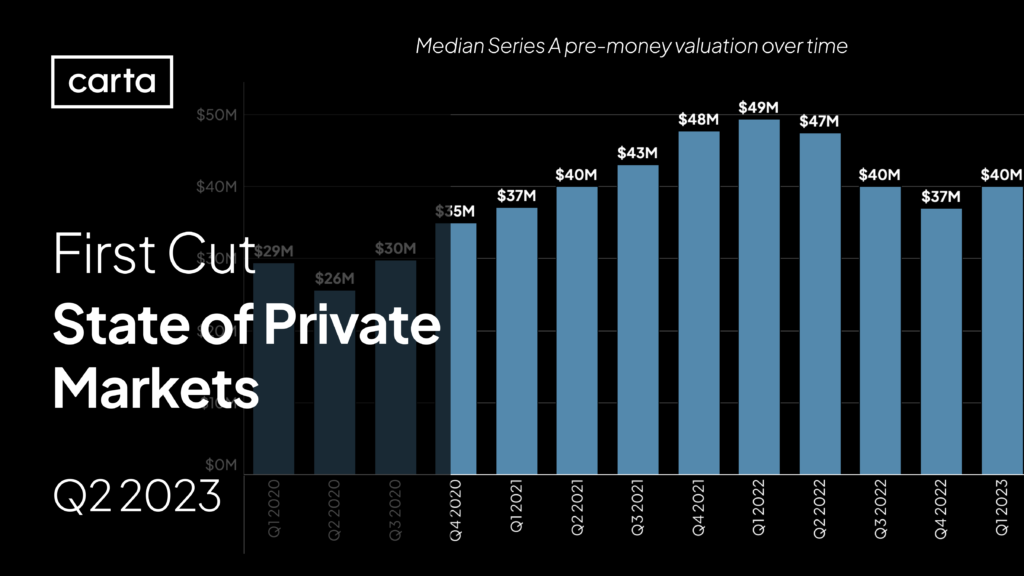

Every quarter, Carta releases information on the startup ecosystem in our State of Private Markets report. It can take a few weeks for rounds to be recorded on our platform, so we produce a full analysis after we get the final numbers. However, we publish a “first cut” of data as close to the end of the quarter as possible. This initial report focuses on round valuations and cash raised across the venture stages.

So—how did Q2 shake out?

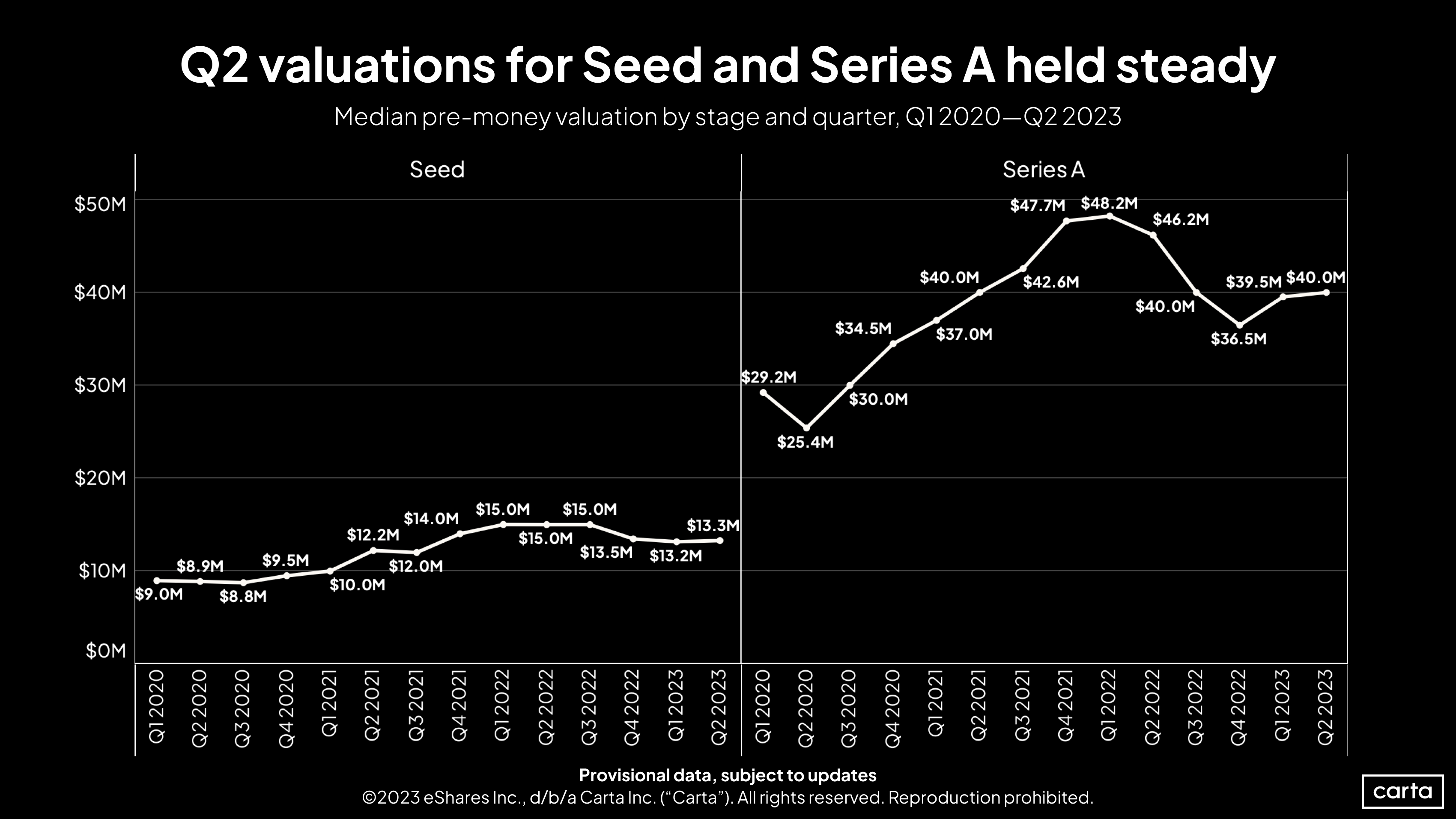

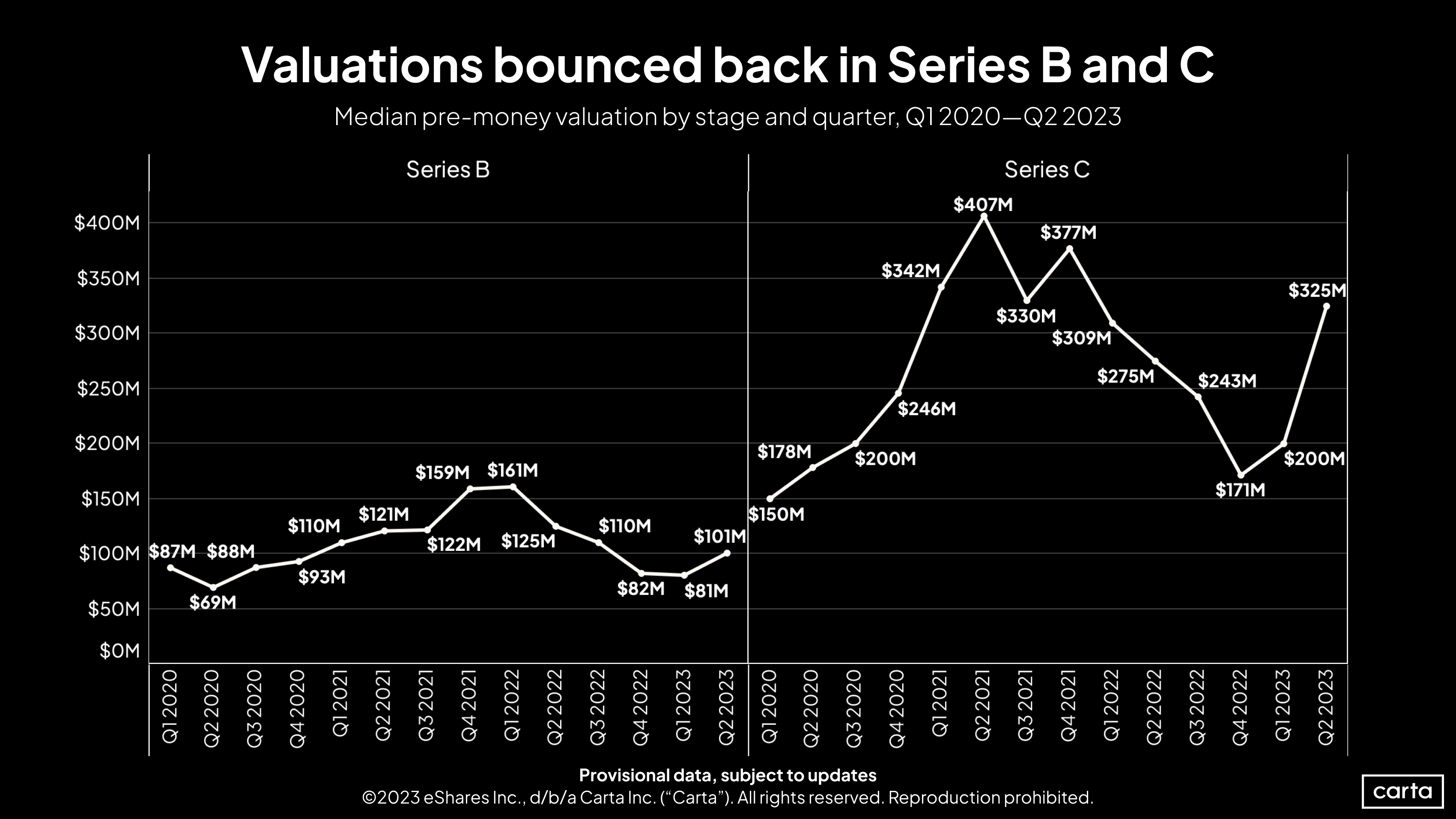

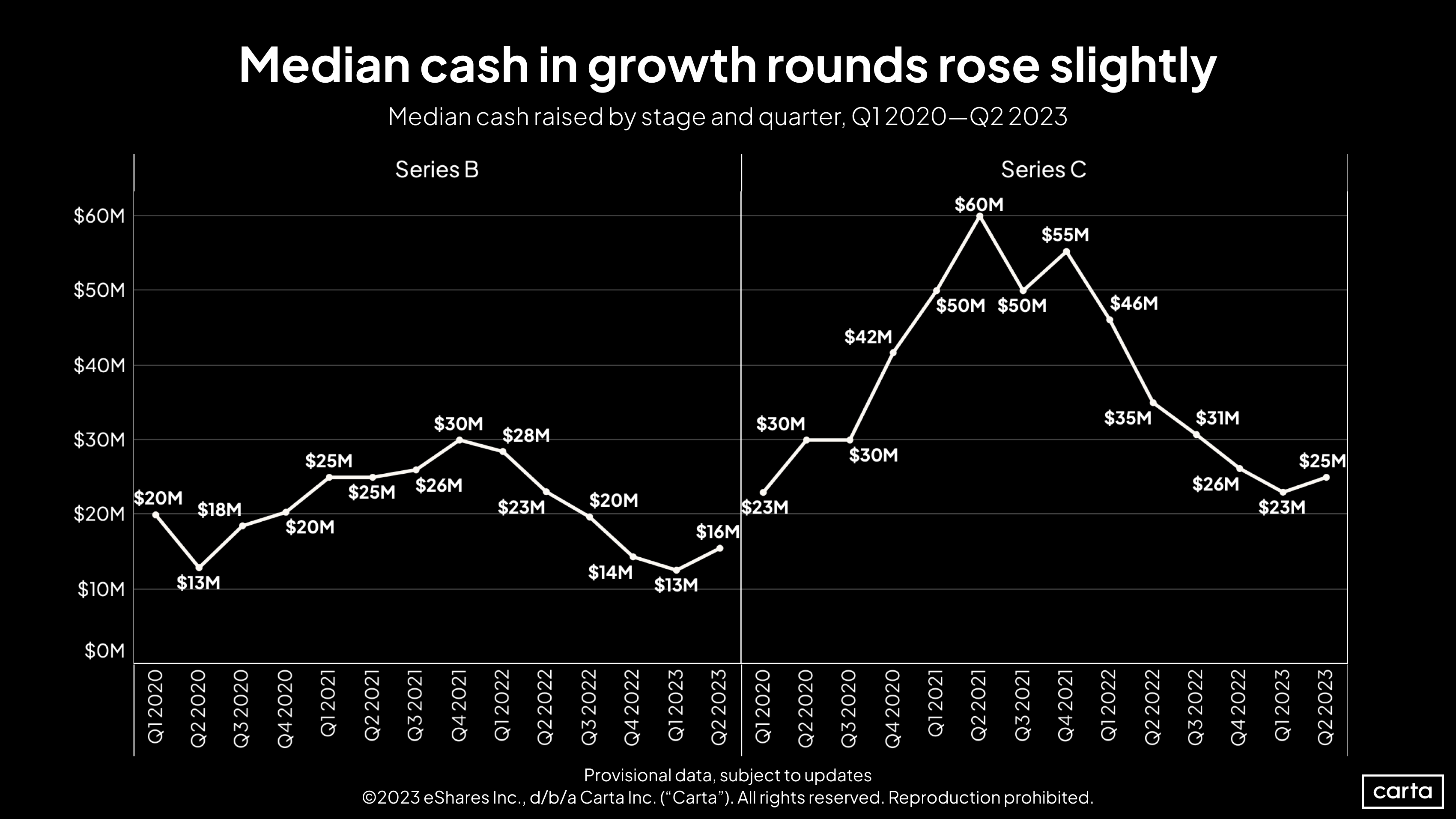

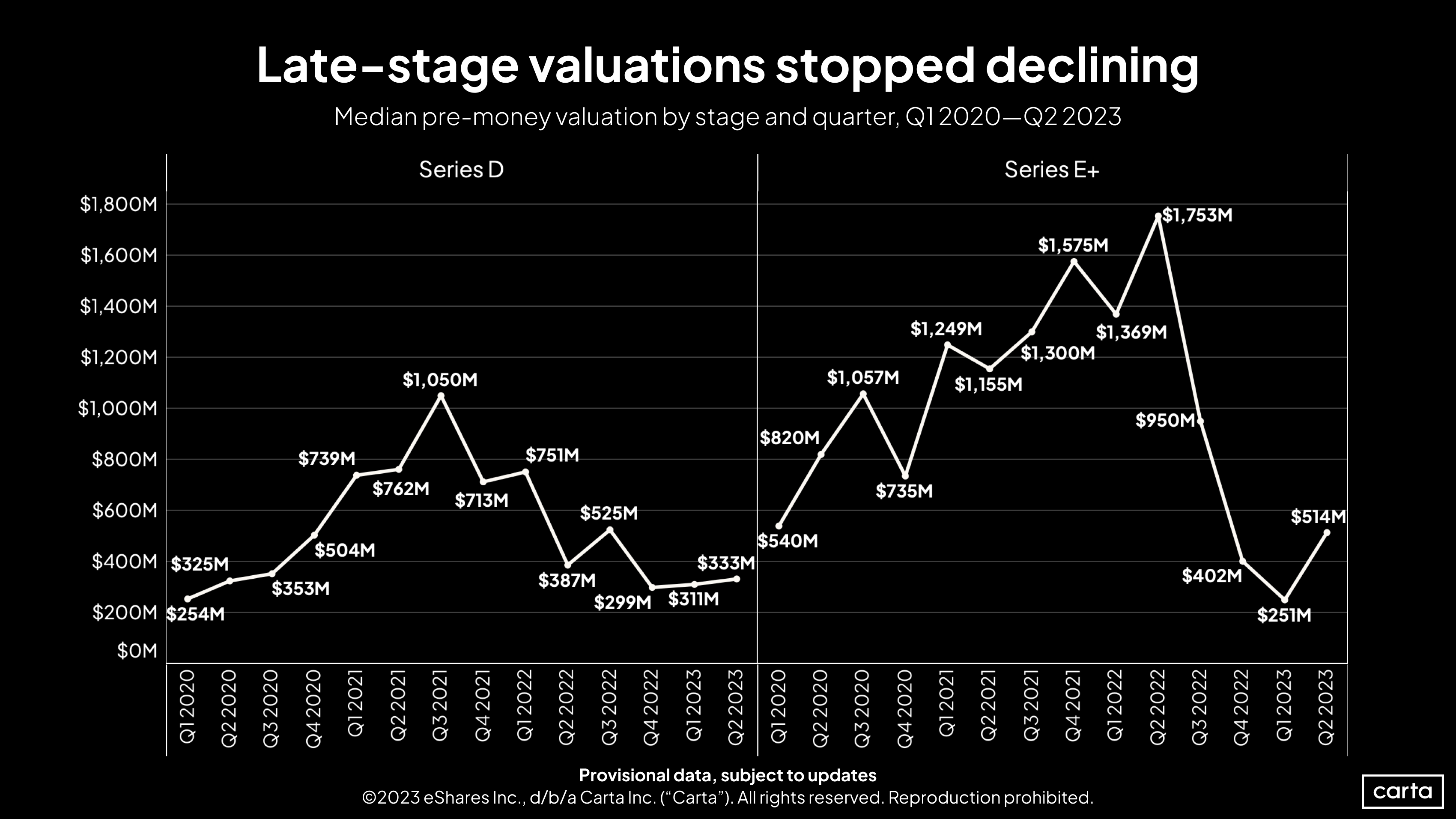

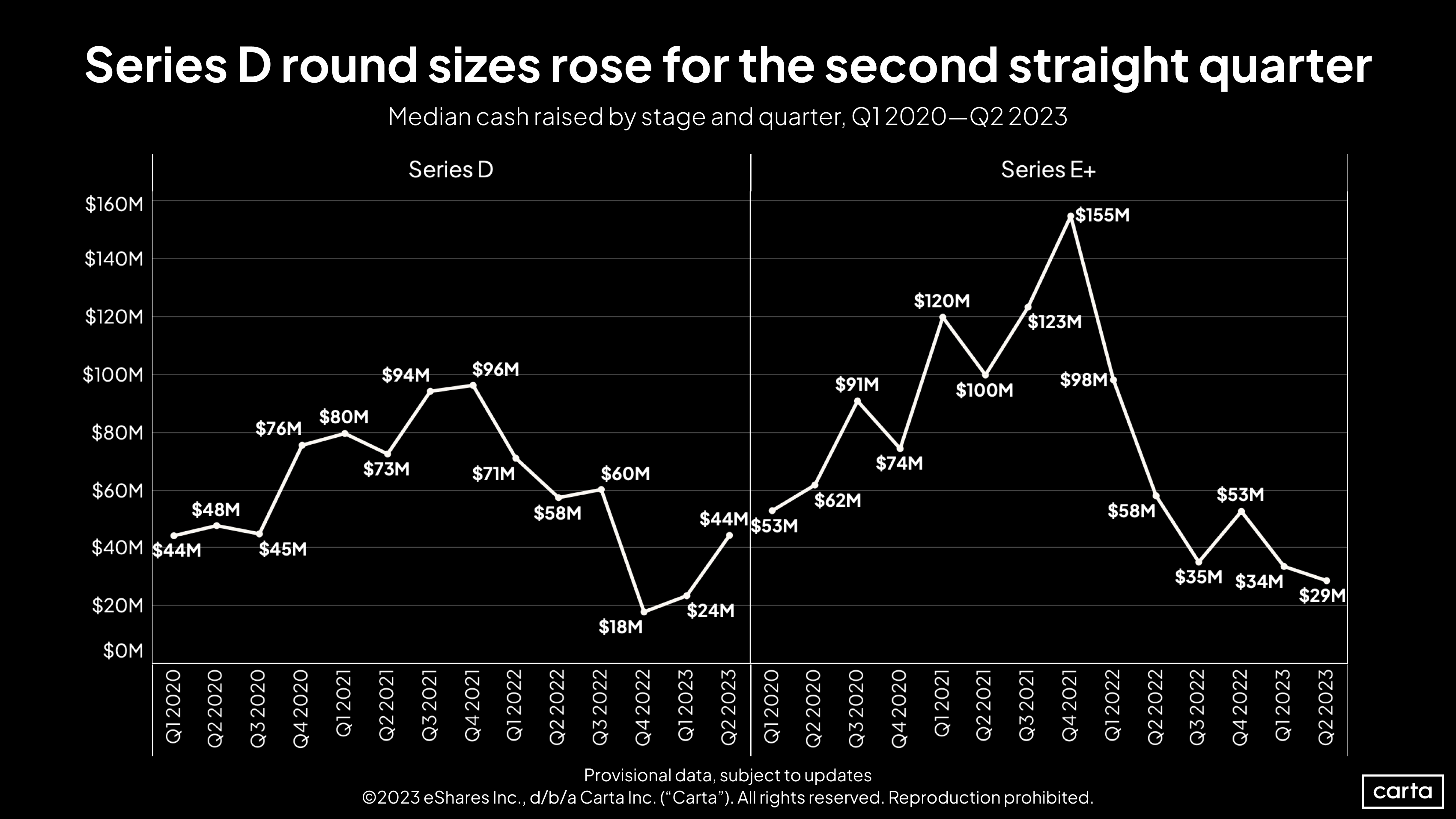

Across all funding stages, Q2 valuations came in above those of Q1. Series B and C in particular saw substantial gains over recent lows in median pre-money valuations. Median round sizes saw more muted increases across the venture ecosystem. Although the final numbers on total rounds and capital raised are not yet available for Q2, they are almost certain to come in above Q1 on both counts.

We’ll publish our full set of quarterly data in the coming weeks. To receive the full report direct to your inbox, sign up for our Data Minute newsletter.

To see the data below split into primary and bridge round figures, download the first cut addendum.

Seed & Series A

Series B & Series C

Series D & Series E+

More detailed data

To see the data above segmented into primary and bridge-round figures, download the addendum: