With the help of different LP classes, insights from fund managers, and our experience in structuring and supporting funds, we’ve provided insights into what LPs look for in emerging fund managers. The report includes a look into the European VC market, statistics on performance for funds I-III, insights into the different LP classes and how best to approach them, as well as words of advice from experienced VCs and active LPs in the emerging manager space.Find the full report below:

Download the report here.

The paths to becoming an emerging manager

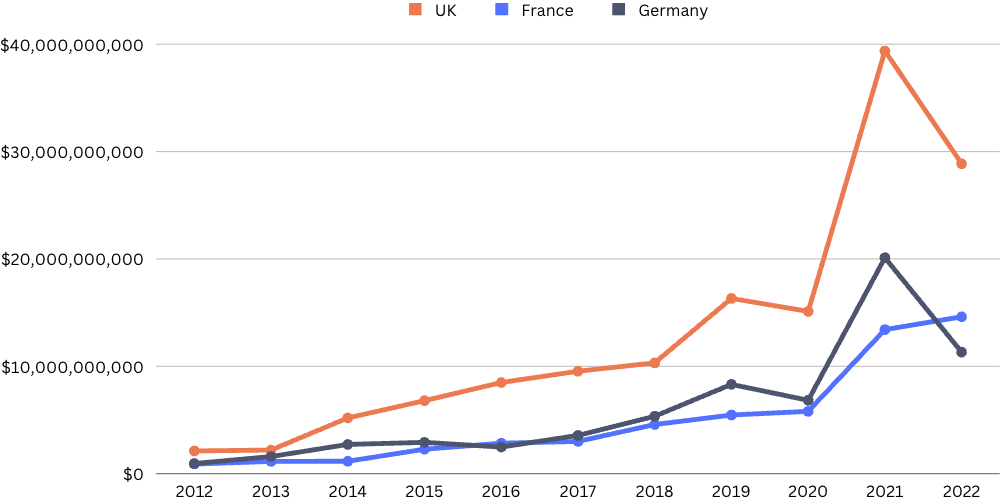

VC activity slowed down in 2022, but managers remain resilient. In fact, many argue: it’s a great time to invest in venture capital.Overall, the numbers are down compared to the record-breaking year of 2021. But 2021 was just that, an exceptional year and not, in fact, a new baseline for VC funding & deal count.If we instead compare 2022 to the last 10 years it paints a very different picture. Excluding 2021, the big three receivers of VC funding in Europe; the United Kingdom, France, and Germany, all boast considerably more funding in 2022 than any year prior.

Amount of VC funding from 2012-2022 (source: Sifted)

Venture continues to outperform other long-term asset classes at an 11.5% 15-year horizon IRR, and remains attractive for LPs. In particular, emerging funds outperformed ‘blue chip’ funds from 2004 to 2020.

We identified what performs best – and that’s small funds. Essentially, show that you can build a great portfolio and deploy all capital pre series A.” -Institutional investor (anonymous)

With 123 new first-time fund managers in the last two years, the demand is there and growing.So, how do you become an emerging fund manager?We've seen 4 common routes into launching your venture fund:

-

Spin Out

-

The Founder

-

Strategic Investor

-

Solo GP

Keep in mind that the road to become an emerging fund manager is not always this straightforward. There has been a recent trend of influencers, journalists, and expert leaders who became emerging venture capitalists. Talk to any VC: their path has not been traditional by any means.

Spin Out

The Spin Out is a previous partner, usually at a well-established firm, who decides to create their own fund. They are very familiar with investment strategies and techniques, often complemented by a strong network. However, operating a first-time fund is very different than investing with an established firm. Digging into their profile is important to distinguish whether they may have had limited decision-making autonomy or been reliant on their employer or colleagues for deal flow.

The Founder

This is an exited founder that brings their experience and knowledge from building a business to support startups in their industry. Their entrepreneurial experience and strong industry knowledge make them a valuable asset for portfolio companies, being able to provide much more than funding. However, consider whether they have the strong track record and fund management experience necessary to convince LPs. A strong founder does not always make for a strong investor.

Strategic Investor

Strategic Investors often come from diverse backgrounds, ranging from private equity to syndicate leads and angel investors, or industry experts and operators. They combine very good analytical skills with strong industry connections and often highly coveted expertise. However, they may face the same difficulties as exited founders: a lack of track record or fund management expertise.

Solo GP

The Single General Partner can come from any of the backgrounds described above. The only difference is that they decide to do it alone. While difficult, going solo does have some advantages. Solo GPs are hyper-efficient, able to quickly take decisions without being slowed down by conflict or diverging interests. This advantage is a double edged sword. Without a partner to second guess and question decisions, Solo GPs rely solely on their own judgement.

