In 2008, Atlanta was an unlikely place to base your new startup. But Lynne Laube and her co-founders saw potential. After considering the city’s proximity to tech talent and its attractive cost of living, they decided Atlanta was the perfect home for their fledgling fintech company, called Cardlytics.

Sixteen years later, it looks like a wise choice. Cardlytics is a publicly traded company on the Nasdaq with a market cap of more than $300 million. Laube stepped down from her role as CEO in 2022. But she’s still immersed in Atlanta’s startup scene—which, in recent years, has found itself at the center of a geographic shift in the way venture capital is distributed across the U.S.

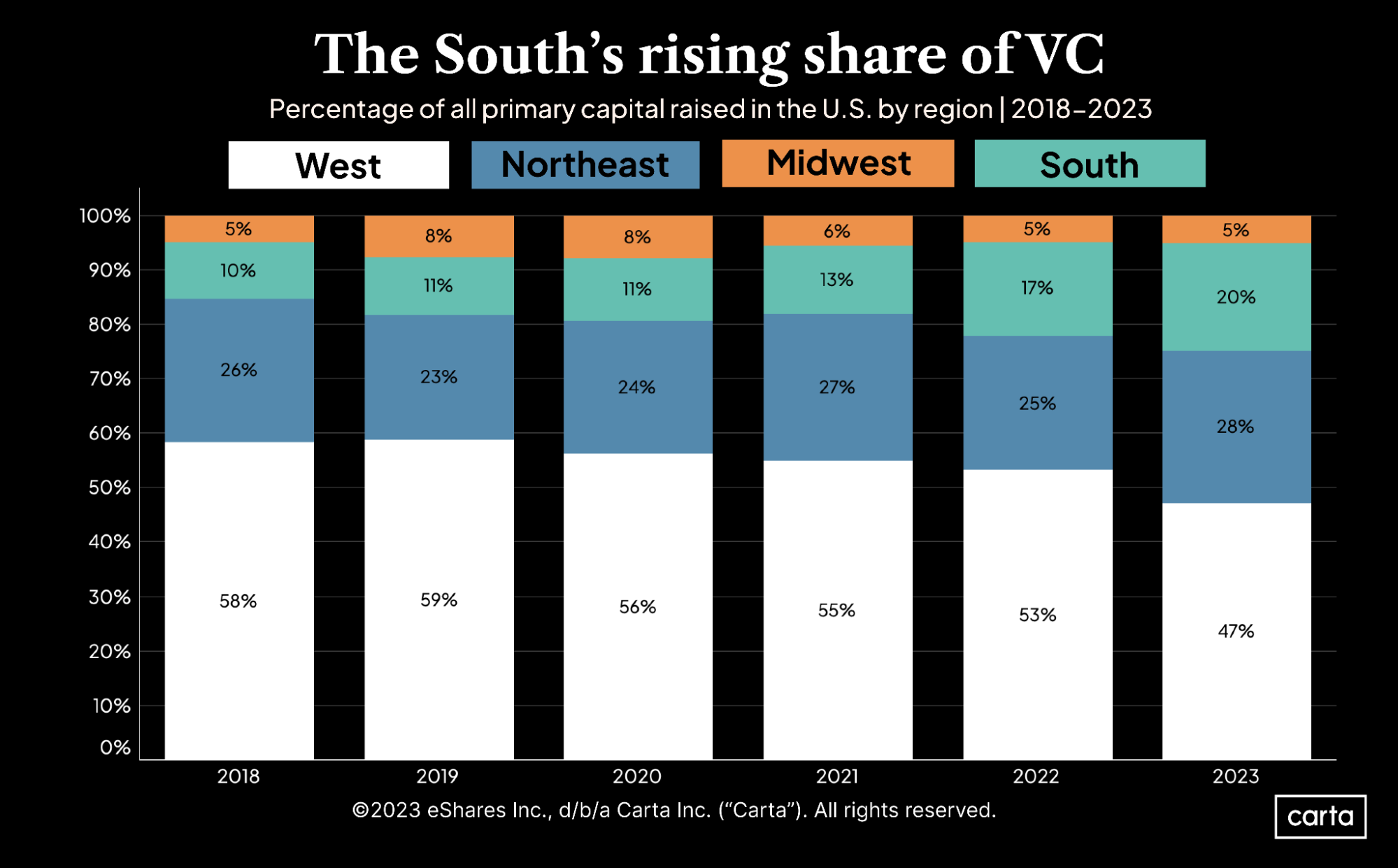

Laube now works on the other side of the dealmaking table as an operating partner at Valor Ventures, an Atlanta-based VC firm focused on seed investments. From that new perch, she’s watching the South transform from a VC afterthought into a buzzing hub of activity for tech founders and investors. Through the end of September, Southern startups had raised 20% of all venture capital on Carta in 2023, up from 11% as recently as 2020. It’s the nation’s fastest-growing region for startup activity.

