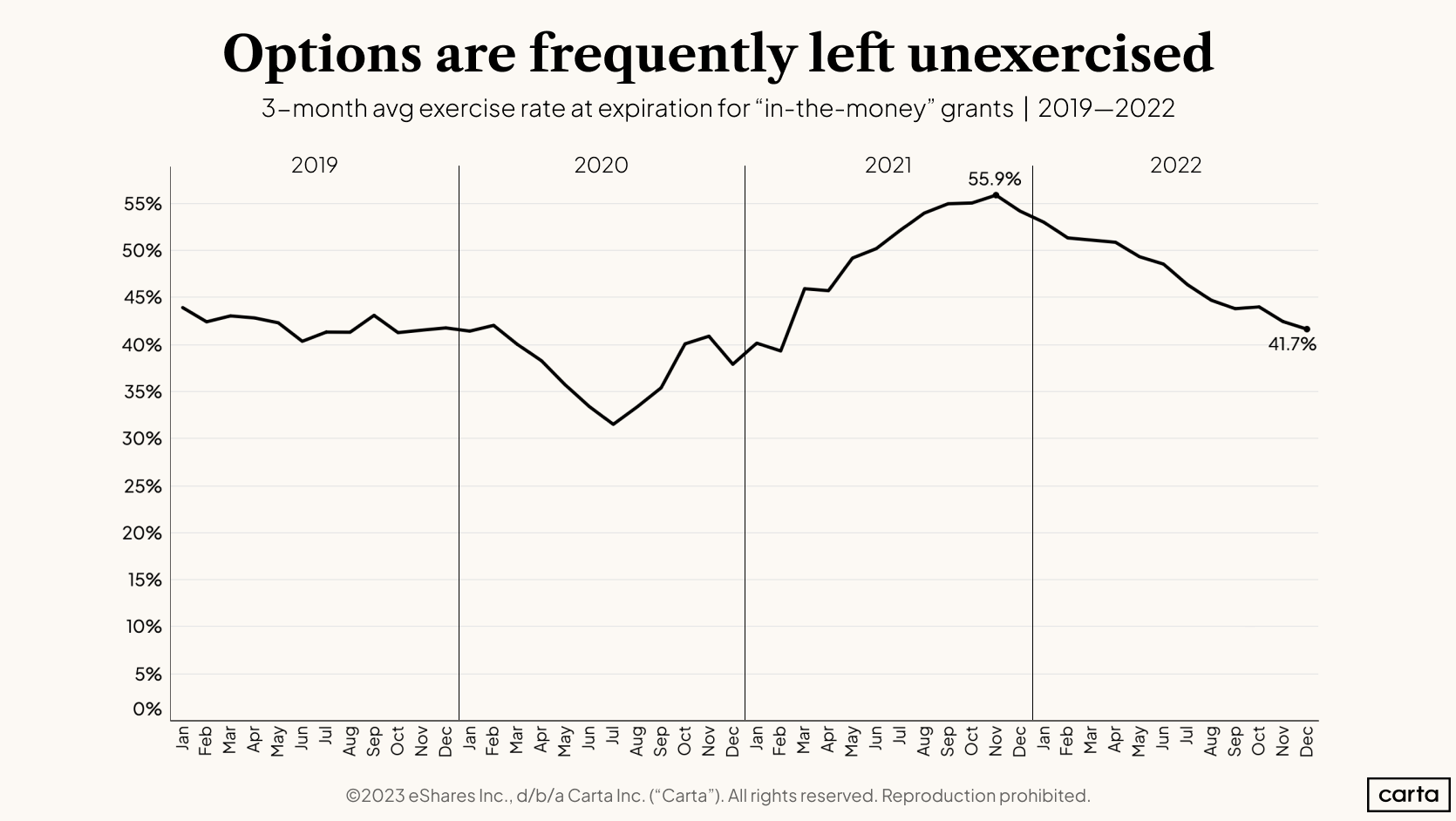

Employees are leaving money on the table.Nearly half of in-the-money options that expired in 2022 were left unexercised.

-

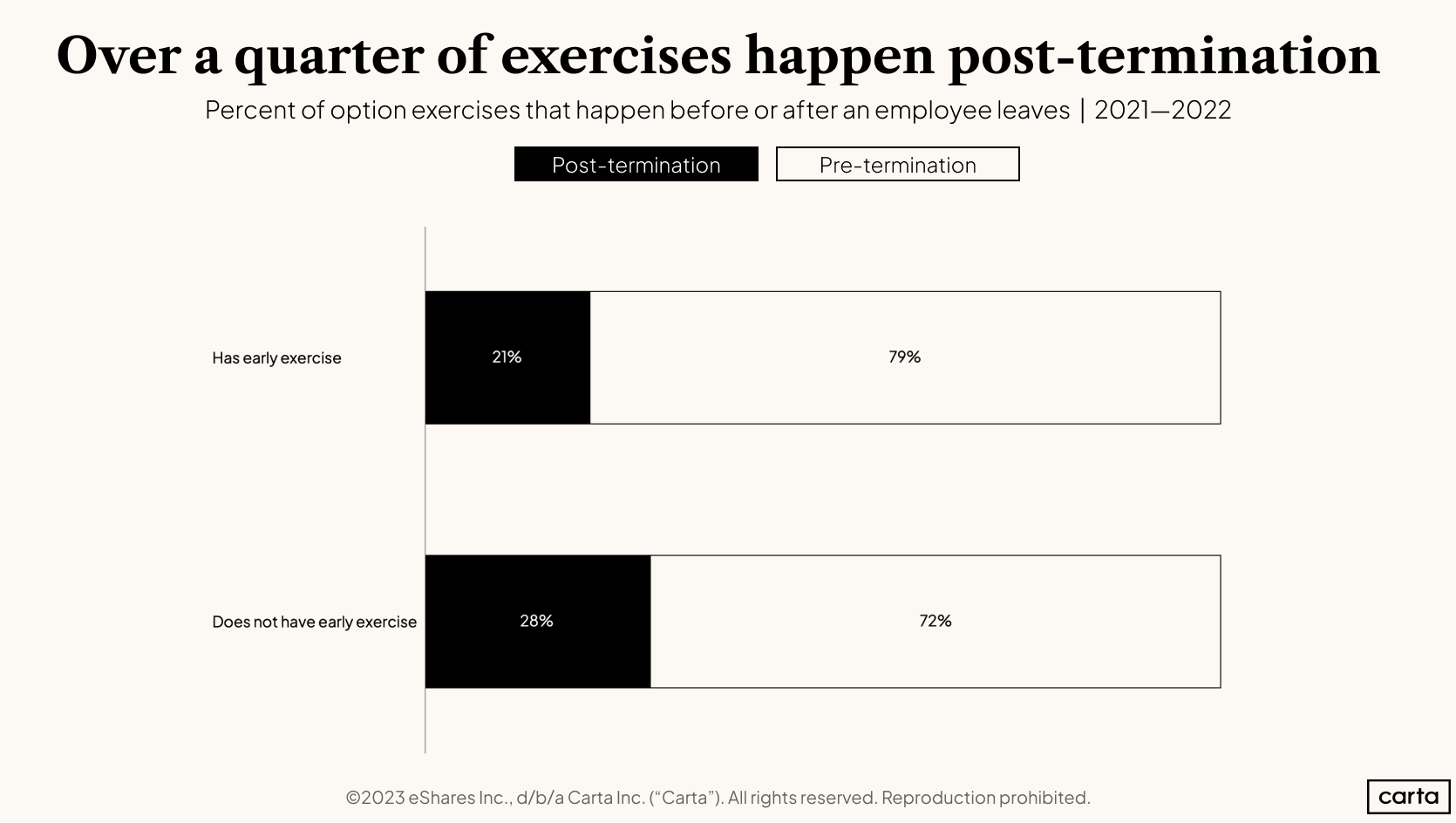

Employees delay exercising their options.More than a quarter of employees wait until they leave their company to exercise their options.

-

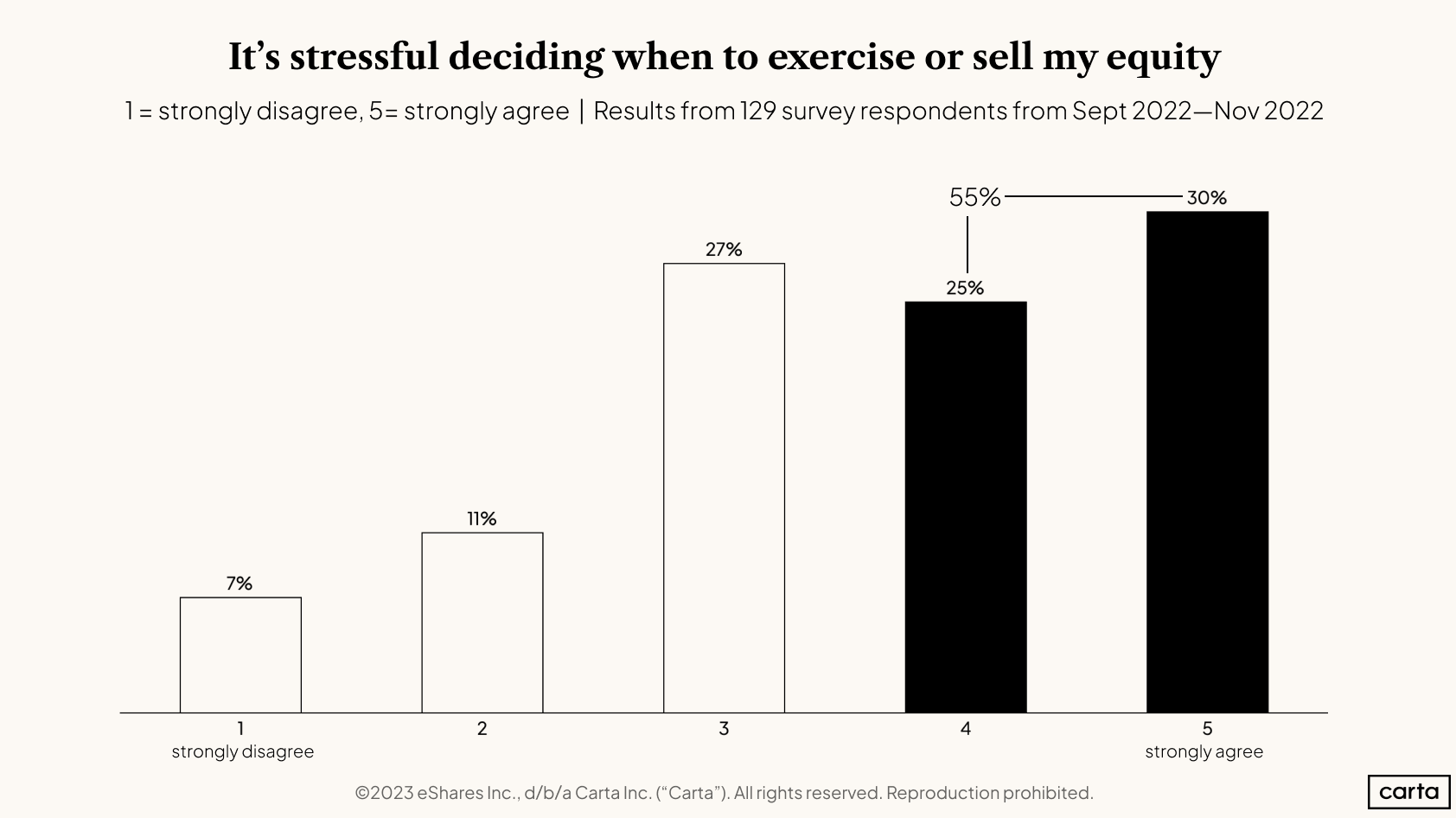

Employees don’t feel confident making decisions about their equity.More than half said equity decisions are stressful.

-

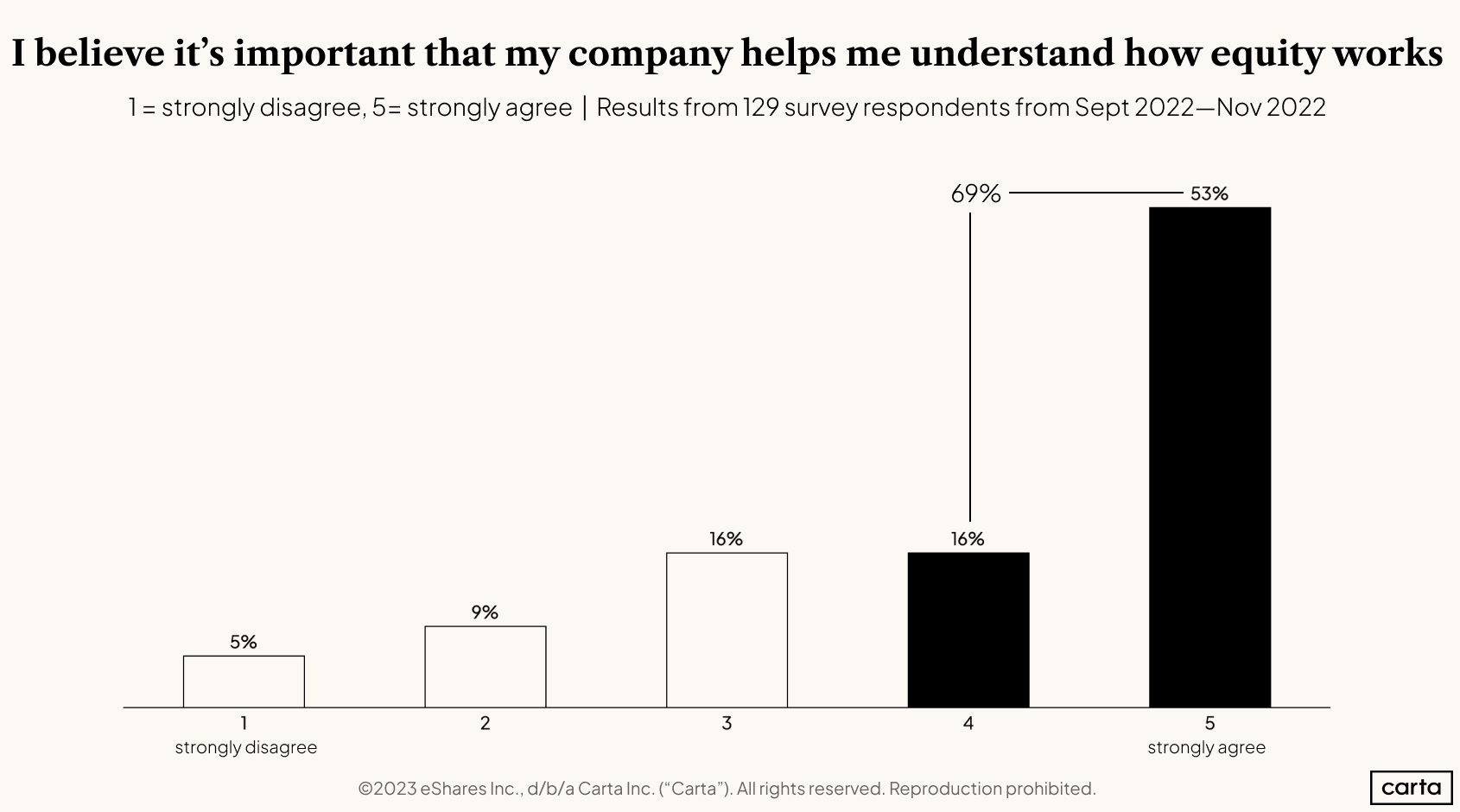

Employees want more equity education at work.More than two-thirds think their company should help them understand how their equity works.

Download Carta’s Equity 101 deck

To help your employees better understand their equity, download our Equity 101 presentation deck with speaker notes.

Employees are leaving money on the table

46.1% of in-the-money options—that is, whose current 409A fair market value was higher than the strike price—remained unexercised when they expired in 2022.

While there are many valid reasons employees may choose not to exercise—like not believing in the success of the company or having other plans for their money—it’s also true that some employees don’t understand their stock options. In our recent survey of employees with equity on Carta, 13% of employees said they didn’t exercise because they were afraid of making a mistake or thought they already owned them.

When employees exercise

Over a quarter of exercises happen after someone leaves their company. 28% of options that don’t qualify for early exercise are exercised during the company’s post-termination exercise period (PTEP).

85% of grants have a 90-day PTEP. If employees don’t think about exercising their options until they depart their company, they’re forced to make a decision in a short amount of time. While some employees may have the cash to exercise their options, some may be forced to leave money on the table if they didn’t plan ahead.

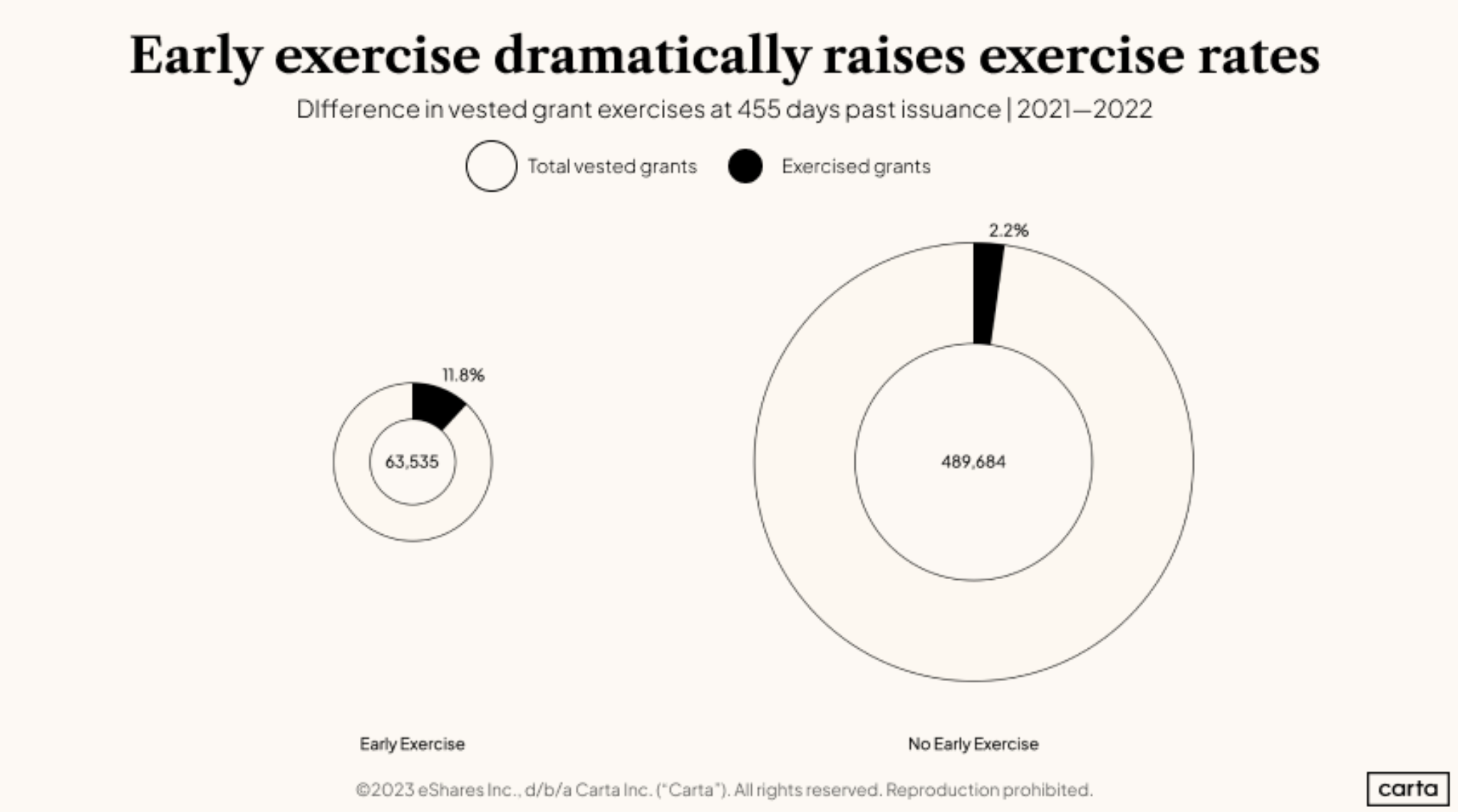

Early exercise

Some companies allow employees to exercise their options before they vest (“ early exercise”). If a company allows this, employees can exercise options as soon as they get their option grant, but the early exercised shares will continue to vest according to the original schedule on the grant. Early exercising can allow employees to save on taxes because they can exercise their options while the spread between their strike price and the fair market value is zero or very low.

Employees who have the choice to early exercise have five times higher exercise rates at the 1-year cliff than employees who don’t. Just 2.2% of non-early exercise option grants that vested have at least some portion of the grant exercised after 14.5 months vs. 11.8% of early exercise options.

Similarly, employees with the choice to exercise early, exercise at higher rates while still employed (79%) instead of waiting to exercise during the PTEP, compared with employees who don’t have that option (72%).

