Under the Corporate Transparency Act, most small businesses operating in the United States are required to report information about their ownership to the Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Department of Treasury charged with anti-money laundering and preventing financial crimes.

Learn more:

-

Issue brief: The Corporate Transparency Act

-

Virtual Event with FinCEN: Corporate Transparency Act—What business owners need to know

-

Download: The CTA compliance checklist at the bottom of this article

The purpose of the CTA is to deter financial crimes and prevent the financing of terrorism. Financial criminals use shell companies to conduct illegal transactions, finance illicit activities, commit tax fraud, and evade existing sanctions. By requiring businesses to report their beneficial owners to FinCEN, the CTA gives federal agencies a better view into company ownership in the United States so they can identify and monitor large stakeholders in private companies. This visibility is meant to uphold national security and deter criminals from using private companies as mechanisms for illicit financial operations.

What is the Corporate Transparency Act?

The Corporate Transparency Act is a U.S. law that requires certain private companies to disclose information about their beneficial owners—the people who hold a significant ownership stake in the company or who exercise substantial control over its operations.

In January 2021, the CTA became law as part of an omnibus defense spending bill.

What is a beneficial owner?

A beneficial owner is a person who either:

-

Owns or controls at least 25% of a firm through possession of equity, stock, or voting rights, or

-

Exercises substantial control over a company and its operations.

What counts as substantial control?

Under FinCEN regulations, an individual exercises substantial control over a company if they:

-

Are a senior officer in the company, including people with roles like president, CEO, CFO, COO, general counsel, or any other role with similar executive powers.

-

Have the power to appoint and replace senior officers or a majority of directors.

-

Are an important decision maker at the company.

-

Exercise another form of substantial control.

This last category is a deliberately vague “catch-all” provision intended to acknowledge the possibility of unique or newly devised forms of control over a company.

Who must comply with the CTA?

The CTA subjected millions of business entities to a BOI reporting regime for the first time. The law applies to a wide range of privately owned business entities, including corporations, limited liability companies (LLCs), and business trusts.

Virtually all small businesses in the U.S., including venture-backed startups, are considered reporting companies under the CTA. Foreign companies with physical plants or offices in the U.S. must also comply with the legislation.

Corporate Transparency Act exemptions

The CTA exempts 23 types of companies from reporting obligations, including:

-

Publicly traded companies

-

Broker-dealers

-

Venture capital fund advisers

-

SEC-registered investment advisers (RIAs)

-

Pooled investment vehicles (operated or advised by RIAs or venture capital fund advisers)

-

Private companies with more than 20 full-time employees and more than $5 million in gross receipts in the previous year.

Most of the 23 exempt entities are types of companies that already fall under another disclosure regime, such as public companies, banks, and registered investment companies.

Startups and the CTA

Most early-stage startups will not qualify for one of the 23 exemptions and will have to begin complying with the CTA by January 1, 2025 (or shortly after incorporation if the company formed after January 1, 2024). See below for a compliance timeline.

Corporate Transparency Act reporting requirements

FinCEN requires specific disclosures under the CTA around reporting.

Company information reporting

Reporting companies have to provide the following basic identification information about themselves:

-

Company name

-

Trade names, if any

-

Current U.S. address

-

U.S. jurisdiction of formation

-

IRS taxpayer identification number (TIN) and employer identification number (EIN)

Company applicant reporting

Domestic and foreign reporting companies created or registered to do business in the U.S. on or after January 1, 2024 must report their company applicants.

At most, two individuals need to be reported as company applicants:

-

The person who directly files the creation or registration document with a secretary of state or similar office, and

-

If more than one person is involved in the filing of the creation or registration document, the person who is primarily responsible for directing or controlling the filing.

Beneficial ownership information reporting

Reporting companies must also supply the following information for each of their beneficial owners:

-

Full legal name

-

Address

-

Date of birth

-

A unique identifying number from an official document, such as:

-

U.S. passport

-

U.S. state driver’s license

-

Another official document issued by a state or local jurisdiction

-

Foreign passport

-

-

The jurisdiction that issued the unique identifying number

In addition to reporting, the CTA requires businesses to maintain records of the information they report to FinCEN for five years.

Timeline for compliance with the CTA

Reporting requirements under the law began to take effect in 2024 as follows:

|

Company formation date |

BOI initial filing deadline |

|

Before January 1, 2024 |

January 1, 2025 |

|

After January 1, 2024 |

Within 90 days of incorporation |

|

After January 1, 2025 |

Within 30 days of incorporation |

After making an initial filing, companies have 30 days to report changes to the BOI, such as changes to an owner’s legal name or address.

However, a reporting company is not required to file an updated report for any changes to previously reported information about a company applicant.

Corporate transparency act penalties

Penalties for noncompliance with CTA reporting include civil penalties of $500 per day in fines (up to $10,000) and criminal penalties of up to $10,000 and two years of imprisonment. Penalties can result from failure to file a timely updated report or from filing a false or fraudulent report. The amount of the penalty is determined by the severity of the violation, as well as the company’s history of compliance.

Because penalties for noncompliance are public, your company could sustain reputational damage and lose customers or investors as a result of noncompliance.

How Carta helps with CTA compliance & filing

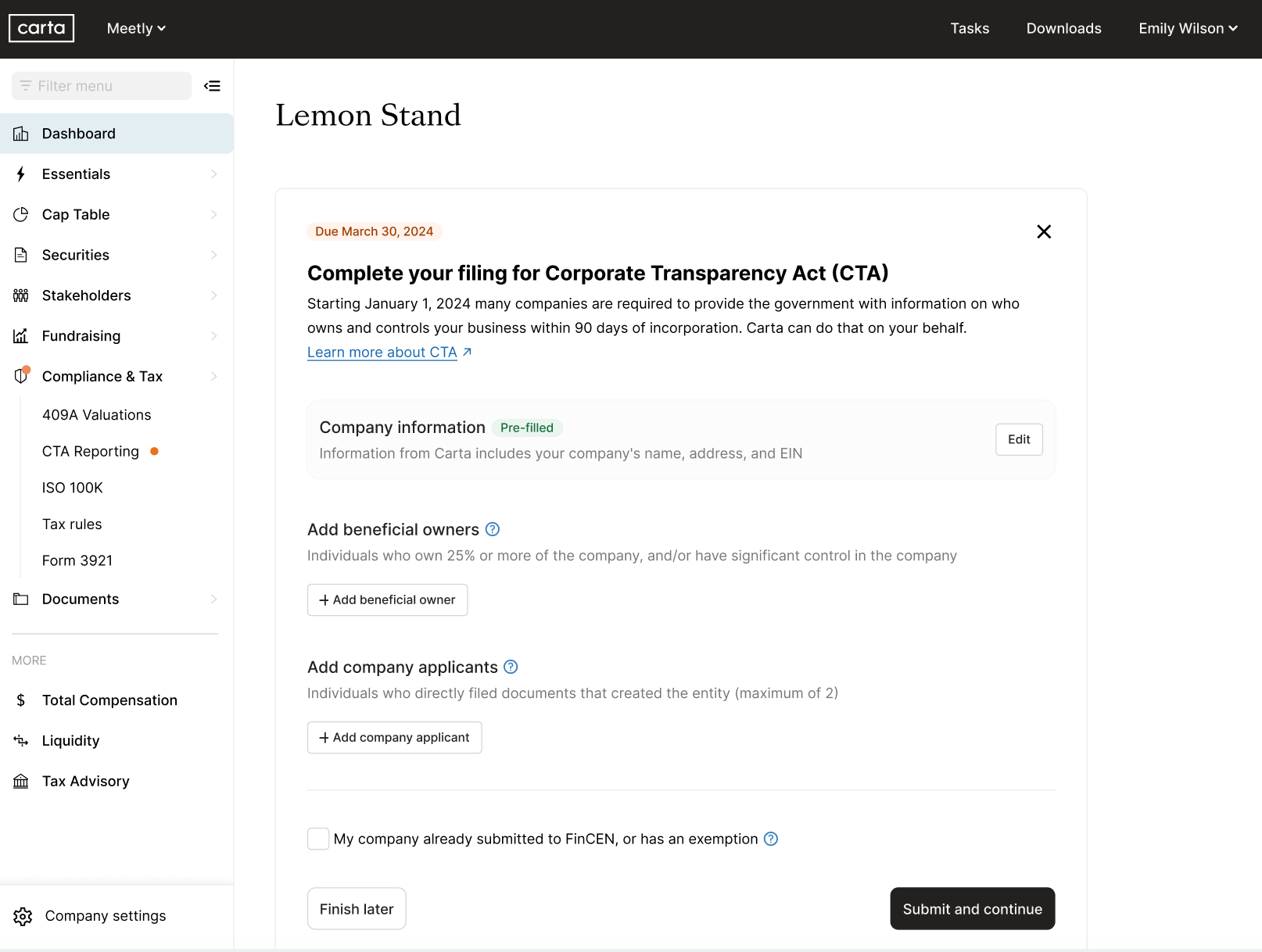

Carta developed an in-app solution for helping companies comply with the CTA. The tool is already available to companies formed after January 1, 2024.

You can find it under the Compliance & Tax section in Carta:

Here’s how it works:

Pre-filled reporting

Our CTA reporting tool uses information gathered during onboarding to pre-populate your company’s required FinCEN filing. A guided workflow then allows you to add any additional beneficial owners who aren’t already identified, such as decision-making officers at your company. You’ll also be prompted to enter information for company applicants (the person or people who filed the paperwork to incorporate the company).

Collect additional data from beneficial owners

We made it easy for you to collect any missing information from your beneficial owners, such as a picture of their photo ID: In the CTA workflow, simply enter the person’s email address and assign them a task. The task tool also allows you to easily generate reminder emails for each task recipient.

Review and submit

After verifying that your information is complete and accurate, you can authorize Carta to submit the required filing to FinCEN on your behalf.

Carta will also ensure records of the filing are maintained for the required five years.

Ongoing advocacy and communications

Carta’s Policy Team continues to engage with policymakers and regulators in Congress to clarify aspects of CTA compliance that remain unresolved. If you’re not already on our Policy Weekly distribution list, you can sign up today.

To learn more about Carta and CTA compliance, reach out to an associate today.

Download the checklist

For a step-by-step guide to understanding CTA compliance, download Carta's CTA compliance checklist: