Executive summary

Issuing equity to employees has long been the standard for venture-backed tech companies. Equity grants help founders align employee compensation with company goals. The success of this model for the tech economy is undeniable—and the broader private equity community has taken notice.

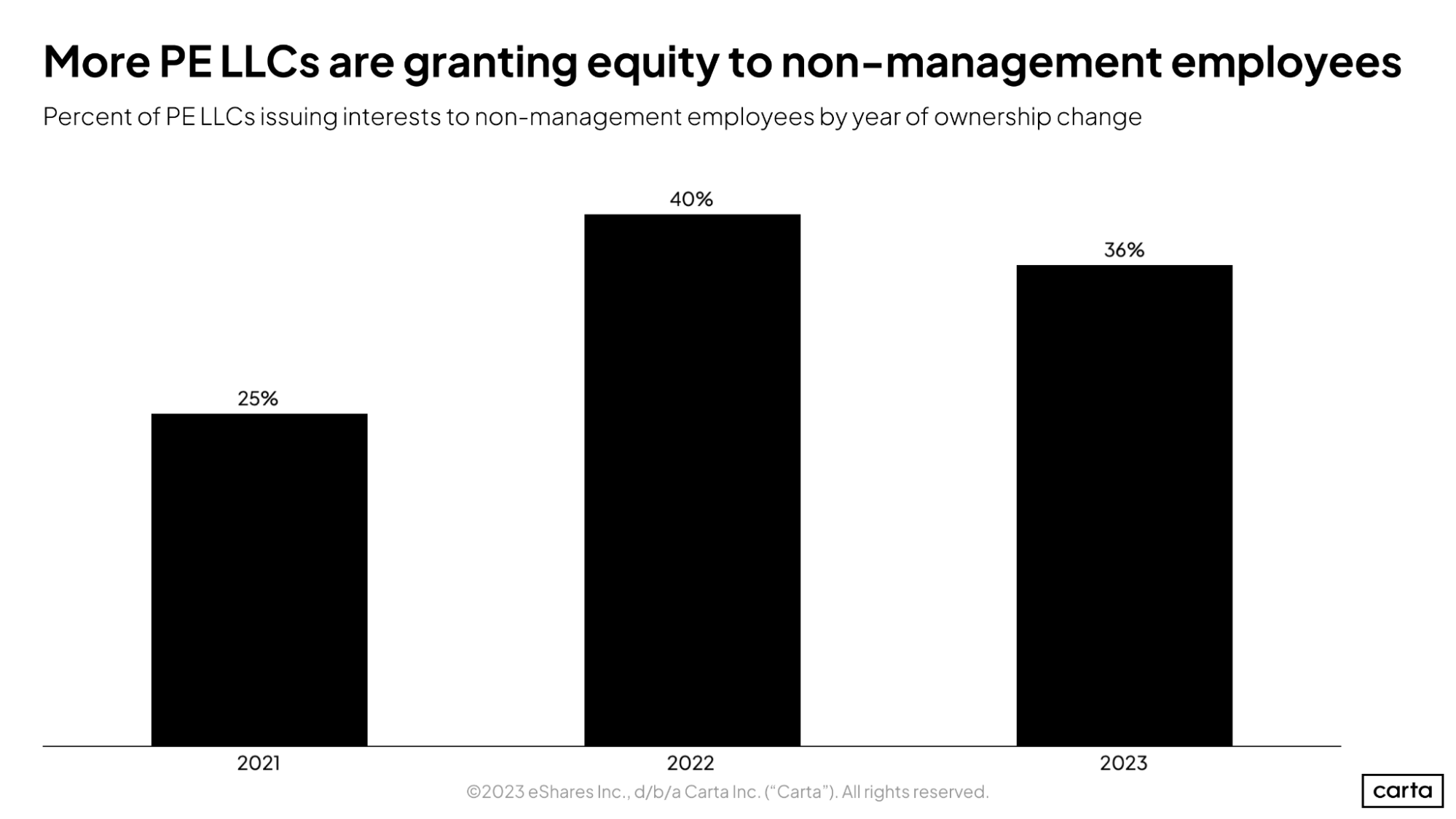

In the past, the PE industry standard was to grant equity only to management. Now, broad-based plans that distribute equity to employees are starting to become table stakes. Of the PE-backed LLCs on Carta that changed ownership in 2021, 25% issued at least some equity to non-management employees. Thus far in 2023, that figure is up to 36%.

