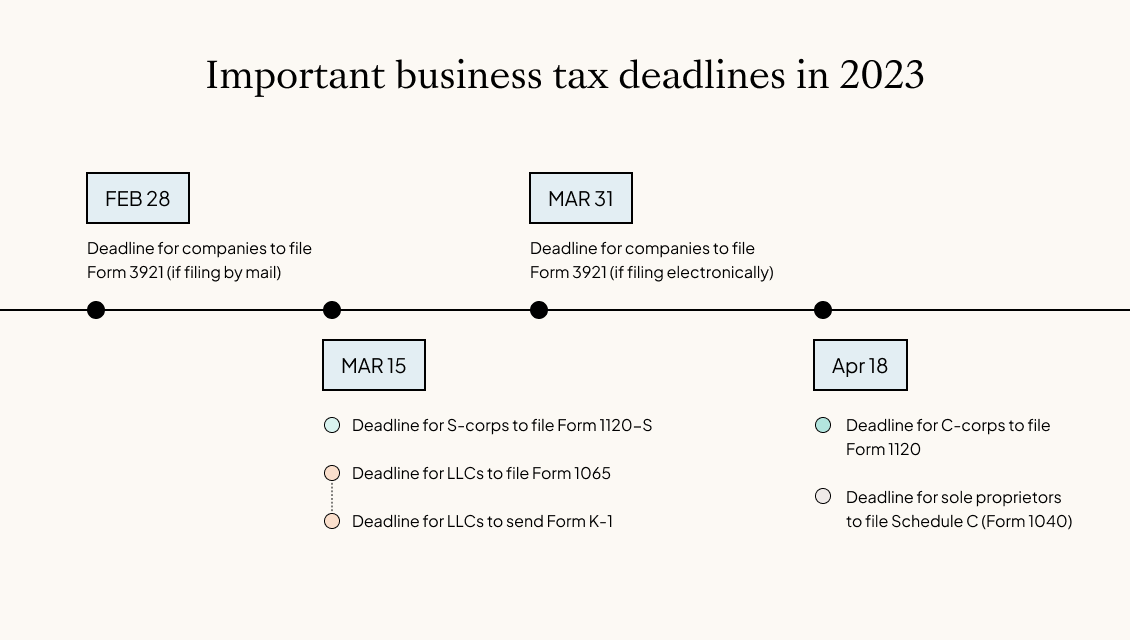

The 2023 deadline to file individual income tax returns for 2022 is April 18. Tax deadlines vary for startups and other businesses classified as corporations and LLCs. Here are some of the key business tax deadlines for the 2022 tax year:

Deadlines also vary based on the fiscal year an entity uses; make sure to check the IRS website for further details on when to file. Business can file for extensions.

Here are the key dates for corporations (both C-corps and S-corps), LLCs, and sole proprietorships:

Corporation tax deadlines

February 28, 2023

|

FORM 3921, if filing by mail(employee ISO exercises) |

|

Who must file?– Every corporation that had an employee exercise an ISO (incentive stock option) during the tax year must file copy A of Form 3921. A form must be filed for each employee who exercised an ISO. |

|

Good to know:– This is the deadline for filing by mail; the deadline for filing Form 3921 electronically is March 31 (see below).– Filing late results in penalties, starting at $50 per form (meaning, per employee ISO exercise) if 30 days late and increasing from there.– A Form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien and does not receive a W-2 form. |

|

For employees:– Employees who exercised incentive stock options during 2022 are required to include that on their tax returns, since exercised ISOs are considered taxable income by the IRS.– The information needed to report this is included on Form 3921, which is provided to employees by their employer. |

March 15, 2023

|

FORM 1120-S (S-Corporation tax deadline) |

|

Who must file?– S-corporations (deadline for C-corporations is generally April 18; see below) |

|

Good to know:– This deadline applies to S-corporations that use December 31 as the end of their fiscal tax year; check IRS guidelines for deadlines if your fiscal tax year ends on a different date.– S-corps can receive an extension by filing Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) by the regular due date of the return. |

March 31, 2023

|

FORM 3921, if filing electronically (employee ISO exercises) |

|

Who must file?– Every corporation that had an employee exercise an ISO (incentive stock option) during the tax year must file copy A of Form 3921. A form must be filed for each employee who exercised an ISO. |

|

Good to know:– This is the deadline for filing electronically; the deadline for filing Form 3921 by mail is February 28 (see above).– To file Form 3921 electronically, first you have to request authorization from the IRS to file electronically and receive a Transmitter Control Code (TCC). With that code, you can set up an account on the IRS Filing Information Returns Electronically (FIRE) system. It can take several weeks to receive a TCC.– Filing late results in penalties, starting at $50 per form (meaning, per employee ISO exercise) if 30 days late and increasing from there.– A Form 3921 is not required for the exercise of an incentive stock option by an employee who is a nonresident alien and does not receive a W-2 form |

|

For employees:– Employees who exercised incentive stock options during 2022 are required to include that on their tax returns, since exercised ISOs are considered taxable income by the IRS.– The information needed to report this is included on Form 3921, which is provided to employees by their employer. |

April 18, 2023

|

FORM 1120 (C-Corporation tax deadline) |

|

Who must file?– C-corporations |

|

Good to know:– This deadline applies to C-corporations that use December 31 as the end of their fiscal tax year; check IRS guidelines for deadlines if your fiscal tax year ends on a different date.– C-corps can receive an extension by filing Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) by the regular due date of the return. |

LLC tax deadlines

March 15, 2023

|

FORM 1065 (partnership tax deadline) |

|

Who must file?– Limited liability companies (LLCs) and other domestic partnerships |

|

Good to know:– As pass-through entities, partnerships typically don’t pay tax on their income but rather pass through any profits or losses to its partners, who must declare such items on their returns.– LLCs can receive an extension by filing Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) by the regular due date of the return. |

March 15, 2023

|

FORM K-1 (deadline to distribute form to LLC partners) |

|

Who must distribute?– Limited liability companies (LLCs) and other entities that “pass through” taxes to their partners |

|

Good to know:– As pass-through entities, partnerships typically don’t pay tax on their income but rather pass through any profits or losses to its partners, who must declare such items on their returns. The K-1 form details the partner’s share of the partnership’s income/losses, credits, and deductions for the year. |

Sole proprietor tax deadlines

April 18, 2023

|

Who must file?– Sole proprietors must use Schedule C (Form 1040) to report income or loss from a business they operated or a profession they practiced. |

|

Good to know:– An activity qualifies as a business if: – Your primary purpose for engaging in the activity is for income or profit – You are involved in the activity with continuity and regularity |