At Carta, we’re always searching for ways to improve our products and services. We work hard to ensure our customers have an excellent experience by combining our best-in-class technology with superior service.

In Q2, our team of product managers, engineers, and designers focused on building capital call lines, calibration, and tools to enable your fund administration team to work more efficiently. Automating accounting, reporting, and other repetitive tasks allows your fund admin team to spend more time helping you reach your strategic goals.

Capital call line of credit

Get capital faster and more easily

We’ve made capital call lines of credit simple. With Carta, you can get started with a capital call line for as little as $5,000. There’s no application fee, facility fee, unused line fee, or drawdown fee.

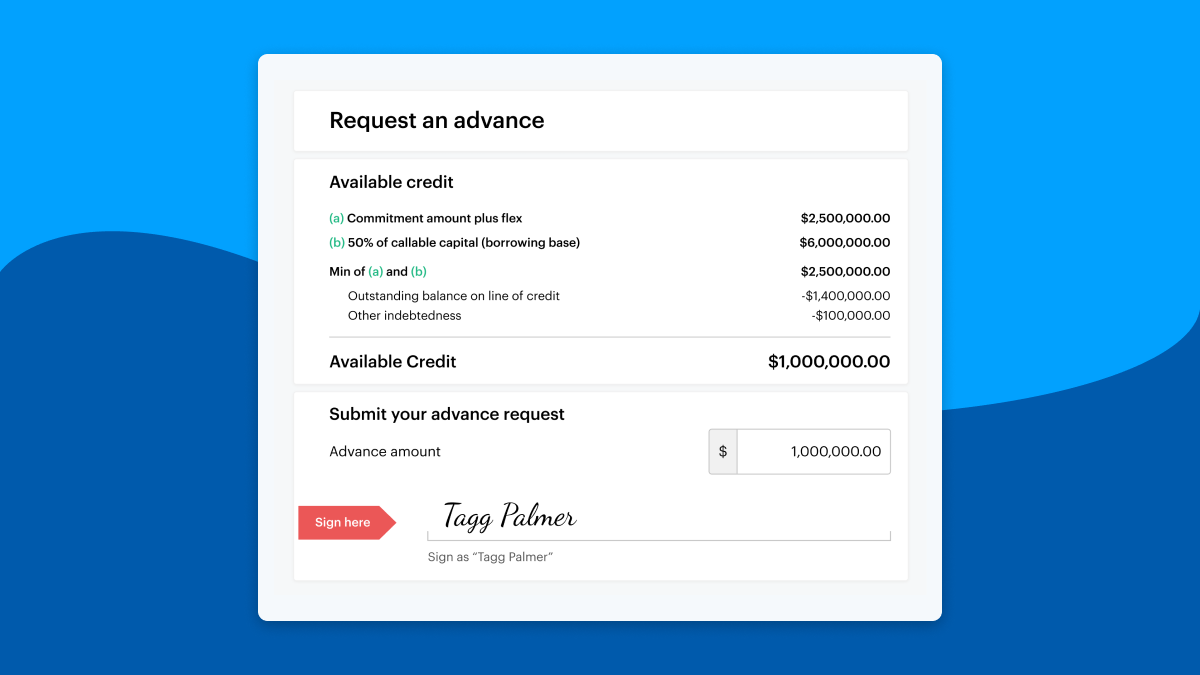

Initiate an advance or payback in-product

See an overview of loans across your funds, including the outstanding balance, available credit, interest balance, and due date for each loan.

Always up-to-date loan information

Double click on each loan to see your interest rate, borrowing base, active and historical advances, transaction history, and more.

Calibration

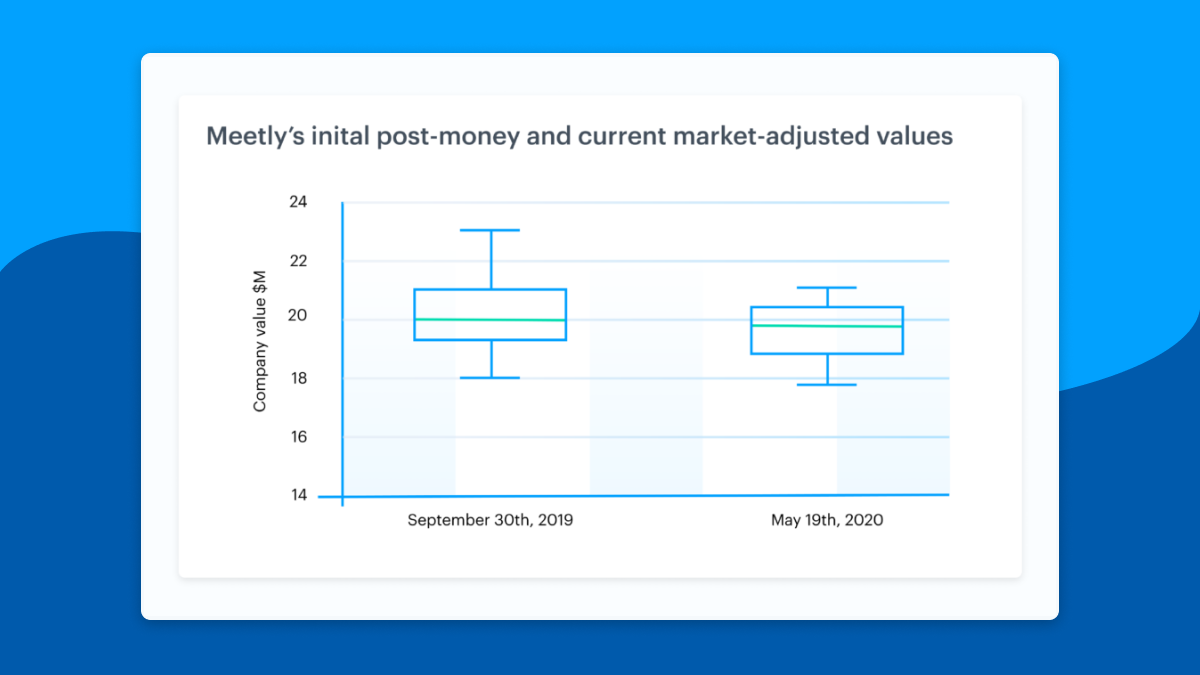

We created a free calibration tool to estimate the changes in your portfolio companies’ values quickly and in bulk. With changing market conditions, historical transactions may no longer be valid indicators of company value.

No more spreadsheets

With Carta’s calibration tool, our software does the math, so you can estimate valuation changes in just a few clicks.

ASC 820 integration

Calibration identifies which portfolio companies need an in-depth ASC 820 valuation. Use our intuitive self-service valuations software, or, choose full-service and let our team handle your complex valuations for you.

Reporting efficiency

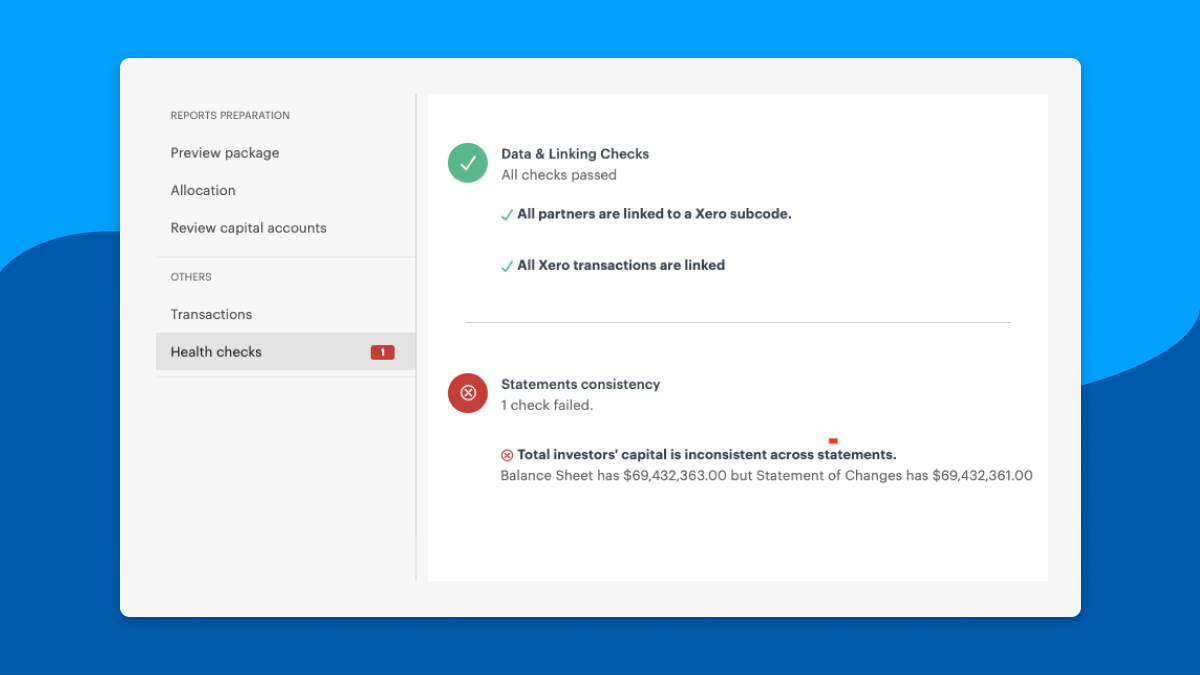

Health checks

As part of any reporting package, your fund administrator performs manual reviews. Health checks automate the initial review process to help your fund admin fix reporting inconsistencies faster. Your fund administrator still performs manual reviews, but automated health checks help your fund admin team accelerate the review process.

Improved rounding

It’s important to have clean cash figures in your financial statements. That’s why we’ve implemented default rounding, line item rounding, consistent calculations between your balance sheet and SOI to help generate better, cleaner reports.

Fund properties

When your fund onboards with Carta, we convert the limited partnership agreement (LPA) and relevant side letters from PDFs into structured data in order to ensure compliance with your LPA. This allows your fund administrator to see your fund’s terms at a glance so they can prepare capital calls, distributions, and financial reports faster and more accurately.

Fund families

Your fund administrator can now create fund families in-app. If your firm has multiple funds, your fund admin can report on the entire fund family automatically, instead of in a manual spreadsheet. This helps to facilitate consolidated reporting and performance tracking for parallel entities.

Partner management

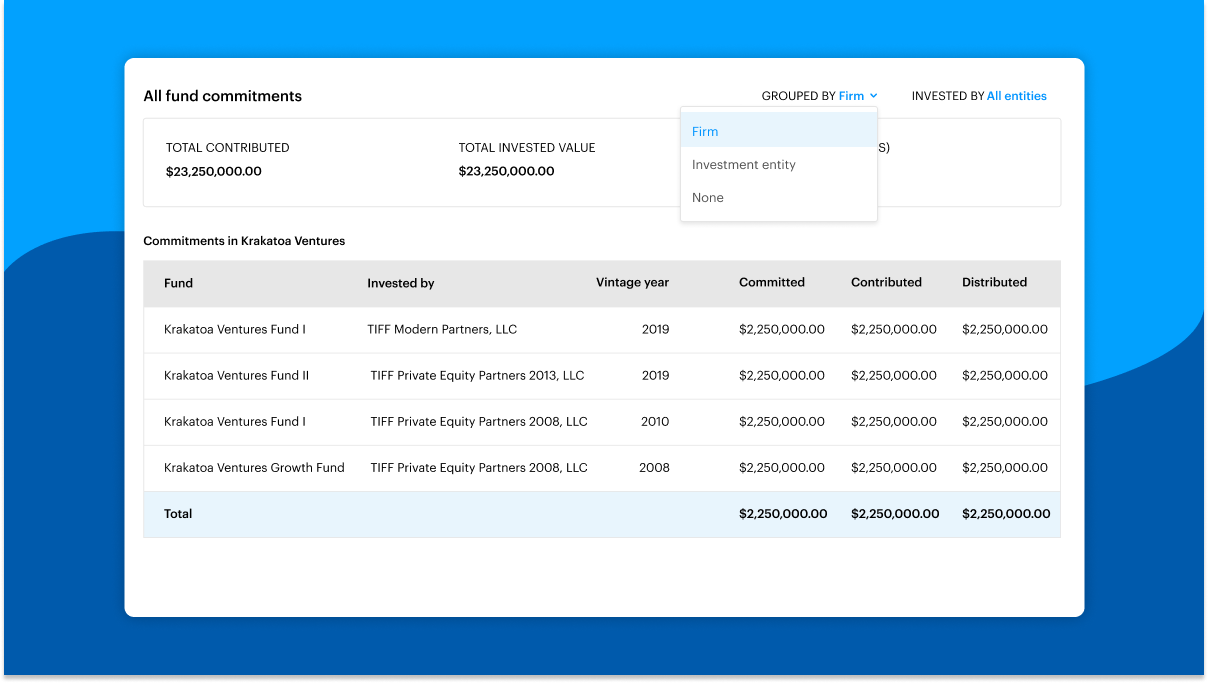

All fund investments page for LPs

This page lets your LPs see all their fund commitments on Carta. All actions that an LP would need to take, like paying a capital call or viewing a fund document, will be at the top of the page.

Amendments and side letters

Your fund administrator can directly include amendments and side letters in-app. The amendments and side letters are seamlessly integrated to enable faster calculations of management fees and allocations.

Transfers to existing partners

Your fund administrator can easily transfer a fund commitment to an existing partner. With this feature, all your profile and accounting data moves seamlessly during a transfer, so both the new and prior LP see up-to-date information.

Distributions

Your fund administrator can now export a CSV file containing the journal lines for a distribution. Additionally, they’ll be able to mark whether a partner is paid or unpaid. This serves as an in-app reminder if a partner still needs to receive their distribution.

We hope these new products and features make your experience on Carta even better. We’d love to hear from you. If you have any questions or suggestions about our product, reach out to us.

DISCLOSURE: This communication is being sent on behalf of Carta Investor Services, Inc. (“Carta IS”) and Carta Financial Technologies, LLC (“Carta Financial”), wholly-owned subsidiaries of eShares, Inc., dba Carta, Inc. Certain transactional fees may apply. This communication is not to be construed as legal, financial, accounting or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta, Carta IS and Carta Financial do not assume any liability for reliance on the information provided herein.