State of fundraising

We often hear that fundraising has gotten harder, which while not wrong, does not provide a full image of the fundraising landscape. VC remains an active part of LP’s overall investment strategy: 58% of LPs intend to invest the same amount in venture capital in 2023, while 23% plan to invest more. Capital is certainly not drying up, but receiving it will be harder.LPs are still recoiling from the sudden market slowdown. 2022 saw 46% of LPs have their benchmark exceeded by venture capital performance, compared to 68% the year prior. Most important, however, is the rising rate of LPs who fell short on returns: from 5% in 2021 to 23% in 2022.This combination of factors means that LPs are suffering from VC performance anxiety. They are more reluctant to deploy capital or, at least, not without extensive and reinforced due diligence.To help you in your next fundraising round, here are the 4 biggest things LPs will be looking for.

Track Record

The best way for LPs to gauge the volume and type of deal flow you’ll be able to secure allocation for is simply historical performance. Start building a track record sooner rather than later, notably through angel investments or leading SPVs. If you can’t invest directly, just sharing deal opportunities with prospective LPs is a great way to connect and build a relationship.

Team

While you need a demonstrable personal track record, your team history needs to show that you can deliver results. Having worked together historically will be a huge advantage, as LPs are very reluctant to back first-time teams. Even having been C-suite operators together in the past will go a long way to show you work well, get along and can deliver great results.

Strategy

Your investment thesis and strategy has to be sound and consistent: have a plan, and stick with it. Many emerging managers try to bend their thesis to fit around LPs, but that’s not how it works. LPs will see this as a red flag so be careful. LPs have their own investment strategy, so just clearly present who you are and what you want to achieve and if they want to back you, they will fit you in.

Investment Terms & Fit

Sometimes, everything will line up and it’ll seem like a match made in heaven. Your track record, team composition, and strategy wowed them, and yet, they don’t back you. The truth is that there’s more to it than just those three elements. Considerations such as Fund and Fee structures, governance, reporting, ESG, etc will mean that LPs have restrictions and limitations to certain terms and conditions. Even though everything else is a perfect match, a single sticking point can mean an LP will have to pass up on backing you.

Limited Partners

Lastly, you need to know who your limited partners are and what their key considerations will be. As an emerging fund manager, you’ll fundraise mostly from these investor types:

-

High Net-worth Individuals (HNWIs)

-

Family Offices

-

Fund of Funds

-

Institutional Investors

High Net-worth Individuals

Individuals with significant investable assets. They can offer large pools of capital, and most importantly, will often build a personal connection or mentorship. They would’ve done this before and will likely be very experienced. They will hard to access though, often exacerbated by specific investment criteria they’re looking for.

Family Offices

These are private wealth advisory firms, mainly for wealthy families. With their primary goal of maintaining and growing generational wealth, they will be operating on a long-term investment horizon. A formidable LP to land in your fund, family offices are notoriously hard to access. Many don’t have websites or easy ways to get in touch. For these LPs, you will most likely need a personal connection or introduction.

Fund of Funds

Fund of Funds are investment vehicles that pool capital from multiple LPs of their own to invest in a diversified portfolio of VC funds. These often carry a certain prestige, so onboarding them as an LP grants emerging managers much needed brand recognition. Additionally, since they actively and exclusively invest in funds they will be able to provide expert insights and advice. One thing to note, due to the nature of their investment thesis they are unlikely to deploy large quantities of capital in a single fund.

Institutional Investors

From endowments, foundations, corporate VCs to government institutions; institutional investors are far more rigid on investment terms than other LPs. They will operate on a specific mandate and follow precise investment criteria. However, if you fit their criteria you will have a long-term strategic partnership with immense support and collaboration.

Words of advice

“Don’t wait until your fund is launched to build a track record or develop a brand. Use whatever resources you have to start investing - even if it is a small angel ticket. Doing is a lot more valuable than just talking about it in pitches.”

-Monik Pham, General Partner, Pact VC

“There's a kind of anecdotal correlation that we've observed in terms of first time teams, if they haven’t worked together historically, or made investment decisions, or been C suite operators; they actually break up before they even raise the fund, more often than not. So, we’re happy to back first time funds, but we will never back first time teams.”

-Dominic Maier, Partner, AXA Venture Partners

“Keep your fund structure simple, don’t overcomplicate it or try to reinvent the wheel. Following accepted industry standards will send a signal to your investors that you know what you are doing. Choose your service partners wisely as your administrators, lawyers or auditors may be a valuable extension of your team and provide helpful market insight.”

-Thomas Laurer, Partner, Curtis

"Find something that makes you unique and go all in on why that characteristic or focus is appealing & why you are best to execute the strategy you have set out. It sounds obvious but true differentiation in VC is pretty hard and very rare, and having it makes it hard for LPs to reject you solely on the basis that they have exposure to something similar.”

-Bertie Highmore, Head of Investments, BWC

“Get a reputation for helping founders without expecting anything in return and you will build trust and a powerful founder network. Build an angel syndicate to show how you operate as an investor then starting a fund will be easier.”

-Marcus Love, General Partner, Love Ventures