Having worked in the fund administration industry for more than 20 years, it’s always surprised me that the lengthy administrative processing time for quarterly reports is just an accepted nuisance. Industrywide, we see reporting 30, 45, 60, sometimes 90 days after the end of a quarter.

As head of VC Delivery at Carta, for me, everything comes back to creating a better customer experience. Recently, we decided that the industry-standard, post-quarter wait for reports was unacceptable for our customers.

We’re creating a new standard of Day 1 Financials: delivering draft quarterly financial statements on the first business day after the end of the quarter. That means that on the first day of January, April, July, and October, Carta customers will have draft financial statements for the previous quarter in their inbox. This draft statement outlines any open items that we need from the customer to finalize financial reporting, ultimately cutting down the lengthy administrative processing that can take weeks after the end of the quarter.

With this offering, we’re here to set a higher standard of support for our fund administration customers. As we evolve our Day 1 Financials process and scope, the next step is offering tax services to our customers and achieving delivery of K-1s on a timeline that is unmatched.

With these steps we can lead the way in turning a service industry into a technology-backed one—while enabling our fund administration team to focus on value-additive interactions with our customers.

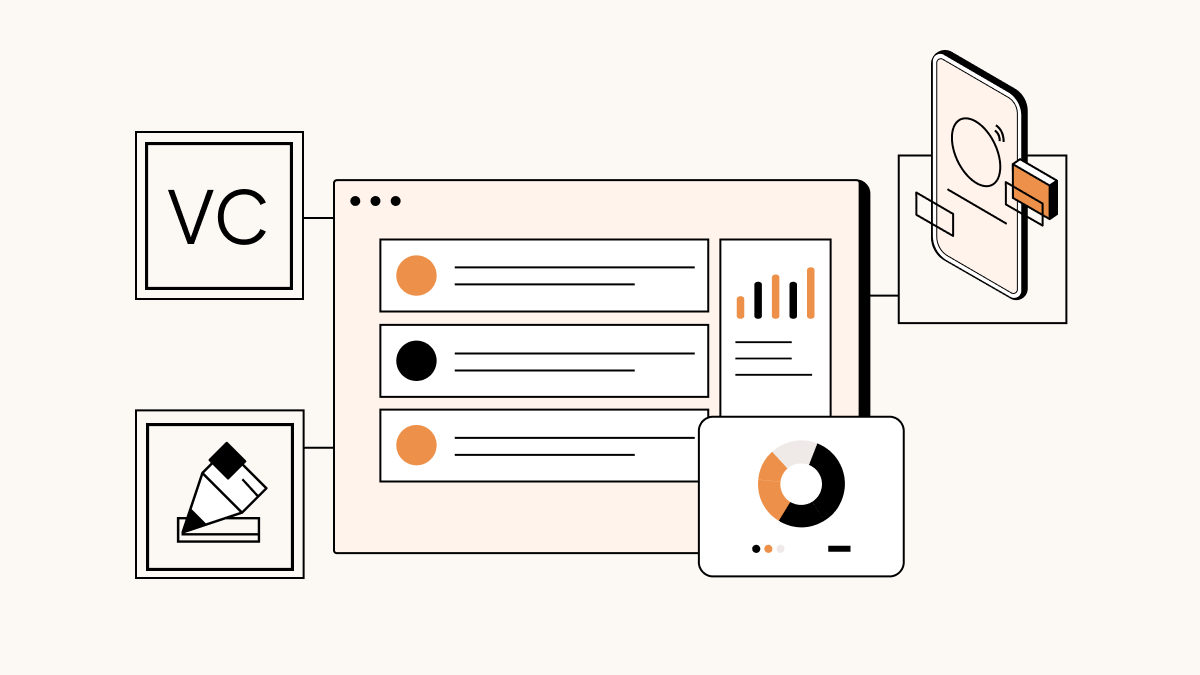

Earlier this year we launched the General Partner Activity Tab and Carta Carry, both of which empower customers to perform day-to-day fund activities within the app, such as paying an expense or making an investment. This means faster turnaround times for our customers, real-time daily processing, completion status, and more time for our teams to provide counsel and guidance.

Building technology-backed efficiencies in a service industry like fund administration is reflective of Carta’s commitment to our customers. Almost every organization will say it’s fast-paced and driven by technology, but Carta truly is unique in this regard.

We are different from traditional fund admin shops, which are still operating according to legacy systems and outdated standards that no longer serve the needs of customers (and which are impossible to scale). At Carta, we are now able to flip that script and lead the industry to the Carta way—and we believe it’s 10x better.