Often, the earliest stage startups raise money through convertible notes and SAFEs. But Dapple Security, a cybersecurity company building a biometric solution to replace passwords for small and medium-sized businesses, recently raised a priced pre-seed round.

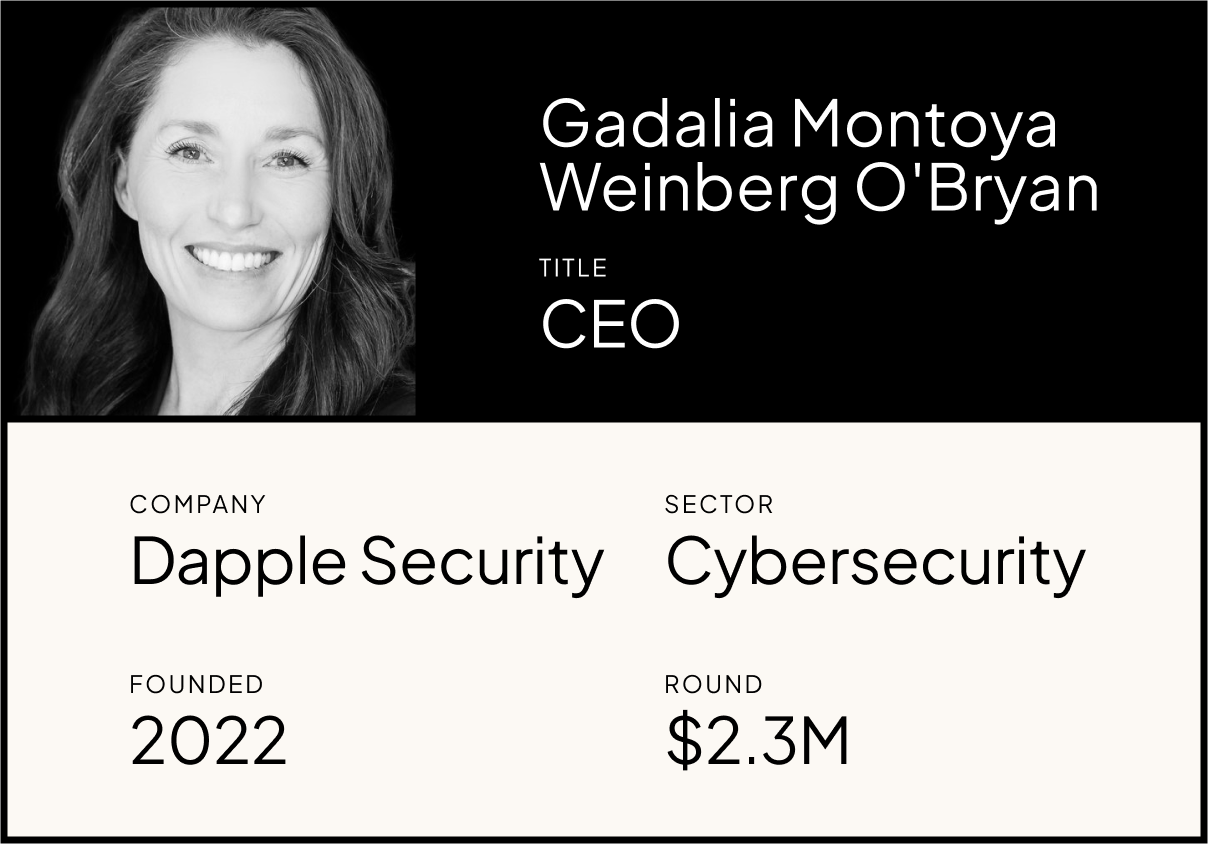

The $2.3 million funding was led by First In, and included ex/ante, Access Ventures, and Techstars. The priced round followed a series of convertible notes Dapple raised last spring.

The Denver-based company was founded in 2022 by Gadalia Montoya Weinberg O’Bryan, who previously spent nearly a decade at the National Security Agency as a crypto-mathematician.