The Carta platform supports hundreds of PE-backed companies. Two consistent questions we receive from partners are: What’s the industry standard for employee equity? And as broad-based plans become more prevalent in PE, how can I compete for talent?

Our first-ever Ownership Trends in Private Equity report offers a look into what Carta data has to say about the shift toward employee ownership in private equity.

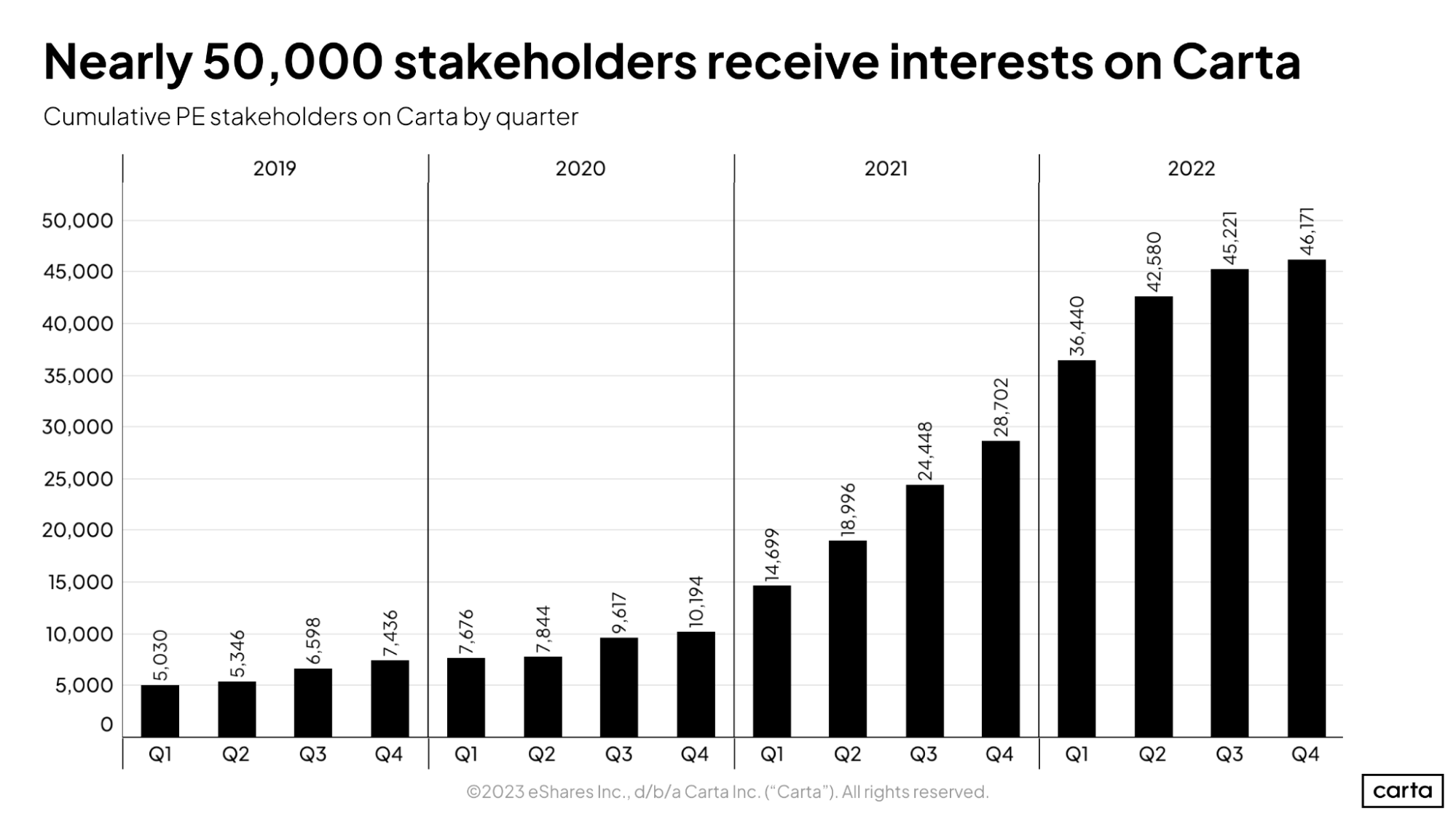

PE stakeholders on Carta

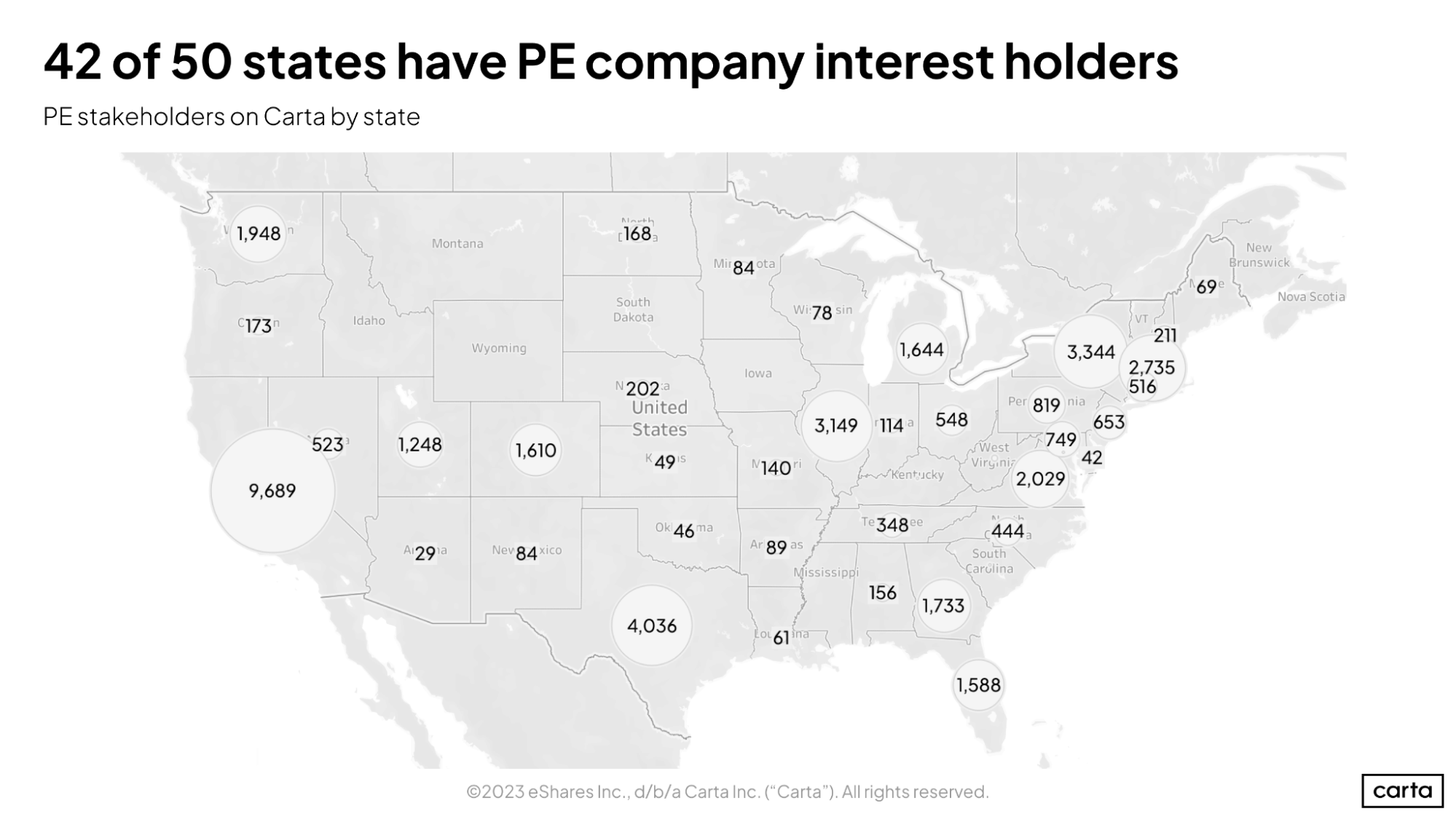

Geographical distribution of PE ownership exceeds VC

The geographic distribution of stakeholders of PE-backed companies on Carta is much more diversified than that of venture capital stakeholders.

As of Q4 2022, more than 21% of stakeholders of PE-backed companies on Carta live in California, the highest share of any state. Texas has the next-highest share, at 9.7%, with New York (8.1%), Illinois (7.6%), and Massachusetts (6.2%) rounding out the top five. Ten states are home to at least 3.5% of employee stakeholders of PE-backed companies on Carta.

Among Carta’s venture-backed companies, stakeholders are far more concentrated: 41% of company stakeholders reside in CA, followed by 13.8% in NY and 6.6% in MA. Texas is the only other state with at least 3.5% of the total stakeholder base.

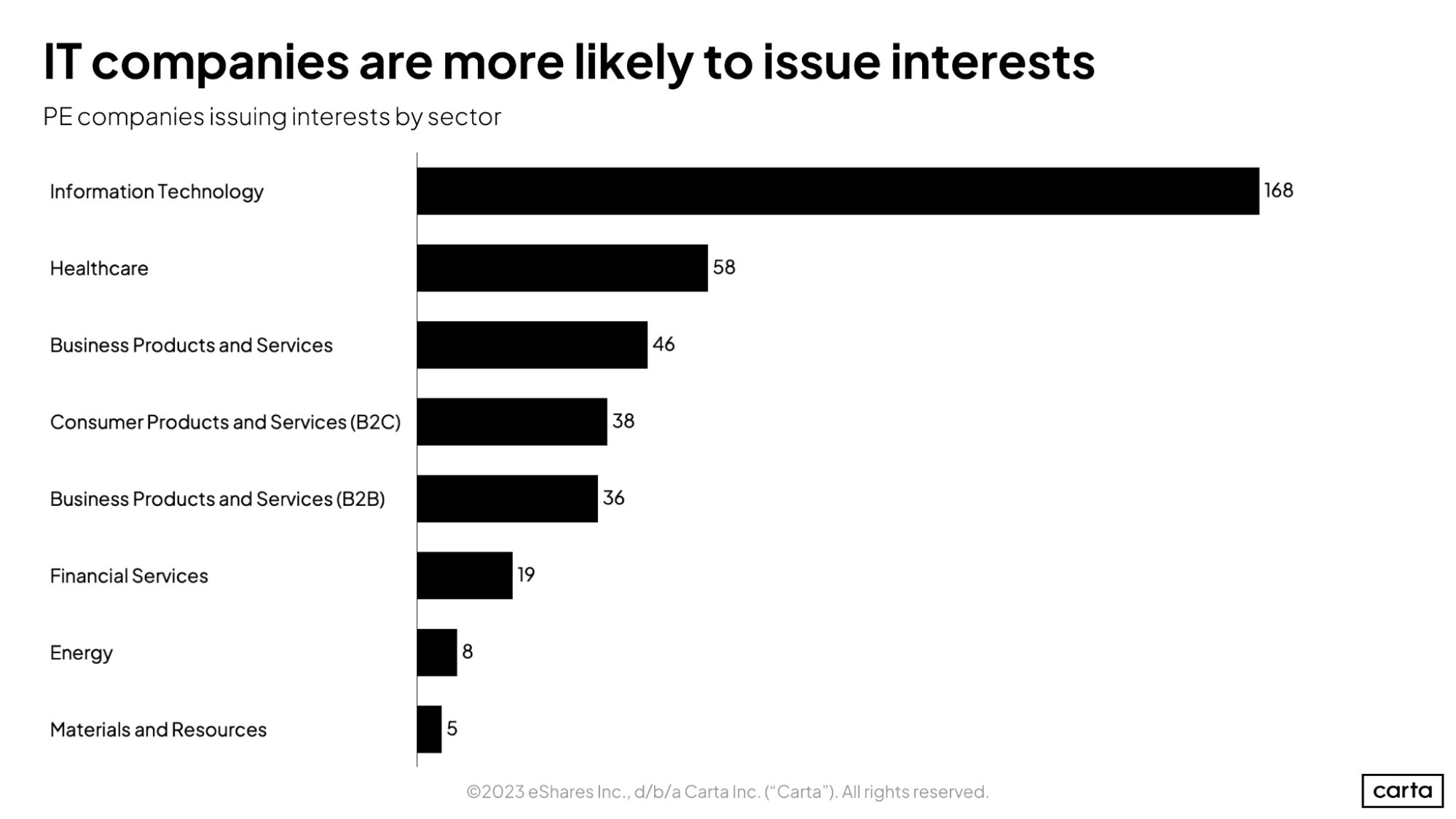

PE employee ownership by sector

About 44% of all PE-backed companies on Carta that issue equity interests to employees are in the IT sector. No other sector accounts for more than 15%.

One reason for the preponderance of IT companies among PE companies offering employee equity might be that these companies are competing for the same talent as VC-backed startups.

Employee ownership at PE-backed LLC businesses

PE-backed LLCs are becoming more likely to grant employee equity. Only 25% of PE-backed LLCs on Carta that changed ownership control in 2021 granted equity to non-management employees. So far in 2023, that figure is 36%.

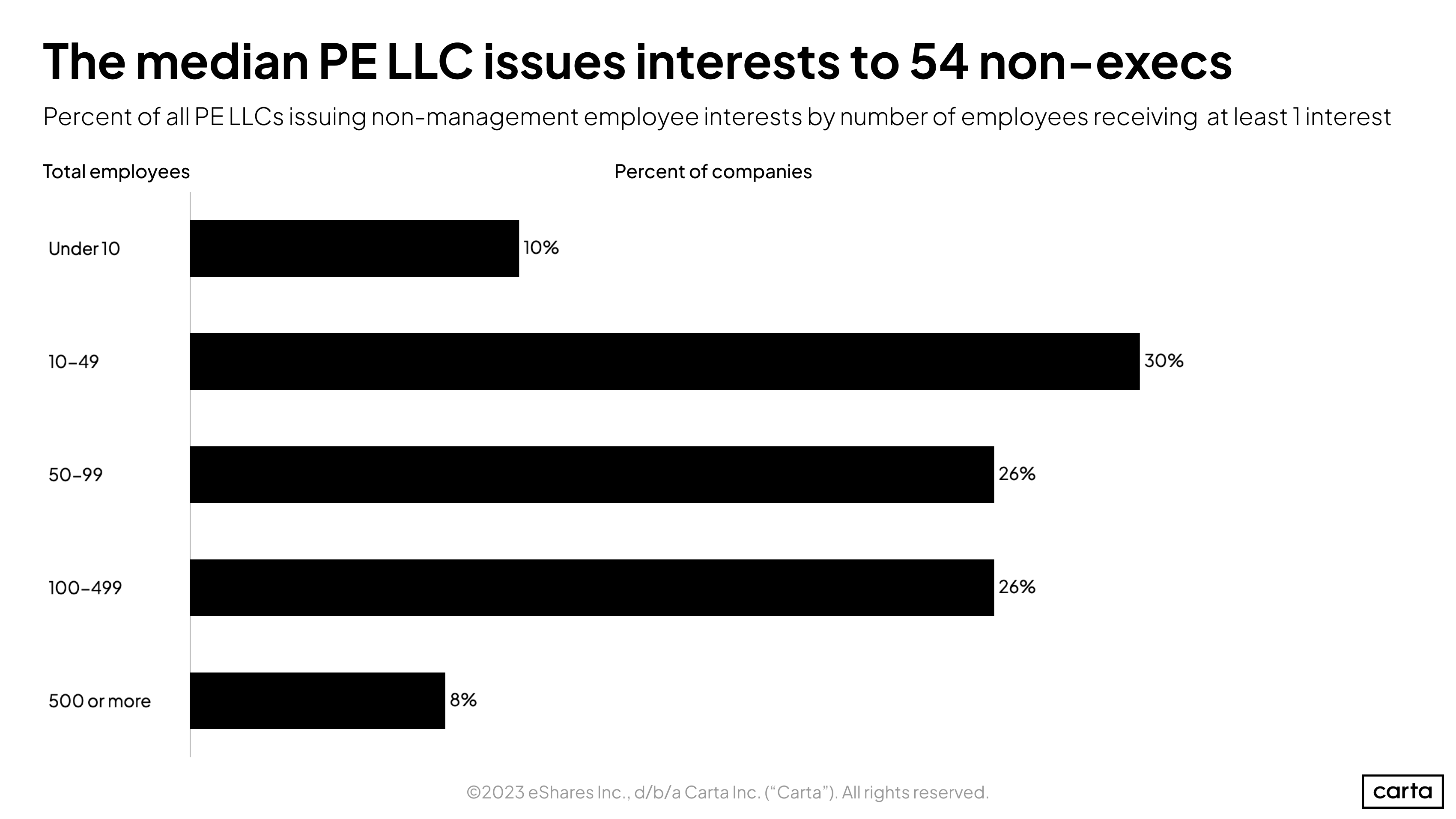

Among PE-backed LLCs on Carta that grant their employees equity, the median number of employee recipients is 54. About 8% of LLCs with employee ownership programs grant equity to more than 500 employees.

Types of LLC equity interests

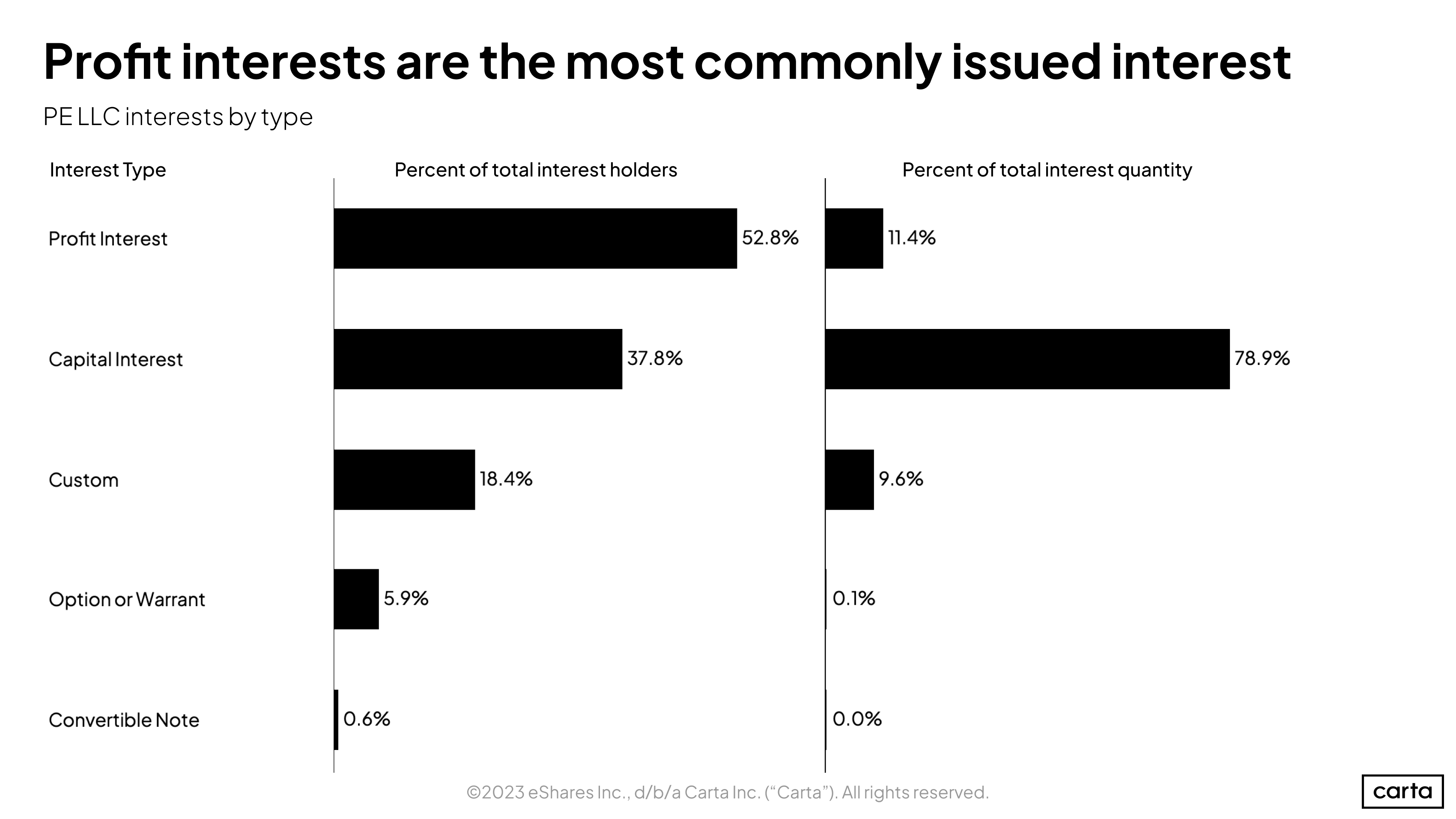

LLCs can issue various kinds of equity interests. Profit interests units (PIUs) are by far the most common in terms of quantity of total grants. But capital interests represent the vast majority of equity issued in terms of percentage ownership of the company.

Nearly 53% of all stakeholders in PE-backed LLCs on Carta own profit interests, a type of interest that gives the holder the right to a share of any of the LLC’s future earnings and appreciation. But just 11.4% of all issued interests are PIUs.

Compare that to capital interests, a type of interest that gives the holder a right to part of the LLC’s existing capital as well as its future income: About 38% of PE LLC stakeholders own capital interests, but capital interests make up almost 79% of all interests on Carta.

These figures show that holders of capital interests tend to own a much larger quantity of those interests than holders of profit interests.

Capital interests are typically reserved for executives and other high-ranking workers who tend to receive larger compensation packages, as well as the investors who also receive this type of interest. The broader employee base is much more likely to receive profit interests.

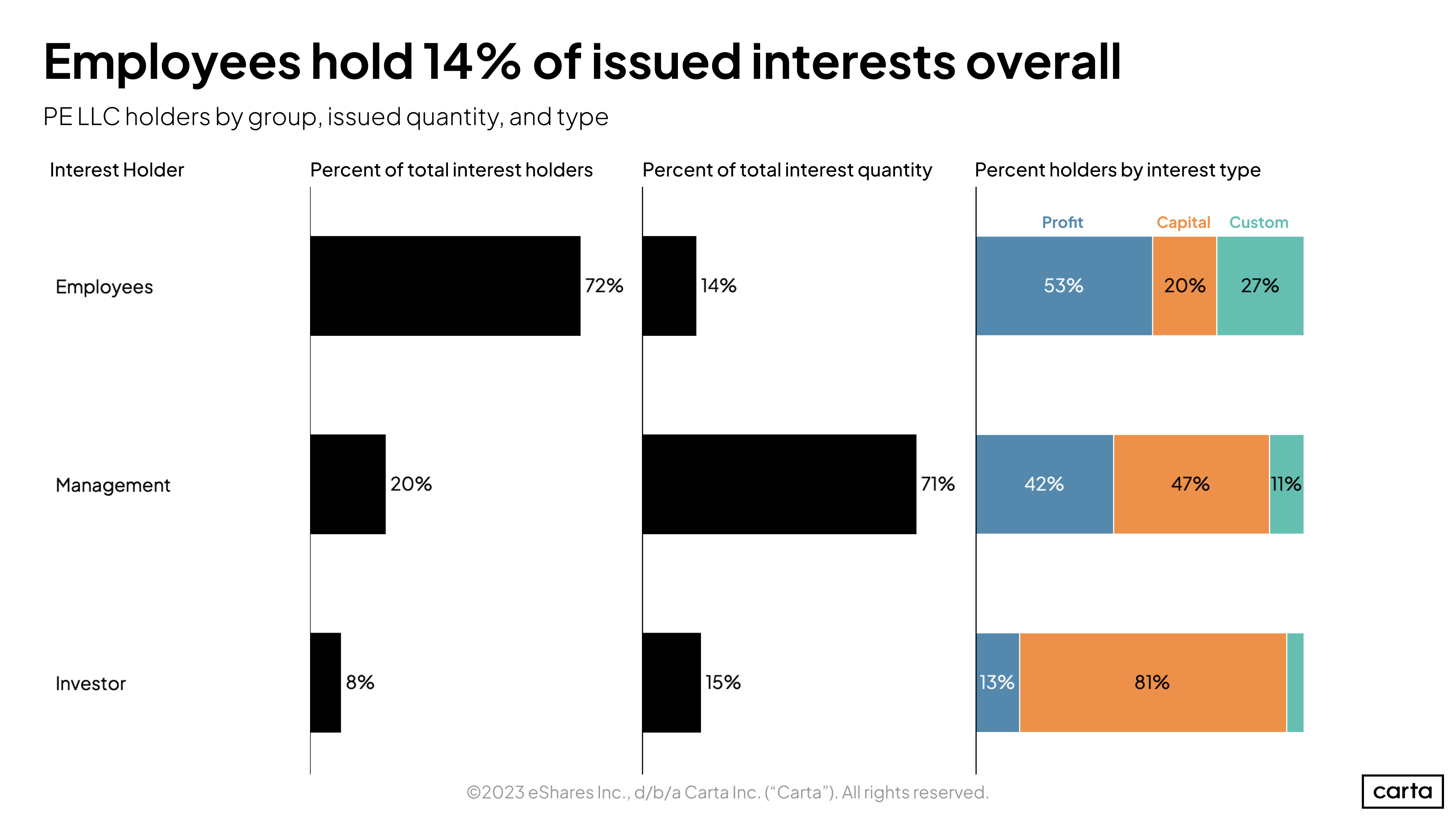

About half of employee stakeholders at PE portfolio companies receive profit interests; the other half are roughly split between capital interests and custom interests.

PE managers typically receive profit interests or capital interests, while the vast majority of equity held by PE investors is capital interests.

Learn more about employee equity plans for LLCs in Carta’s LLC Blueprints, a step-by-step guide to building an employee equity plan.

Methodology

This study uses an aggregated and anonymized set of Carta customer data from companies backed by private equity firms. Companies that have contractually requested that we not use their data in anonymized and aggregated studies are not included in this analysis.

The data presented in this report represents a snapshot as of March 31, 2023. Historical data may change in future studies. In addition, new companies signing up for Carta’s services will increase historical data available for the report.

Interest holder groups, such as Employee, Management, and Investor, are aggregated categories based on free-text input fields.