Distributions are key milestones for members of limited liability companies (LLCs) and should be cause for celebration—especially when they are triggered by events like the profitable sale of the company or the achievement of financial success metrics.

But for many executives, founding partners, and finance and accounting teams, calculating these distributions is a major headache. These executives are responsible for keeping track of who must be paid, how much, and when—and then notifying dozens or even hundreds of members of the varying payments they’re receiving.

When your company’s investments and preferred returns are tracked in old-fashioned Excel spreadsheets, the threat of math glitches is a constant worry. Nothing ruins a distribution like inaccurate payments sent out to holders, resulting in a painful, costly, and time-consuming cleanup effort. What should be a great investor experience turns out to be a poor one.

A better way to handle LLC distributions

Imagine a tool that could automate all distributions tasks for LLCs—the tracking, the calculating, the notifying—and let administrators rest easy in the knowledge that it’s all accurate.

Imagine no more individual calls from dozens or hundreds of members, wanting to know their current holdings, the status of upcoming distributions, or their prior distributions history. Instead, you can direct them to an easy-to-use dashboard that answers all their questions.

>> Learn more about building an equity plan for your LLC

At Carta, our mission is to make it easier for you to operate your companies. That’s why we’ve made the above scenario a reality.

Today we’re proud to announce our new LLC Distributions tool that will eliminate the wasted time and frayed nerves that have plagued distributions for too long.

What you can do with LLC Distributions

LLC Distributions is a whole new way to do distributions. Skip the spreadsheets, the formulas, the dozens of files, and the hours of worry.

With LLC Distributions, you can:

-

Seamlessly connect to your cap table and customized distribution rules

-

Automate calculations to determine holder payouts

-

Integrate distributions with waterfall modeling

-

Notify all holders of their individual distributions information, with the click of a button

-

Direct holders to a dashboard that tracks their invested capital and any preferred returns that have been paid out to date

How LLC Distributions works, step-by-step

With our new LLC Distributions tool, you can accomplish in a few simple steps what used to eat up days or weeks of your time—without the worry of getting it wrong.

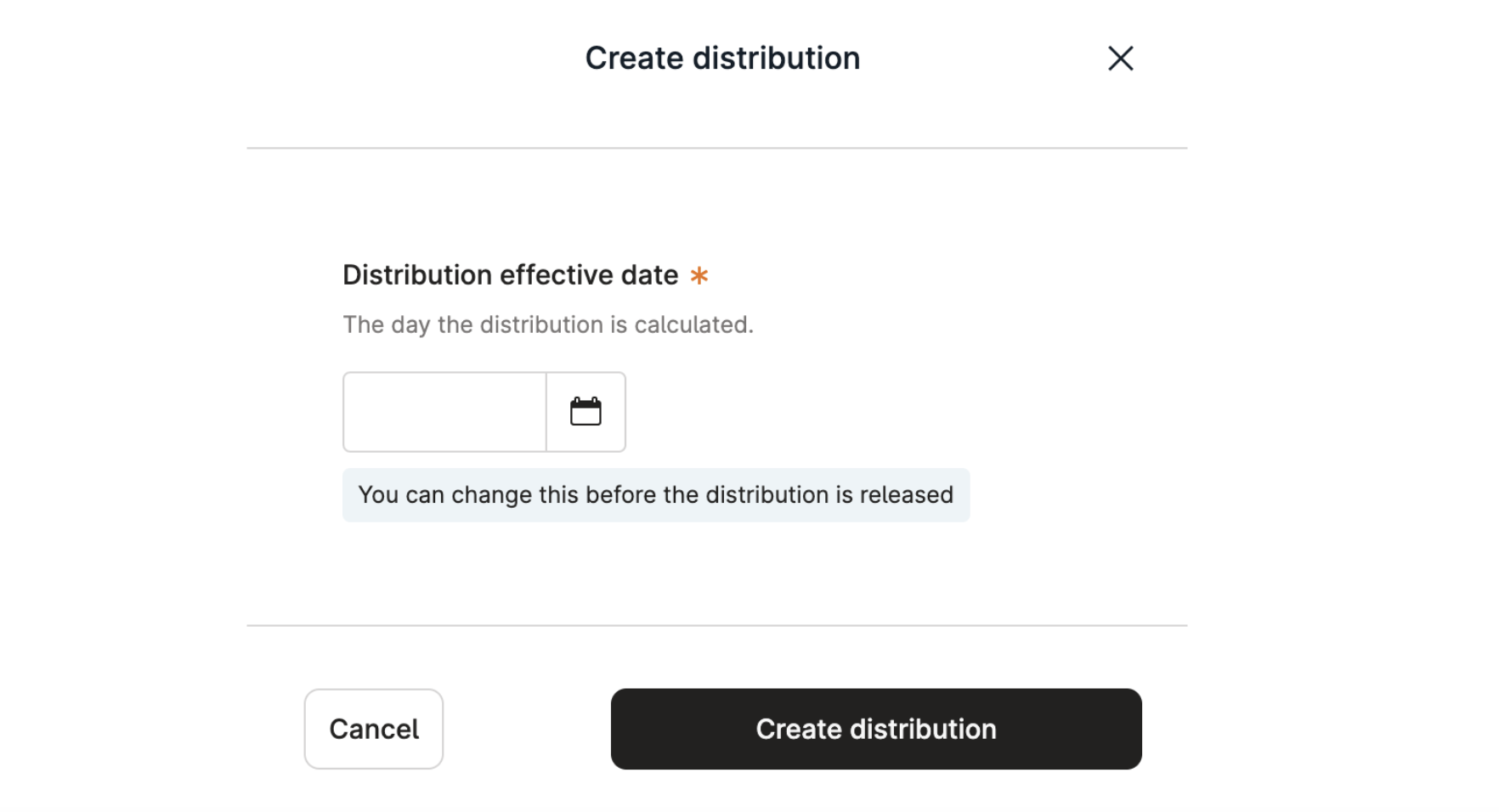

1. Create a distribution

Open up our LLC Distribution tool and create a distribution with the effective date and the amount of the distribution. This new distribution will link automatically to the cap table.

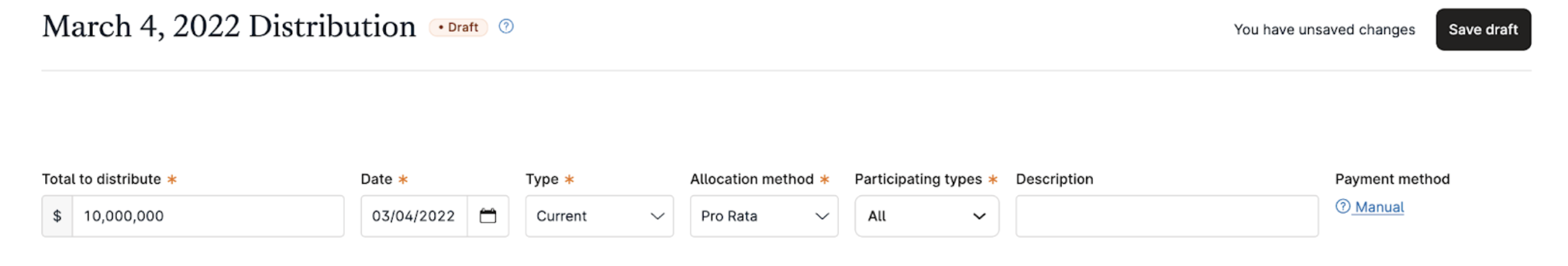

2. Select the distribution type and allocation method

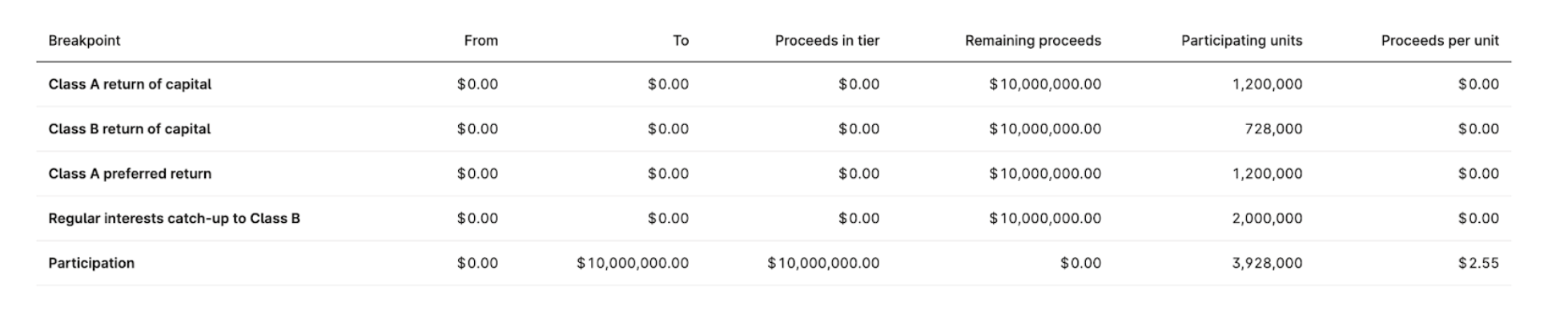

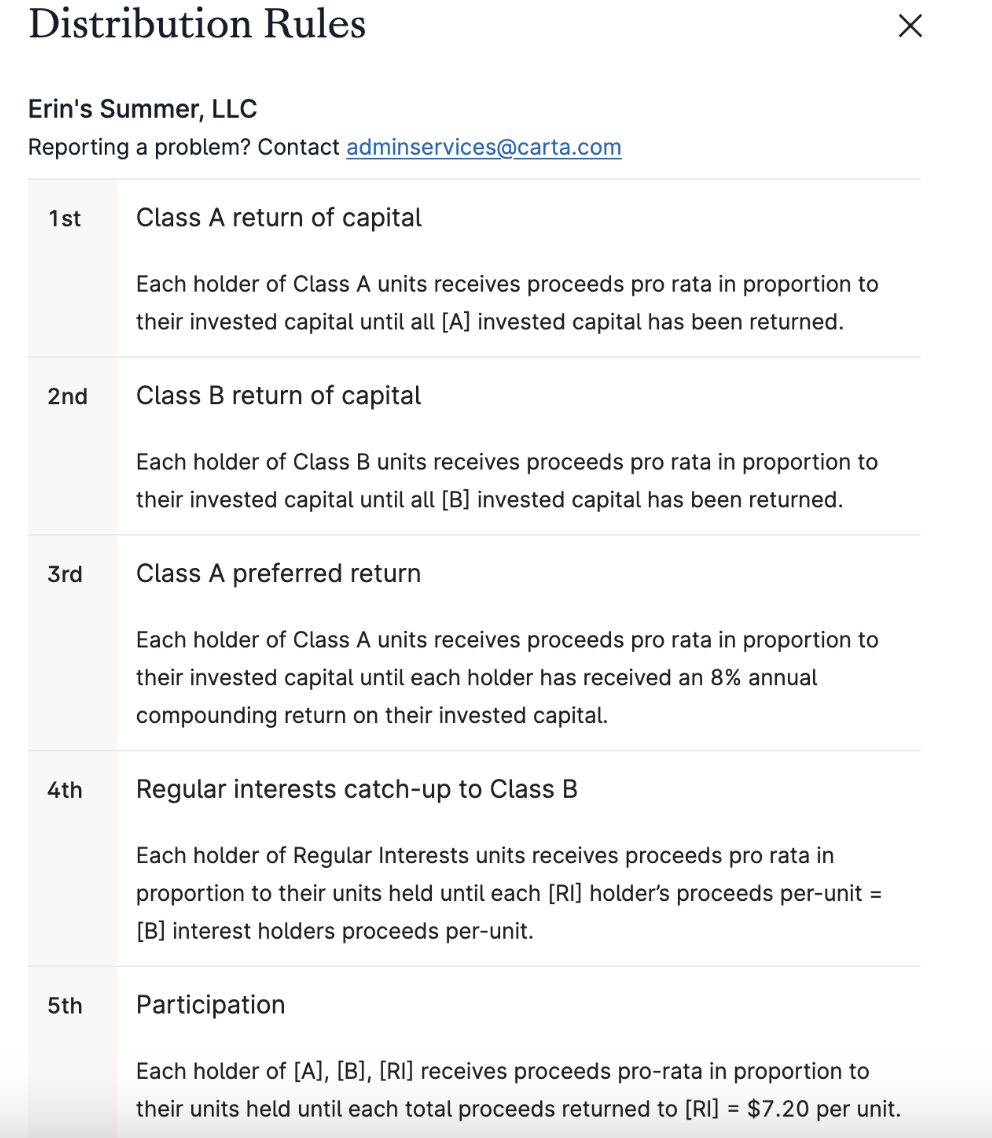

Select what type of distribution it is—current/profit, tax, or sale—depending on what’s triggering the distribution. Then, choose the allocation method—a simple pro rata, a more complex waterfall scenario, or a custom scenario (i.e. one-off calculation to a single holder).

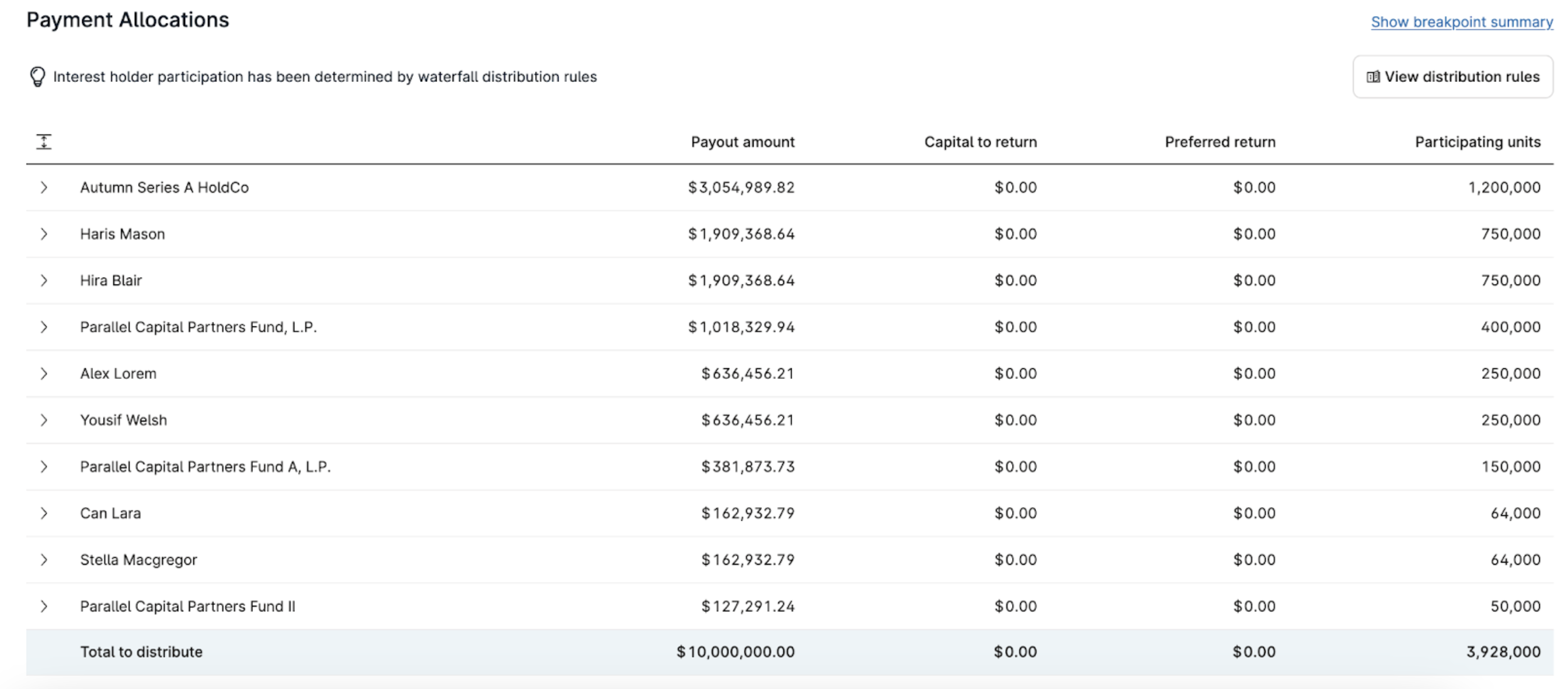

3. Review the allocations

Review the payment allocations across all the interest classes that the system has auto-generated using both the cap table data and any available custom waterfall rules encoded into our platform.