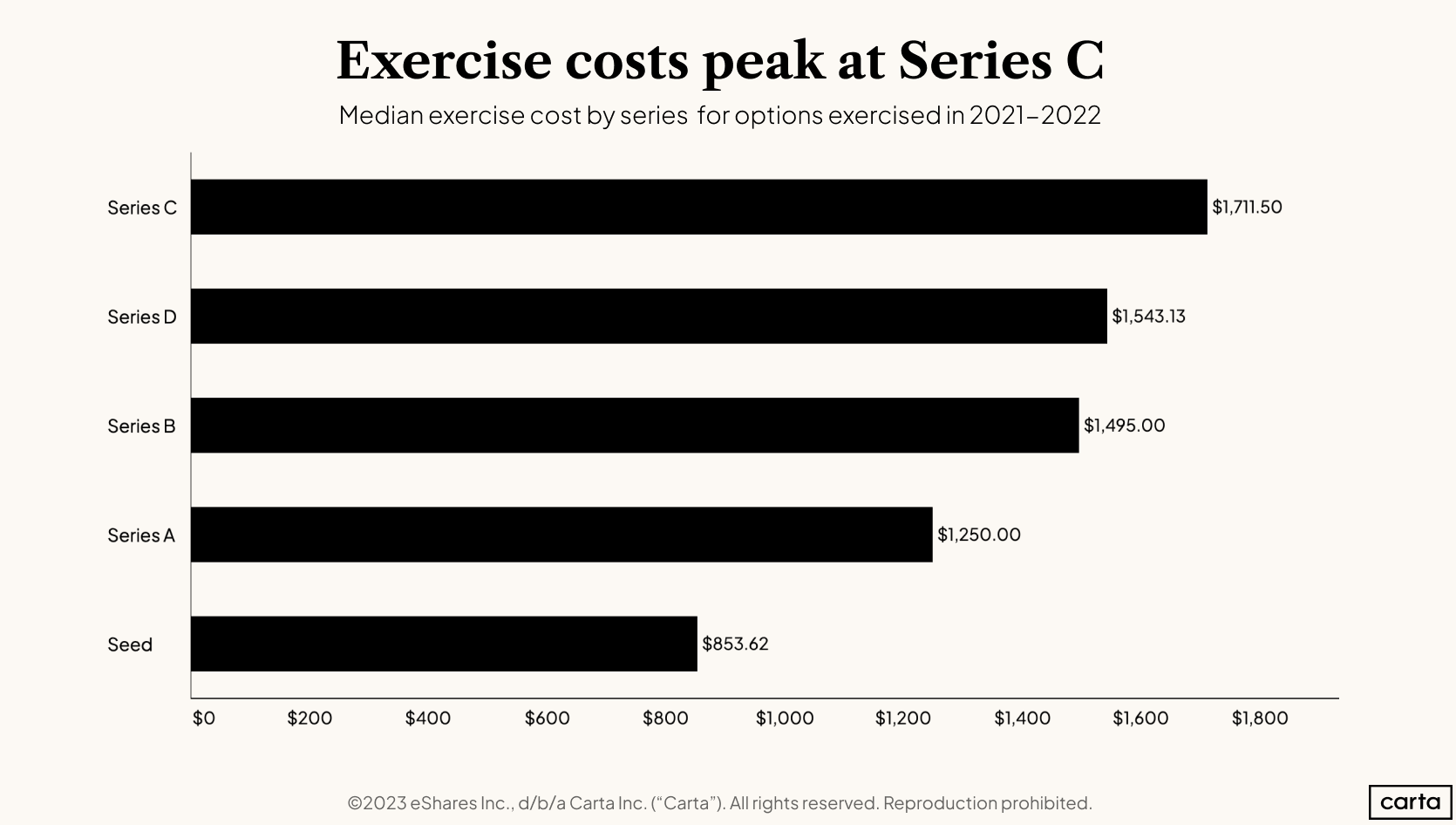

Cost to exercise

The cost to exercise, calculated by the strike price multiplied by the number of options exercised, increases every round from seed until Series C and then begins to decline.

Who is exercising

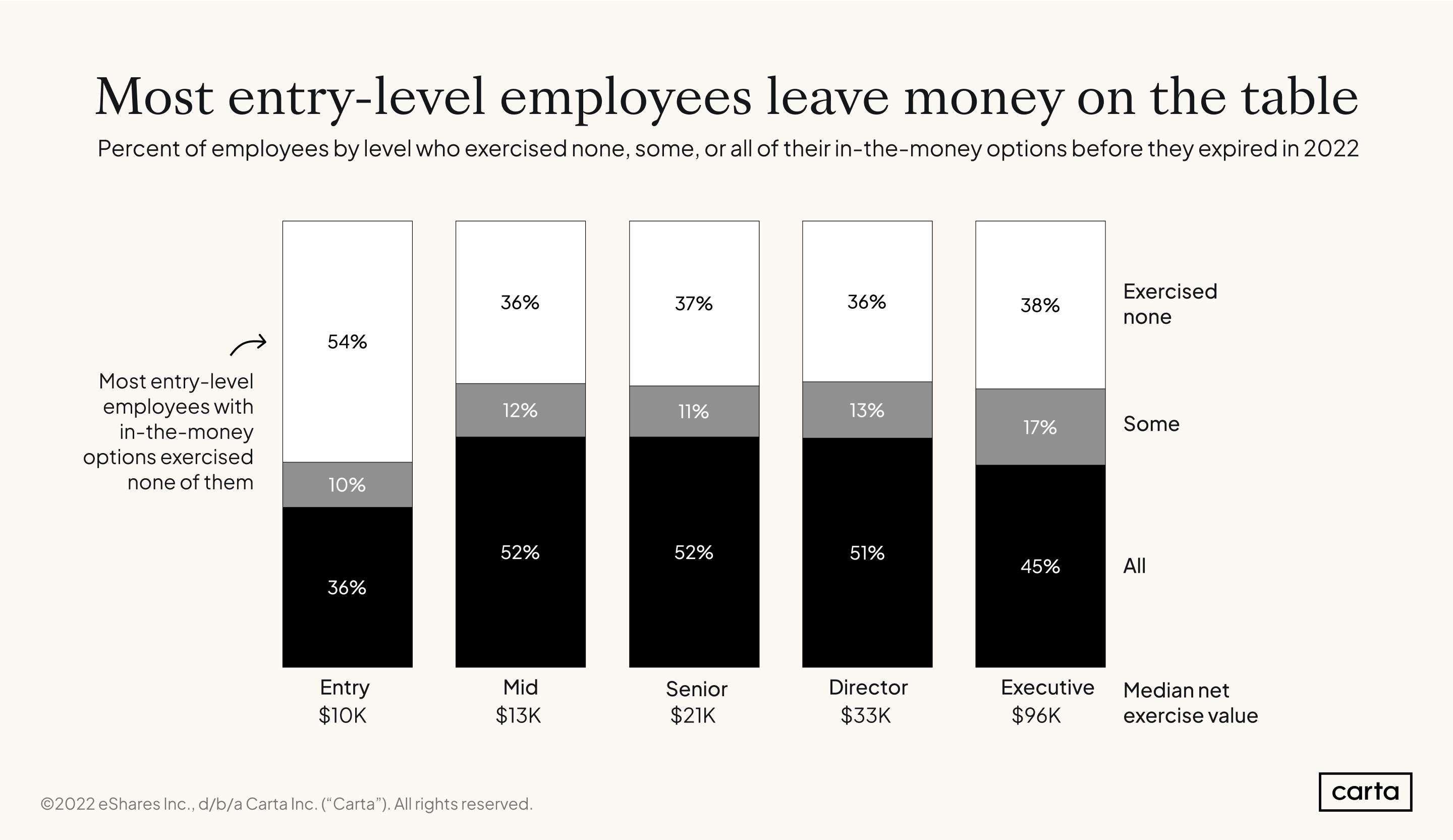

More than half of entry-level employees did not exercise any of their in-the-money options. Entry-level employees have less experience with stock options and may need more equity education to feel confident making decisions about their equity.

Outside of the entry level, the majority of employees exercised at least some of their options. There was a dip between directors and executives when it came to exercising all of their options, possibly due to the much larger size of grants to executives.