Read more: Rising salaries in 2023 help raise the appeal of some smaller startup hubs

“In the early days, we were truly one of the only startups [in Atlanta],” Laube says. “It was a language people did not understand. And that has changed dramatically in 15 years.”

The demographics behind the South’s ascent

The U.S. Census divides the country into four primary regions: West, Midwest, South, and Northeast. The South is by far the biggest, with 128,716,192 residents as of 2022. The second-largest region is the West, with a population of 78,743,364—about 50 million fewer people.

The South is also the fastest-growing of the four regions. About 2.2 million people moved into the South between 2020 and 2022, accounting for about 1.8% population growth. Meanwhile, the populations of the Northeast and Midwest both got smaller, and the West grew by 92,000 people, or about one-tenth of 1%.

This growing population is packing an economic punch. In 2022 , the six Southern states of Florida, Texas, Georgia, Tennessee, North Carolina, and South Carolina had a higher share of U.S. GDP than the entire Northeast, an inversion of historical trends.

Yet the South still lags well behind the Northeast and the West in terms of venture dollars. For investors, these three variables—the South’s population, its ongoing growth, and the VC gap that still exists between it and the coasts—make for a tantalizing combination. On a per capita basis, the South still has plenty of room to grow.

“There’s as much talent in the South as anywhere else,” Laube says. “There’s just a lot less money.”

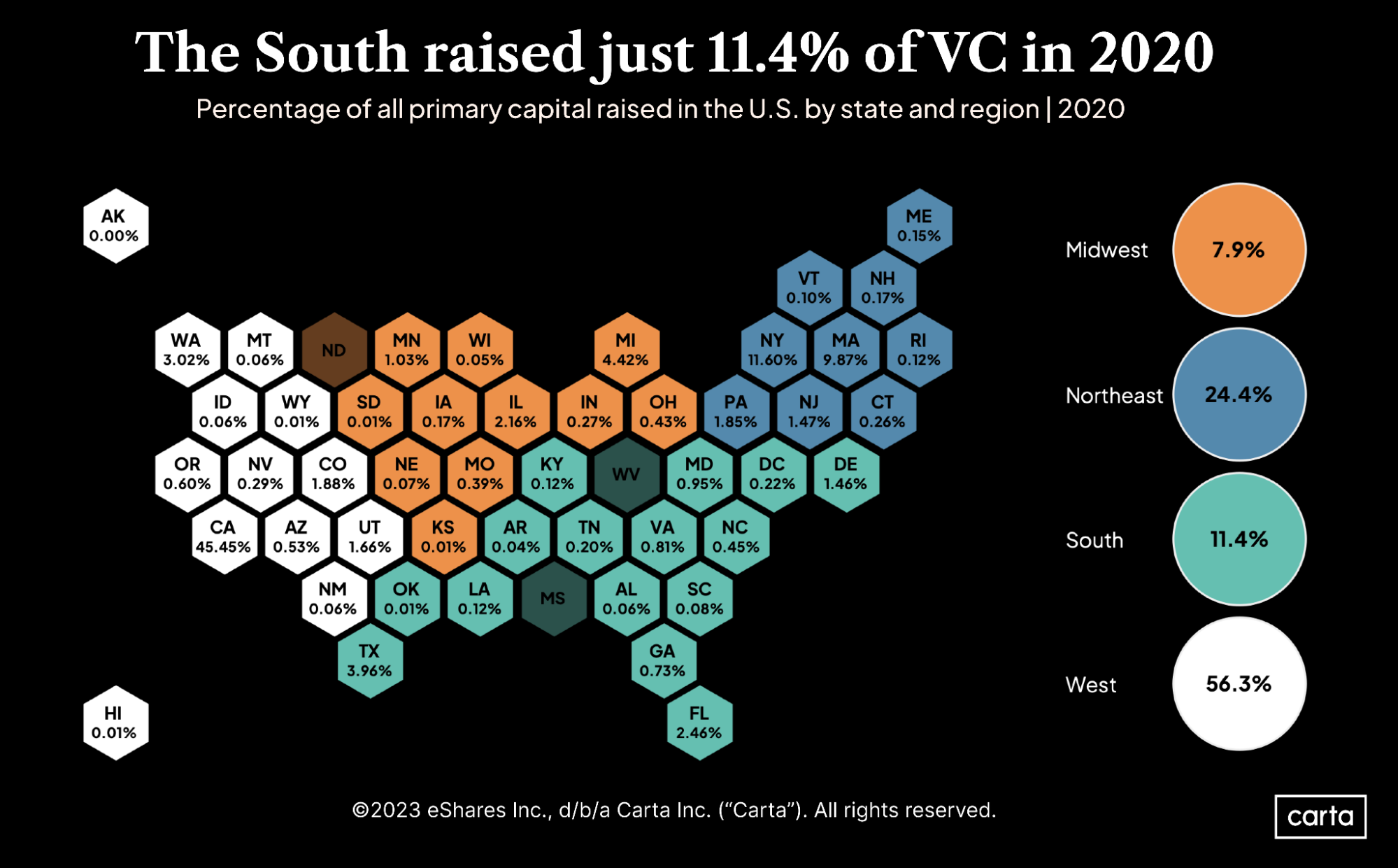

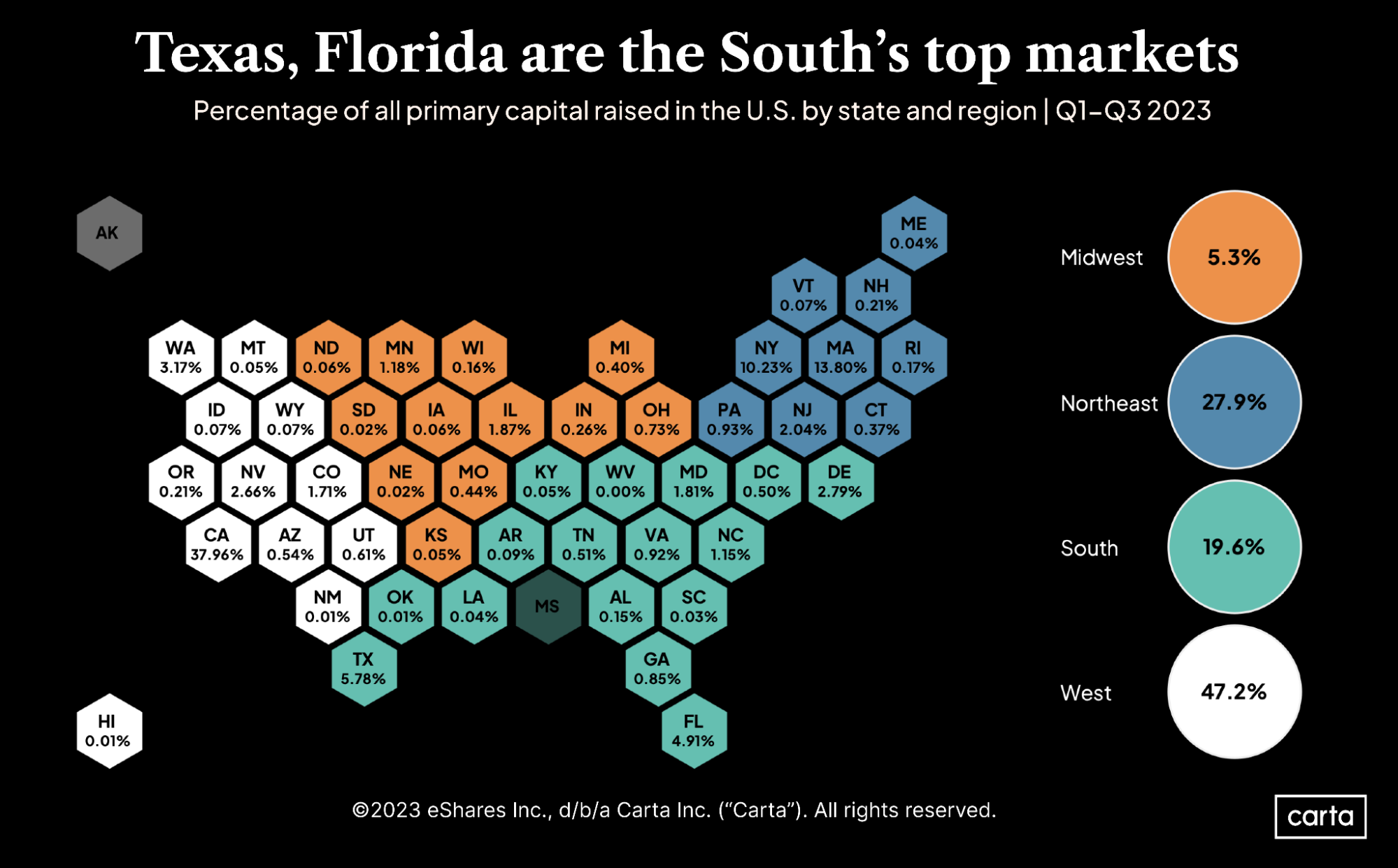

The charts below show how various states across the South have assumed a growing role in VC over the past four years.

2020

2023

Southern VCs on a shifting scene

Santosh Sankar has been part of the Southern venture ecosystem since 2016, when he co-founded Dynamo Ventures, a Chattanooga-based firm that makes seed and pre-seed investments in supply chain and transportation startups. Even on that shorter timeline, the change has been remarkable.

“We have really seen an ecosystem emerge that in 2016 didn’t exist, quite frankly,” Sankar says.

Sankar thinks this emergence is due to a confluence of factors. One is that companies like Cardlytics have begun to establish a track record for success, which has in turn caused investors to pay more attention to the South. And when they pay more attention, Sankar says, they tend to like what they see.

”There’s more interest from outside capital providers,” Sankar says. "It was a realization that there are places in the U.S. other than San Francisco, Boston, and New York where you can find really interesting, smart people with ambition who can build large, meaningful businesses.”

Another reason for the South’s surge is that the region is home to established corporations and industries that, in recent years, have begun to look ripe for digital transformations. Dynamo’s focus on freight and supply chains is one example. The firm’s headquarters in Chattanooga are less than 350 miles away from FedEx headquarters in Memphis, less than 125 miles away from UPS in Atlanta, and within driving distance of several other major shipping and freight companies.

Lisa Calhoun is the founding managing partner of Valor Ventures, where Laube now works. Some geographic regions are closely associated with one or two specific industries, such as California with tech, New York with financial services, and Boston with biotech. But Calhoun says that’s not the case in the South. Rather, she thinks the region’s strength is in the sheer number of industries that have some sort of major Southern footprint.

“There’s not a list of the top three things—there are dozens of things,” Calhoun says. “We have infrastructure, logistics, automobile manufacturing, carpet production, airlines … there’s healthcare, there’s transportation, there’s agriculture. If you look at a map of Fortune 500 corporate headquarters, 33% of them are headquartered in the South. That's more than any other census region."

For VCs and founders, these large, established companies nearby can be both potential clients and sources of talent.

But the South certainly isn’t an established hotbed for every industry. When it comes to many kinds of tech and software, Calhoun says that California is still king, and convincing a talented developer to move from the Bay Area to the South can be difficult. But things are changing: Southern startups are more capable than ever of competing for talent from other regions.

“Hybrid and remote work are more acceptable now,” Calhoun says. “So for that incredible person that couldn't move South because of their deep coastal attachment—well, now they can work for startups in the South.”

Building the pipeline of founders and funders

The proliferation of startup investment in the South is not limited to one or two metro areas. Sankar and Calhoun highlighted Atlanta, Miami, and Austin as three of the biggest markets. But the list goes on: Nashville, San Antonio, Washington, D.C., and the Research Triangle in North Carolina are emerging centers of VC activity. In some ways, these cities are all different startup markets. In other ways, they’re all part of one larger Southern ecosystem, one where a rising tide of investor interest and tech talent can help lift all boats.

“What’s happening among VCs and startups in the South is not so much competition as cooperation, which is very Southern,” Calhoun says. “And it’s creating a lifting mentality around regional innovation that is a joy to be a part of.”

Every startup ecosystem needs capital, particularly seed and pre-seed capital to help first-time entrepreneurs get up and running. In established markets like San Francisco and Boston, some of the best sources for this early-stage funding are former founders and employees who achieved an exit and have decided to invest some of their profits in other startups.

Historically, these sorts of people have been few and far between in the South. But as more companies go public or are acquired, the number of these potential angel investors grows.

Laube says that her favorite part of Cardlytics’ success is watching what her former colleagues and employees choose to do next.

“I know we created a lot of wealthy people in Atlanta. Many of them are now working for local startups, some of them are working for funds, and some of them are coaching local startups like I am doing,” Laube says. “Money follows talent. And that’s what we’re seeing happen.”

Get the latest data

For weekly insights into Carta's unparalleled data on the private markets, sign up for Carta’s Data Minute weekly newsletter: