Carta launched in 2012 with a mission to create more owners. To achieve our goal, we took an opaque, manual process—issuing shares—and created a platform to make it easy and transparent.

Now, we’re doing the same for fundraising.

Together, Carta’s fundraising suite offers tools and services to make startup fundraising simpler, more efficient, and less expensive for founders.

Here’s what we built:

SAFE Financings

What is it?

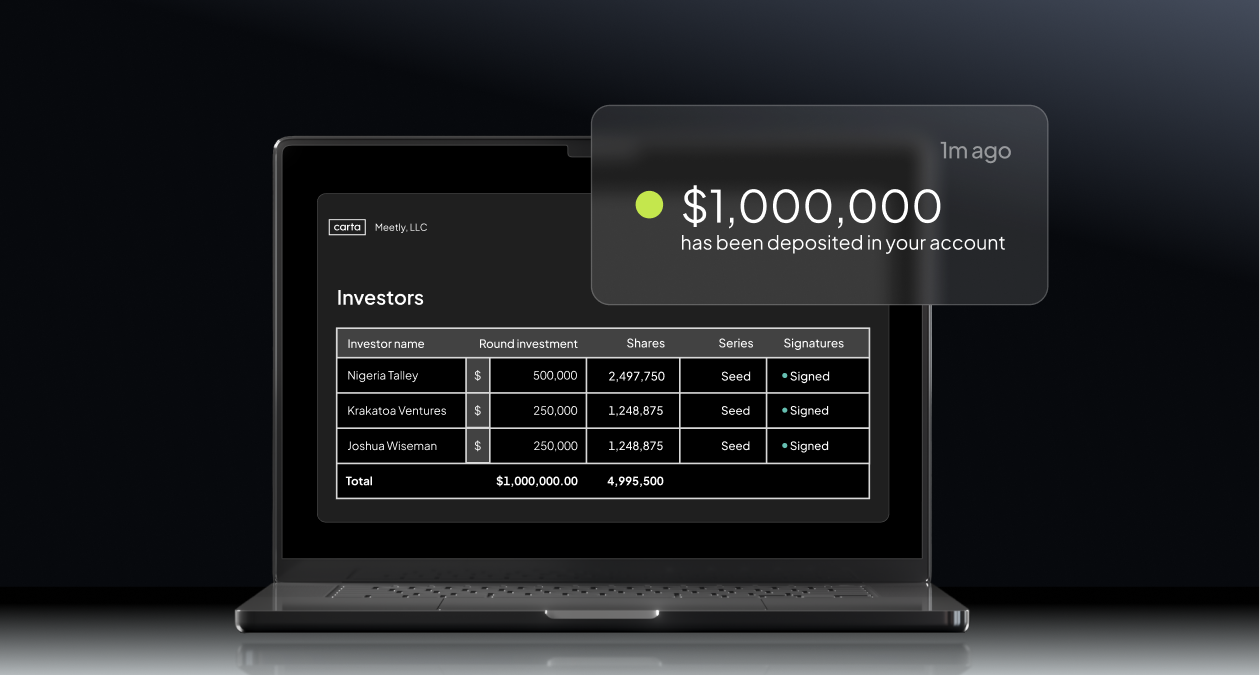

With SAFE Financings, you can generate and upload SAFE documents, send them to investors, collect signatures, and fund your deal without ever leaving the Carta platform.

What’s it for?

Previously, raising a SAFE required considerable legwork, especially when it came to tracking the agreements and ensuring investors sent over money. Now, it’s a seamless experience: With everything in one place on the Carta platform, you’ll never misplace any documents or forget to collect a signature. After the deal is done, we automatically update your cap table to reflect the new investment.

With Carta SAFE Financings, you can also:

-

Generate SAFEs using templates created by Carta or Y Combinator

-

Upload a customized SAFE and side letter

-

Receive funds on Carta through a one-click ACH transaction

Scenario Modeling Tool

What is it?

The Scenario Modeling tool shows you how different financing scenarios will impact your startup.

What’s it for?

We built the Scenario Modeling tool to give founders a 360-degree view of their financing decisions. You can use the tool to:

-

Understand how one or more financing rounds would affect your company’s stock dilution, valuation, and share classes

-

Learn how a new investment would impact ownership

-

Compare how different term sheets would impact your next round

-

Adjust deal terms until you find the right fit for your company

Knowledge is power. Carta’s Scenario Modeling tool will help you make sure you get to the negotiating table with a solid understanding of what’s right for you and your team.

Deal Pro Forma

What is it?

Our Deal Pro Forma tool leverages your existing cap table information to help you and your lawyer create a deal-ready pro forma for your next financing round.

What’s it for?

Deal Pro Forma gives founders and their law firms a ready-to-use pro forma model that shows how a financing round would affect investor pro rata rights, convertible pro rata rights, and more. With this tool, users can make incremental changes to investment amount, pre-money valuation, and other inputs, and the tool will automatically adjust the model’s calculations.

Creating a deal pro forma used to require hours of tedious administrative work. Now you can do it in minutes—and keep your fundraising plans on track.

Deal Closings

What is it?

Carta’s Deal Closings workflow tool automates administrative tasks required to close a financing round.

What’s it for?

The Deal Closings workflow allows you to collaborate with your lawyers to make closing a round faster, more transparent, and more cost-efficient. With Deal Closings, you can:

-

Collect and manage investor signatures, communicate with stakeholders, and request wires in one simple interface

-

Track the entire closing process—from requesting the first signature to receiving capital

And after you complete a priced round, we automatically update your startup’s cap table to reflect the new investment.

Carta Deal Team

What is it?

The Carta Deal Team provides dedicated support to help you close your SAFE or priced round.

What’s it for?

For a first-time founder, fundraising can be confusing. Even for repeat founders, fundraising can still be complex and time-intensive. We put together a team of advisers with decades of combined experience to walk you through every single step of the process.

Carta’s Deal Team will help you:

-

Compare your term sheet to industry standards

-

Build your pro forma

-

Understand deal terms

-

Create and track signature packs

-

Coordinate and confirm fund transfers

-

Issue SAFE agreements or securities post-closing

-

Produce and distribute all finalized docs to your investors

-

Evaluate proprietary data insights specific to your industry and stage.

Learn more

Carta’s SAFE Financings, Deal Pro Forma, and Scenario Modeling tools are already available for all Carta cap table customers.

To learn whether Deal Closings and the Carta Deal Team are right for you, reach out to our team.