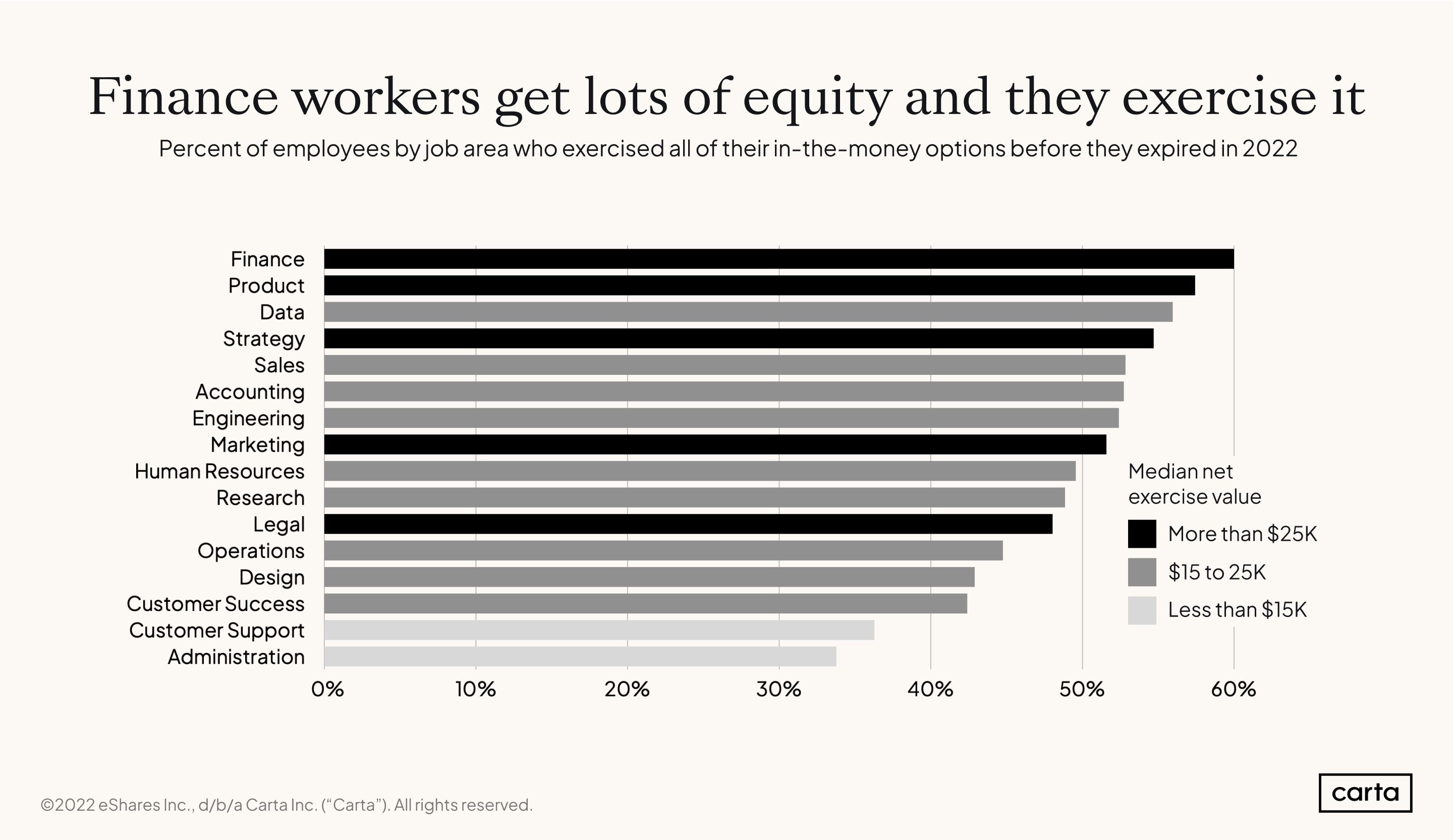

Finance workers are the most likely to exercise their equity. This might be because they know more about stock options and financial planning, and view stock options as an important part of building their portfolio and wealth.

Fair market value and employee taxes

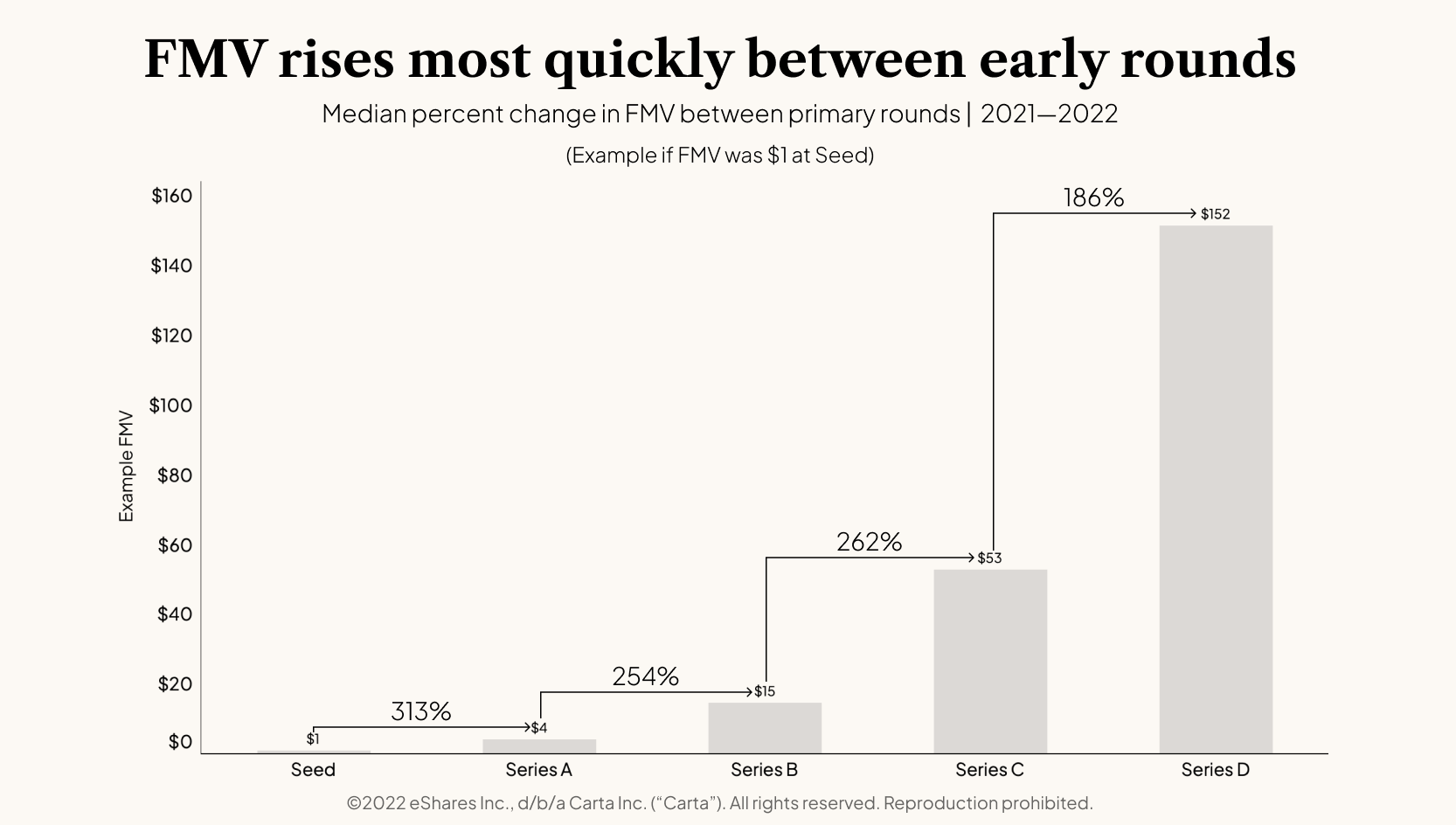

During early-stage growth, the median fair market value (FMV) experiences the largest percentage increase.

The FMV determines the strike price employees pay to exercise and is a factor in the taxes they’ll owe. The total cost to exercise for employees who receive grants at earlier stages but wait to exercise until a later stage will likely increase, because the spread between their strike price and the FMV at exercise increases.

Why are employees not exercising their options?

To better understand why employees were choosing to exercise (or not) and how they approach decision making, we conducted a survey of employees on the Carta platform.

Employees reported they didn’t exercise options in the past because they:

-

Couldn’t afford the cost to exercise or associated taxes (23%)

-

Thought it was too much of a financial risk (18%)

-

Were worried about making a mistake or thought they already owned them (13%)

-

Didn’t think their options were worth anything (11%)

41% percent of employees didn’t exercise because they believed they couldn’t afford the cost to exercise (23%) or that the financial risk of exercising was too high (18%).

But 13% of employees didn’t exercise because they were worried about making a mistake or thought they already owned them, showing the need for greater equity education.

The remainder of respondents either hadn’t vested, always exercised their options, or had other reasons for not exercising.

Employees don’t feel confident making decisions

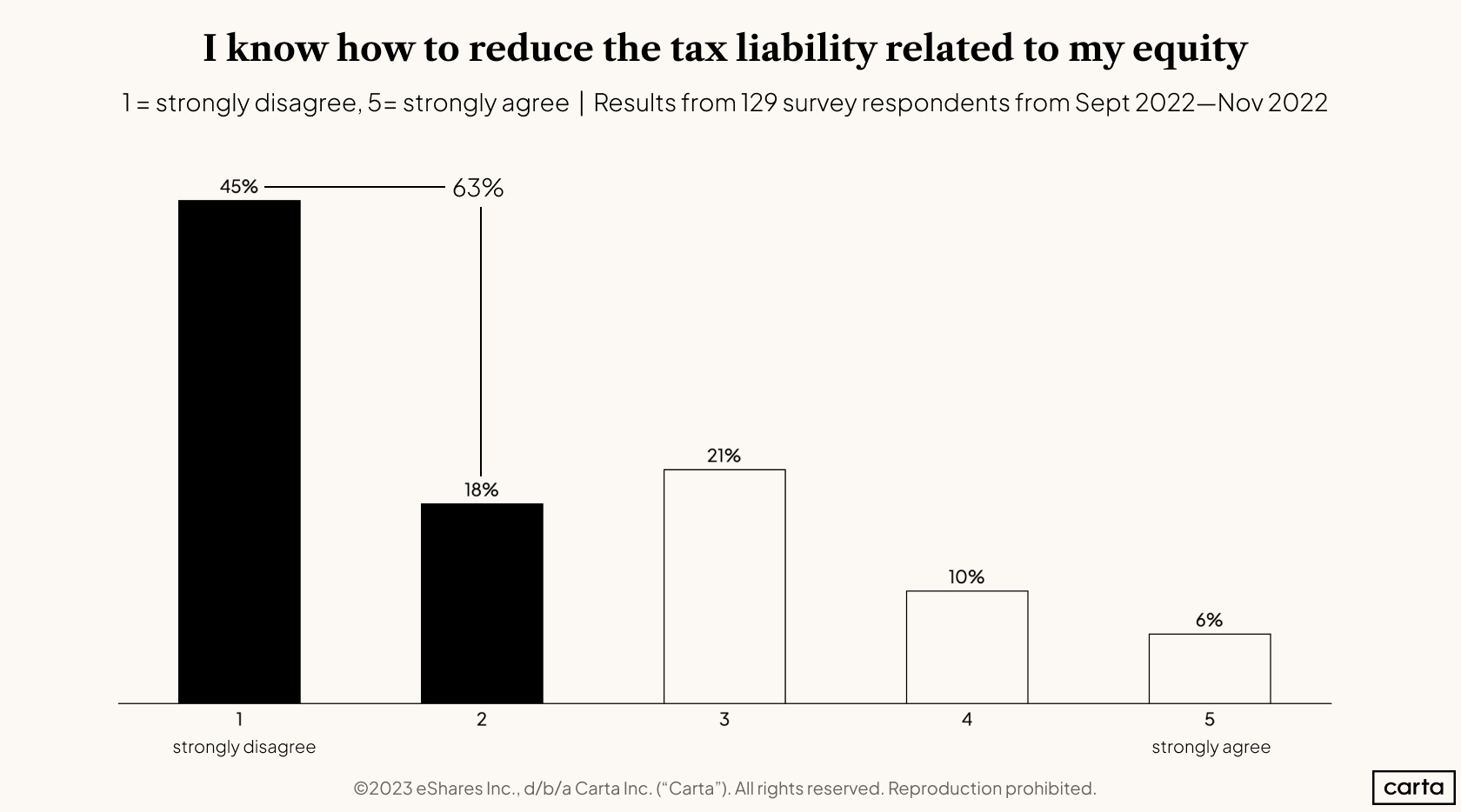

63% percent of employees don’t know how to reduce the tax liability related to their equity. For some employees, knowing how to reduce their tax liability could mean the difference between tens to even hundreds of thousands of dollars.

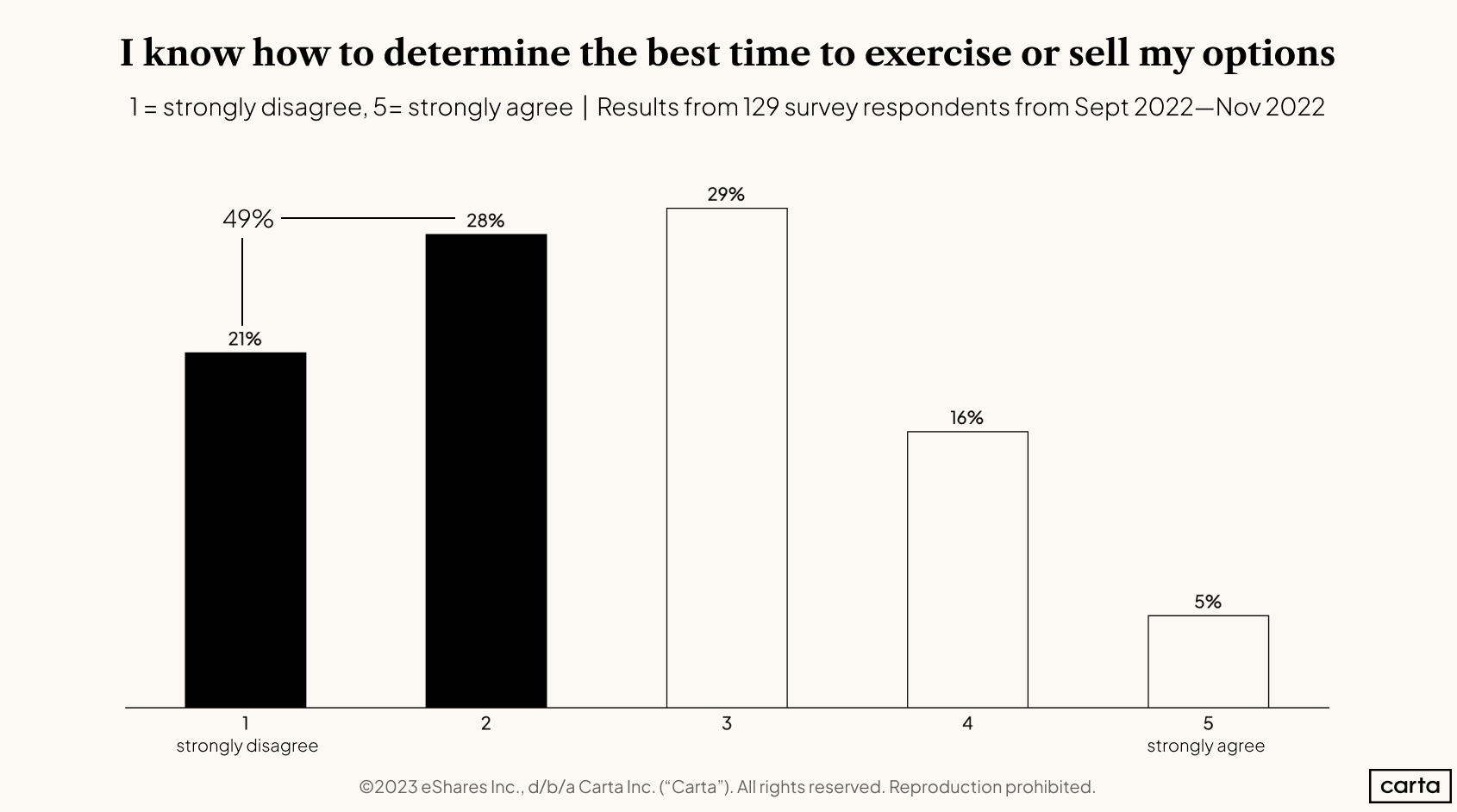

49% percent of employees don’t know how to determine the best time to exercise or sell their options. Providing a framework for thinking through whether to exercise or not can help employees feel more confident making decisions about their equity.

55% percent of employees think it’s stressful trying to decide when to exercise or sell their equity.

Employees want more equity education

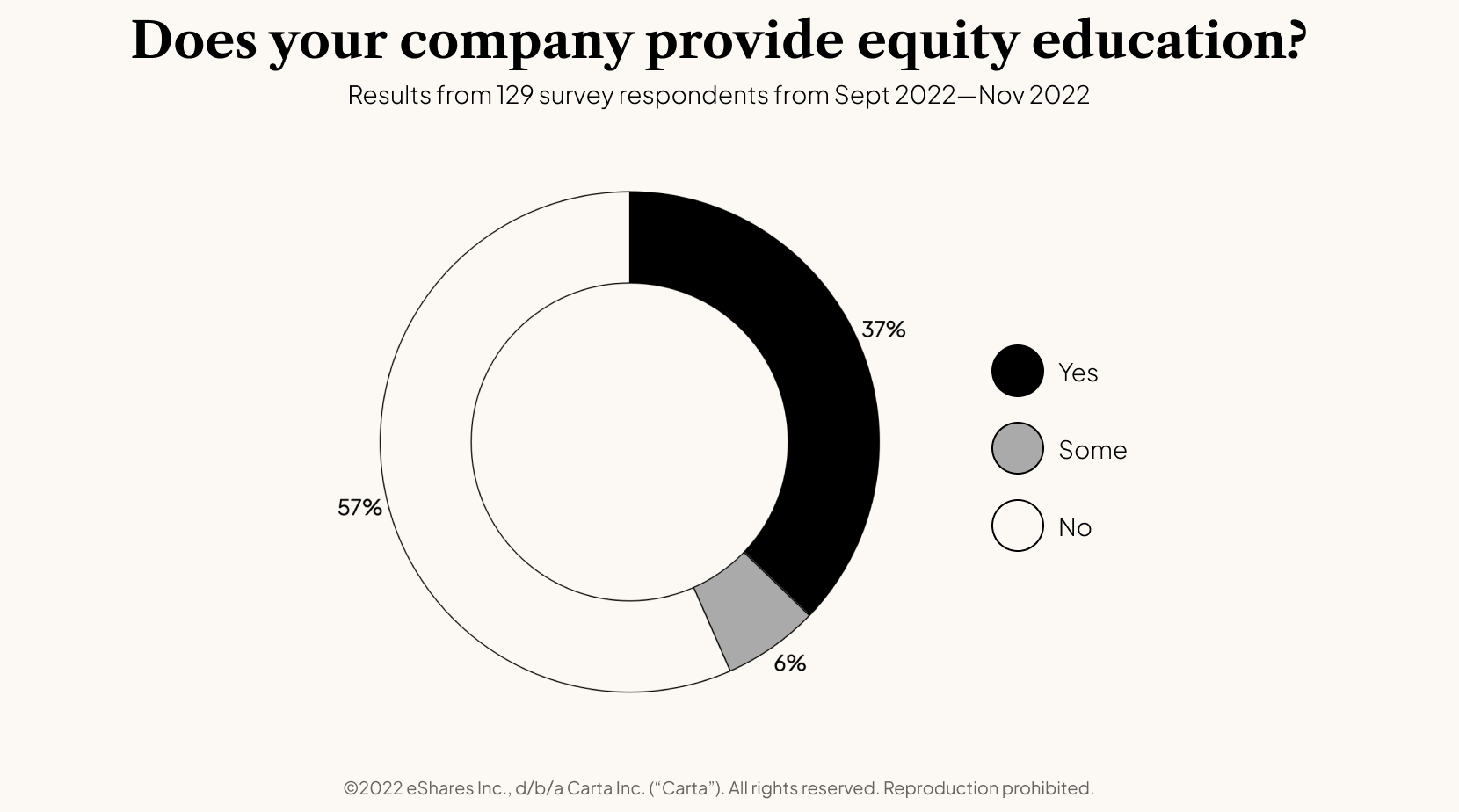

69% of employees think it’s important for their company to help them understand how their equity works—but only 37% of employees’ companies provide adequate equity education.

57% of companies don’t provide any equity education, and 6% offer insufficient education in the eyes of their employees.

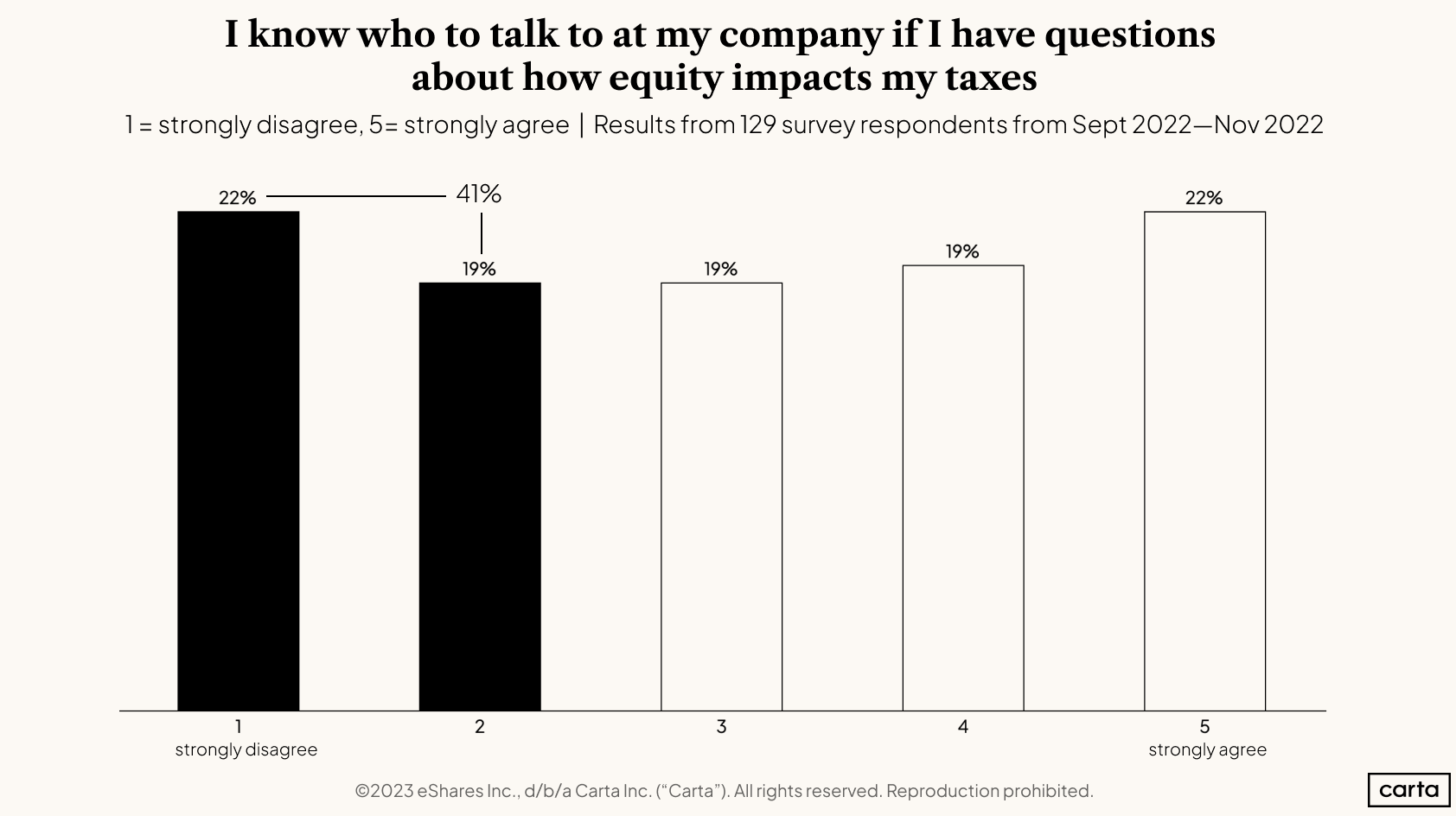

41% of employees don’t know who to talk to at their company if they have questions about how their equity is taxed. While employees can find information online, taxes on stock options can be complicated. For instance, if employees don’t realize they need to file an 83(b) within 30 days of early exercising, they can miss out on large tax savings and could face a huge and unexpected tax bill.

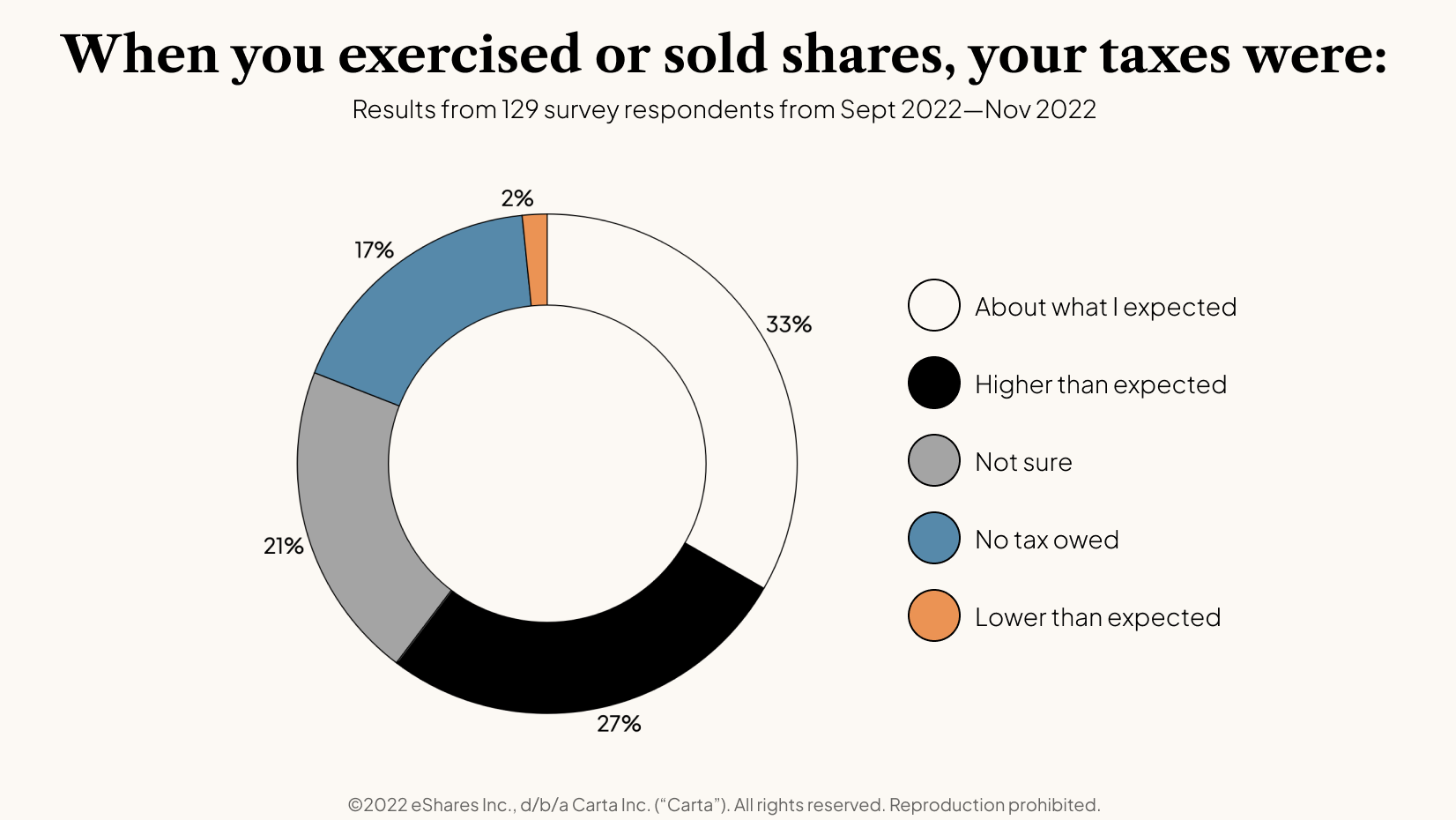

More than a quarter of employees had a higher than expected tax bill when they exercised or sold shares, which could be due to the lack of equity education and resources provided by their company.

How companies can support their employees

Equity Advisory is an offering exclusively for Carta customers that includes live company-wide webinars, in-product on-demand education, and unlimited one-on-one sessions—all hosted by Carta’s Equity Tax Advisors.

Our experts can help your employees understand equity basics and optimize their equity ownership by explaining potential risks and tax considerations for exercising and selling at different company stages. Since your company’s cap table and each employee’s equity grant are on Carta, our Equity Tax Advisors can model tax scenarios based on real data to help employees make informed decisions.

The Equity Tax Advisor team has given individual tax advice to thousands of employees, with a 4.9 customer satisfaction score.

Methodology

Carta helps more than 30,000 primarily venture-backed companies and 2,100,000 security holders manage over $2.5 trillion in equity. We share insights from this unmatched dataset about the private markets and venture ecosystem to help founders, employees, and investors make informed decisions and understand market conditions.

Overview

The “Exercising options” part of this report uses an aggregated and anonymized sample of Carta customer data. Companies that have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.

The data presented in this report represents a snapshot as of January 2, 2023. Historical data may change in future studies because there may be an administrative lag between the time a transaction took place and when it is recorded in Carta. In addition, new companies signing up for Carta’s services will increase historical data available for the report.

Employee survey data

We emailed a survey to employees on the Carta platform from September 19, 2022 to November 10, 2022. We received 129 responses from employees with varying tenures, salaries, and ages working at startups of varying sizes.

***