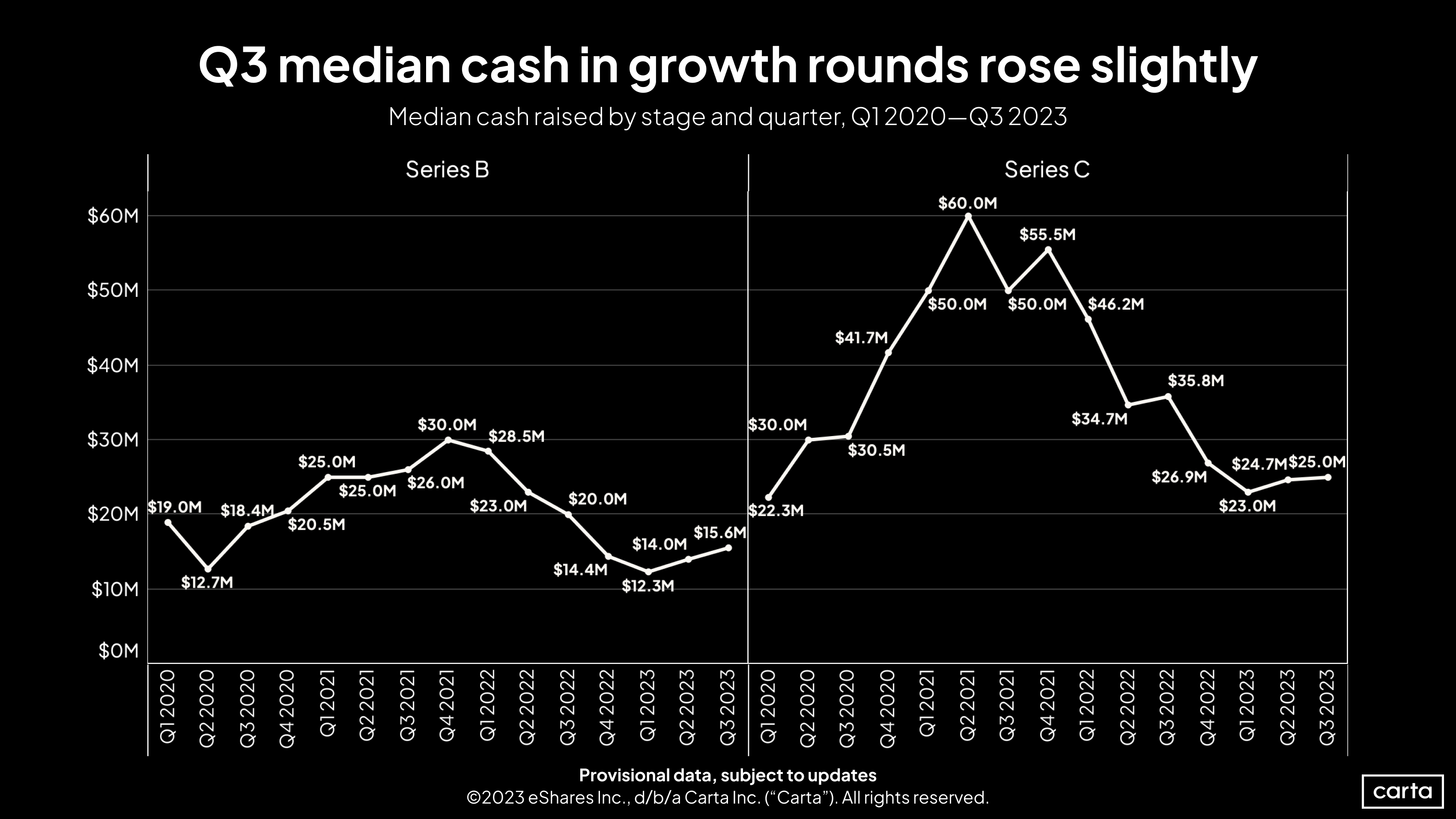

Between Q4 2021 and Q1 2023, the median Series B round size on Carta fell from $30 million to $12.3 million. Over the same span, the median Series C round shrunk from $55.5 million to $23 million. These twin 59% plunges were a clear demonstration of how the fundraising market shifted during the recent venture downturn.

In the past two quarters, however, the market has shifted again.

The median round size on Carta at both Series B and Series C has now increased for two consecutive quarters, according to initial data from Q3. The median Series B climbed to $15.6 million last quarter, while the median Series C reached $25 million.

These are relatively slight increases—the median Series B is down 48% compared to Q4 2021, and the median Series C is down 55%. Still, if this trend holds when the final figures come in, it will be the first time since Q4 2020 and Q1 2021 that both stages have seen median deal size increase in consecutive quarters.

In much of the startup funding market, the past two years have been a period of distinct highs and lows. These two middle stages of the venture life cycle are no exception. At both Series B and Series C, most of 2020 and 2021 were periods of rapid growth, with median round size increasing by over 125% in less than two years. Meanwhile, the median Series B valuation more than doubled, and the median Series C valuation nearly tripled.

All that expansion was followed in 2022 and 2023 by substantial contraction. By Q1 2023, the median Series B round size was lower than at any point in the past four years. The median Series C that quarter was the second-lowest it’s been since the start of 2020.

It appears now that this volatility at these middle stages may be calming down. The median Series B round size grew by 11% in Q3, marking the smallest amount of quarterly movement since Q1 2022. The median Series C got just 1% bigger, resulting in its least volatile quarter of the 2020s.

Trends in venture round size can change quickly—you need only look at the past few years for proof of that. But in Q2 and Q3, the market’s recent swings at Series B and Series C have given way to some stability.

Get the latest data

We’ll release full Q3 data on valuations, round sizes, and other private market metrics in the coming weeks. To stay in the know, sign up for Carta’s Data Minute weekly newsletter: