- Crypto framework passes House with strong bipartisan backing

- Topline

- House passes landmark crypto regulatory framework

- All eyes on the Fifth Circuit as PFA decision looms

- FTC and DOJ expand scrutiny of private equity acquisitions and roll-up strategies

- CA governor pushes to delay VC diversity disclosures

- House Republicans launch public comment portal on tax reform

- News to know

- Upcoming events

- Sign up below to receive Carta’s Policy Weekly Brief:

Topline

-

House passes landmark crypto regulatory framework

-

All eyes on the Fifth Circuit as PFA decision looms

-

FTC and DOJ expand scrutiny of PE acquisitions and roll-up strategies

-

CA governor pushes to delay VC diversity disclosures

-

House Republicans launch public comment portal on tax reform

House passes landmark crypto regulatory framework

The House passed a comprehensive crypto regulatory framework—the Financial Innovation and Technology for the 21st Century (FIT21) Act—in strong bipartisan fashion. Despite strong campaigning from senior Democrats on the Financial Services Committee, opposition from the Biden administration, and a rare intercession from the SEC Chair formally opposing the bill, 71 Democrats, including former Speaker Nancy Pelosi and other members of Democratic leadership, joined Republicans to advance the landmark bill by a vote of 279-136 —a much higher margin than either side anticipated.

How we got here: For years, the industry has pushed for guidance and clarity, maintaining that existing regulations do not work for crypto products and platforms. But instead of issuing rules or guidance tailored to digital assets, the SEC has taken an aggressive enforcement posture toward the nascent industry. FIT21 would create a comprehensive regulatory framework tailored to digital assets and delineate authority between the SEC and CFTC, granting the CFTC authority to regulate digital assets that run on a functional and decentralized blockchain or digital ledger as digital commodities. This would tilt the balance of power toward the CFTC. The bill would also grant the CFTC additional authority to regulate spot markets for digital commodities and establish rules for crypto intermediaries and entrepreneurs seeking to raise capital through digital asset sales, among other provisions.

What’s next: Creating a comprehensive crypto regulatory framework has been a top priority for House Financial Services Committee Chairman Patrick McHenry. While Senate passage seems unlikely this Congress, the House vote on FIT21 shows genuine interest on both sides of the aisle to create a regulatory framework for digital assets and provides a strong foundation for Congress to act next year. The strong vote also improves the prospects for passing a stablecoin framework, which is more targeted and enjoys broader bipartisan support. McHenry has engaged Senate Leader Chuck Schumer on a path forward, and those discussions will continue.

Why it matters: Despite numerous setbacks, the crypto industry has devoted significant resources on both the policy and political fronts, and those investments have paid off: Crypto policy continues to capture national interest and aims to play an important role in the upcoming elections. Crypto skeptics— who contend such actions would endanger investors and the broader financial system—seem to be losing influence. Engagement matters.

All eyes on the Fifth Circuit as PFA decision looms

The Fifth Circuit Court of Appeals is expected to issue a decision any day that could shape the fate of the SEC’s Private Fund Adviser rules.

-

These rules impose new compliance obligations and restrictions on private equity and venture capital fund advisers—both registered investment advisers (RIAs) and exempt reporting advisers (ERAs)—regardless of fund size.

-

Industry groups representing the private fund industry filed a lawsuit in the Fifth Circuit to vacate the rules on the basis that the SEC lacked authority to regulate the relationship between private funds and their investors.

-

An adverse decision for the SEC could limit the agency’s ability to regulate the private fund industry by rejecting some of the authorities the agency has used to justify rules, including the marketing rule and proposed custody rules.

What’s next: Expect a decision soon. While the court will determine the ultimate timeline, the parties to the lawsuit have requested a decision by May 31, 2024. The Carta team will continue to track these developments and provide resources to help the industry navigate the shifting landscape. Read more about how the Fifth Circuit’s decision could impact regulation of the private fund industry here.

FTC and DOJ expand scrutiny of private equity acquisitions and roll-up strategies

The Federal Trade Commission (FTC) and Department of Justice (DOJ) are probing the prevalence of serial acquisitions and roll-up strategies across the U.S. economy, broadening their ongoing review of the same tactics in the healthcare industry.

-

The request for information (RFI) again targets private equity operations, specifically seeking information on the ownership and control exercised by PE firms during acquisitions.

-

This is the latest in a broader interagency crackdown on PE firms. Updated merger guidelines recently finalized by the FTC and DOJ also target roll-up strategies, though they are nonbinding.

-

The agencies were dealt a blow in May when a federal district court dismissed an FTC suit alleging that a PE firm’s portfolio company deployed a roll-up strategy to monopolize the Texas anesthesia market.

Why it matters: Despite recent setbacks, regulatory scrutiny of the PE industry continues to grow. RFIs are typically precursors to formal rulemaking. The agencies are unlikely to reach that stage this year, but this RFI will set a foundation for further action. PE firms continue to draw bipartisan scrutiny on Capitol Hill as well, particularly in the healthcare sector, and that spotlight is unlikely to fade anytime soon.

CA governor pushes to delay VC diversity disclosures

The Newsom administration has proposed giving venture capital firms an additional year to comply with new diversity disclosure requirements that were enacted last year, extending the reporting deadline from March 1, 2025, until March 1, 2026, in addition to other changes.

-

Under the new law, VC firms with a California nexus—virtually all VC firms—will have to survey their portfolio companies and report to the state on diversity metrics related to the founders of those companies, as well as financial data about investments made in diverse founders. These metrics will be published in a searchable online database.

-

Funds that do not comply could face significant monetary fines, though founders will be able to opt-out of providing such information without penalty.

What’s next: Governor Newsom acknowledged implementation and compliance challenges when he signed the law, and the proposed amendments seek to address some of these issues. Any delay would have to be approved by the legislature, and we expect these changes to be included as part of the state budget, which must be approved by June 15. VC firms will likely get some breathing room but should start thinking about implementation.

House Republicans launch public comment portal on tax reform

House Ways and Means Committee Republicans launched a new online portal for public input on tax policy, specifically surrounding key provisions of the Tax Cuts and Jobs Act (TCJA) set to expire by the end of 2025.

-

House Republicans have previously announced “tax teams” to study key provisions of the TCJA, and similar efforts are starting to take shape in the Senate.

-

Comments will be accepted through October 15, 2024.

Why it matters: Tax policy affects nearly every aspect of the innovation ecosystem. Carta and its coalition partners have begun engaging with the House tax writing committee to lay down markers on policy priorities to benefit the innovation ecosystem, and we will continue advocating for key pillars that would contribute to incentivizing and expanding innovation and ownership.

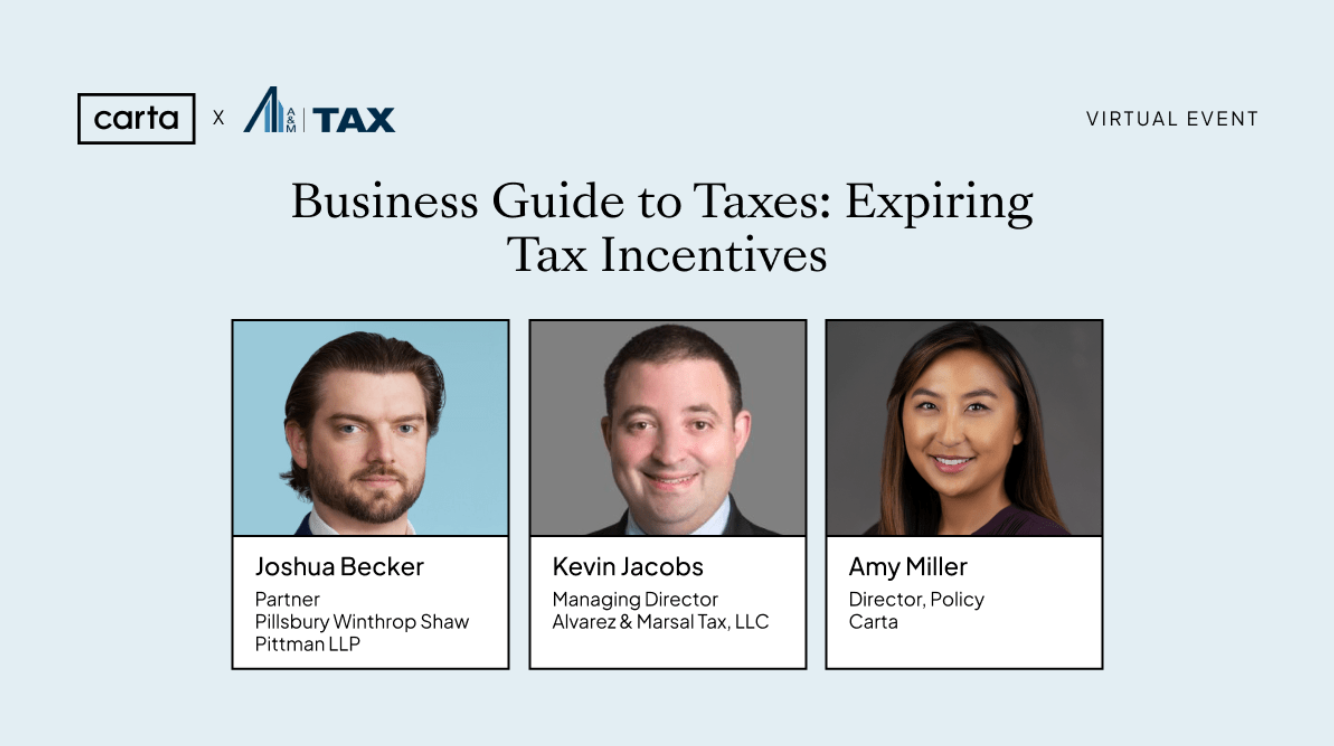

To learn more about the current tax landscape and practical guidance to navigate upcoming changes that will have significant impacts on your business, register for our June 4 virtual event at 10 a.m. PT / 1 p.m. ET.

Register hereNews to know

-

SEC approves rule change to allow creation of ether ETFs. In another win for the crypto industry this week, the SEC took steps to allow exchange-traded funds (ETFs) to buy and hold ether—the second largest cryptocurrency. Additional approvals are needed before trading can begin, but this movesignals the agency may be softening in its regulatory approach to crypto after a series of legal challenges—and signals that ETH is a commodity.

-

FDIC chair to resign after a successor is confirmed. Facing bipartisan calls to resign, embattled FDIC Chair Marty Gruenberg announced plans to step down from the agency once a successor is nominated by the president and confirmed by the Senate. The fallout from a scathing report on misconduct at the agency continues, and many lawmakers felt his departure should occur immediately.

-

Blackstone to pledge expanded employee equity in future U.S. buyouts. Blackstone announced plans to grant equity to most employees involved in future deals that involve its private-equity business buying control of a company.

-

Yellen opposes global billionaire tax. Treasury Secretary Janet Yellen said the United States would not join growing calls for a global wealth tax on billionaires. Brazil, France, Spain, Germany, and South Africa are considering a proposal to levy a 2% annual tax on billionaires’ overall wealth.

-

EU Council approves AI Act. The Council of the European Union approved the AI Act this week, following approval by the European Parliament in March. The law, which is the first major framework for regulating AI, will take effect 20 days after publication in the Official Journal of the European Union.

-

Colorado enacts the first domestic AI regulatory regime. Governor Jared Polis overcame his reservations and signed into law a contentious bill that creates a regulatory framework to govern companies’ use of AI. Polis previously cautioned that the bill could stymie innovation, but he recognized the expected benefits for consumers.

-

Revamped privacy bill begins lengthy consideration process. The American Privacy Rights Act (APRA), a bipartisan and bicameral attempt to restart the long-stalled effort to create a national data privacy standard, began its journey through the House with a subcommittee markup. The revised bill will next be considered by the full Energy and Commerce Committee, but several obstacles make enactment unlikely.

-

Justice Department sues to break up Live Nation-Ticketmaster. Antitrust enforcers allege the nation’s largest concert promotion and ticketing company abused monopoly and drove up prices for tickets.

Upcoming events

-

CFTC Commissioner Pham to speak at the Hellenic Capital Market Commission Public Conference at the IOSCO Annual Meeting - May 29 at 5:45 a.m. PT / 8:45 a.m. ET

-

OCC to host the Roundtable for Economic Access and Change (Project REACh) Financial Inclusion Summit on May 29-30

-

Justice Department and Stanford University host joint workshop on Promoting Competition in Artificial Intelligence - May 30

-

FTC Commissioner Holyoak to speak at The Competitive Enterprise Institute Summit Edinburgh - May 31

-

Carta event: Business Guide to Taxes: Expiring Tax Incentives - June 4 at 10 a.m. PT / 1 p.m. ET

-

SEC Investor Advisory Committee meeting - June 6 at 7:00 a.m. PT / 10:00 a.m. ET

-

U.S. Department of Treasury: 2024 Conference on Artificial Intelligence & Financial Stability - June 6-7