The squirrel & the snake

The pension fund is the Grey squirrel of the financial machine. It scampers across the terrain gathering seeds and nuts to devour. It knows that food is scant in the harsh winter months; so it must hoard deposits in miscellaneous locations to be retrieved at a later date. It is ubiquitous in the UK, just as pension funds hold the most AUM (£2.1TRN.)

The VC fund is a Boa Constrictor. It spends its days stalking prey so big it can barely fit in its mouth. Given the precision required to strike, it will have many failures. But driven by its hunger, it will eventually find a succulent meal via skill or serendipity. The bulging carcass protruding from its stomach will provide the crucial energy for next month’s hunt.

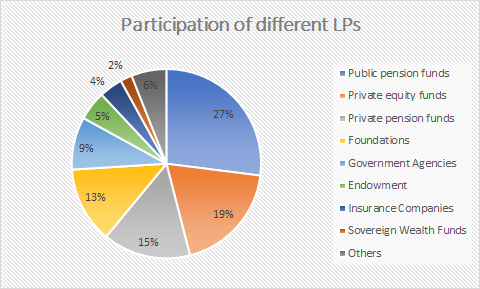

So if the approach of these organisms contrasts so starkly, why are pension funds the largest investor in the top 100 global VC funds by some distance?

Source: Prequin

The answer reflects a unique synergy of objectives. The pension fund has a 40-60 year time horizon until redemption for its youngest contributors; the average pre-seed-to- exit timeline for a startup is around 8-12 years.

Indeed, pension fund trustees can shape the world they want to see upon maturation with their investments. Just as the squirrel’s uneaten seeds allow plants to grow, pensions-for-venture can produce strong returns whilst nurturing the ecosystem.

Any prudent pension fund manager will tell you that pensions contain precious retirement money that must deliver an inflation-linked return rain or shine. So even the most buccaneering of funds will allocate a maximum of 5% of the total portfolio to this asset class.

The UK: a pension pariah

3.7% of all the money invested into the UK tech industry came from British pension funds, while 36.5% came from international pension funds amid rock-bottom yields for fixed-income instruments and high inflation, as our CEO Remy Astie pointed out.

This not only reflects UK public markets being dominated by legacy industrial and insurance firms, but inertia from regulators and trustees to open up pensions to venture.

Now after watching its success in the US and Canada, there has been a significant push from the UK Government, Financial Conduct Authority, Department for Work & Pensions and the British Business Bank to encourage more ‘patient’ capital to flow into startups.

Right now, there remain 3 key barriers to the shift:

1. Liquidity

Venture is an inherently illiquid asset class, more so than PE and real estate. The UK’s defined contribution pension funds have to factor in the risk of redemption requests at any time, since they are open ended. The FCA warns of the risk of ‘ gating’ for illiquid assets, such as when withdrawals were suspended for a few major property funds after the EU referendum in 2016.

So, as open ended trusts have mechanisms to prevent the forced sale of underlying assets, this could be problematic if there was a wave of redemptions. On the other hand, early redemptions are less common in pension funds than funds reliant on high-net-worth investors.

Yet the BBB argues that since venture would only represent a tiny allocation of the total portfolio, the liquidity risk can be managed at default level.

2. Cost

The DWP states that VC and growth equity offers DC schemes access to the top end of the ‘illiquidity premium.’

Since maintenance and administration is high for venture, and a unique knowledge is required to make the best investments, the premium is estimated to be around 7%. But the BBB estimates that the average 22 year-old could achieve a 7-12% increase in total retirement savings. In other words, it might be worth it!

The legal charge cap, however, sits at 0.75% designed to stop fund managers from ripping off citizens. It falls far from the 20% carry plus 2% management fees for VC funds. The BBB proposes a more flexible arrangement to facilitate this - although none seems to be forthcoming.

Instead, the Government has opted to raise the charge cap to create an 'investment big bang", but this will just increase fees for savers, without the desired effect of increasing allocation to venture capital.

Sunak wants more investment into the UK's tech sector

3. Suitable legal vehicle

Open ended trusts require daily reporting of Net Asset Value (NAV), which can be obscured by intangible assets. The BBB says this is easily resolved by using existing VC fund quarterly valuations, so this shouldn’t be an obstacle.

The key issue is that VC funds are closed-ended, so indelibility renders them incompatible.

In addition the absence of economies of scale, the solution is purported to be the creation of a pooled vehicle to reduce costs - but both the BBB and FCA accept that the legal fees are simply too high for any provider to initiate its inception.

The potential for a pooled vehicle is obscured by the zero-sum nature of the industry. Pension providers are competitors, so voluntary cooperation is unlikely.

In addition, Employers have policies that are too diverse to be amalgamated into one entity. For VC funds, although they would appreciate the extra capital, it's not as if they are struggling to find other sources in this fecund environment.

Taking tips from further ashore

Some UK funds are finally diving into the asset class like their foreign counterparts. A few large funds are even throwing their weight behind single venture deals; here at Vauban, we have multiple pension funds as LPs, including one major UK fund.

Over in Canada, the Ontario Teachers’ Board Pensions Plan was a lead investor in a $138M round for recruitment tech startup Beamery. This level of risk is largely facilitated by CCP Investments; a quasi-independent pooled pension fund that invests in sustainable and innovative companies, amongst other products. Only time will tell if the Canadian model yields results.

The closest the UK has to this is the Strathclyde Pension Fund committing £20M to the UK Clean Growth Fund, which we discussed here. One other interesting development is Connected Asset Management, which manages pensions for London-based Smart Pensions, acquiring impact VC Bethnal Green Ventures.

This illustrates that there are myriad ways for the pensions industry to get involved in the space.

The great emancipation of retirement savings

The great emancipation of British retirement savings would be beneficial from a returns, impact and employment perspective.

Unfortunately in Britain, the two industries are aligned on time horizon, but diametrically opposed on risk. To surmount the hurdles will require regulatory action beyond the changing of fees within the existing framework.

In 1979, the US passed the ERISA, which allowed pension funds to allocate up to 10% of its portfolio to venture. The effects were mixed but it's no accident that Silicon Valley stands head and shoulders above the rest of the world for innovation - it’s time the UK caught up.