4. Save and finish

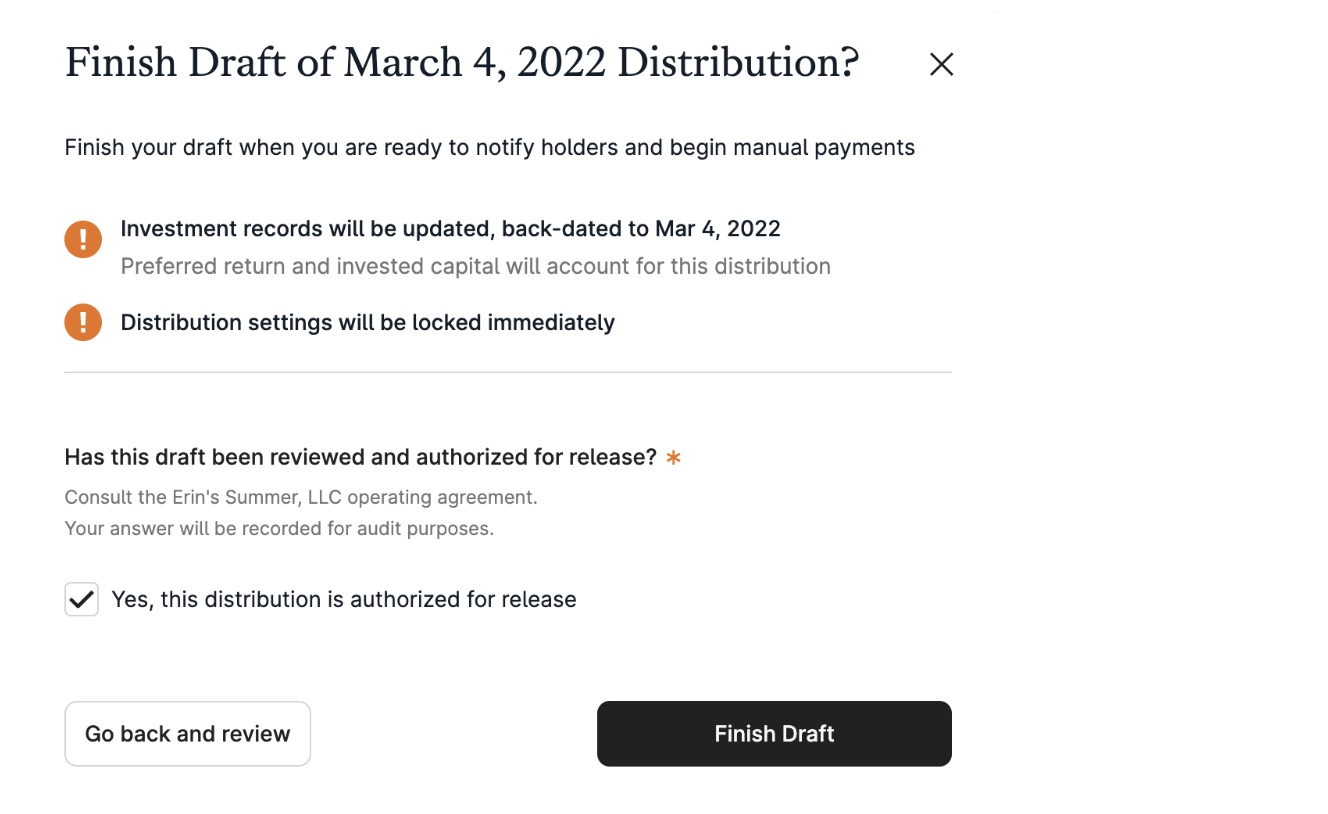

Once all the payment allocations are confirmed, save and finish your draft distribution for release.

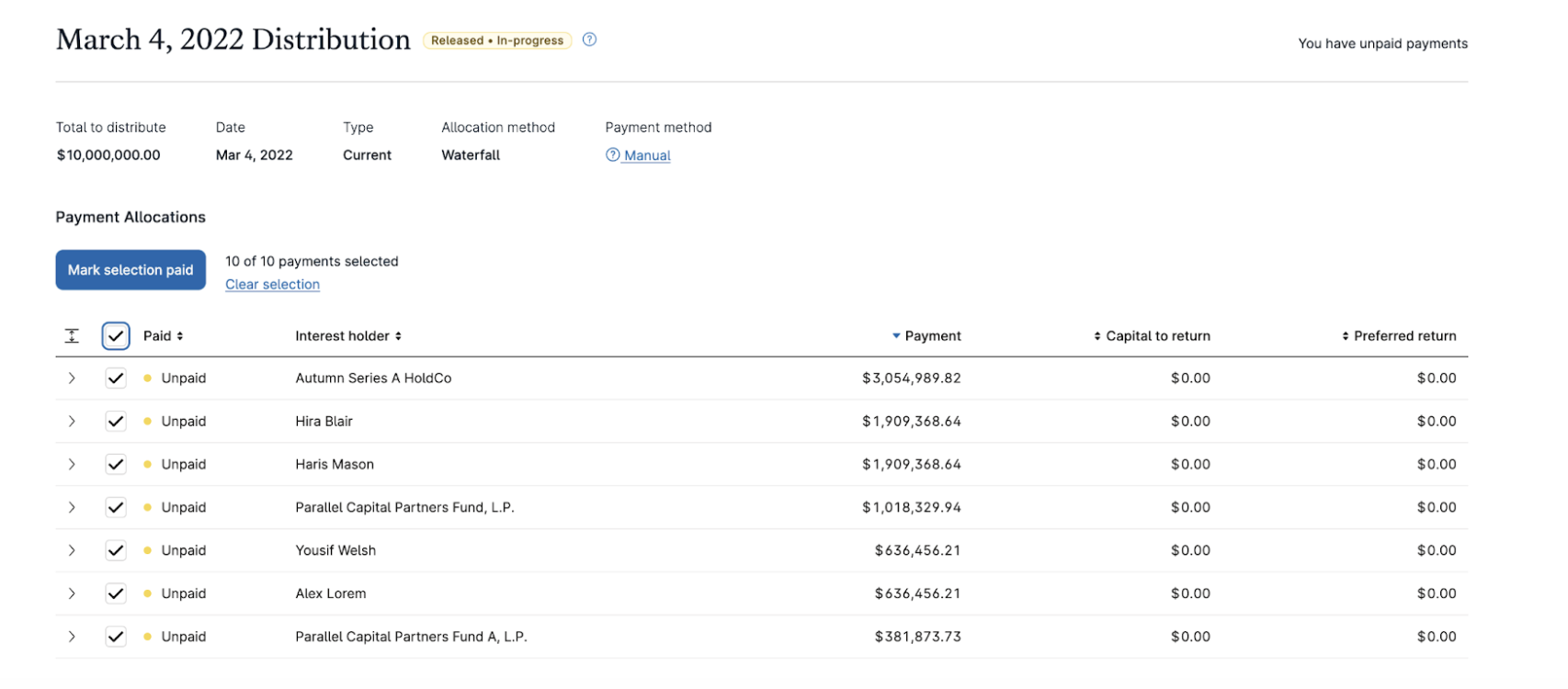

5. Pay out the distribution with a click

Confirm the information, and bulk-select “marked as paid.” At this point, each holder can “self service” by logging in to their holder distributions tab and see that the distribution has been paid out, along with distribution details and distribution history. No more having to answer questions for each individual holder—the tool handles it all.

That’s it. What used to take dozens of hours is now done in minutes—accurately and seamlessly.

LLCs are the lifeblood of the American economy, and Carta believes in giving you the tools that allow you to focus on what’s most important—running your companies in the most efficient, productive way possible. We’re proud of our new tool, and can’t wait to show you more of the tool in action. Reach out to a member of our team and we’ll answer any questions you have.