Dapple was named a “ cybersecurity company to watch” in 2023 by CSO, which said the company “prevents phishing and related attacks that rely on stolen credentials” and “offers the ability to securely log into systems without storing sensitive identity data.”

We sat down with O’Bryan to talk about communicating your vision to investors, raising money as a pre-revenue and pre-product company, and options for deal structures at the pre-seed stage.

This conversation is part of Fundraising Files, an interview series with startup founders and operators, diving into how they raise money and build companies.

Highlights

-

Convertible notes vs priced rounds at the pre-seed stage

-

The right founder/investor relationship beyond the check

-

Honing your elevator pitch

-

What you need to close a round pre-product in this market

CARTA: What was it like raising a pre-seed round in the current environment?

GADALIA O’BRYAN: We ended up doing it in two phases. We're a really young company, so last year raising money was definitely a matter of survival. And so we raised about $500K on convertible instruments in the spring and summer. And that was great because it gave us enough runway to do our customer discovery, land our first design partner, start product development, get the initial team in place, and say okay, we're a real company now.

And then we could go and raise the real money, which is what we did through a fixed-price pre-seed round that closed in December. I think having the ability to do it in those two stages was really important because the first one was necessary for survival, but we weren't yet at a place where we could have gone out to seek the larger amount of money. And in the market right now, gone are the days when you can just raise a ton of money on a PowerPoint, so we sort of had to have that phased approach.

>> Download our free exclusive report on pre-seed fundraising trends.

That’s interesting that you raised a priced pre-seed round, since often seed or Series A will be a startup’s first priced round, with convertible instruments before that. Tell us about that decision between convertible notes and a priced round.

That was definitely a major thing we had to figure out. Initially we were going to raise the pre-seed round as another convertible note, a SAFE, with just a higher valuation than we had done the first time around. And it wasn't until we identified our lead investor and they brought up a priced round that we switched gears. They had two major reasons for this preference: the first was starting the QSBS clock for their LPs, and the second was establishing a more formal partnership between lead investor and founder through a priced round.

It was definitely harder in some ways: It took much longer to close and was more expensive from a legal and paperwork perspective. But now I'm very glad that we were able to do that because now I see how those convertible instruments convert. The idea of stacking multiple rounds of SAFEs on top of each other—it can get tricky.

Before this experience, I understood from a theoretical standpoint the dilutive impact of those instrument conversions, but until you actually see it happen it is hard to 100% wrap your head around that impact. I think a lot of founders end up in a situation where you have these convertible instruments that end up stacking up, and it can catch up to you before you know it. Cap table and dilution math gets harder when convertibles with different valuations stack on top of each other, and tracking the impact of associated rights like pro-rata rights or Most Favored Nation clauses that some investors have and some may not gets increasingly complicated. All of this leaves founders open to surprises when a priced round finally does occur and the instruments convert. So now I'm very glad that everything is converted and we have a nice clean cap table.

Download a free cap table template from Carta

You raised funding before you had any revenue and before you had a product. Tell us about the pitch: How did you put it together, and what made the difference?

I think back to the initial investor conversations I had when I first started working on the idea, and I’m almost embarrassed to reflect on some of those, because I was all over the place. It took me 20 minutes to get to the point.

But it was valuable for me to have some of those initial conversations before I was actively raising, because it was almost like a dry run—practice when it didn't matter. And repetition is just priceless. So whether it's because you've set up sort of investor calls before you're raising, or whether you're doing it with mentors, friends, even family members, I think having tons of repetition to hone that message is key.

We also went through the Boulder Techstars accelerator program in the fall, right before our raise. And part of that program is mentor-founder matchmaking, where you do a whole week of meetings. My co-founder and I met with about 70 different potential mentors, in 10- to 20-minute conversations, so we had to be really concise.

I realized coming out of that week, which was exhausting, that not only did we have some great mentors at the end of it, but we also had 70 practice conversations, and that was invaluable.

And then there were a couple of things that ended up being important for closing a round in this market. I can talk about that?

Yes, please.

So in this market, you can’t raise on a PowerPoint or a sketch on a piece of paper. In general, I think what investors are looking for has shifted down a round, so what used to be the bar for Series A is now at seed. And then what might have been good at seed, you now need at pre-seed.

Although everything shifted down a round, we were able to raise money being pre-product and pre-revenue, which I think is not always the case in this market. Some things were really important for being able to do that.

First, even though you can't raise money on just a story, the story is so important. Being able to communicate your vision and the market into a compelling bedtime story makes all the difference.

And founder-market fit is even more important in this fundraising market. And so not only who you are as a founder and your credibility, but also how well you understand your market and how your experience gives you an advantage and understanding of the market. Why are you the one team that's going to pull this off? I think that has become even more important. Versus "oh, that's a great idea, great product." But the “who” of it has become increasingly important in this market.

And then the last piece that I think was really important in our storytelling was the “why now.” Why now and not five years ago or five years from now? Why is this the right time for it? We're not an AI company, but for some people, I think that could be the why-now story. However, AI does have an impact on our industry, and phishing attacks in particular. So that occurring in the market starts to make that pressure clearer as to why this is important right now.

It can be difficult for early stage companies to get connected to investors. Both for those initial convertible notes, and later for the priced round, how did you approach getting introductions and getting connected to potential investors? What was that process like?

That’s a really relevant question, which I think isn't talked about enough. There's so much information out there around how to talk to investors and how to close your fundraising process, and that’s all very useful. But especially for me, not coming from a network or family of high-net-worth individuals or investors, it wasn't automatically clear to me how to even start.

In retrospect, it all came from my professional network that I really started putting energy into building two or three years ago. And at the time, I don't think that I knew exactly what the culmination of that would be. But I just remember thinking, “If I want to be a founder, I'm gonna start having to build these connections.”

I started with local connections, and I'm lucky enough that there's a very vibrant startup community in Denver. And then you get introductions outside of the local area from those initial people. And in the end, when I look at all of the investors who participated in both of those stages, they really did come from that personal network that I’d grown completely from scratch. Every founder's journey to closing a round is probably different. But for me, this network was definitely what made it.

I'll add to that that I was lucky enough that I really didn't do any outbound, cold investor outreach. It all came from sort of this organic either inbound because they had seen some local coverage or a podcast or something on LinkedIn, or warm intros from someone who was already in my network. I don't know, when it comes time to raise our next round, if that will continue to be the case or not. But I do hear from everyone that warm intros are golden and that absolutely was true for us.

Let’s talk about the lead investor relationship. Your lead was First In, a firm that focuses on cybersecurity—was that an important part of the decision to work with them? How were conversations with them different from those with more generalist investors?

It ended up being vital that we had investors who are in cybersecurity and privacy. Because both our technology and the market landscape for these kinds of products is really complex. With generalist investors, even when they were really interested, I found myself having to do more education and it was harder for them to reach conviction, because they didn't come from that background of understanding the problem set, understanding the competitors in the landscape, and understanding what approaches other cyber companies had taken to being successful.

So having investors who knew the privacy space and the cybersecurity space was really important. But it's also great to just have them as supporters. Obviously, I'm extremely grateful for the money, but I'm also extremely happy with the group that came together, in terms of the vision and the strategy, and just the operational support that they can bring to us because they come from that world.

Beyond the check, what were the things you were looking for in an ideal investor relationship? What support were you looking for?

We were lucky enough to have our round end up being pretty competitive, and so I actually did have the opportunity to kind of choose who we wanted to be involved. It was really important that they share a common vision and mission set. Not just around security but around valuing privacy for biometric information, and around us as a team and how we're building our culture. So having that mission alignment with our investors felt really nice.

One thing in particular that our lead First In brought to the table is an advisory network who can help us with things like establishing sales channels. And since we're going after the SMB market, channels are going to be really important, because we're going to have more of those in order to scale revenue. You can't just rely on a few bigger contracts. We'd already hit it off with First In, but then little details like that would come out and we’re like, “This is just perfect, you can help us with exactly some of the pieces that we are really going to need help with.” And thinking about me as a founder and an operator, I reflected on what are my strengths and what are my deficiencies? And finding a great investing team is about finding where they can help fill some of those deficiencies.