Topline

-

FTC bans noncompetes—U.S. Chamber files legal challenge

-

Tax focus shifts to 2025 as R&D package becomes unlikely this year

-

Department of Labor finalizes rule on retirement savings

FTC bans noncompetes—larger industry players file legal challenge

On Tuesday, the Federal Trade Commission (FTC) finalized a broad ban on the use of noncompete agreements for most workers. On Wednesday, the U.S. Chamber of Commerce sued, alleging the agency overstepped its authority.

-

The final rule imposes a retroactive and proactive ban on noncompete agreements for workers, with the exception of existing agreements signed by “senior executives” who earned more than $151,164 and hold a “policy-making position.” The rule also includes an exception for a noncompete agreement entered into in the context of a sale of a business.

-

The rule does not include an exception related to trade secrets, as the agency held that other forms of legally binding agreements, including nondisclosure agreements, provide sufficient protection.

Why it matters: The rule revokes a standard industry practice and a lever to manage talent and certain aspects of competition. The FTC expects the ban to bolster innovation and increase the number of startup companies by 2.7% per year by eliminating a common barrier faced by individuals trying to found new companies.

What’s next: The rule is scheduled to take effect 120 days after it is published in the Federal Register, but the agency may be forced to pause the implementation process until pending legal review. The plaintiffs brought the case in the U.S. District Court for the Eastern District of Texas, where the court has been more skeptical of regulatory overreach. Given the court’s posture, the rule may be stayed. If the rule ultimately withstands the legal challenge, the FTC estimates that it will impact 18% of U.S. workers—roughly 30 million people.

Tax focus shifts to 2025 as R&D package becomes unlikely

Efforts to move the House-passed bipartisan tax bill, which includes the R&D tax provision Carta and industry support, have chilled in recent weeks, as attempts to break the stalemate on Republican opposition to the Child Tax Credit expansion fell flat. However, some senators are working towards a compromise that would attach the tax package to the reauthorization of the Federal Aviation Administration (FAA), though that has a very slim chance of success.

Looking ahead: Lawmakers are turning their attention to the broader tax reform discussions that will shape 2025, when many of the Tax Cuts and Jobs Act (TCJA) provisions sunset. Top Republicans on the House Ways and Means Committee have formed “ Tax Teams” composed of the panel’s Republican members that will review key TCJA provisions set to expire. The TCJA was enacted in 2017 and is the last major tax-focused package to move through Congress. The newly created Tax Teams include groups dedicated to “Main Street,” the “New Economy,” and “U.S. Innovation.”

Why it matters: The bipartisan tax deal still lacks sufficient Republican support to advance out of the Senate, but the attempt to attach it to the FAA reauthorization demonstrates lawmakers’ commitment to getting something done on the tax front. Ultimately, the R&D provision will likely fail to pass this year and become part of the 2025 package as it takes shape over the coming months.

Tax & the innovation economy: Tax policy affects nearly every aspect of the innovation ecosystem. As Congress prepares to engage on tax reform, Carta and its coalition partners are urging Congress to prioritize several key pillars that would contribute to fostering growth and American competitiveness: preserve and expand the innovation ecosystem; expand the value of ownership; and modernize the IRS.

Department of Labor finalizes rule on retirement savings

The Department of Labor finalized new rules that update the fiduciary standard that applies to financial professionals who provide retirement advice under the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code.

-

The final rule broadens the definition of “fiduciary” to include nearly all transactions involving retirement investments.

-

Notably, rollover advice will now be ERISA-covered fiduciary “investment advice” regardless of whether the advice is provided on a “regular basis.”

-

By eliminating the prong on whether an adviser provides advice on a “regular basis” from its five-part test in determining who is a fiduciary, other instances of one-time advice that were not previously covered may now be considered fiduciary “investment advice” under the final rules.

What’s next: The final rules come into effect on September 23, 2024. And while the DOL narrowly avoided the late May or June cutoff date that would allow for a Congressional Review Act (CRA) challenge in the next Congress, the rules are expected to face challenges in the courts.

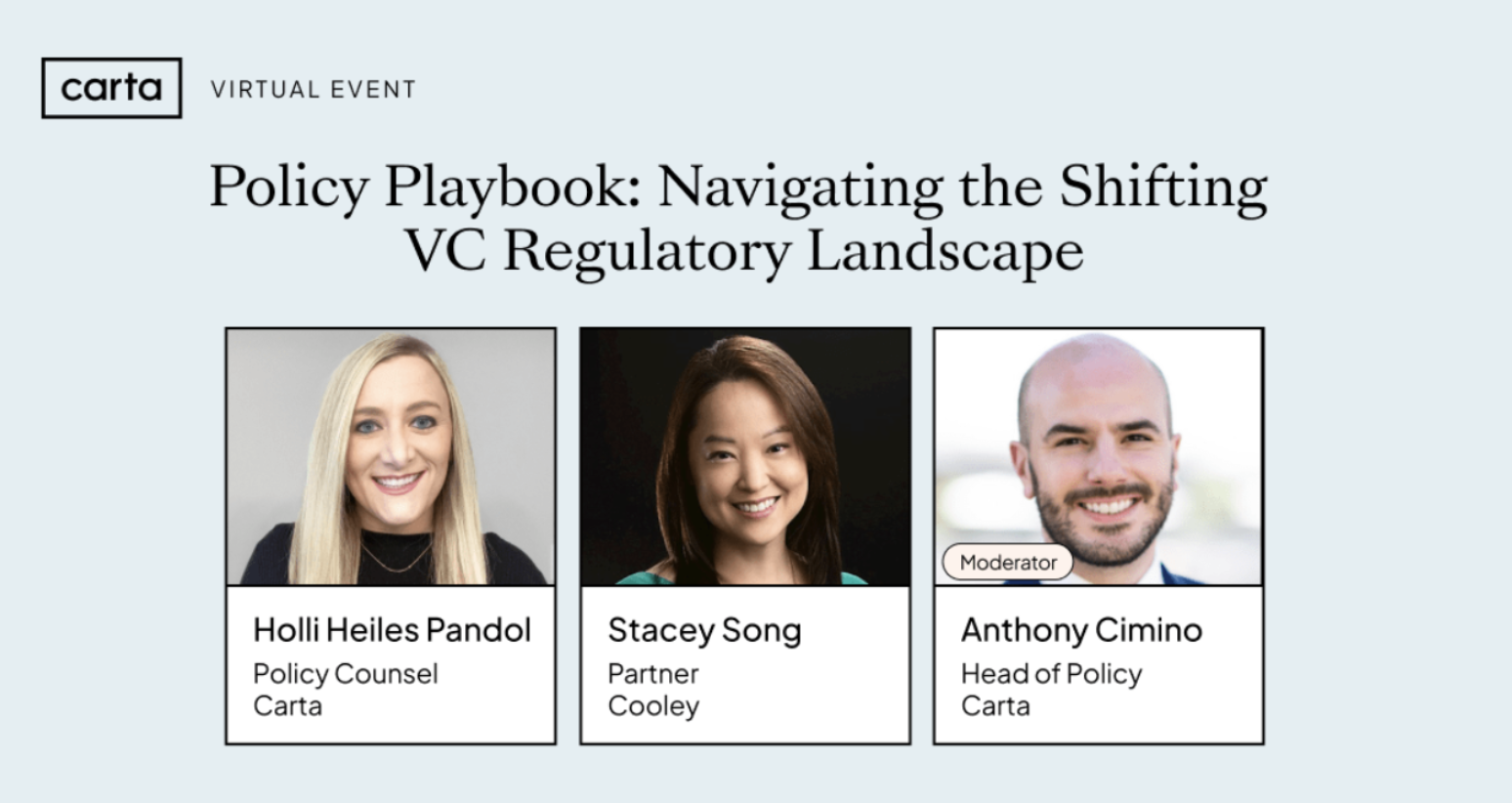

The private market regulatory landscape is changing. The SEC has adopted rules that will fundamentally impact how the venture capital industry is regulated, and also how it operates. Join Carta’s Policy Team on April 30 at 12 p.m. PT / 3 p.m. ET to learn more about:

-

How the SEC’s private fund adviser rules will impact venture capital fund advisers

-

How the SEC’s broader regulatory agenda will impact the private funds industry

-

How to navigate the shifting regulatory and policy landscape

News to know

-

Biden signs TikTok divestment bill. The bill requires ByteDance to divest TikTok in nine months to a year in order to avoid an effective ban in the U.S. The law marks the first time the U.S. has passed a law that could trigger the ban of a social media platform, and TikTok has stated that they will take the Biden administration to court, claiming the law would suppress the free speech of millions of Americans.

-

Senior Democrats file amicus brief in support of Corporate Transparency Act (CTA). The brief urges the court to uphold the constitutionality of the CTA, which was ruled unconstitutional in a federal court case in Alabama last month. In response to the ongoing lawsuits, a Treasury spokesperson reiterated that new businesses formed in 2024 who are not named plaintiffs in ongoing litigation are still bound by the CTA and should plan to file with FinCEN until further notice. The Carta team has developed a free CTA-compliance tool on our Launch platform, which supplies early-stage founders with free resources to help raise funds and issue equity.

-

EU’s untapped capital markets ‘increasingly untenable’ per French government. A French taskforce report on European securities markets highlights the urgency of deepening European capital markets. The report emphasizes the need to close the gap with international competitors, as well as recommending further centralized supervision.

-

SEC charges AI startup founder with defrauding investors. The SEC has filed charges against the founder of AI startup Centricity, Inc., accusing him of misrepresenting the company’s customer base, revenue and his own background to raise $2.8 million from seven investors, and misused more than $250,000 of the company’s funds for personal expenses.

-

Crypto groups challenge dealer rule. Two trade associations representing the cryptocurrency industry have filed a lawsuit alleging that the SEC’s revised rule on broker-dealer registration is ambiguous, overinclusive, and in violation of the Administrative Procedure Act.

-

IRS raises eyebrows in digital assets industry with draft broker form. The IRS has released a draft form 1099-DA for reporting proceeds from broker transactions involving digital assets and is seeking public feedback. The form, which is intended to bring regulatory clarity and formalize tax treatment of digital assets, could potentially lead to the reporting of hundreds of millions of transactions.

-

Treasury finalizes rules for transfer of clean energy tax credits. The Treasury Department has finalized regulations that permit the transfer of clean energy tax credits directly to a taxpaying entity. These rules, part of the Biden-Harris Administration’s Investing in America agenda, aim to expand the usability of the clean energy tax credits and facilitate quicker and more cost-effective project construction.

-

FCC Democrats vote to restore net neutrality rules. In a party-line vote, the Federal Communications Commission reinstated Obama-era rules that govern net neutrality. The regulation was reversed during the Trump administration and governs how broadband providers route internet traffic.

-

Consensys files preemptive lawsuit against SEC over Ethereum. Consensys sued the Securities and Exchange Commission Thursday seeking to head off any coming enforcement action, claiming that they have been subject to "coercive investigation" by SEC staff.

Upcoming events

-

House Small Business Committee Hearing: “ Under the Microscope: Examining FinCEN’s Implementation of the Corporate Transparency Act” - April 30 at 7:00 a.m. PT / 10:00 a.m. ET

-

House Ways and Means Committee Hearing: “ The President’s Fiscal Year 2025 Budget Request and Treasury Green Book with Treasury Secretary Yellen” - April 30 at 7:00 a.m. PT / 10:00 a.m. ET

-

Carta event: Startup Fundraising 101: Building Strategic Partnerships - April 30 at 10:00 a.m. PT / 1:00 p.m. ET

-

Carta event: Policy Playbook: Navigating the Shifting VC Regulatory Landscape - April 30 at 12:00 p.m. PT / 3:00 p.m. ET

-

SEC Small Business Capital Formation Advisory Committee Meeting - May 6 at 7:00 a.m. PT / 10:00 a.m. ET

-

Carta event: State of Private Markets: Q1 Venture Spring? - May 7 at 10:00 a.m. PT / 1:00 p.m. ET

-

SEC’s Eleventh Annual Conference On Financial Market Regulation - May 9-10.

-

SEC’s 2024 Conference On Emerging Trends In Asset Management - May 16 at 6:00 a.m. PT / 9:00 a.m. ET